The annual Governmental Affairs Conference in Washington is the largest and, many would say, the most important convening of credit union leaders.

In the nation’s capital, attendees from around the country will hear from their congressional representatives. And from all three NCUA board members on the state of agency policy.

Today’s Washington is not a kind place. Tens of thousands of public servants have been summarily fired. Many remaining are at best uncertain and at worst fearful for their personal and professional futures.

The pretense of eliminating waste has been quickly demonstrated to be a political fraud. An unelected, billionaire, Elon Musk, who recently used a chainsaw to present his approach to responsibility is in charge of this political stunt.

Trump’s purpose is not governmental efficiency. Rather it is eliminating any federal role that acts as a check and balance over the animal spirits of the “free market” and its billionaire oligarchs.

The NCUA Board’s Opportunity

Institutions, no matter how well funded and designed, cannot in themselves be constraints on abuses of power. Or destruction of the democratic process.

It is the people who are appointed as well as those who are elected that must exercise this critical responsibility.

For credit unions, their immediate representatives are the three-person NCUA board responsible for the agency’s management. That is why their views are so important.

What credit unions want to hear is how they are interpreting their responsibility having taken this oath of office:

I, [Hauptman, Harper, Otsuka] do solemnly swear that I will support and defend the Constitution of the United States against all enemies, foreign and domestic; that I will bear true faith and allegiance to the same; that I take this obligation freely, without any mental reservation or purpose of evasion; and that I will well and faithfully discharge the duties of the office on which I am about to enter. So help me God. (emphasis added)

The US Constitution requires the practice as explained in this 2019 article:

The reason is simple – public servants are just that – servants of the people. After much debate about an Oath, the framers of the U. S. Constitution included the requirement to take an Oath of Office in the Constitution itself.

Article VI of the Constitution says, “The Senators and Representatives before mentioned, and the Members of the several State Legislatures, and all executive and judicial Officers, both of the United States and of the several States, shall be bound by Oath or Affirmation, to support this Constitution .

The author, Jeff Neal, states the intent: One purpose of the Oath of Office is to remind federal workers that they do not swear allegiance to a supervisor, an agency, a political appointee, or even to the President. The oath is to support and defend the U.S. Constitution and faithfully execute your duties. The intent is to protect the public from a government that might fall victim to political whims.

Where Political Power Lies

The three NCUA board members’ remarks in this current effort to concentrate political executive power in one person will be telling.

Will they simply state their role is to “comply” with the administration’s numerous directives of unlimited executive authority over an independent agency?

Or might they simply state their role as guardians of the NCUSIF purse and “protectors of the taxpayer” is their highest duty?

Or will they simply ignore reality and give an AI-like generated talk on regulatory priorities?

NCUA board members’ press interviews and comments at last Thursday’s public board meeting suggest they are still uncertain what their stance should be. One can understand their personal jeopardy and hesitancy to speak up. In their remarks, all three were like bipartisan deer frozen by the Trump administration’s headlights shining on all federal agencies. The sense of an overriding mission was at best formulaic.

