Knowing history helps us navigate current uncertainties, even severe problems. This is a story of a credit union that was mismanaged. There was front page publicity about the problems, NCUA’s role, and direct quotes from NCUA, including Chairman Callahan.

The year was 1983. The credit union was charter number 435 which opened on January 1, 1935. State Department FCU also served NCUA employees.

Here are the opening paragraphs of an August 16, 1983 Washington Post article investigation of the situation:

The State Department Federal Credit Union has operated at a loss since last year and has been placed on a “problem list” by federal regulators, according to credit union officials.

The federal action is based on the credit union’s overall financial condition, but it comes at a time when the credit union’s administration is under attack from some of its members for the amount of money it spends on receptions and trips for employes and board members to conferences in places such as Las Vegas, Munich and Paris.

The credit union, which has $166 million in assets and 36,000 member accounts, reported a loss of $346,095 on total income of $8 million for the first half of this year. Last year the credit union, with a total income of $15.7 million, lost $224,200.

Examiners from the National Credit Union Administration (NCUA), which regulates federally chartered credit unions, told the board of the credit union in a meeting July 27 that the member-owned institution has been placed under special surveillance, according to Edward N. Gulli, general manager of the credit union.

Here are further detals from this lengthy report:

NCUA examiners said the credit union “would have no problem” if board members “took the steps to turn it around and become very profitable again.” . .

Some 7 percent of the 11,200 federally regulated credit unions in the United States are on the NCUA’s “problem” or “watch” list, according to Layne L. Bumgardner, director of supervision and examinations at the NCUA. . .

In an effort to conserve the credit union’s cash, Gulli said the board has voted to stop traveling first class, which was previously allowed on any trips of more than three hours’ duration, and to suspend any travel until the end of the year. However, he said travel to conferences is a necessary part of credit union activities and will be resume .. .

During 1982, the credit union spent $51,628 to send board members–who are State Department employes performing the credit union work as volunteers, receiving no extra salary–to conferences in places including Paris and Munich. . .

They spend money like water on trips, and they say they don’t have the money to hire additional tellers or pay better interest. They think we’re dumb,” said Mary Drakoulis, an employe in State’s Freedom of Information office who was one of the original organizers of protest against the credit union management. . . .

The article included five paragraphs listing individual board and senior executive travel expenses. Here is one example:

A June 26 to July 1, 1982, trip to a credit union industry conference in Las Vegas by six board members and three of their spouses costing $3,099 in hotel expenses at the Las Vegas Hilton and $9,520 in first class airfare. Five board members and a credit union employe traveled to Las Vegas again for a similar conference in May of this year. . .

NCUA’s chairman, Callahan, said the question of what is or is not a proper level of expenses is up to the members to decide. “We do not usually get down to splitting hairs as to which expense is appropriate. If it is a problem institution, I’m sure their expenses are being scrutinized,” said Callahan, who is a member of the credit union.

Even Larry Connell, the former NCUA Chair and now CEO of Washington Mutual Savings Bank was asked for comment. He stated: “To me,” he said, “the best enforcement is for the membership to vote on whether to continue the management. I would think the members should have reasonable access to the records of the credit union.”

Finally, the President’s compensation was published. Federal charter salaries are not required to be disclosed as is the case with state charters.

Because Gulli’s salary increases are based on the (board) recommendations, not the (U.S.) president’s decision, he got a raise last year of 18.47 percent, while federal workers got a raise of 4 percent.

