This month the Congressional Budget Office (CBO) released a 27-page report analyzing the Federal Home Loan Bank System.

The significant chapters include an Overview, Financial Condition, Subsidies and Risks.

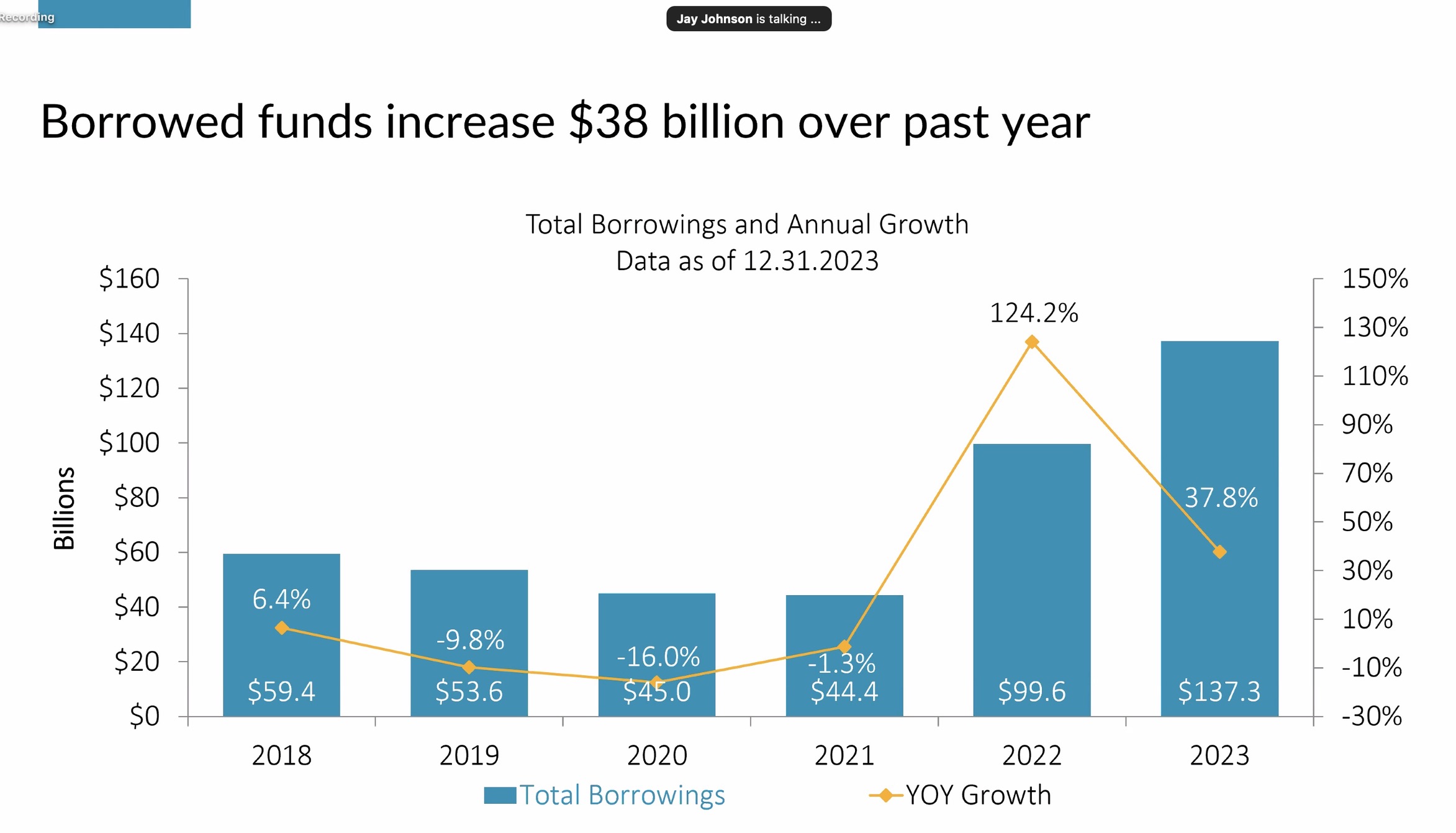

The FHLB system is the largest lender to credit unions. Hundreds of credit unions have capital invested in individual banks and rely on them as critical partners for liquidity and ALM management. At 2023 credit union borrowings reached a peak in the system’s history:

The Central Liquidity Facility

How can the cooperatively owned, tax exempt FHLB, created to serve the savings and loan system, thrive with credit unions while their own funded CLF plays no role at all? Certainly, the borrowing demand is there.

At February 2024, the CLF reported $913 million in total assets, equity of $862 million and one loan for $1.0 million.

A 5% return on the fund’s retained earnings of $42 million would pay all CLF’s operating expenses. It’s 4th quarter 2023 dividend of 4.62% trailed the overnight market by .75%. Why aren’t members even receiving a market return on their shares?

More importantly, what can credit unions learn from the CBO’s analysis and the system’s response?

The CBO and FHLB Summary

Ryan Donovan, CEO of the Council of the Federal Home Loan Banks posted a reply #FHLBank to the CBO report: “it does a fair job of acknowledging the many things we have been saying.” He singled out a number of key success factors:

Private investors — not the government or taxpayers — bear the cost of any “subsidy” associated with the FHLBank system.

The FHLBank system plays a valuable role in providing liquidity to its members, particularly during times of market stress.

The benefits the system provides accrue not only to the members but to borrowers and the public. In fact, it says,

“Lower financing costs on FHLBs’ debt are passed along through lower rates on advances than members would receive when borrowing in private debt markets. In turn, competition leads members to offer lower rates to borrowers.”

“Because members are both owners and customers of FHLBs, almost all of the subsidy (after afford-able housing payments are deducted) probably passes through to them, either in the form of low-cost advances or, to a lesser extent, through dividends.”

The existence of the FHLBank system “reduces mortgage rates and provides liquidity to the housing market, particularly during period of financial stress.”

The FHLBank system poses very little risk to taxpayers. If one accepts the CBO’s figure of $600 million in federal tax exemption, the roughly $1 billion that the FHLBanks will distribute in affordable housing and community development grants this year seems like a very good investment for taxpayers.

Donovan concludes: The report stymies critics . . .because CBO makes clear FHLBanks pose little risk, they provide significant public benefit, the implicit guarantee is perceived by bond investors and the benefits of the system flow through to borrowers and communities.

The FHLBank system is poised to deliver $1 billion toward affordable housing and community development . . .We’re engaged every day with our members and other stakeholders on how those resources can be used most effectively. (end)

All these housing and community benefits should be possible with the CLF. Why isn’t this happening? What might a CBO report on the CLF say? Would anyone care?

Music for Holy Week

With each daily post I will be adding excerpts from some of the great classical music inspired by this Holy Week. Today’s is the “Resurrexit” from Berlioz Messe Solennelle.

(https://www.youtube.com/watch?v=K-RX0XtBBnw&t=29s)