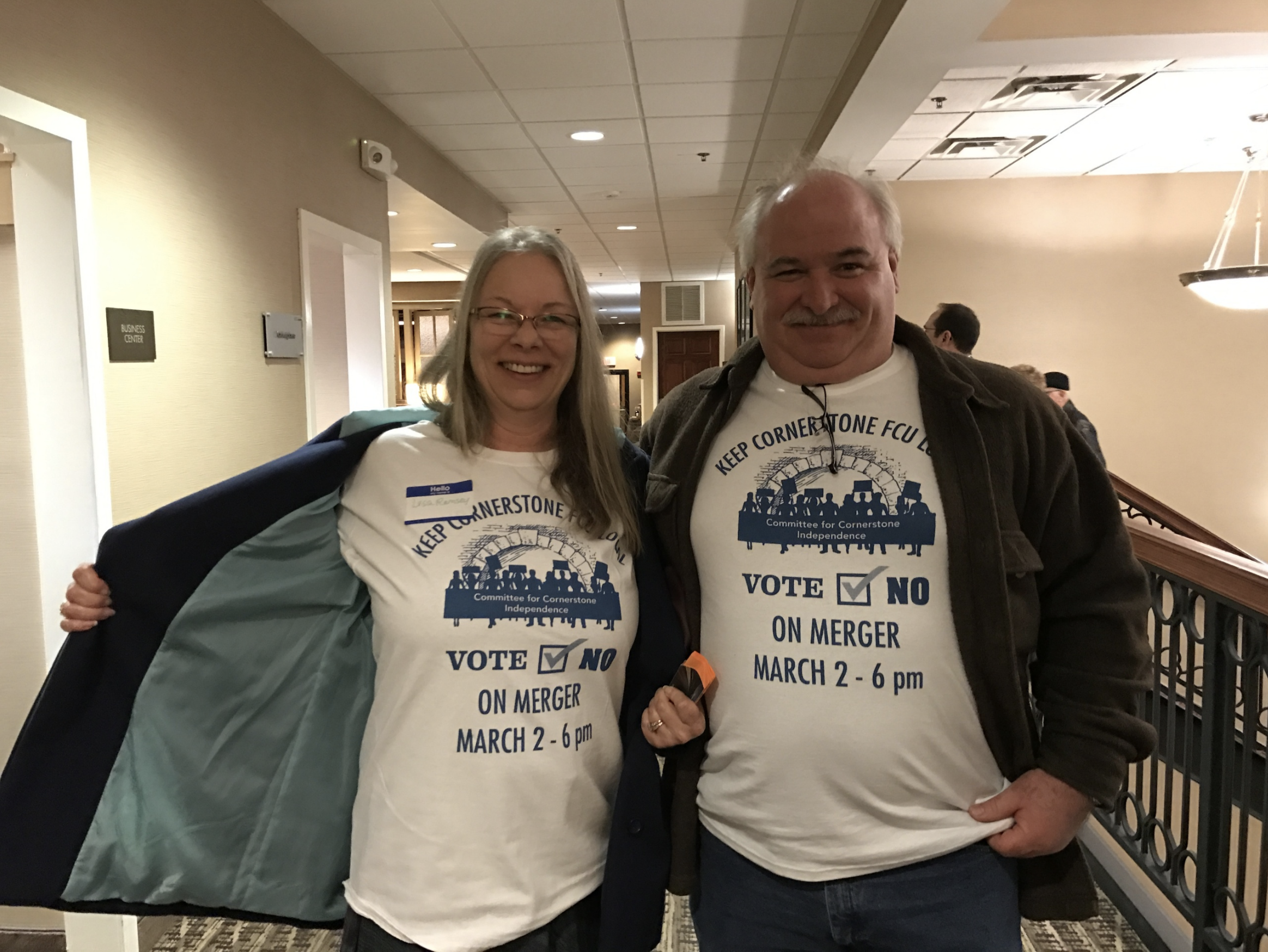

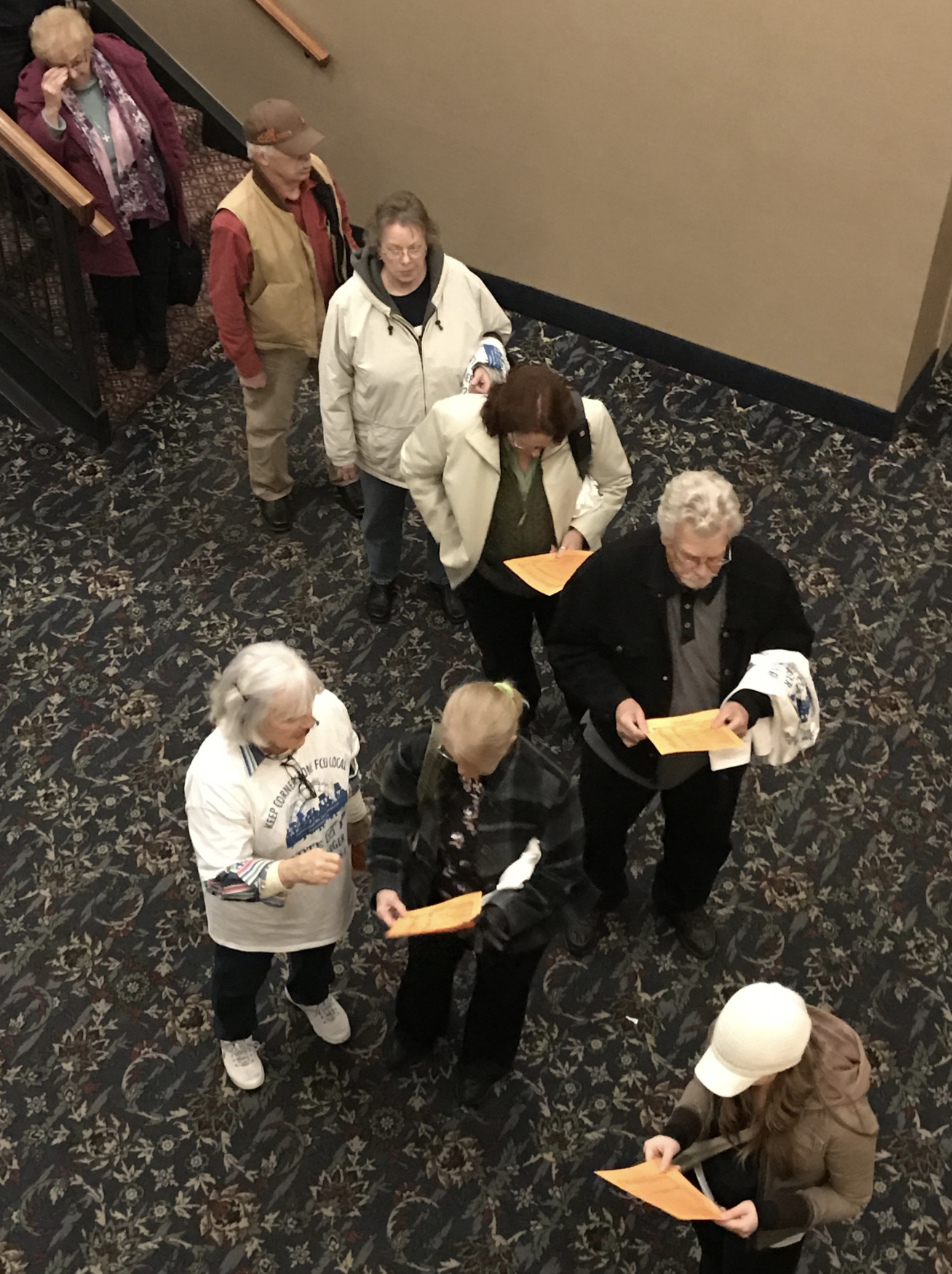

But as the board members look out over the thousands of attendees in the convention center, they will see where their responsibility and true power really lies. It is with the people. For the grassroots may be slow to mobilize but will be unstoppable when activated for purpose.

The political temptation is to always seek a middle way, a consensus. All Americans and the rest of the world saw last Friday that we no longer live in “normal times.” When a leader of the free world visited the Oval Office and was publicly scolded by the President and his colleagues for not being “grateful,” for not having any “cards” to play, for “threatening WW III,” we know we are not living in normal times.

The people to which NCUA board members will be speaking at GAC and beyond hold the ultimate authority. How will they fulfill their oath of office? The circumstances are not easy, but leadership in crisis is what the Constitution depends on.