Rare bird sightings are often front-page local news. Such was the lead story on July 5, 2022 in Rockland, MI: Rare Eurasian bird spotted in Michigan, first sighting in US:

A Michigan birdwatcher made a once-in-a-lifetime discovery this weekend when he spotted a bird known as a common redshank in a marsh near Detroit, a few thousand miles from the bird’s usual home.

Equally rare among the financial species is discovering a new credit union charter. The local news headline says it all: Somebody Actually Started a New Credit Union. Here’s How They Did it.

This was the second sighting of a new credit union charter this year. NCUA’s press announcement described the event as an example of credit union’s purpose: Supporting underserved communities and providing capital for community development is at the core of the credit union mission.

Few in the credit union movement are actively trying to spot new charters. CU*Answers and its CUSO challenge is one multi-year institutional effort. Two individuals have been public in their pursuit of this rare activity: Denise Wymore and NCUA Vice Chair Kyle Hauptman.

Because this event is so unusual, the joy, passion and hope embodied in a new credit union today are often overlooked.

Many persons’ deep desire to create something new to serve one’s community is a defining characteristic of American enterprise.

Entrepreneurs are central for a market economy, especially for new credit union charters that begin with limited financial capital.

On this Labor Day eve, I am reprinting this August 30 story as I believe it describes the dynamic human spirit new charters bring to the movement. Enjoy this description of Community First Fund FCU’s creation by OSCAR PERRY ABELLO:

A Credit Union in the Neighborhood: It Just Makes Sense

Leo Rodriguez knew all he needed was $10,000 in startup capital to open his own hair salon, something he’d dreamt about doing since he was four years old and saw a poster of legendary hair stylist Vidal Sassoon. Twenty-nine years and countless clients later, he is more excited than ever to invest back into the only institution that believed enough in him to make that loan.

The year was 1993. Rodriguez had already spent the previous several years studying cosmetology and hair styling in New York City and London. He returned to his home city of Lancaster, Pennsylvania, where he landed a job working at a new downtown hair salon founded by local legend Paula Severino Standish. After a wildly successful year, gaining his own influential clientele, he knew it was finally time for him to go out on his own.

He just needed that $10,000. But none of the banks he went to around town were interested in loaning him the money.

“I wasn’t looking to, like, renovate a building, I just needed a couple chairs, just to get started,” Rodriguez says. “There were a lot of banks that just didn’t want to give you any money. It was very hard to start a business. Also being a minority, that was difficult.”

A Personal Connection

But as fate would have it, one day Rodriguez was catching up with his childhood friend, Daniel Betancourt, who had recently left his job in commercial banking to join a new loan fund created by another local legend, a Black civic leader named James Hyson. Now called Community First Fund, it invests in Black, Hispanic, immigrant and other entrepreneurs whom traditional financial institutions weren’t interested in serving.

Not only did Community First Fund give Rodriguez his first $10,000 loan, it also taught him the ins and outs of running a business, creating a business plan, proper accounting, and profit and loss statements. He soon repaid that $10,000 and borrowed another $35,000, then $50,000. Every time he needed to expand or renovate or move his salon to a different location, he went back to Community First Fund. During his prime — he’s 63 now and expects to semi-retire in a few years — Rodriguez had 10 stylists working in his downtown Lancaster hair salon.

“I probably borrowed over three or four hundred thousand dollars from them in total over 30 years,” Rodriguez says. “They’ve never turned me down. They were always, always there for me.”

Loyalty and a Credit Union

Earlier this year, Community First Fund opened a traditional financial institution, a credit union. Why? Because after serving entrepreneurs like Rodriguez for 30 years, the fund found that the families and communities around those entrepreneurs either weren’t getting access to banking and affordable credit elsewhere or would prefer access to banking and affordable credit from a name and face they’ve come to trust.

Rodriguez was one of the first members of the new Community First Fund Credit Union. He’s moving all his personal and business accounts over.

“I’m into loyalty, man. I’m into taking care of people. it’s what I do,” Rodriguez says. “When Dan was telling me they were gonna open up this credit union, I’m like, ‘Oh, Jesus, thank God.’”

New Credit Unions Much Rarer

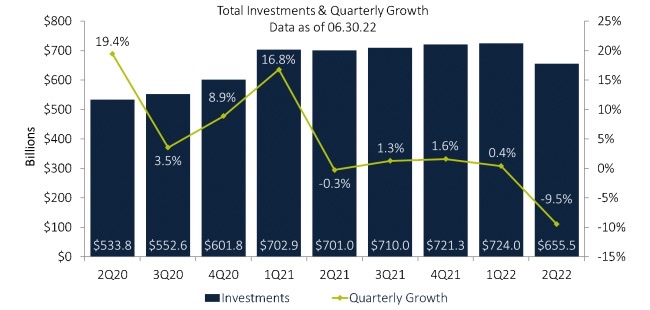

Starting up a new credit union is much rarer than it used to be. Prior to 1970, it was typical for federal regulators to charter 600-700 new credit unions every year. But since then, for multiple reasons, the number of new credit unions chartered every year began a long, slow decline. The new Community First Fund Credit Union was one of only four chartered in 2021. That’s as many new credit unions chartered over the previous five years combined. With so few new credit unions starting up, and scores closing or merging with others every year, the total number of active credit unions has declined from a high of 12,977 in 1970 to just 4,872 today.

