In last Thursday’s Board meeting the NCUA members twice failed in their fiduciary role as directors.

The first shortcoming is specific. It was their collective unexamined and unquestioned acceptance of the continuation of the current NOL for 2024 and the failure to vote on the upper limit one way or the other.

The NOL sets the fund’s cap for retained earnings each year. Any net income above that amount must be distributed back to credit unions as a dividend.

This was a fundamental part of credit unions agreeing to an open-ended 1% funding of insured shares to provide a stable NCUSIF revenue base. So essential was this understanding that it was put into the revised 1984 Title II statute at 1.3%-only to be modified by CUMAA in 1997.

This design is the cooperative alternative to the failed premium models the other federally managed funds used—and still use today. This yearend 1.3% had been the traditional limit until 2017 when the board raised it to accommodate the merger of the TCCUSF’s surplus.

When credit union performance and fund net income do well, then credit unions share in the success. When there are unexpected crises, then credit unions can be assessed a premium.

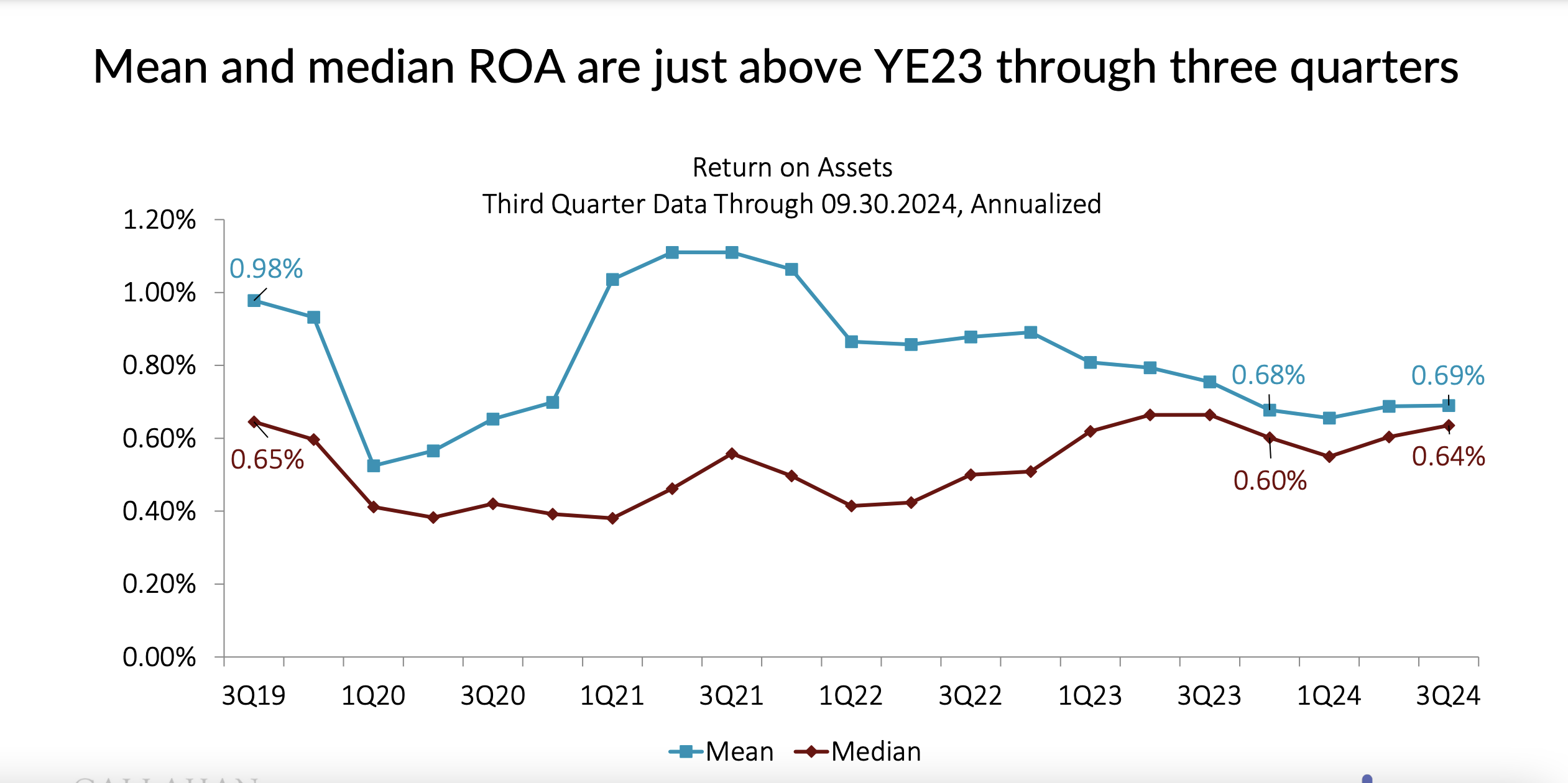

As reported, 2023 was one of the best years in the fund’s history. Actual credit union losses were just over $1.0 million in a year the FDIC had spent over $761 billion in “receiverships costs” through just the first nine months. The NCUSIF’s yearend NOL was 1.3%, or 3 basis points higher than staff had projected only three months earlier-a significant miss.

(note: for credit unions’ concerns about this change, see NCUA’s summary of comments on the 2017 change at the end of this post)

Staff’s Failure to Document a Higher NOL

Every year since 2017 the staff has provided the board their internal modeling assessment following a policy laid out at that time. But not this year. At a time when all of the objective data shows the fund more than well capitalized for any contingency, the board did not even raise a question about the missing documentation and why the actual 2023 yearend outcome should not be more than sufficient going forward.

Staff’s dereliction was pushed aside by CFO Shied saying that there was a need for more analysis. However when one revisits the model’s disclosed inputs for the previous two prior years’ NOL (2022 and 2023), those numbers do not support the presentation that the NCUSIF floor of 1.2% would have been reached in an adverse scenario, These models, fully run, provide no support for a 1.33% NOL cap in those years. And certainly not in 2024.

If their models had showed otherwise, staff would have presented it along with the assumptions used. Here for comparison is the official Board position on risk modeling in December 2021 when setting the NOL:

