How would the author of “disruptive strategy” counsel credit unions in this time of rising rates and tightening liquidity?

I met Clayton Christensen following his participation on an expert panel debating the future of higher education and its ever increasing costs.

His message was that college and post graduate institutions were subject to the same disruptive challenges that he had described in multiple businesses. His theory explained why successful companies often fail even though they appear to have a dominate competitive position.

Further he announced, during the panel, that he would inaugurate such a disruptive effort at Harvard Business School with an Internet course based on his strategic theory. I asked if Callahans might talk with him to see if this course might be a resource adaptable for credit unions. He gave me his card, his administrative assistant’s name was on the back, and said to call and make an appointment.

Several months later a team from Callahans went to Cambridge.MA to meet his colleagues filming the course modules for Internet delivery. After taking the course and adapting concepts to the cooperative context, Callahans launched a course on disruptive strategy for the credit union market.

Even though Christensen died in 2020, today his course on disruption lives on as part of the Business school’s online offerings.

From the Bottom Up

The central theme of successful disruption is challenging market leaders from the “bottom up.” Credit unions might say from the “grass roots”up.

Successful firms generally grow beyond their initial markets and increasingly focus on more profitable segments. They neglect early and familiar targets to go after more lucrative ones by expanding with more sophisticated and complex solutions.

Then their lower end markets become vulnerable if new entrants better define the “job to be done” and add value where the larger firm is no longer investing. A new entrant gains a foothold at the lower end and can then relentlessly innovate to move up market.

His theory is a framework that asks questions and introduces concepts to sharpen leaders’ strategic intent. It is not a model dependent on technology driven advantage, but one of business model disruption.

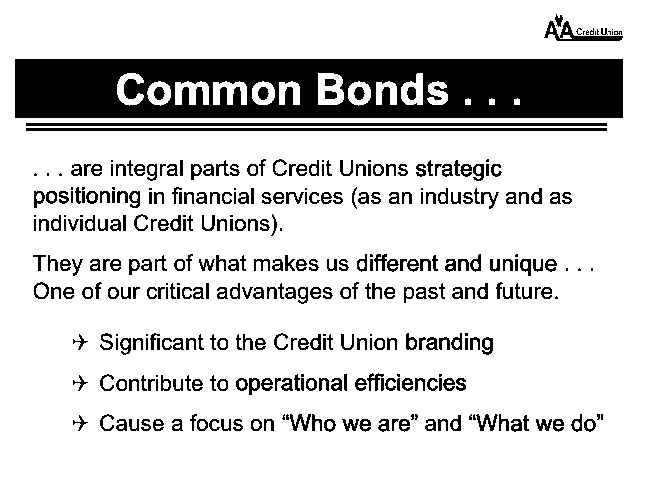

The cooperative design based on local, defined markets (members), the values of service and collaboration, and self-funded financing is very compatible with Christensen’s theory. For many decades credit unions have been an example of his strategy playing out in consumer financial services. Their success is measurable and market gains real.

However as credit unions became more financially self-sufficient and the focus on original groups lessens, market ambitions expand. Today a number of credit unions seem to embrace the “top down” pursuit of more affluent consumers served by regional and national financial institutions.

Some credit unions openly proclaim multi-state, national, and even global market ambitions. Others purchase entry into new markets by buying banks or pursing mergers far distant from their proven success.

In doing so credit unions are sacrificing their competitive advantage of alignment with members or groups. These credit unions have become “market players” going wherever an opportunity appears, versus serving a distinct area or need.

The Liquidity Challenge

A current example. Many credit unions today are facing liquidity pressures. Slowing share growth, continuing loan demand, underwater investments and rising rate competition for shares pose new challenges versus the decade of easy money. Some respond the way the big players do by bidding for money with CD rates currently in the 4.25-4.75% range and advertising openly for anyone’s cash.

Others have taken a look at their core strengths including local relationships, community presence, branch networks and the fact that many employers are looking for a special benefit to attract and retain employees. Their back-to-future share growth with new members’s savings rely on credit unions’ core local advantages and reputations within communities that took years to establish.

A Second Message

The public reputation of credit unions rests partly on their values and democratic origins. One CEO’s mission statement simply reads: Do the Right Thing. In the for-profit competitive consumer finance markets, this appeal is distinctive. Value is about more than price or even great service.

The New York Times columnist David Brooks distinguishes between what he calls “résumé virtues” and “eulogy virtues.”

“Résumé virtues are what people bring to the marketplace: Are they clever, devoted, and ambitious employees? Eulogy virtues are what they bring to relationships not governed by the market: Are they kind, honest, and faithful partners and friends?”

In a YouTube video Christensen summarizes his understanding from his own life and work in a 2012 Ted talk How Will You Measure Your Life? This 19 minute video opens with his discussion of why successful companies fail. Then he extends the analysis to his own HBS classmates lives and the personal disappointments they have encountered while achieving material success.

(https://www.youtube.com/watch?v=tvos4nORf_Y)

The source of both corporate and personal disappointments is the same. We live in a system that rewards short term achievements, investments that will pay off now, not in the years to come. Creating successful relationships whether in family or businesses, does not result from short-term thinking.

He closes with how to “measure” your life’s success at minute 17. If you have only two minutes, listen as he presents what David Brooks calls the eulogy virtues.

Christensen’s Two Messages

Christensen’s theory of disruption is a classic way of understanding credit union advantages from a strategic standpoint. The framework focuses on long-term competencies combined with “job-to-be-done” tactics.

This approach asserts that it is not the demographic characteristics of the member that motivate market choices; rather it is what the member wants to accomplish that determines which financial firm the member will chose.

The second point is equally consequential. Your “success” (personal and professional) will depend on “how well you help other people to become better.” Even if this just entails giving your business card to a stranger in the audience.

Both observations seem to me an endorsement of a credit union “calling.”