The new Community First Fund Credit Union is also an even rarer example of something else. It’s modeled partly after Hope Credit Union, based in Jackson, Mississippi — which itself is really a replication of a model for banking that was birthed either on the South Side of Chicago or Manhattan’s Lower East Side, depending on who you ask. The model explicitly combines deposits from inside the community with deposits brought in from outside the community that might otherwise be deposited in bigger banks like those on Wall Street.

CDFI Plus a Credit Union

“The very fact that a new credit union is chartering is something noteworthy,” says Clifford Rosenthal, who helped establish Lower East side People’s Federal Credit Union in 1986. “And it’s especially significant in the CDFI world that this loan fund has used its resources to establish a credit union, which in the optimal scenario will operate side by side with the loan fund and hopefully achieve some real synergies.”

CDFI stands for “community development financial institution,” a U.S. Treasury designation for loan funds, credit unions, banks and venture capital funds that have a primary mission of serving low-to-moderate income, historically marginalized communities. Rosenthal helped craft the legislation passed in 1994 that created the CDFI designation as well as the CDFI Fund, an arm of the U.S. Treasury that provides grants, tax credits and other forms of support for CDFIs across the country. Community First Fund is a CDFI loan fund, and after it gets up and running, the new credit union can also seek its own separate CDFI certification.

Based on his own experience helping to start a credit union to serve a neighborhood other financial institutions were leaving behind at the time, Rosenthal expected that the new CDFI Fund would provide assistance to other groups starting either new credit unions or banks — regulated, depository institutions. But that isn’t how things turned out. Most of the CDFI Fund’s support has gone to loan funds like Community First Fund. And, with assistance from the CDFI Fund, some of those loan funds have grown very large, with assets in the billion dollar range.

“Some of the loan funds clearly have the capacity to launch a depository institution if they choose, but none of them have until now,” Rosenthal says.

Five Years Planning

Betancourt, now the CEO of Community First Fund and its credit union, says he started mulling over the idea maybe around five years ago. Clients of Community First Fund would occasionally ask if the loan fund could maybe help them or their families out with a home mortgage, or a used car loan, or alternatives to payday loans. Maybe they had tried getting those loans elsewhere and couldn’t, maybe they just wanted to deal with an institution they already knew and came to trust. At the time, Community First Fund had no way to help with those situations directly, it could only refer those requests to others.

Betancourt says he also started reading books like Lisa Servon’s “The Unbanking of America,” which gave him even more food for thought. Community First Fund also partnered with Lancaster’s Franklin & Marshall College to do a study of underbanked populations in Lancaster County.

More recent findings affirm what Betancourt was starting to grapple with. A study released last week from the Joint Economic Committee Democrats in Congress found Black and Hispanic Americans are more than twice as likely as white Americans to be unbanked or underbanked. Similarly, families at the bottom of the income distribution are more than six times as likely as families at the top of the distribution to be among the unbanked or underbanked. In 2021, 46% of Black Americans and 37% of Hispanic Americans reported that they had been denied credit or were approved for less credit than requested, compared to less than 25% of white Americans. Evidence shows that while new financial technologies show less bias than face-to-face lenders, they fail to eliminate discrimination.

Social Change with Transformational Deposits

The year 2020 ended up becoming the moment that provided the fuel for Betancourt’s credit union fire. Between the racial disparities laid bare by the COVID-19 pandemic, and the racial reckoning sparked by George Floyd, Breonna Taylor and other Black people killed at the hands of police, individuals and corporations were looking for something to do in response. One of the options that emerged was moving money into Black banks and credit unions.

Hope Credit Union received a $10 million deposit from Netflix and another $10 million deposit from PayPal, on the way to raising $100 million in deposits from corporations and philanthropy. CEO Bill Bynum started telling corporations his credit union actually didn’t need any more, but he could refer them to others like Betancourt who were looking to secure such big dollar corporate deposits — which Bynum started calling “transformational deposits.” They aren’t donations. These are part of the large pots of money that all corporations keep around on their balance sheets as part of managing their finances, but historically they’ve left those deposits in big banks or short-term Wall Street investments.

