That was the first question the reporter asked. Others followed. Will some fail? Would secondary capital options help?

My Answer and the Data

Yes, the system has adequate capital. Credit unions have total reserves of almost $193 billion and an average net worth ratio over 11%.

In 2019 the industry’s annualized loan losses were .63%. At March 31, 2020, 85% of all loans were secured and first mortgages backed 43% of the portfolio. Unsecured loans were under 10%. The allowance account was 150% of all delinquent loans.

In the Great Recession of 2009, the net loan charge off rate was 1.21%; and in 2010, 1.13%. The market value of homes securing mortgages was a major concern. That is not the case today.

In 2019, the industry’s net loan losses were $6.1 billion. However. credit unions added $6.5 billion to the allowance account and still reported $14.5 billion in net income. Credit unions could see their historical loss rate of .50-.60% grow by three of four times (double the 2009/10 experience) and still be very sound.

Two Capital Sources

Averages provide a macro context, but problems are micro, in individual credit unions. Might individual credit unions have higher than average losses?

A fact of the covid economic shutdown is that the impact on individual households is disparate. According to a Bipartisan Institute Survey, 42 % of households report negative effects on income from the dual crises. For Hispanic households, the result was 60% and for black homes, 54%. Over 59% of single parent households, regardless of race, saw income reduced or were forced to seek unemployment.

Individual credit unions will have differing proportions of members financially impaired. But that is why the cooperative system has two capital sources.

The primary reserves are each firm’s retained earnings. The second is the collective capital in the NCUSIF approaching $17 billion.

Cooperatives’ Collective Capital

Unlike the FDIC fund, the cooperative system’s insurance fund was redesigned in 1984 to be a ready source of capital assistance. This assistance is authorized by Section 208 of the Federal Credit Union Act.

When the FDIC is given a troubled charter by separate supervisory authority, its role is to close the institution by liquidation or sale. Providing FDIC assistance is considered inappropriate because of public policy concerns about the use of “public money” to restore private wealth.

Credit unions create common wealth. Their reserves are the collective savings of all the members. Members in turn send 1 cent of every share in a credit union to the NCUSIF to comply with the 1% deposit requirement.

These collective reserves, updated semi-annually, are always fully available to assist individual credit unions. In the premium model, funds must come from expenses charged to the insured banks.

NCUSIF assistance in the form of cash, subordinated debt or guarantees has been used since the fund’s founding in 1971. These actions not only minimize losses, but most importantly enable familiar service to members who may be caught in the same economic circumstances as their credit union.

Capital Is Not the Issue

The dollars of capital or the level of net worth is not the primary issue for the coop system. Important yes; but more critical is how the reserves are used by credit unions and NCUA. Is it just to expense away troubled credit unions, or to invest to restore sustainable operations?

Cooperative reserves, like all capital, can be underused or misused. In a competitive market system however, capital’s objective is to gain long term returns and create competitive advantage. Liquidation is always the costliest option, both in terms of immediate expense and the elimination of all future income.

Today credit unions are working with millions of members whose financial situation has been disrupted through no fault of their own. Standing alongside members’ transitions can result in years of fervent loyalty. Similarly, the welfare of the whole system is enhanced when credit unions suffering loses, can work to again be sound.

The National Effort to Save Jobs, Assist Consumers , and Support Businesses

Every covid emergency program passed by Congress including the CARES Act with its $600 unemployment weekly increase, $1,200 one-time payments to families earning less than $75,000, the PPP loan program with loan forgiveness, the Federal Reserve purchase of EFT’s with high risk bonds, and its Main Street loans to business are public expenditures intended to prevent corporate and individual financial failure. The goal is to restore the economy and consumers to full activity as quickly as possible.

However, some at NCUA may not have bought into this bipartisan, government-wide effort. Bound by a literal PCA mindset, the NCUSIF’s CFO announced a $60 million addition to loss reserves in the May Board meeting, even though every financial trend presented was in a positive direction.

In April the Inspector General in his semi-annual report to congress confidently predicted: “Given the economic impact of the COVID-19 pandemic, we anticipate an increase in required MLRs in the coming year.” A Material Loss Review is required in every circumstance where the cost of a problem resolution exceeds $25 million.

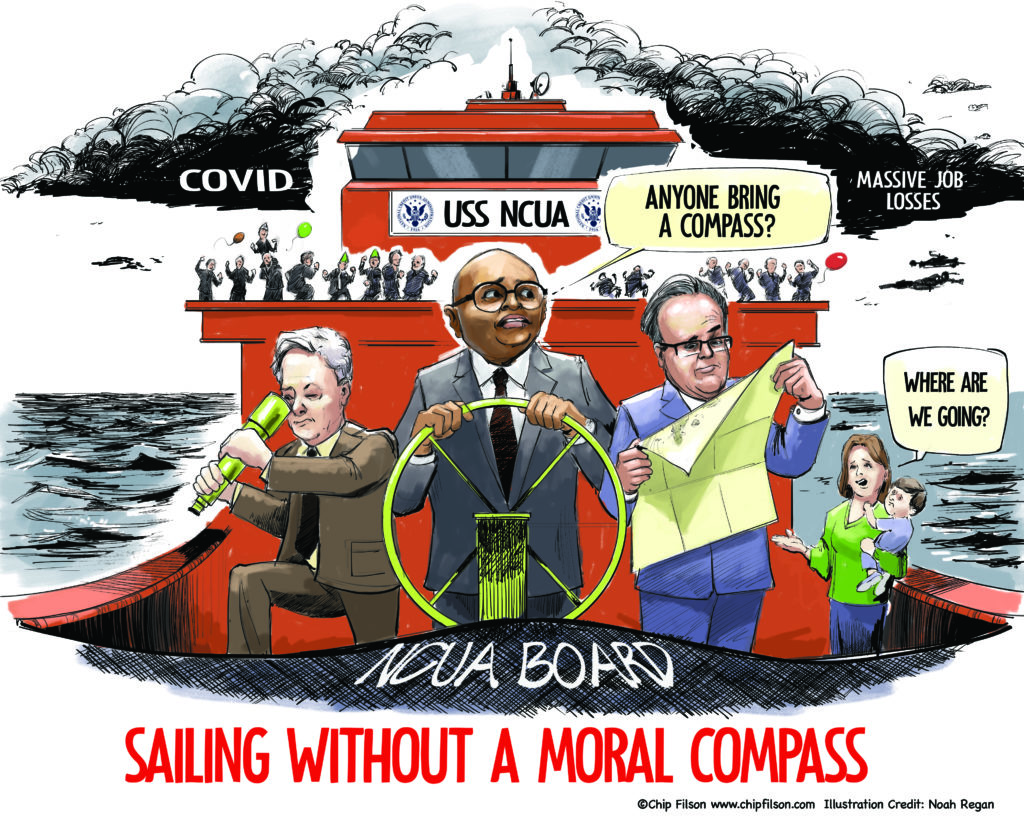

Chairman Hood has issued policies to give credit unions greater flexibility and time to work through financial downturns. The question is whether these policies will be just press releases or will they change staff behavior

For that to happen, the Chair will need to ensure operational performance. That oversight accountability, not the amount of capital, is the real test for the Agency’s leaders.