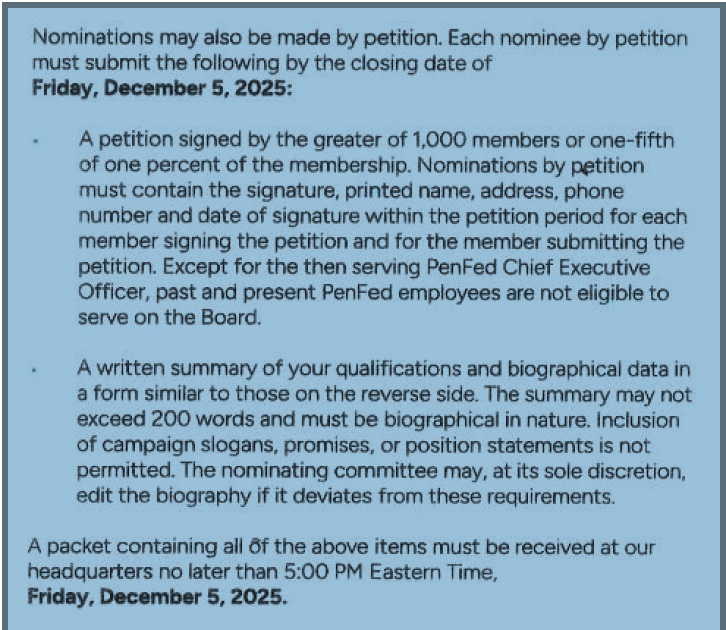

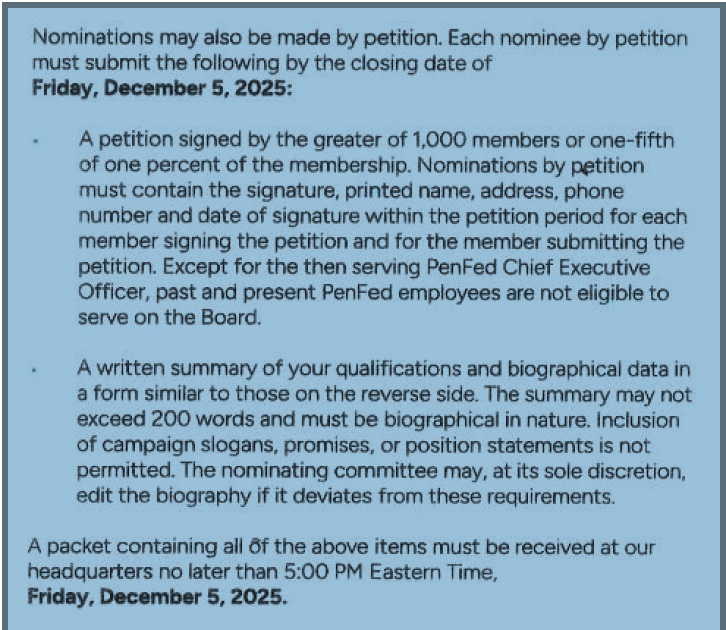

In a response to yesterday’s post citing PenFed, a member sent me the following notice requirements for an owner to be nominated for an open board potions at the credit union.

The 1% standard cited would require 28,128 member signatures based on the latest call report. It is a mere pretense of democratic owner control.

The member added this comment: Credit unions are becoming more like Fortune 500 companies every day. They exist not to meet the needs of customers or shareholders but entitled corporate executives.

The notice also contained short bios of the three board nominated candidates. The first is a retired army colonel who has been on the board since 2008 and serves on the Planning Committee.

The second is a retired USNR aviator who served for ten years on the Supervisory Committee before “joining the board” in 2022. He also serves on multiple committees including planning and risk management.

The third board nomination joined the board in 2005 and has just retired from a 38 year career working for the federal government. This person is the board treasurer and chair of the financial and risk committee and on the planning committee.

All have earned advanced degrees and have served in multiple professional civilian roles. No one would question their credentials. However their candidate descriptions include no statements about their priorities for the credit union and its current performance.

PenFed’s Recent Trends

At September 2023 PenFed’s total assets peaked at $35.4 billion. As of this June the total was $30 billion. This $5.4 billion asset decline is a continuing trend. In the 12 months ending June 2025, shares have fallen by over 10% or $3.0 billion, and loans by 13.2%, or $3.6 billion.

In the income and expense comparison for the first six months of 2024 and 2024, total revenue is down 14.1% and operating expenses by 3.75% The net income for both half years is positive with ROA’s of .27% and .54%. However these results were achieved by recording “non opeating gains” of $86.3 million and $95.3 million in the two periods. Otherwise, net income would be negative. Non-operating gains result from the one time sales of assets such as buildings or loans.

In the past 12 months, there has also been a decline in the number of branches (4), employees and members. It has downsized its balance sheet by reducing external borrowings from $3.8 billion at December 2023 to $756 million as of June 2025. The reduction in total assets has resulted in a net worth ratio between 9% and 10% even with minimal earnings in the past 24 months,

In sum, PenFed is moving steadily backwards.

