“You will pry my credit union from my cold middle class dead hands.” Words of defiance from a credit union believer. One of hundreds of comments posted last week.(source below)

A leader’s ultimate success much depends on how the person manages the instruments of power. For some in authority, the point of power is to use it to expand one’s dominion. Using requires building up an institution’s size, scope of activity and resources to control or dominate.

However, there is another leadership model.These individuals believe that the role of authority is empowering others. Credit unions at their most effective are subversive of status quo structures. They organize from the bottom up. By the grass roots, not by investors hoping to make money. No capital, just personal sweat equity, time and collaborative effort to accomplish common purpose.

This counter-cultural, not-for-profit cooperative design is also the key to credit unions’ latent political power. Here is a case study from last week of what this looks like in practice.

Responding to a Newspaper Opinion

Last week the Washington Post published an Opinion article by the former chair of the FDIC, Sheila Bair, titled: Tax-free credit unions are thriving at public expense. Her bank in Chesterton, MD, The Peoples Bank, accepted a purchase offer from a Massachusetts credit union “using some of their untaxed income.”

Her article referenced other examples of credit union branding and expansion. Her recommendation was to level the playing field with community banks by taxing credit unions. Otherwise, she warned, ““Give them an inch and they’ll take a mile.”

I had used the credit union’s purchase of “her” bank as an example in a blog Time to Ask WHY. My p;oint was to illustrate the bigger public stage on which credit union actions are now viewed.

I did not foresee the Post’s readers’ reaction to her article. When the postings were stopped 253 comments had been submitted, almost all from credit union members.

The members universally defended their credit unions, called the article a “hit” piece, and provided hundreds of firsthand examples of how credit unions provide special member value.

Following are a few examples of the readers’ responses unleashed by this former banking regulator’s critique of credit union’s tax status.

From a bank customer and credit union member:

I have business both with a major bank and a credit union-right now the rate on my major bank credit card is 27.99% (they cut my rate a whopping 2% from 29.99% a few months ago!)

Right now, the rate on my credit union credit card is 8.99%

You can probably surmise from the above anecdote who gets most of my business…

From a 30 year member::

I have been a credit union member for 30 years. No hidden fees, low interest credit card, interest on my checking and savings, no service charges, talking to real people, great service, the list goes on and on. I would prefer to never have to deal with a bank again. I’m sure big banks would love to crush credit unions.(Reader comment ratings: Provocative/Thoughtful 61)

From a member with mortgage loans for 37 years;

I’ve had a mortgage since 1988 on my successive residences, usually with an escrow account to pay property tax and homeowners insurance. Refinancing in 2012 with a credit union was the first time I managed to persuade my lender to include California Earthquake Authority premiums in the escrow account associated with my mortgage.

I’ve been much more satisfied with the service I’ve received from a credit union than from any of the big banks I’ve patronized over the years….

A Question posed: The difference, who cares more about you?

Ask yourself a simple question. WHO cares more about YOU as an individual? A big bank or the credit union where you are a member?

Notice that YOU are a member of the credit union – not just a customer. With banks – YOU are just another income source.

A question: Why the article?

Of all the non-profits that exist (and ALL credit unions are non-profit) – why attack the one group that actually takes care of their members instead of pushing propaganda as part of a political agenda?

Attacking the for-profit Washington Post:

Wow, taking a shot at non-profit banking!?!? Proof once again that the Post is in the bag for corporate interests. Where is the guest opinion on the mis-deeds of for profit banks? Instead of recommending that credit unions return to stricter membership rules, or limit their ability to purchase commercial banks, you go right for their non-profit status. I have not used a for profit bank in 25 years. Thankfully almost everyone on Capitol Hill banks with the Congressional Federal Credit Union (as do I) so they understand the value of a credit union.

A comment on the Opinion author:

As others have pointed out, Shelia Bair was chair of FDIC during the 2008 financial meltdown. She was a major architect of the TARP bailout of Chase, Bank of America, Wells Fargo, and the other big banks.

This is an unadulterated hit piece against Navy Federal Credit Union, which is competing with the big banks directly in their consumer banking business.

How and When Is Member Power Mobilized?

The comments extend for another 240+ reader reactions. These words are not lobbying jargon, irrelevant numbers or cliches. They are from lived experience motivated by personal feelings.

Implicit in these words is a readiness for action. This potential is the real source of credit union power, not the amount of PAC dollars donated. It is the member-owner-voter’s relationship with their credit union.