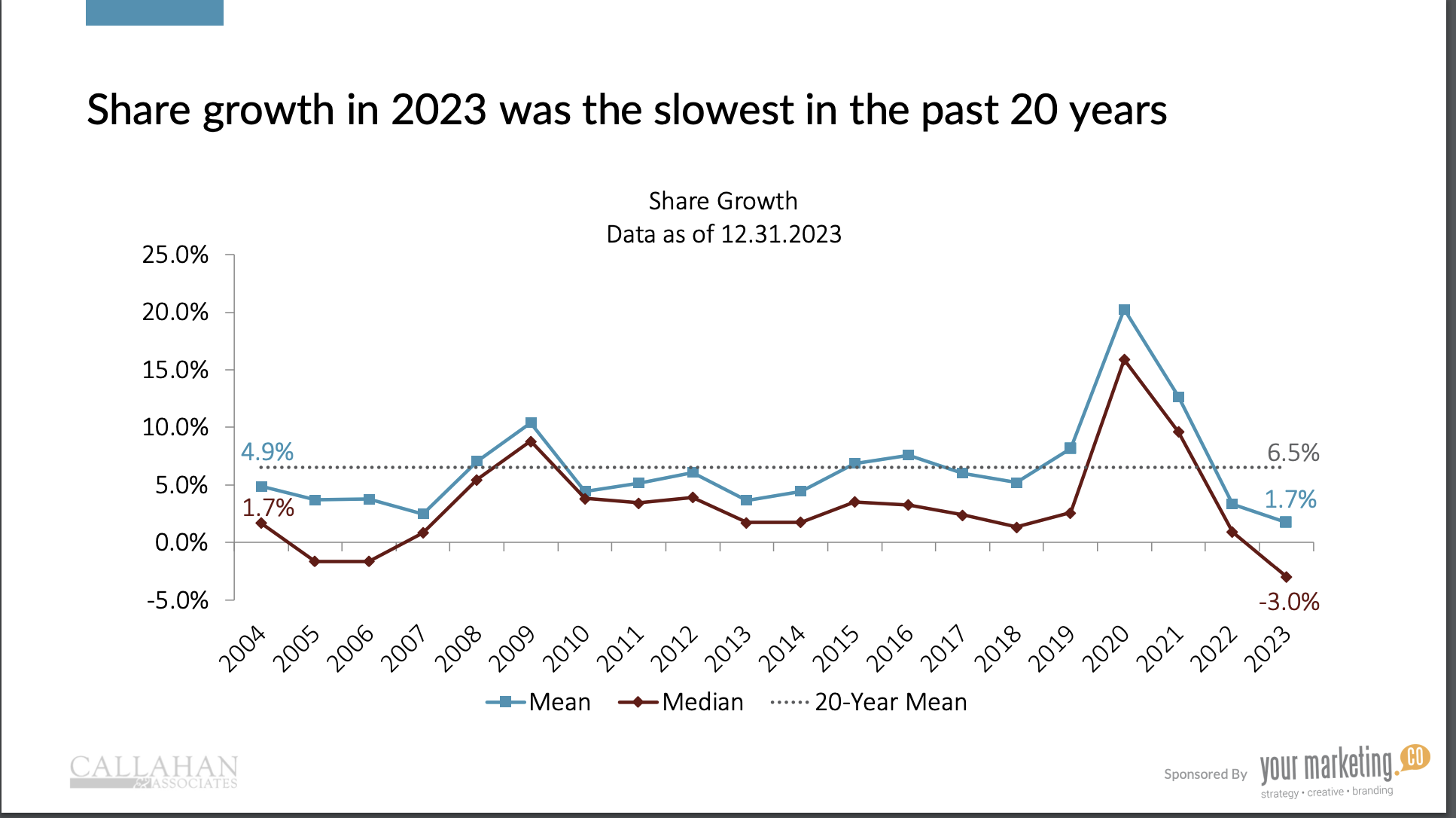

The unprecedented share growth related to the pandemic resulted in an equity ratio of 1.26 percent as of December 31, 2020, and an equity ratio of 1.23 percent as of June 30, 2021.

The Board does not agree with arbitrarily setting the NOL. The NOL represents the level of equity the Share Insurance Fund should have to meet the policy objectives based on a robust modeling of risk.

A $525 Million “Premium Tax” On Insured Credit Unions for 2024

The failure to lower the NOL to its long time, proven upper limit set by all previous boards until 2017 will likely cost the credit unions a dividend in 2024. Each 1 basis point above 1.3% in 2024 will equal at least $175 million. By not lowering the cap, the NCUSIF will hold onto $525 million or more that should have been paid to credit unions.

The most disappointing response was by Vice Chairman Hauptman. He had been a board member for each of the three prior NOL settings in December 2020, 2021 and 2022. He had no problem approving the staff’s recommendation even when a fellow board member in 2022 suggested a lower limit of 1.3% was adequate. This year he feigned ignorance of his prior votes, saying he didn’t know what the right number should be !.34 or 1.35 or 1.36!

Hauptman compounded his recently acquired amnesia with a total misunderstanding of the fund’s financial model. The model does not require a specific level. Under GAAP, a loss allowance for both specific and general insurance losses has already been expensed from retained earnings-a level that auditors review. But in addition there is a ten basis point range of .2 to .3 of equity plus the current year’s earnings to cover any additional losses. That 10 basis point now totals $1.75 billion of capital. The NOL is only the upper CAP on this wide range of equity.

Chairman Harper and newcomer Otsuka each voiced similar themes.

Since joining the NCUA board Harper has made no secret of his intent to remove all current statutory limits on NCUA’s oversight. He has repeatedly cited the FDIC’s options as ones he would like to have for the NCUSIF. This year as the FDIC again struggles, he did not repeat his admiration for the FDIC’s premium model.

Harper’s basic regulatory philosophy can be summed in one word, MORE–more resources, more rules, more personnel and more of whatever anybody else does or has, and NCUA does not.

His longstanding dour forecasts suggests a lusting for real industry problems to be able to justify NCUA’s existence-and his role. This behavior began even before he became chairman. Here are some early comments of his outlook for the credit union’s system:

At June 2019 board meeting: With the recent inversion of the yield curve, we know that a recession is coming, we just don’t know exactly when and how severe.

December 2019 OpEd in CuToday:

We know that a recession is coming. . . That’s why we should fix the roof before it rains by implementing this rule (RBC) at the start of 2020.

February 2021 speech to the DCUC after becoming chair:

As the COVID-19 pandemic rages on, we must smartly, pragmatically, and expeditiously address the economic fallout within the credit union system. To that end, when I first became Chairman, I issued my Commander’s Call to the agency.”

August 2021 DCUC speech:

But, I must caution everyone that we are not out of the woods just yet. Credit union performance will continue to be shaped by the fallout from the pandemic and its financial and economic disruptions.

