Wednesday the Federal Reserve will announce its latest overnight Federal Funds target range. After it began its 2022 upward interest rate cycle to reduce inflation, the impact on share growth and credit union liquidity was significant.

Actual share growth in 2023 was just over 2%. This year the third quarter results indicate a n increase of only 3%. The long term average share growth since 2000 is 6.5%.

Whatever the Fed’s says about its future rate intentions. trends suggest that liquidity will continue to be a top priority for credit unions next year. This means slow share growth, longer term investments still underwater, and continued competition for consumer deposits from money market mutual funds and other consumer financial options.

The Neutral Rate

One economic variable that all market participants debate is what will be the “neutral” rate of interest for the US economy once the inflation rate cycle tightening is ended.

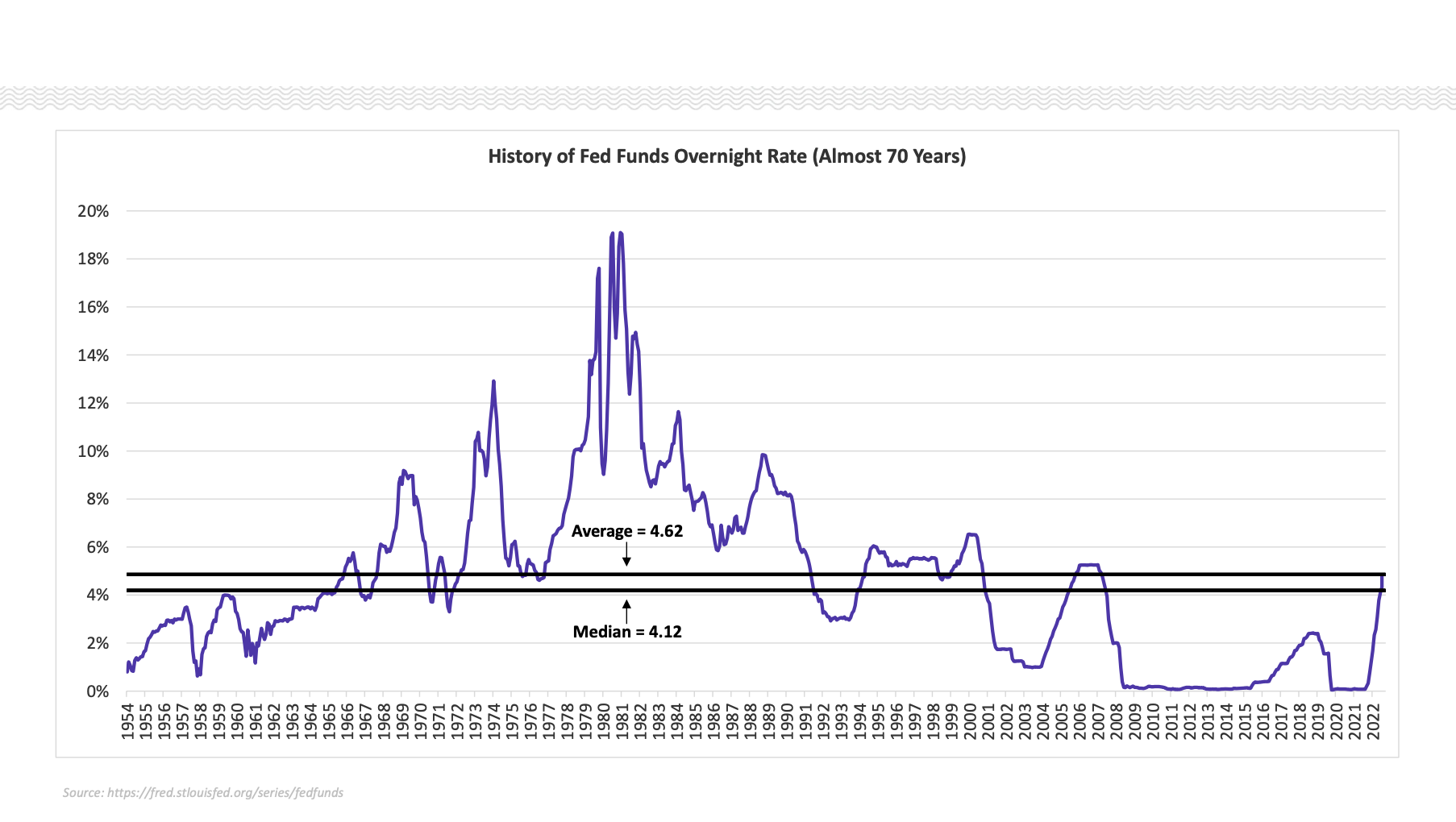

The neutral setting is the range which doesn’t stimulate or slow economic growth. The market got used to very low Fed Funds interest rates during period following the 2008 financial crisis through the 2021 Covid response.