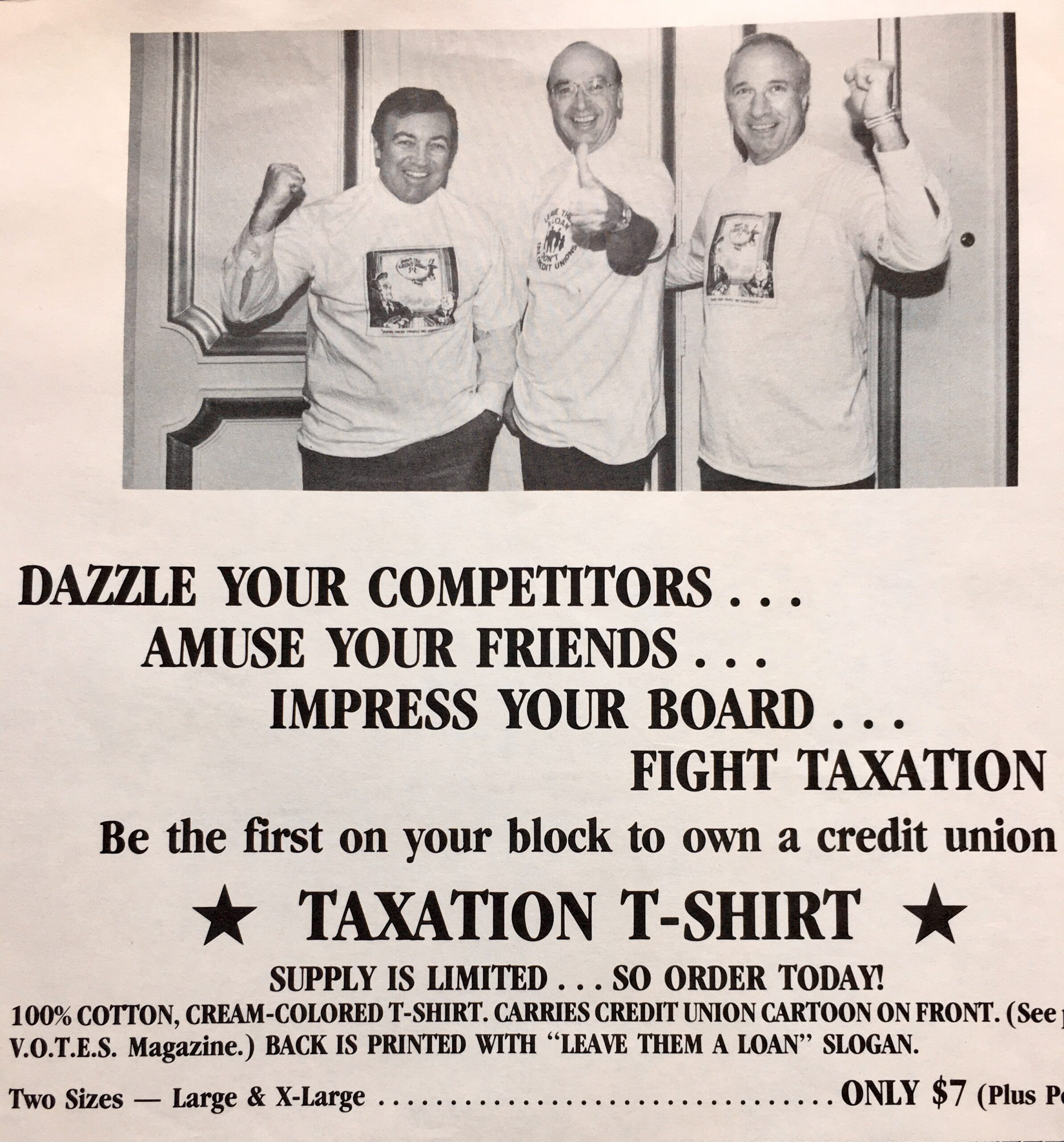

This foundation of the movement is a latent, “sleeping giant”-a phrase used by Ed Callahan during the 50th anniversary of the FCU Act in 1984 and afterwards. Deregulation had placed the responsibility for the future of credit unions back where it started, in the hands of boards and members, not the federal government.

The Immediate Challenge

America is in an era of political disruption. The issue of taxation will undoubtedly arise in several contexts. But the real challenge of crafting a new beginning, a rethinking of who we want to be, is much greater. And it may be beyond the grasp of those who seek only to defend the existing co-op status quo.

What is necessary are new models to tackle critical opportunities for clarity about credit unions’ future role in the American economy and members’ lives.

The country is hungry to reset foundations, recommit to fundamental values and for new generations of leaders who can innovate with cooperative design.

We should avoid marketing our fear of change to garner internal support, but rather take this fluid moment to rally our members for a renewed vision of what we can be.

And like the initial founders, or the change makers who led deregulation, this new era can be both frightening and enlightening. This redesign may involve both government/regulatory relationships and new realities for industry participants taking responsibility for our future. It may entail new organizational relationships and partnerships.

If one looks closely the seeds for a new future are already there. Some have been planted by those seemingly old school; others are in the enthusiasm of a generation that seeks to change the world. Our skill will be to identify those whose directions empower others with their vision, versus those intent on enhancing their existing legacy returns.

Let the conversations begin. If you have any doubts about what members value, just go the article and read some of the several hundred more comments. The members’ voice is there if we really listen.