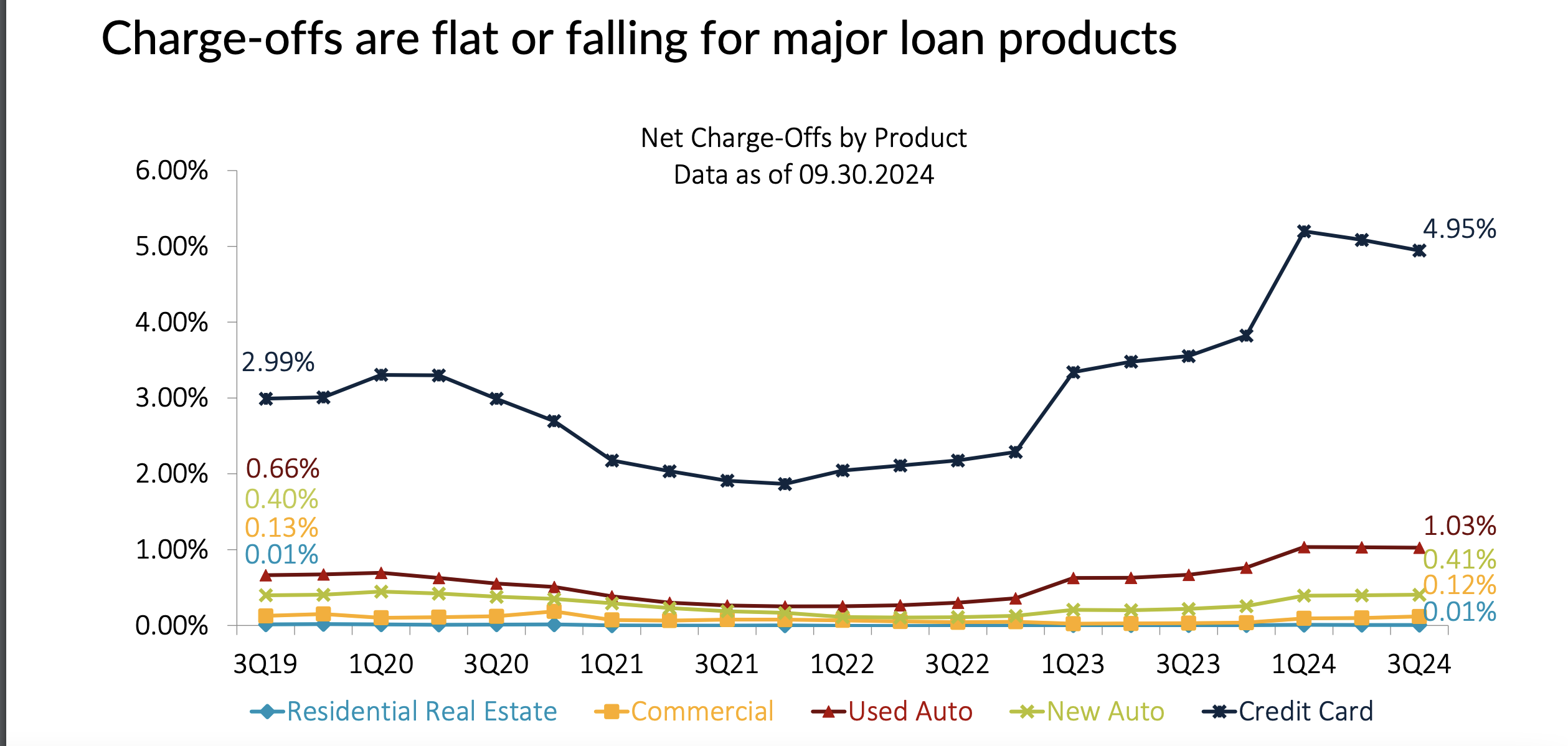

With pandemic-relief efforts like supplemental unemployment benefits, foreclosure prevention programs, and eviction moratoriums coming to an end, many households could face financial stress in the coming weeks and months. This could lead to higher delinquency and charge-off rates and potential losses for credit unions — and even failures.

September 2021 Board meeting: But, nevertheless, we ultimately should expect delinquencies and charge-offs to rise in the months ahead, and all credit unions should pay careful attention to their capital, asset quality, earnings, and liquidity. To protect the Share Insurance Fund — and, ultimately, taxpayers — against losses, the NCUA needs to stay on top of these emerging risks and problems in the credit union system.