Finding Capital

But Betancourt needed more than just transformational deposits to charter a new credit union. Federal regulators require depository institutions to set aside a small portion of cash as a cushion against potential losses. For banks the minimum is $1 set aside for every $11 in assets, for credit unions it’s $1 set aside for every $16 in assets. New banks typically raise that initial small portion of cash from their shareholders. New credit unions can’t do that. So Community First Fund instead launched a capital campaign, in the traditional sense of a nonprofit or church group capital campaign in which donors are asked to make multi-year pledges.

For every corporation that called about making a transformational deposit, Betancourt also approached them about making a multi-year pledge as part of Community First Fund Credit Union’s capital campaign. And of course Community First Fund went around to its long list of previous donors to see who else might be interested in contributing to the capital campaign. A pledge of $500,000 could be spread out over five years, as $100,000 a year in retained earnings for the credit union to set aside as part of its regulatory requirements.

A Wealthy Donor

Community First Fund might have needed more time were it not for MacKenzie Scott’s surprise $10 million donation to the nonprofit, $2 million of which it plowed into the capital campaign for the new credit union. Thanks to the capital campaign pledges, stretched out over as many as five years, the new credit union projects it will have positive net income starting from year one. That’s unusual for any new depository institution, most of which anticipate negative net income during the first few years of getting up and running.

With its target customer base, letters of intent for transformational deposits and capital campaign pledge letters, not to mention its decades of experience making 5,592 small business loans and counting, Community First Fund submitted all of that as part of its charter application to the National Credit Union Administration in December 2020. The agency approved the application in just six months — lightning speed by normal chartering standards.

Since then, Community First Fund converted its headquarters into its first credit union branch, serving the Lancaster metropolitan area’s 550,000 residents. The credit union eventually plans to open six total branches and also leverage online and mobile banking to serve Community First Fund’s entire footprint, which now includes Philadelphia and crosses state lines into Delaware and parts of New Jersey.

The loan fund will continue to do what it has been doing, providing loans to underserved business owners, 71% of whom so far have been people of color. But now it has an affiliated credit union as a way to meet those requests for home mortgages, auto loans, emergency loans and other personal loan requests from its existing borrowers and their networks.

A Credit Union in the Neighborhood: “It Just Makes Sense”

“I’m so happy that they got the new credit union,” Rodriguez says. “It’s almost like the old way, you know, where you had a bank in the neighborhood and it knew everybody in the neighborhood and you knew the bank was there to help you. I believe every client that they ever had will open up an account there. It just makes sense.”

Chip,

I’ve been waiting for people smarter than me to comment… I know they’re out there!

My observation is that if you do the Seven Cooperative Principles right, DEI feels like it’s already built in. Raising DEI as an Eighth Principle seems like we need a collective kick in the butt for not getting the first seven properly implemented!

Far from dismissing the idea, I see this as a challenge we need to take on. If anyone, either within the movement, or on the outside, isn’t feeling it, then it MUST be raised up – but not as a revolutionary new principle for us to debate, but as an EVOLUTIONARY opportunity to fix what’s already in place.

Too many people are feeling disenfranchised these days, and the view from my soapbox is that credit unions specifically, and cooperatives generally, are the best way to restore power back in the hands of the people.

By all means, credit unions should raise the DEI issue – not as a “checklist” item – “here’s our position in response to this issue” – but as a challenge to their own leadership, their staff, their members, and their communities, to GET INVOLVED.

Our grounding principles are solid. If we erred in the how we built on them, we need that diversity and inclusivity to drive our evolution.

P.S. I recommend the writings of Ray Dalio (don’t settle for watching him on the financial channels; really dig in to his 3 “Principles” books). I’m also a fan of Israeli historian Yuval Harari (3 books), as well as French economist Thomas Piketty for his work on participative socialism, and Thomas Hobbes for his ideas on the social contract… he was too late to save the heads Charles I, or Cromwell, but Charles II learned a few things.

We seem to have lost that social contract, and have allowed a much larger Leviathan to form.

Leo, may I recommend a book to you – “Jesus and the Disinherited” by Howard Thurman. It’s a short read and don’t be put off by the title if you’re not religious. If you’re black you should read it, if you’re white you must.

But, it is far more than just another sermon about race relations in the U.S. It is about the often dehumanizing psychology underlying any relationship between those with power and those without – an “unbalanced” equation which, in the economic world, credit unions were created to address.

So many of our cooperative leaders seem to have loss sight of that original thought, that original principle. A financial cooperative with a social purpose is not a bank, nor should it be. Without a social purpose….?

“Life is not the way it should be, it is the way it is”… with our task growing larger daily, perhaps we shouldn’t rest on our laurels – nor our principles.

Hope you will take a look at what Howard Thurman has to say about all of us, including you and me…and credit unions.