The opening paragraph provided the details:

Pentagon FCU was approved to acquire its third credit union in the past six months, the $26 million Fort Hood Military FCU, in Fort Hood Texas, NCUA said Tuesday. That follows two December acquisitions for the $5.8billion credit union, those of $46 million Fort Shafter FCU in Hawaii and $13 million Coast Guard Employees FCU in Maryland.

This twenty year old description was before mergers of sound, long serving independent credit unions became much more widespread. A decade later credit union system CEO’s, consultants and regulators openly promoted these acquisitions as a quick and easy alternative to internal organic growth. After all isn’t success just a factor of size?

This industry competition for acquisitions was based on offering private personal inducements for CEO’s and senior managers. The practice became so blatant that in 2017 NCUA passed a rule to bring more transparency to the process. The rule didn’t slow the wheeling and dealing. It may have even legitimized these payoffs.

Now credit unions could routinely add wording to the required Notice and Disclosures of these payments and state that the regulators have approved the merger subject only to the member vote.

A Case Study Lookback

Two weeks ago I described the final step in PenFed’s 2021 merger with the $36 million Post Office Credit union in Madison, WI. In August 2024 PenFed announced the closing of its only office in Madison. Since the 1934 chartering, Post Office’s 3,153 members (at time of merger) had received personal service. No more.

I called this closure the final step in “asset stripping.” This is the practice in a takeover acquisition to maximize the profit and eliminate any future investment or expenses. All of Post Office’s resources, reserves, member accounts were transferred to the control of the Virginia based PenFed. There is no longer any local presence, nuance or leadership roles in the community. With this branch closure, all member relationships are now virtual and remote.

The Final Cashout

Last week the land and building of the former Post Office location were put up for sale.

An internal view.

When the merger occurred, Post Office’s call report showed these assets with a book value of $589,222. The real estate listing on September 17, 2024 had a list price of $1,260,000. This is an increase of $671,000 (113%) in the three and one half years since the merger. The net gain on sale all goes to PenFed as “other operating income.” This is the final liquidation step of this 90-year old credit union which had 22% net worth at the merger date.

All Gain, No Risks, Members Left Behind

Paying nothing in these acquisitions for total control of all of another credit union’s members’ net worth and reserves makes these takeovers a very profitable practice. Systematically stripping out all of the most valuable assets for maximum cash value puts the icing on the cake. No worry about local commitments or member and community relationships.

Such takeovers are a common strategy in for-profit companies. However in credit unions there is no acquisition cost, just a few crucial payouts to the CEO and perhaps, other senior executives whose approval and pitch to the Board is required. It is literally free assets for the taking.

This practice is becoming more widespread. It is self-immolation, a systematic institutional dismantling of the credit union system driven by greed and personal ambition, not member benefit.

In many situations today, the merger destroys the local advantages, loyalties and relationships that are the foundation for credit union’s success. The acquiring credit union’s field of membership, or market focus, has no center or rationale. There are no “network effects” for branding or service delivery that would create operational efficiencies. Most critically the headquarters and leadership is hundreds or thousands of miles away. Local familiarity is all lost.

The consequence of credit unions preying and suborning their fellow CEO’s and boards is systematically demolishing the credit union advantage at both a market level and in the public’s eye. The coop model is seen as no different from other financial options. Especially in an era when virtual relationships are available from all financial providers.

And a credit union’s values are the same as every other market participant. The winner takes all.

The rationale is that growth and size will guarantee success, an assumption frequently at odds with the facts and members’ experience. Size does not automatically correlate with efficiency, growth or other financial metrics let alone operational excellence.

The PenFed Merger Demolition Derby Takes Off Again

Penfed pulled back from the American Banker’s “binge” strategy during the initial years of this century. It should be noted that the three mergers listed in the article were all military bases. One could argue that these were natural affiliations consistent with with PenFed’s focus and traditional brand. In 2010 there was a single merger with the $11.6 million Tripler FCU in Hawaii. And then a lull until 2015.