Harper’s modus operandi (MO)when presenting the state of the credit union’s system is to focus on risk, uncertainty and fear.

And he was true to form this in this meeting. After acknowledging all of the Fund and credit union strengths, his traditional downbeat forecast about how things can only get worse from here followed:

“While we should recognize those positive things, today’s presentation also illustrates why we cannot become complacent in the supervision of federally insured credit unions, In recent quarters, the NCUA has seen growing signs of financial strain on credit union balance sheets and consumer financial stress. And, we continue to see that financial stress manifest itself in the number of credit unions and the percentage of assets held by composite CAMELS code 3, 4, and 5 credit unions.” Etc

Board member Otsuka took her cues from the chairman, apparently oblivious to the lack of any staff documentation for the NOL and the 40-year history of the fund’s 1.3% cap proving more than sufficient in all economic environments and CAMELS distributions. She said:

“The percentage of shares held by CAMELS 3 credit unions has more than tripled in the last two years and more than doubled this last year. . . . I understand we had few credit union failures this year and that the necessary reserves decreased in part due to greater economic stability forecasted in the macroeconomy, but this is a concerning trend that I will be focused on as the year progresses.

This may be one of the moments where it is good to be prepared and think about the “what ifs.” While there are several positive factors to be encouraged about, there are some worrying signs as well. “

In these comments, the members fail to note that it is the Agency’s supervision and examination activity that is the primary means of for managing individual credit union risk taking-not the NCUSIF. The Fund comes into play only when this most critical activity fails in its oversight role.

Board Members Fail the NCUSIF’s IRR Oversight

CFO Schied repeatedly cited liquidity and interest rate risk (IRR) as the dominate factors in CAMELS downgrades.

