Yesterday I spent several hours in two exercises with organizations founded on democratic principles. The first was virtual, watching the Annual Meeting of State Employees NC. The second was in person, a participatory exercise for a much larger political event this weekend.

The Coop’s Annual Meeting

The theme. I believe, of the two-hour credit union event was The SECU Difference. The first speaker was the parliamentarian who announced authoritatively that the meeting would be under the latest version of Robert’s Rules of Order.

This was followed by the Chairman’s speech, a SECU foundation report and video and CEO Leigh Brady’s summary of the credit union’s performance for the fiscal year ending June 30. All presentations were shown in a single, stationary camera frame, with no views of the audience or other members on stage. Brady’s speech used a split screen when she showing slides to highlight numbers and goals.

The nominating committee chair reported that the number of candidates approved for the members’ vote just equaled the number of vacancies. Therefore no action by members was necessary. This prior board selection was approved by acclamation in contrast to the previous two years where there had been contests for all open board positions.

The President’s Q&A

The final hour was CEO Brady answering questions submitted in advance and read by an employee. Up to this point every speech and action was fully scripted and presented as done events with no member input.

So one would hope the members’ queries might be a bit more spontaneous and informative about The SECU Difference. In short an opportunity for a CEO to show her “chops” that is the grasp of her role and understanding of issues on members’ minds.

And the member concerns were plentiful and seemed candid even as grouped into common issues.

- What is the credit union doing to help members feeling financial pressure?

- Why are you so hard on loan aoolications?

- Any changes planned to the Field of Membership?

- Will SECU seek mergers?

- When will small business loans be available?

- Will fixed rate mortgages be offered, not just variable?

- What is her outlook for interest rates?

- How will the changes at the federal level affect credit unions?

- When will the problems with the outsourcing vendor managing excrow accounts be fixed? etc.

The questions expressed real member concerns and experiences. However every question received a written response of three to four sentences, prepared in advance, with little insight or empathy expressed about the topic. Most replies referenced a process the member should follow if they had a problem, eg. contact your . . .

My take away: this was a 100% scripted event to conduct a required legal activity with no substance or owber interaction wanted. And especially no live member involvement as in recent meetings.

The emerging SECU Difference is that the credit union is striving to be just like every other large credit union in both performance and example. Some of the CEO’s accomplishments include the replacement of over 1,000 ATMs, the installation of digital signage n the branches and the introduction of two new credit card options: a reward and a cash- back choice. There will be a core conversion but that will take at least three years to complete.

The prior offerings that SECU created within the credit union structure including the life insurance company, the investment broker license, the real estate management company and the trust services were mentioned, but no performance details provided. It is unclear if SECU still offers its ATMs without surcharges for non-members. It has stopped the income tax service and ended the operational support ties with both Latino and Civic credit unions.

SECU’s financial performance is stable and it reiterated its commitment to operate branches in all 100 NC counties and focus the foundation’s resources on non profits throughout the state. So the credit union may have refocused on its roots versus more expansive ambitions contemplated several years earlier.

What is different now is that SECU sounds and looks like virtually every other large credit union. That’s neither good nor bad, unless you believe focusing on creating member value options not readily available elsewhere was the purpose of a coop.

North Carolina is one of the most attractive states for new bank investment and branch expansion (after Texas and Florida). Will not having a strategic difference, other than a tax exemption, be a sufficient strategy? Time will tell.