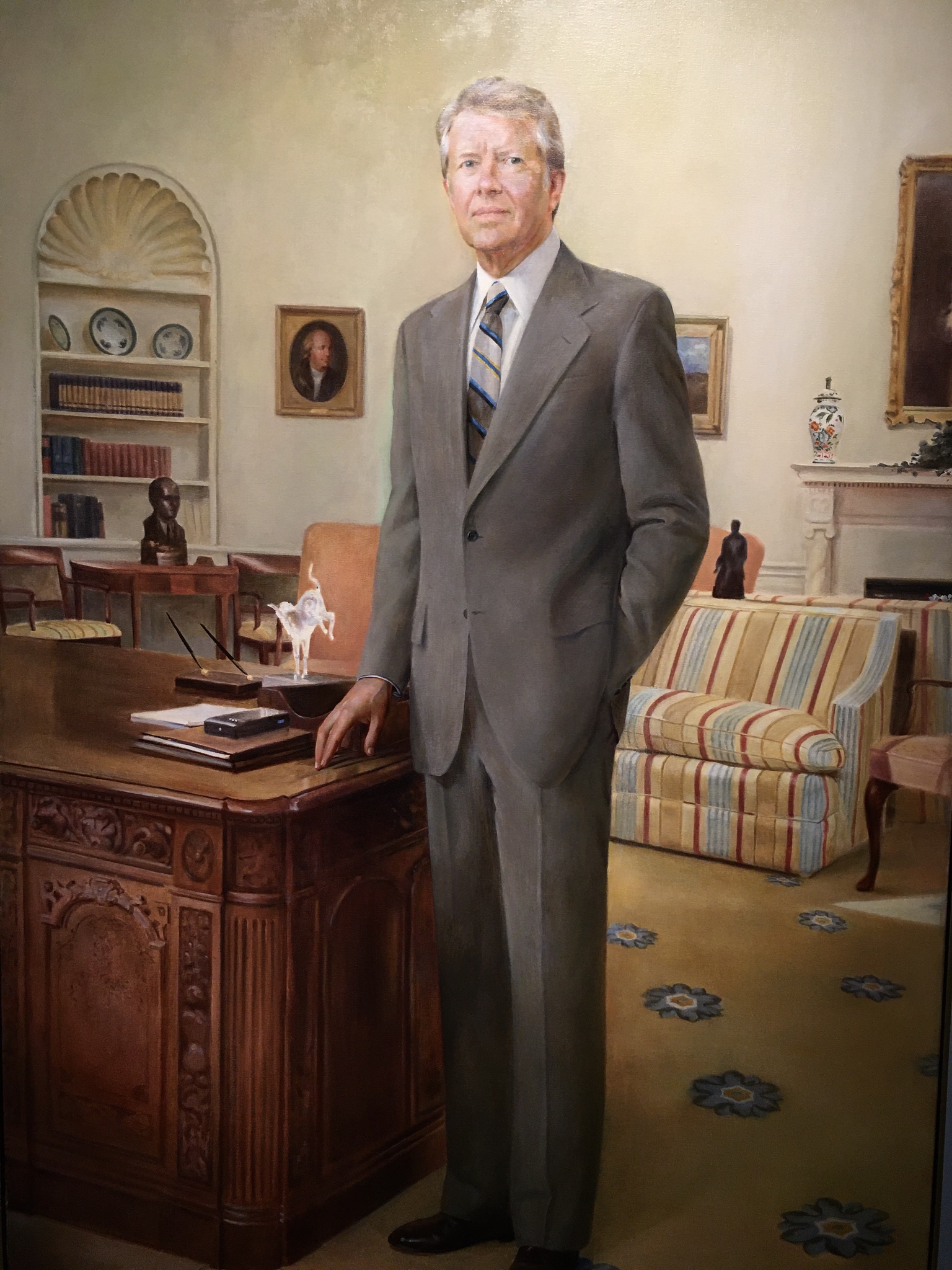

Gulli currently makes $89,000 a year, about $9,000 more than Secretary of State George P. Shultz. He said that since he is not a federal worker, his salary should not be compared with the secretary of state’s. He pointed to a recent industry study showing the median salary of executives employed by the top quarter of government credit unions with assets of $80 million or more is $84,502.

“I don’t have a chauffeur-driven car or a plane at my disposal,” he said, referring to Shultz. He said he got a 15 percent increase in lieu of health insurance and a pension plan.

Lessons from This Case Study

First, the credit union survived this very public airing of its leadership’s perks and excesses, its poor performance and being added to NCUA’s watch list.

Today State Department FCU is a $2.9 billion institution with 88,000 members, 6 branches and over 200 employees. It’s 2024 performance mirrors the industry’s overall trends: delinquency 1.14%, ROA of .34%, net worth 10.5% and loan and share growth around 6%.

Secondly, the transparency on these issues was an important catalyst for change. Members were provided the information on senior management compensation, board and staff travel and their stewardship of the members’ funds.

These details should be standard operating disclosures for all credit unions today. Special events and major business initiatives such as a bank purchase financing should be routinely provided. Such transparency not only provides essential owner information for the annual election of directors; it also induces accountability.

Thirdly, senior NCUA officials from the examiners, the RD, the DC head office and even the Chairman spoke directly to the press. If one reads between the lines, the reporter was questioning whether the regulator should be more forceful in stopping these activities. The response was that this was the responsibility of the owners, unless the excesses undermine the operations. But members must have access to all relevant facts whatever the circumstances.

Every Credit Union Is An Example

Finally, the article several times refers to the entire credit union system and their role in the economy.

Credit unions are nonprofit organizations originally formed to help employes get loans when banks did not make consumer loans. The industry now has $93 billion in assets nationally and 48 million members. The State Department credit union is 46th largest among 19,630 credit unions in the country.

Each credit union today is a representative for the entire cooperative model, for good or otherwise.

Actions from the Article

My colleague Bucky Sebastian’s rule as a public employee was to never say or write anything that you wouldn’t want to read on the front page of tomorrow’s newspaper-or the lead in a blog post. However the solution is not to avoid the topic or say you can’t comment. That will just make the press more interested.

Every credit union will have performance problems. Economic cycles are just that, cycles, not straight line performance. Managers are not perfect and board oversight will vary.

The best way to prepare for these inevitable ups and downs is to be transparent with pro-active disclosure habits in all seasons. This creates a pattern that demonstrates responsibility to the owners, even in times of performance shortcomings. State Department survived this very public thrashing by the Post. NCUA was upfront about its role.

Without this practiced accountability any credit union can risk becoming the next poster child for a cooperative system that seems to have lost its way. And added to the lists of examples kept by those seeking to undo the special role of credit unions in the American economy.