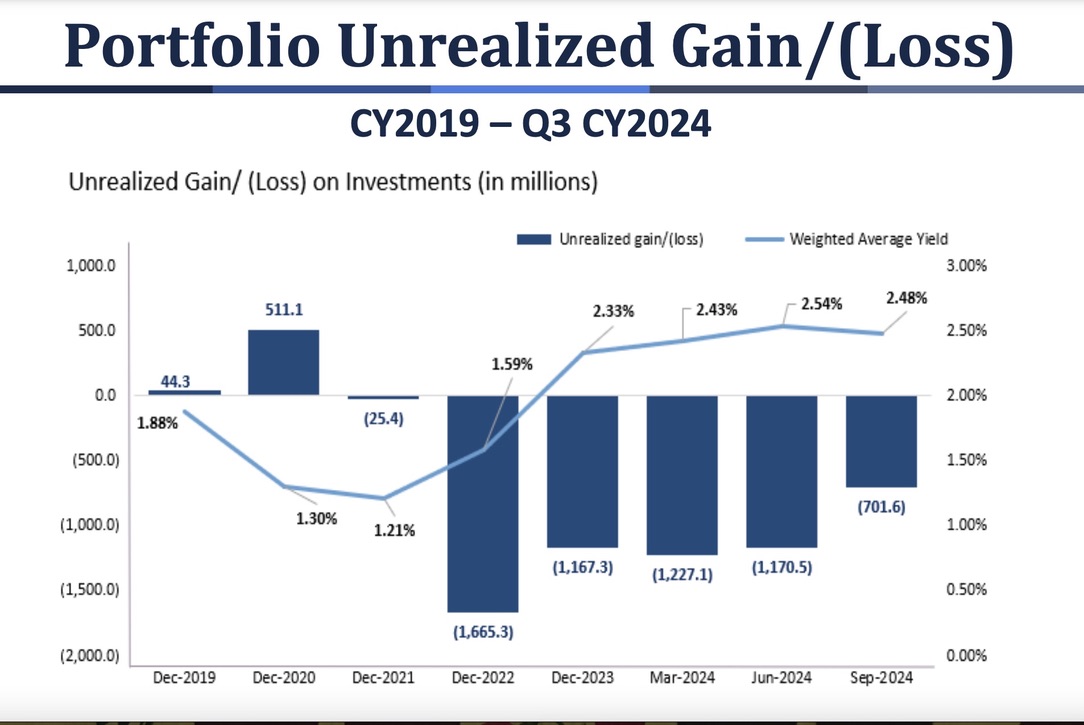

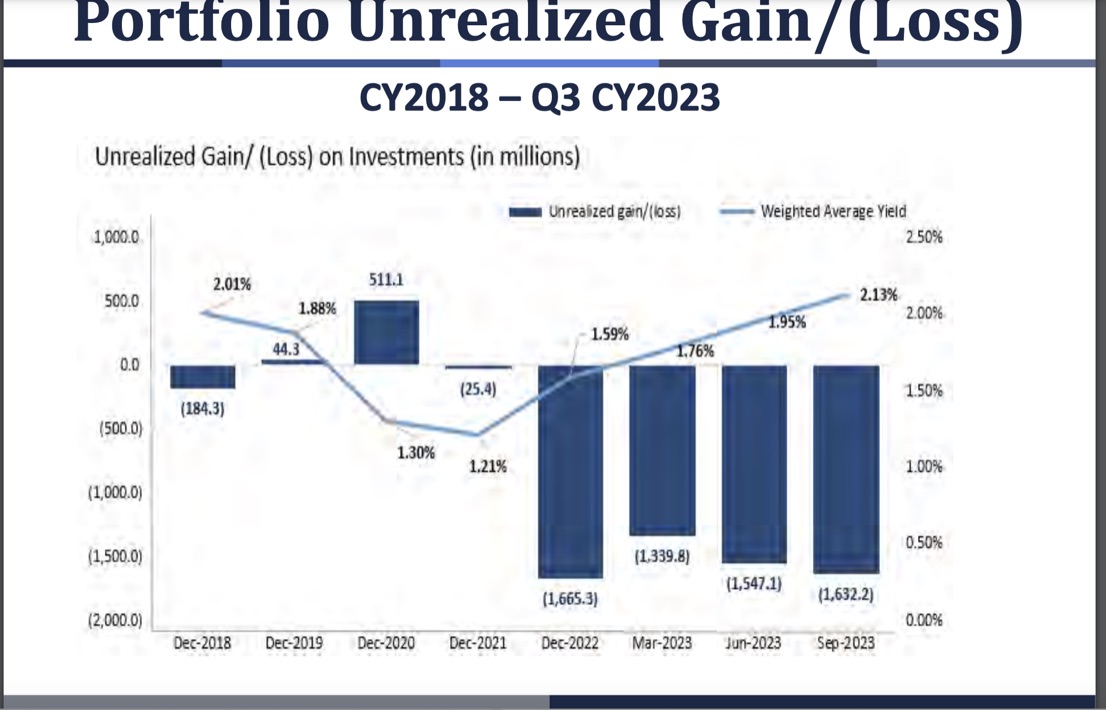

But none of the board members noted that the NCUSIF portfolio has been underwater since December 2021-which means its own interest rate risk management has been at best poor, at worst nonexistent.

Two directors commented, without even a note of irony, that going back into a ladder strategy that resulted in the Fund’s illiquidity and years long below market performance, was the right thing to do.

Interest rate risk management is the number one responsibility of the fund. It determines both NCUSIF liquidity and adequate levels of income.

No one mentioned the one year shortening of the Fund’s weighted average duration which is the vital component of IRR. And a major factor in the gain in interest revenue in 2023.

This silence continued as staff announced its next investment will put the fund back on the same ladder pattern that has resulted in 2 ½ years of underperformance in this current rate cycle.

The Second Failure: Board Governance

In 1977 one of CUNA’s primary legislative initiatives was to replace the Bureau of Credit Unions single administrator ovesight with an independent agency and a three person board. There was concern that a single administrator, even with an industry advisory board, might not be responsive to the growing industry’s needs. In other words an unchecked supervisor.

The public governance process in a Board meeting is a critical demonstration of the effectiveness of the individual member’s and their collective capability. Reading from prepared scripts with questions already written out, is neither transparent nor a model for board conduct.

Why can’t members just have a normal conversation with the staff most responsible for the areas under review versus a designated spokesperson reading responses for which he has no direct accountability (eg. CAMELS scores)?

How Democratic Design Falters

This President’s day weekend we honor the political example of two American leaders for very different reasons.

From essayist Gleaves Whitney: George Washington earned the respect even of his former enemy, King George III, by doing something exceedingly rare in history: When he had the chance to increase personal power, he decreased it — not once, not twice, but repeatedly.

During the American Revolution, Washington put service before self. His personal example was his greatest gift to the nation. It has often been said that the “Father of our country” was less eloquent than Jefferson; less educated than Madison; less experienced than Franklin; less talented than Hamilton. Yet all these leaders looked to Washington to lead them because they trusted him with power. He didn’t need power.

