A 2023 documentary film’s message puts credit unions right at the center of our current political angst.

The film is Join or Die. ( this is the 3 minute trailer) It is based on the work of social scientist Robert Putman who in 2000 published a book called Bowling Alone. It documented the decline of local organizations that create the connections on which individuals built their trust in and sense of community.

The author calls this foundation of mutual confidence and relationships “Social Capital.” In his analysis, these organizational connections have real value.

The film updates this decades long continuing trend of increasing social isolation. He believes the loss of local networks has contributed to the decline of confidence in American democracy. For it is in our connections with multiple organization that we develop awareness of mutual obligations and the common good.

The Credit Union Example

The cooperative movement, and especially credit unions, were founded with social capital. Unlike other profit making firms, only minimal shares were pledged by organizers to receive a credit union charter. The Field of Membership was the existing external network that provided the connections giving a new charter its mutual support and market focus.

The net worth or financial capital requirement was a flow concept. Either 10% or 5% of revenue had to be set aside into reserves until a certain ratio of net worth to risk assets was attained.

In the 1998 Credit Union Membership Act this “flow” concept of capital adequacy was replaced with a “stock” measure–that is the ratio of net worth to assets. This financial point in time definition was expanded by the 2022 imposition of a risk-based capital. This raised the well capitalized ratio from 7% to 9%.

