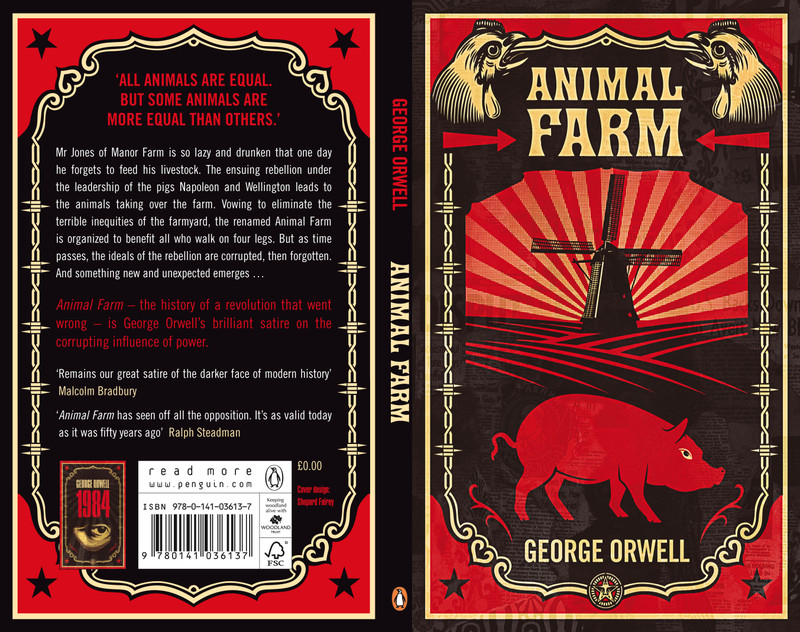

George Orwell masterfully described the erosion of values and the rise of exploitation in his classic novel Animal Farm. The book written in 1945 is a satire of the decline in the Russian Revolution from idealism to the overlord State of Stalinism. To Orwell, what the Revolution had become in post-WWII Russia bore little resemblance to the high hopes of 1917.

In case you’ve forgotten the plot; in Animal Farm the slothful, tyrannical human proprietor of Manor Farm is overthrown by his much abused and neglected farm animals. The revolutionary animals quickly come to realize that when united in cooperative effort, they are quite capable of sensibly managing the farm and their own affairs.

Each animal, by nature and design, has different capabilities and unique qualities. Separately they are weak. But, cooperatively, working together; the united effort becomes far greater than the sum of the individual parts. Each animal contributes in full measure, in its own special way, to the overall success of the enterprise.

The cows and chickens provide milk and eggs for food. The sheep provide wool for cloth; the dogs provide protection; and the horses provide strength for plowing. The pigs, who seem to be the brightest, provide direction and management (surprise, surprise!).

Every civilized society, every social movement, every cooperative effort needs and creates a set of guiding principles – a social compact, a credo, a charter which explains shared beliefs and values. The animals of Animal Farm were no different. They carefully crafted rules for their new social order and painted them on the side of a barn for all to see.

ORIGINAL PRINCIPLES:

1. Whatever goes upon two legs is an enemy.

2. Whatever goes upon four legs, or has wings, is a friend.

3. No animal shall wear clothes.

4. No animal shall sleep in a bed.

5. No animal shall drink alcohol.

6. No animal shall kill any other animal.

7. All animals are equal.

Over time, several incidents occurred which seemed to be out of keeping with those original purposes. The pigs were found sleeping in the former owner’s bed; alcohol reappeared at social gatherings of the pigs; an animal who complained about the changing values was killed; and the pigs seemed to be working less and consuming more than their fair share.

When the animals returned to the barn to review their original principles; they found, much to their surprise, that those principles somehow had evolved into something a bit different!

1. Whatever goes upon two legs is an enemy.

2. Whatever goes upon four legs, or has wings, is a friend.

3. No animal shall wear clothes.

4. No animal shall sleep in a bed with sheets.

5. No animal shall drink alcohol to excess.

6. No animal shall kill any other animal without cause.

7. All animals are equal, but some animals are more equal than others.

The pigs, however, were always there to explain away questions, concerns and objections. Bad became worse at Animal Farm! Eventually, when the animals returned to the barn, they found a whitewashed wall with just one remaining principle.

“CURRENT” PRINCIPLES?

“All members are equal, but some members are more equal than others.”

“Isn’t that what we originally revolted against?,” some quietly asked.

So, what’s the point? In the beginning, there were several essential ideas which formed the core values of the credit union movement: one member, one vote; cooperative; non-profit; equal service to each member; consumer advocacy; volunteer leadership; unstandard answers; shared concerns; us not me.

Have you checked the barn lately?

When did we abandon the average man and woman – the working class; change our focus to the primacy of the bottom line; lower ourselves to worshipping before the false altar of market share; begin acting in the best interest of “the credit union” – not the members !?!; and start offering excuses rather than solutions?

Hey really, what happened…

Who let the pigs in?