In all of the history of the NCUA board, I know of but one, who voluntarily left their position before their term ended. Power, prestige and position are addictive. What’s missing is performance.

From Abraham Lincoln in January 1838 to the Lyceum club in Springfield, Ill on “The Perpetuation of Our Political Institutions” as summarized by Heather Cox Richardson: “The destruction of the United States, he warned, could come only from within. “If destruction be our lot,” he said, “we must ourselves be its author and finisher. As a nation of freemen, we must live through all time, or die by suicide.” . . .

“He warned that the very success of the American republic threatened its continuation. “[M]en of ambition and talents” could no longer make their name by building the nation—that glory had already been won. Their ambition could not be served simply by preserving what those before them had created, so they would achieve distinction through destruction.”

Contrary to the statements of the three board members, their primary fiduciary duty is not to the NCUSIF. It is to the member-owners of credit unions. The Fund is only one of many tools and roles the NCUA has for creating “a system of cooperative credit” for the United States.

The Fund was not even formed until almost 40 years after the Federal credit Union act was passed. It was put on a sound financial basis 50 years after the Act. And it is arguably the least important resource as more than 90+% of all credit unions are safe and sound, not due to insurance, but from supervisory examinations.

The Board’s failure to formally review the NOL was by design. It violated a fundamental agency commitment when the legislation creating the new structure was implemented. Informed governance oversight is missing. Paraphrasing Lincoln, The greatest threat to the NCUSIF is not from external threats to credit union solvency but from internal NCUA mismanagement by intent or simple inexperience.

And that is how freedom is lost, one small step at a time. This time it is NOL review. And next?

Harper has made no secret of his intent to reshape the NCUSIF in with the FDIC’s premium options. Hauptman can no longer claim ignorance of previous precedent and practice. Otsuka must decide if she wants to be merely an echo for the Chair or really dig in and learn about the history and uniqueness of cooperative design. Then truly express her own independent judgment.

The NCUA board was set up with democratic intent, to be a check and balance on agency or individual interest overriding that of credit union members. The design does not guarantee this will happen. Rather it is the conduct of those in their chosen positions of authority that will ensure this structure truly protects members best interests. That is the governance model every credit union is expected to follow.

Additional References

Credit Unions Comment on NCUA’s Raising the NOL in 2017 from NCUA staff summary:

Federal Register Notice October 4th, 2017

Around 55 percent of all commenters expressly opposed any increase to the normal operating level. However, around 90 additional commenters urged a ‘‘full rebate’’ of Stabilization Fund equity, implying they also opposed any increase to the normal operating level that would decrease a distribution in 2018 or beyond. Many of these commenters contended no increase could be justified because a normal operating level of 1.30 percent had been sufficient to withstand the financial crisis. A large number of these commenters (as well as some that supported an increase) were concerned the Board would never again decrease the normal operating level if it increased it in 2017. Many commenters that opposed any increase to the normal operating level urged that, if the Board did increase it, the increase should sunset after one year and the Board should then substantiate any extension of a normal operating level above 1.30 percent. Some of these commenters suggested increasing the normal operating level would erode the NCUA’s motivations to control its operating expenses and that the NCUA’s operating budget and the overhead transfer rate had consumed most Insurance Fund investment returns in recent years. A common thread in the comments was that failure to return all Stabilization Fund equity would be contrary to prior assurances and promises from the Agency.

Some commenters contended an increase to the normal operating level would be akin to credit unions over reserving for loan losses, a practice NCUA examiners generally advise against. They noted the strength of the credit union industry, the recent strengthening of the NCUA’s regulations related to capital, and more stringent supervisory tests as additional firewalls that reduced the need for an increase to the normal operating level. These commenters often pointed to loss estimates related to the Legacy Assets as a basis to doubt the NCUA’s projections of the Insurance Fund’s performance.

Staff response for those citing the Corporate Crisis as a reason for increasing today’s NOL:

Other than the $1 billion capital note issued to U.S. Central Federal Credit Union, no material expenses related to the conserved and liquidated corporate credit unions were paid from the Insurance Fund. Immediately after Congress established the Stabilization Fund, the Board transferred the $1 billion capital note receivable to the Stabilization Fund, at which time the Insurance Fund received full payment on the capital note from the Stabilization Fund.