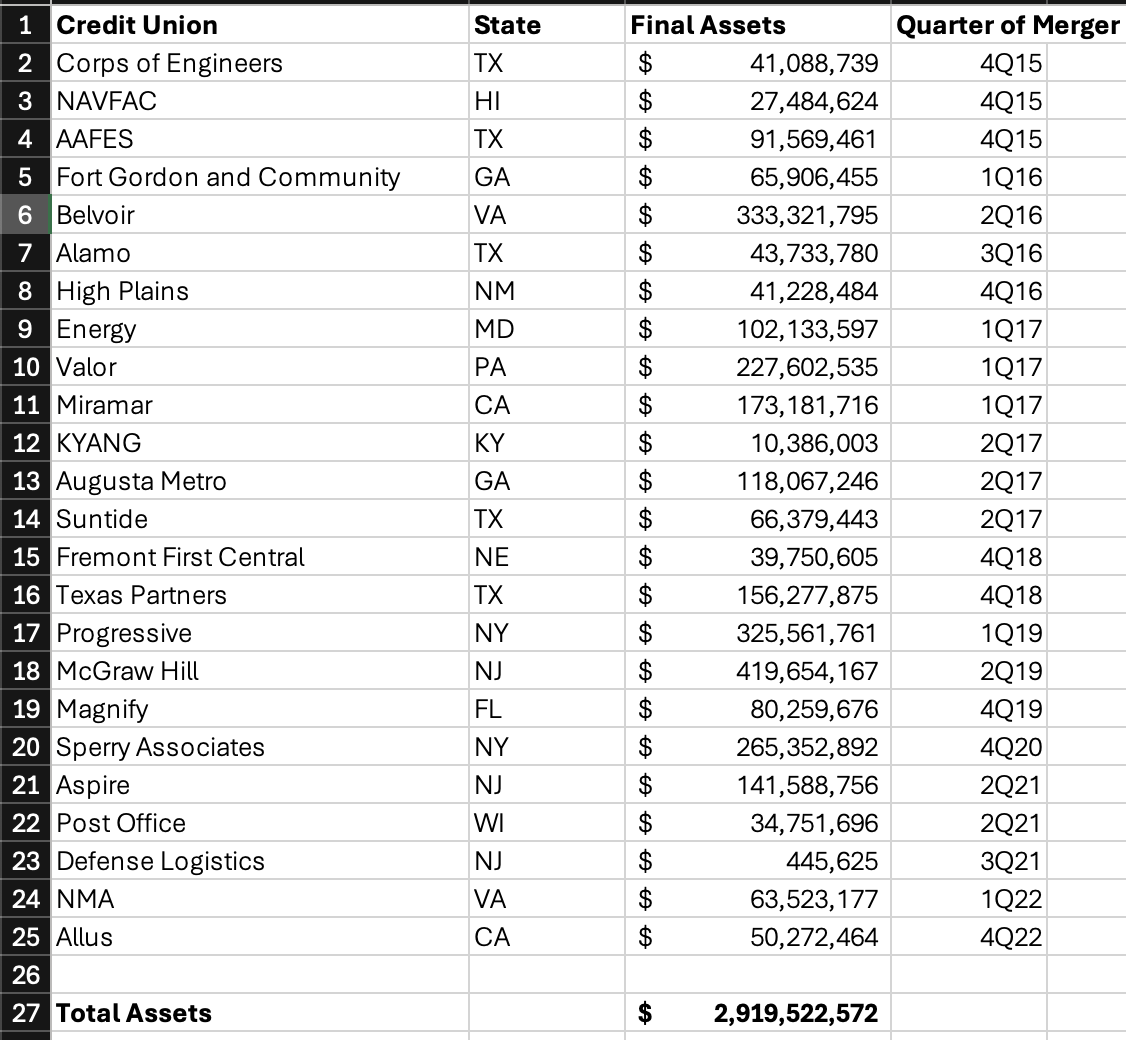

The founding cooperative bond of social capital was replaced with financial ratios. This transformation was accelerated as credit unions evolved their fields of membership into new groups, areas or criteria with little connection to each other. Instead of established connections, credit unions began relying on new brand creations and marketing to establish a their presence in the markets they sought to serve.