The Strategic Catbird’s Seat

PenFed has one of the oldest and most recognizable brands in credit unions. It portrays strength and security suggesting a direct affiliation with the government. The credit union has an FOM charter open to anyone, reporting 342 million potential members.

During the past decade, the credit union has merged over 25 credit unions across the country, acquiring their equity. Often, after a brief transition, the local branches are closed, employees laid off, members offered only virtual services, and the buildings and other assets sold. The local legacy relationships, representation, community presence, and reputation are gone.

PenFed has had strategic advantages many other credit union’s covet. Scale, open membership, diverse products, a recognizable brand, multiple acquisitions of other credit union with their equity and increasing conversions to virtual and remote services. Yet it is in decline.

Where Are the Overseers?

These declining financial trends have taken place for at least the past two and a half years. What has the board been doing? What changes have been tried?

Members are not being served well by their director representatives. But what recourse do they have other than to close their account and leave?

This situation is a concrete example of why member-owner elections are important versus the habit of routine ratifications of board incumbents. All three PenFed nominees would seem to have exceptional credentials. But in practice they are shepherding a significant institutional dwindling.

The financial engineering to maintain a net worth above 9% by selling off assets to record non operating gains is not sustainable. Does the credit union even have a plan or leadershlp capable of reversing this diminishing?

This situation is why annual meetings should matter. Elections are moments for accountability not merely PR exercises. Democratic elections empower owners and promote leader responsibility. In the absence of member participation, there is no answerability by those in leadership positions.

When the regulator is the last resort for addressing financial and operational shortcomings, the credit union has lost its autonomy. And member-owners’ needs are sidelined to meet the priorities of the government overseer.

When democracy as the means for leadership accountability is abandoned, the outcome is rule by habit or authority. Neither is a sustainable approach for long term success.

We live in odd times.

hashtag#CEOs, I know you’ve had frustrating encounters with auditors and regulators. They can feel burdensome, even annoying. But this latest move from National Credit Union Administration (NCUA) isn’t a win for the reduction of “regulatory burden”—it’s something far more concerning.

Although the headlines highlight the elimination of reputation risk, please read further. In addition to eliminating reputation risk as a rating, NCUA has discontinued assigning ratings to all seven risk categories:

• Credit

• Interest Rate

• Liquidity

• Transaction

• Compliance

• Reputation

• Strategic

Imagine someone removing all the smoke detectors from your building and telling you, “Don’t worry, we’ll let you know when we see fire.”

The purpose of these risk ratings was never busywork. At the aggregate level, they provided field offices, regions, and national leadership with a top-down view of where risk was accumulating. From a staffing standpoint, if a credit union’s liquidity risk was rated high, it signaled the need for additional expertise at the next examination.

Examiners and ERM professionals assess each category based on quantity, direction, and the quality of risk management. The point was never to penalize higher-risk profiles. It was to ensure that if you accepted a higher risk, your management practices were robust enough to handle it.

America’s Credit Unions, NASCUS, and American Association of Credit Union Leagues

How is this a win for the members and the safety and soundness of credit unions? Why do we only hear about tax status, and none of these moves requested are discussed with the same intensity?

A couple of foot notes: NCUA Credit Risk Webinar

On July 15, 2025, in an NCUA (https://lnkd.in/ednAJjCE) credit risk webinar, an examiner (Min 13:49) discussed the benefits of key concepts like risk appetite, risk tolerance, and risk capacity. Those are excellent tools for boards and executives. They’re the backbone of modern ERM.

But here’s the contradiction: NCUA is now saying those concepts are helpful for credit unions to adopt, while simultaneously discontinuing examiner use of risk ratings for the seven categories (credit, liquidity, interest rate, compliance, transaction, reputation, and strategic).

National Credit Union Administration:

Additional Actions Needed to Strengthen Oversight

On Sept. 23, 2021, the Government Accountability Office issued a report stating NCUA has opportunities to improve its use of supervisory information to address deteriorating credit unions. By more fully leveraging the additional predictive value of the CAMEL component ratings, NCUA could take earlier, targeted supervisory action to help address credit union risks and mitigate losses to the NCUSIF. As of today, one of the recommendations is still open, and another is partially addressed.

END

As Hauptman tries to burnish his reputation with the administration’s anti-government ideology, the dangers of a single political point of view determining regulatory priorities in a so-called independent agency becomes clear.

This press release is not about ensuring the safety and soundness of members’ funds or enhancing the cooperative systems critical roles. It is simply posturing for another assignment in an administration bent on governmental disruption.

The financial and institutional integrity of the cooperative system requires a competent, active regulatory oversight. Institutions that manage financial assets for others are especially vulnerable to self-dealing. That is why almost every form of money lending, transfer, safe-keeping and advice is subject to governmental licensing and oversight.

Without effective supervision not only will credit unions continue to be lost, the playing field will become crowded with internal and external predators trying to cash in on the abdication of, and disrespect for, regulatory oversight.