However these ultra low short term rates were contrary to the history of the Fed Fund level, and related market rates, prior to that post-crisis era.

There is no consensus on what this “new” neutral rate might be. Bond traders’ and economists’ forecasts range from under 2% to the current 4% plus.

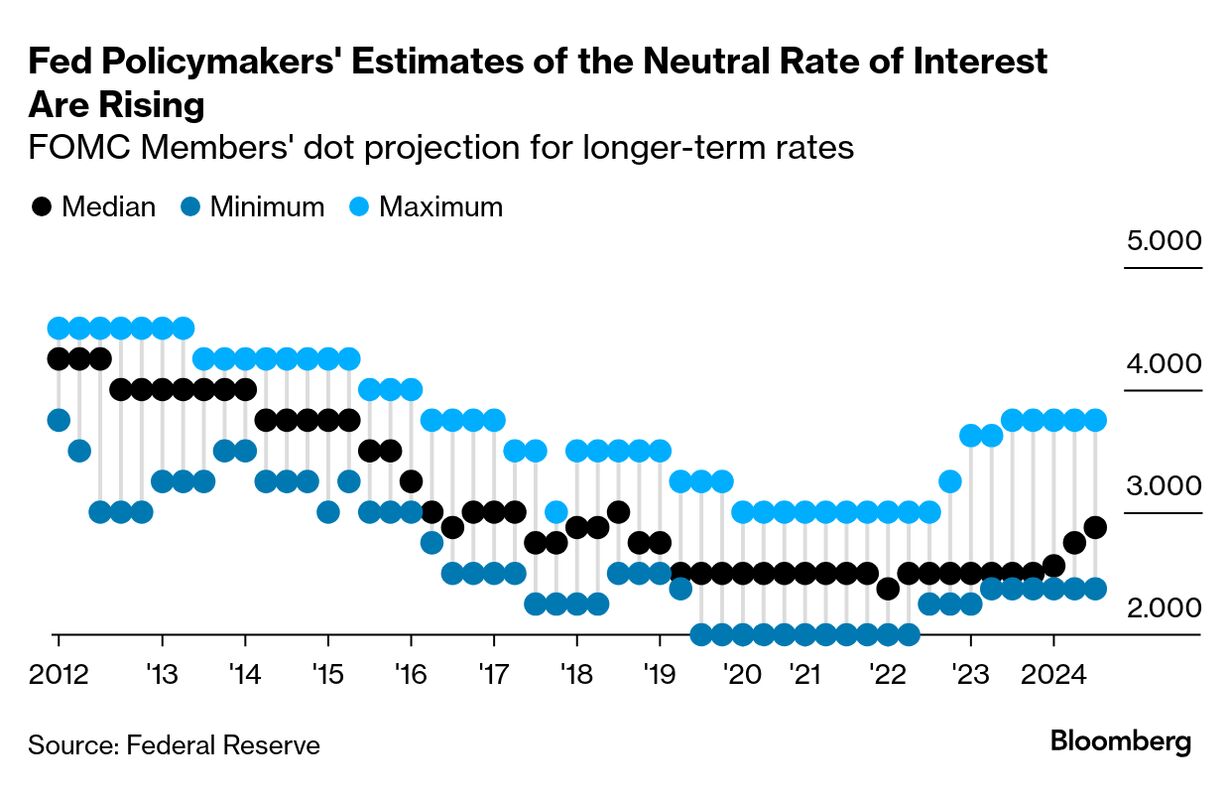

In this chart and comment below, Bloomberg’s December 15 Forecast shows the Federal Reserve governors wide divergence of outlook.

Fed policymakers’ estimates of the long-run interest rate — a proxy for the neutral rate — are divided, too. They’re as low as 2.375% and as high as 3.75% — the widest range since the Fed began publishing the figures over a decade ago. Next week FOMC members will update their estimates of the long-run rate. Keep an eye on whether the median estimate increases — and whether the range of opinion is narrowing or expanding. (Bloomberg)

Credit union funding is almost all from short term savings. A flat or inverted yield curve if the FF rate stays above 3% can squeeze the net interest margin and/or make growing deposits very difficult.

A second unknown is how the growing interest payments on federal budget will affect rates. Could government financing “crowd out” private market debt, that is make it more expensive for corporations to borrow versus relying on internally generated cash flows?

The Growing National Debt Interest Expense

With other aspects of the new administration’s fiscal policy uncertain–taxation, spending, tariffs, etc–the rate environment going forward looks anything but certain.

Credit unions which rely on external new member share gowth versus relationship share strategies, may find it necessary to continue to pay up to attract these funds.

The Fed’s rate announcement this week will be well reported. The difficulty will be interpreting any future direction from it.

No one knows what’s next for market rates and forecasts. However, liquidity and slower growth are likely to be an ongoing challenge for the cooperative system in 2025.