Preparing to Participate in Democracy

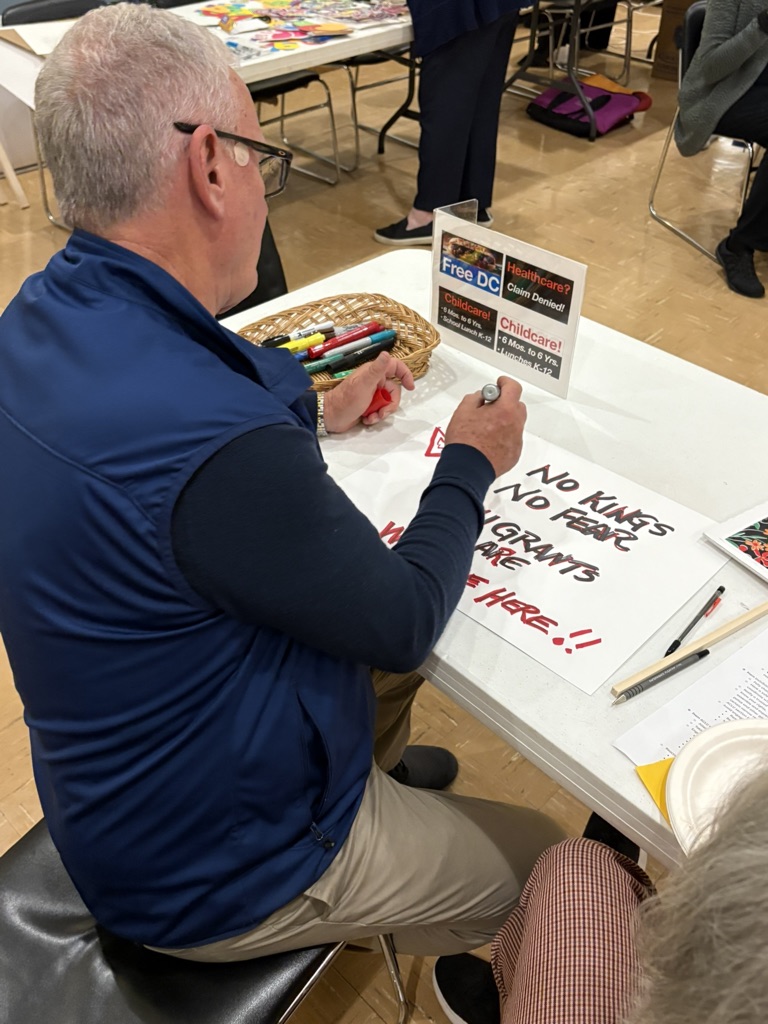

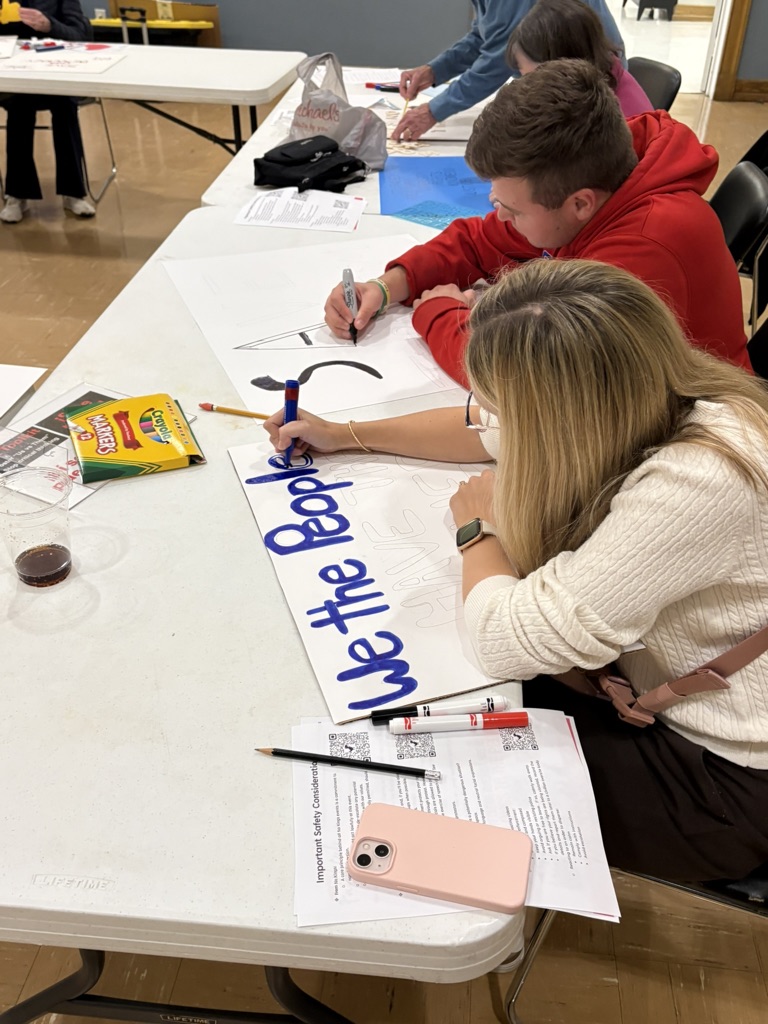

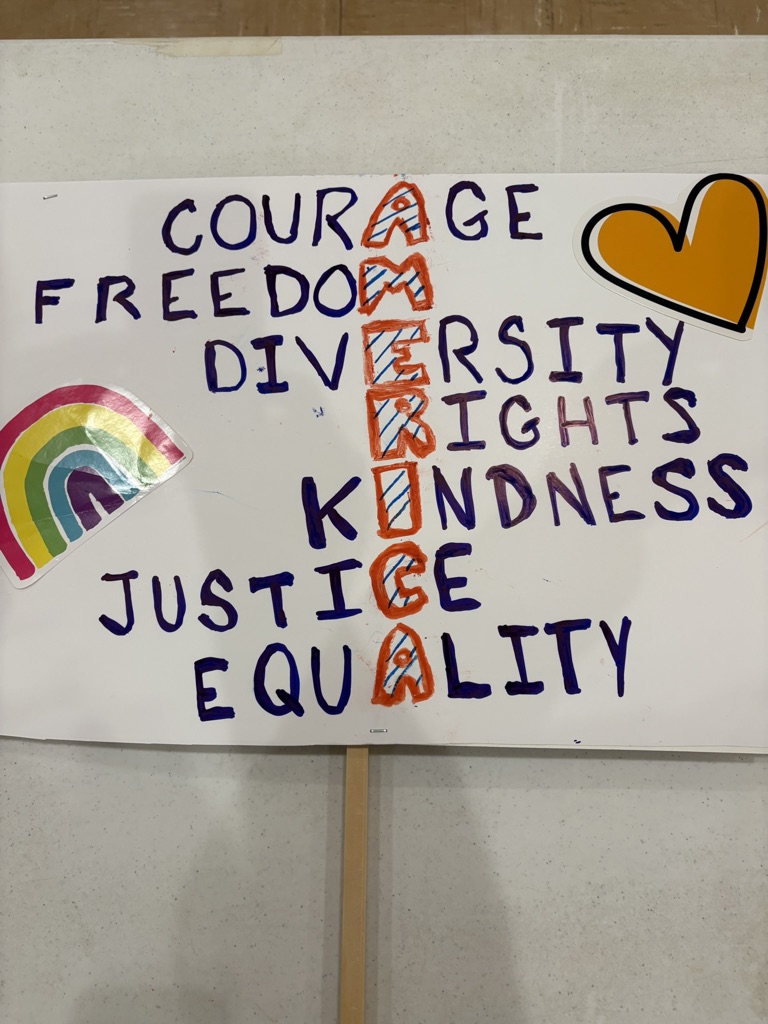

The second two-hour event was a group meeting to discuss how individuals can become more engaged in influencing current political issues. It was followed by a sign-making, pizza-fueled party at a local church’s social hall. About 25 people gathered to learn and prepared to participate in the coming Saturday’s No Kings rallies around the country.

Seeing the Difference in Democratic Practice.

Our Legacies

What will our children and their children inherit from our democratic organizations’ efforts today?