A Second Factor

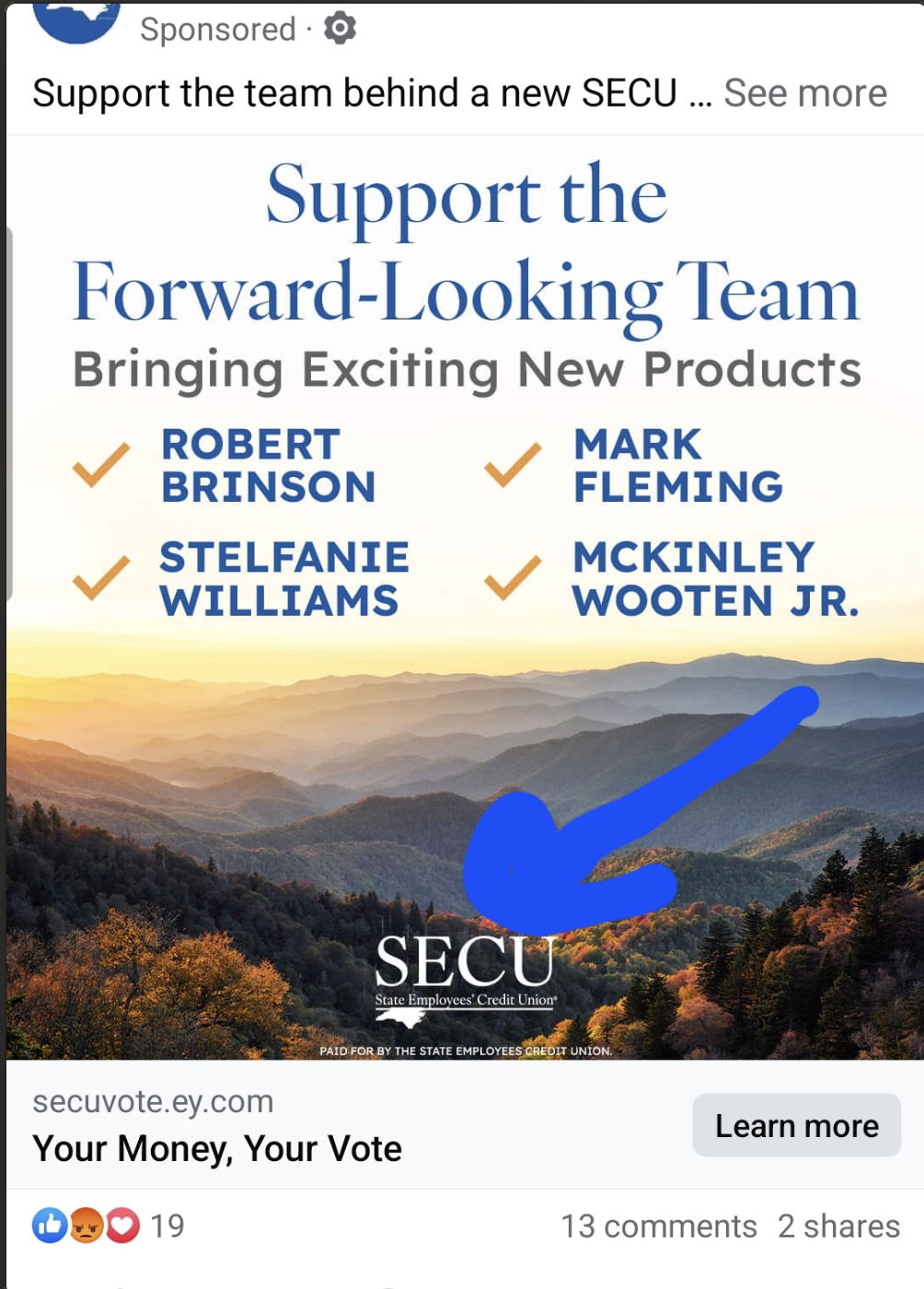

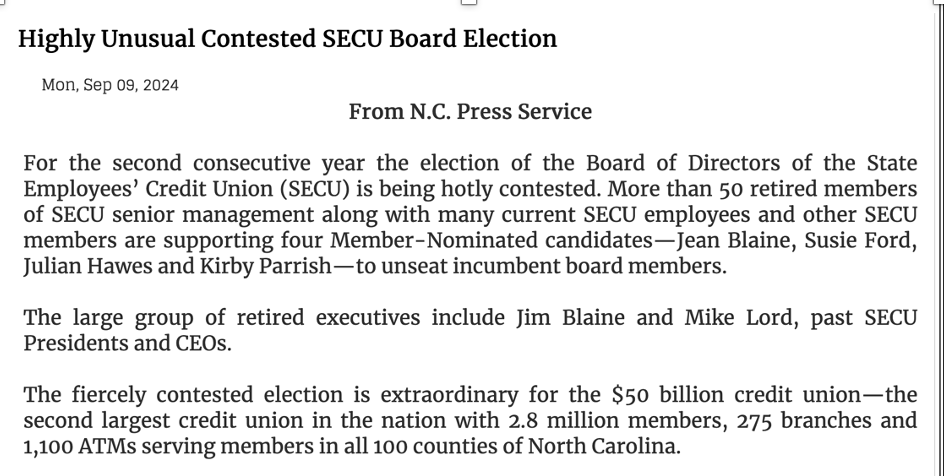

As credit unions moved further and further from points of connection with relationships of trust, a second decline was in member-owner governance. The annual meetings no longer featured contested board elections; rather the board nominated the same number of internally selected candidates as vacancies. No member votes were cast; the positions were filled by acclamation.

This resulted in the erosion of any pretense of democratic governance. Increasingly self-appointed boards grew further and further away from their members. Credit unions were not alone. Putman’s work suggests that over half of America’s social/civic infrastructure has disappeared since he first wrote.

As these foundational experiences of local connection are lost, individuals become more isolated. And with that feeling, so does confidence in the governmental process, both locally and nationally.

One can debate whether credit unions contributed to, or are just another example of, institutions caught up in a fundamental transition of community relationships. It is certainly possible to find longstanding successful credit unions still serving their core markets. One indicator is a credit union’s name such as Wright-Patt Credit Union. The counter evidence would be examples where the institution has repositioned itself with growth efforts based on leveraging of members’ financial capital with mergers or bank purchases.

The film highlights Putman’s analysis of what makes American democracy work.

It explains why our traditional political process of compromise is much more difficult.

Finally he suggests what can be done about it.

While the film documents the loss of social infrastructure, there is good news. As the trends are laid out, the film closes with the message, “You can decide to change history.” The “financialization” of credit unions with their loss of a social capital bonding can be recovered. But how to start?

Re-establishing Credit Union’s Social Capital Advantage

A recent communication from the Texas Credit Union Commission’s monthly newsletter provides a place to reaffirm this core cooperative asset. Change comes from the top. Here is an excerpt from their Newsletter that I believe directly speaks to Putnam’s concerns.

The Importance of Board Meeting Attendance in a Time of Rapid Technological Change

Critical to the long-term success of a credit union is an active, involved board that provides proper oversight of operations and a sound strategic direction for the future of the credit union. One of the keys to ensuring that a board is successful is regular, participatory attendance.

This is particularly true given the rapid pace of technological change and the need for partnerships with financial technology companies (“Fintechs”) to provide services wanted by your members. . . Management and the board must ensure that . . .the Fintechs chosen are a good fit for the credit union and the membership.

Board involvement is important in Fintech selection and other important strategic decisions affecting your credit union. The issue of board attendance is a tricky one. Board members are volunteers with their own jobs, families, and busy lives to balance in addition to the voluntary obligations of serving on a credit union board. However, missed meetings seriously diminish the effectiveness of the entire board, and a director’s irregular or inconsistent meeting attendance could result in removal from the board. . .

It is important for board meeting minutes to reflect if a director’s absence is excused or unexcused. The lack of a record of an affirmative vote by the board is construed as an unexcused absence. . . Once a director misses . . . the prescribed number of meetings . . .there is nothing the board can do except to fill the vacancy with a new person within sixty days. . .

This Texas regulator’s message is a clear reminder of every board’s guiding role and responsibility, from NCUA’s three directors to the system’s smallest of credit unions,

This is an important leadership statement from one component of the credit union’s unique dual chartering system. Board members should actively Join in their roles, or credit unions could Die.