The Merger Frenzy Begins

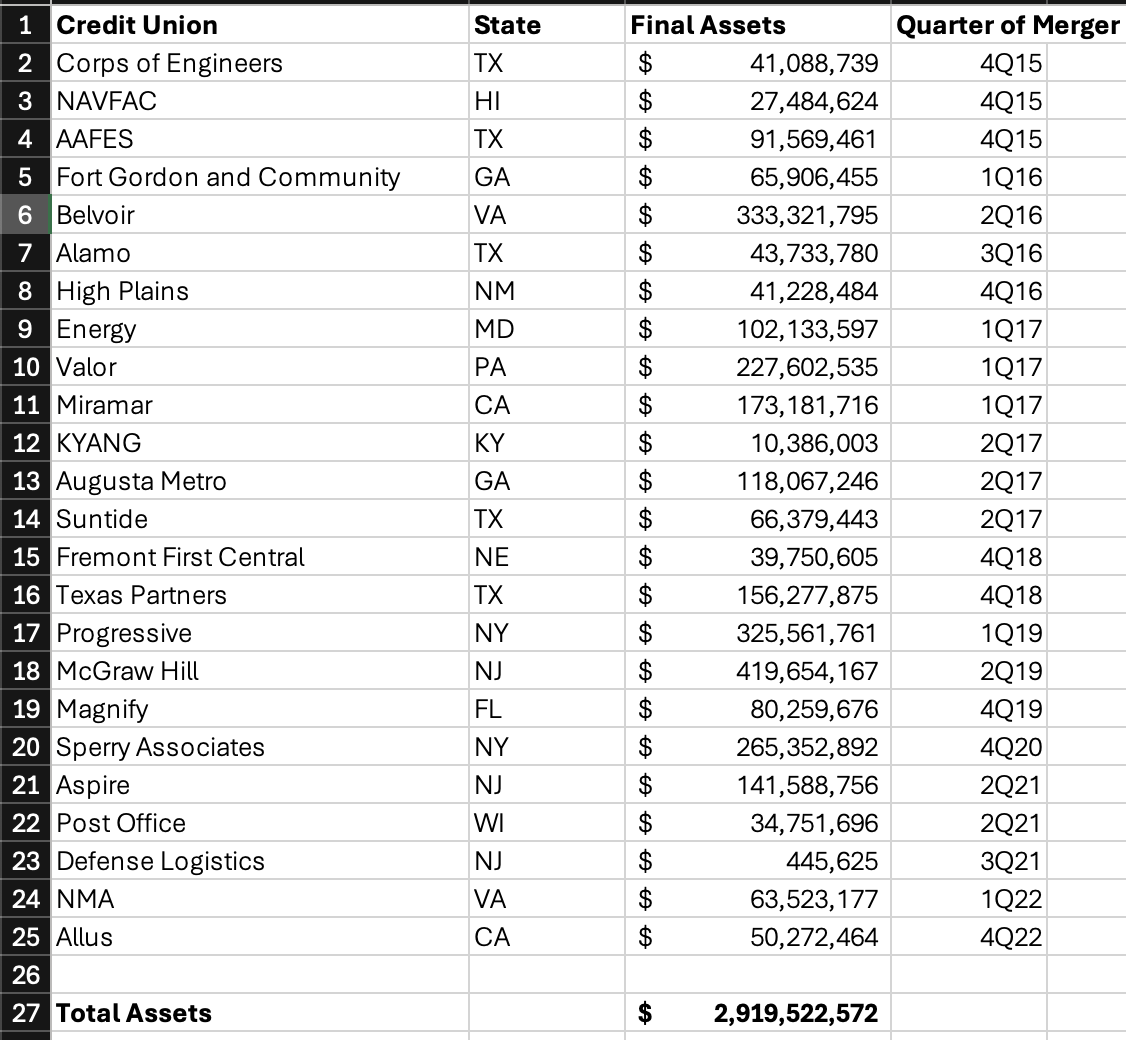

In 2015 PenFed undertook an aggressive acquisition campaign that lasted until 4Q 2022. They took over 25 credit unions located in 14 different states in under eight years. The majority had no military affiliation, such as Post Office, McGraw Hill, Sperry Associates and Progressive.

Progressive, a New York state charter with a single office focused on taxi medallion lending. This merger of a “troubled” institution resulted in a gain in the year acquired; more importantly it gave PenFed a field of membership open to anyone in America (the old Progressive state charter’s FOM).

The combined assets of these 25 acquisitions at the time of merger was almost $3.0 billion. As in Post Office’s example, control over all the assets, reserves, allowances and member relationships were transferred to PenFed’s head office. In some instances such as the very successful $265 million Perry Associates single office credit union, the office was closed immediately after the merger. The employees were let go, and all members forced into a virtual, remote service model.

Dismantling the Coop System

This systematic dismantling of credit unions and their successful local market positions is being emulated by other credit unions. The hunt is supported by a host of hanger’s on who benefit by facilitating this organized tear down of the cooperative alternative.

In many of the combinations below, the members, if a merger were really necessary, would have been better off with a local option familiar with their market and bringing real operational synergies. But in these private deal makings, the largest payoff to the CEO wins. And besides no one ever looks back to see what happened. Except for the members who begin to vote with their feet.

PenFed’s Eight Year Acquisition Spree

But Does It Work?

One could still ask however if the strategy works as a growth enhancement to normal organic tactics. When PenFed completed the final Allus acquisition in 4Q 2022, it reported total assets of $35.9 billion.

At June 2024, PenFed’s total assets were $33.5 billion. It would take more time to calculate all the other merger downsides such as local branches closed, the employees laid off and the number of members who left after being turned over to an organization with which they have no connection. In its initial merger frenzy, PenFed’s growth looked easy and free of any cost or risks.

However members soon see the asset stripping and the absence of local leadership. Moreover, PenFed lost every credit union’s most important strategic advantage: the hard earned, unique value of long lasting member relationships.

When CEO’s care more about themselves then they do for members’ well being, the difference that makes cooperatives successful is gone.

PenFed is not alone in its disruptive wasting of long standing successful cooperative charters. The question for those who believe in the unique role and purpose of cooperative design, is whether this faux capitalistic model becomes the norm for the system. Or like all false idols, will be defeated by the example of those who think the credit union model is first and foremost for members’ benefit, not managers or boards’ personal ambitions.

Powerful post, Chip. You consistently uphold your values by holding credit unions true to theirs and revealing the cracks in the movement. Continue to do well by doing good.

Excellent article. I recently closed my Penfed accounts because they have become too big. I also wrote to the NCUA and asked them to deny approval for the DCU and First Tech merger ( a merger that DCU members were never asked to approve and only notified about after the fact via the media). That merger will remove DCU members’ 6% interest savings accounts, since First Tech has nothing comparable as a product. It would be great if you also felt motivated to write to NCUA against this merger. Credit union members need all the help we can get in keeping credit unions from becoming behemoths and in holding them to their original mission to help members.