Thursday’s NCUA board meeting is unique. Only one of the three person board will be there.

Normally these public events are fully scripted in advance. All senior advisors have briefed each other on their members’ positions. The staff has been given the questions directors will ask. All actions are known in advance. Spontaneous dialogue, let alone direct back and forth is highly unusual.

The first open board with a single member will showcase Hauptman’s approach and how a single board member questions staff. Will it be an open discussion or just a pretend briefing with all the dialogue preset? Will Hauptman be able to challenge a staff response, as he has sometimes done in the past?

The Two Agenda Items

One is the quarterly NCUSIF update. It will be interesting to learn if Hauptman brings a more transparent approach to this financial briefing. Many issues are long standing such as:

Why does the fund’s financial statement presentation not conform with private GAP (the practice until 2010) versus governmental accounting terminology? In all of NCUA’s three other funds, financial performance follows private GAP accounting presentation.

Will there be an informed discussion about the Funds interest rate risk (IRR) policy? The NCUSIF below market performance (2.59% YTD yield) and investment practice have lead to a portfolio value with a net market loss since December 2022.

For two years the normal operating level (NOL) cap has been set above the long term 1.30% with no factual analysis to support this higher level. This cap sets the level above which credit unions are sent a dividend as part of their open-ended funding commitment in the 1% deposit. Will the cap be reset to its historical level?

The fund has a $ 5.4 million provision operating expense in March. Will the staff show the details of how this amount was determined? The loss reserve is now $242 million or 1.36% on insured shares. There have been virtually no insurance losses in the past five years. Why is this reserve still growing relative to total insured shares? How will the closure of Unilever FCU impact the fund?

How will the savings in total NCUA operating expenses due to staff and other spending cuts, reduce the NCUSIF’s expenses for the remainder of the year?

Finally, when will the NCUSIF’s equity and 1% deposit liability to insured shares ratio be calculated using the latest data from a single accounting period. This management calculation would be a more accurate presentation of the Fund’s true financial position. At the moment this ratio is calculated using data from two different time periods six months apart.

The State of the Industry

A traditional part of the quarterly NCUSIF briefing has been an appendix which presents the distribution and trends in CAMELS exam ratings by asset size and numbers.

The problem with this staff presentation is that the ratings are an average at least six months old. This assumes an annual exam cycle. The staff does not present the current industry financial trends as of the same date as the NCUSIF financials. However the industry’s numbers are available.

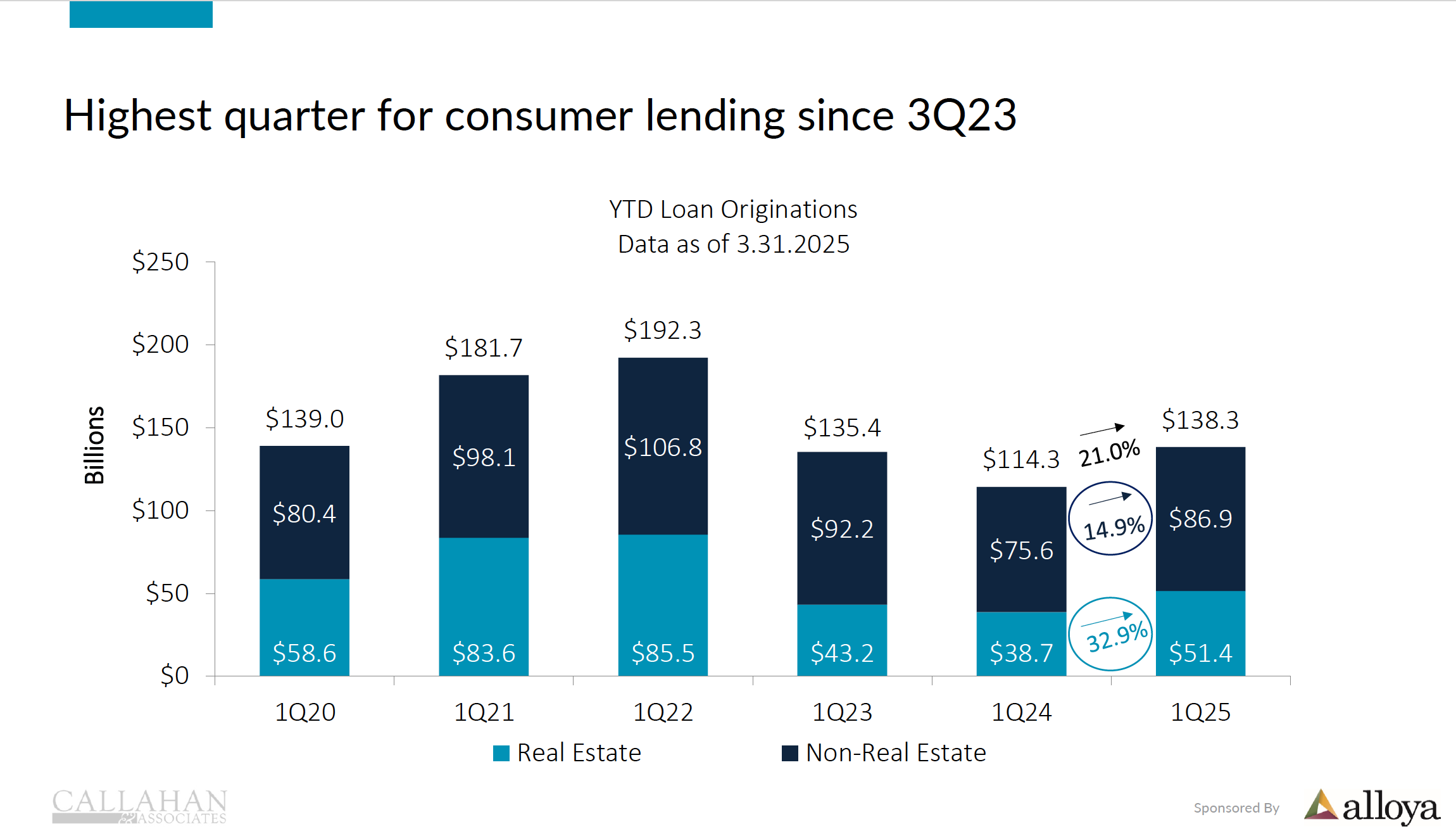

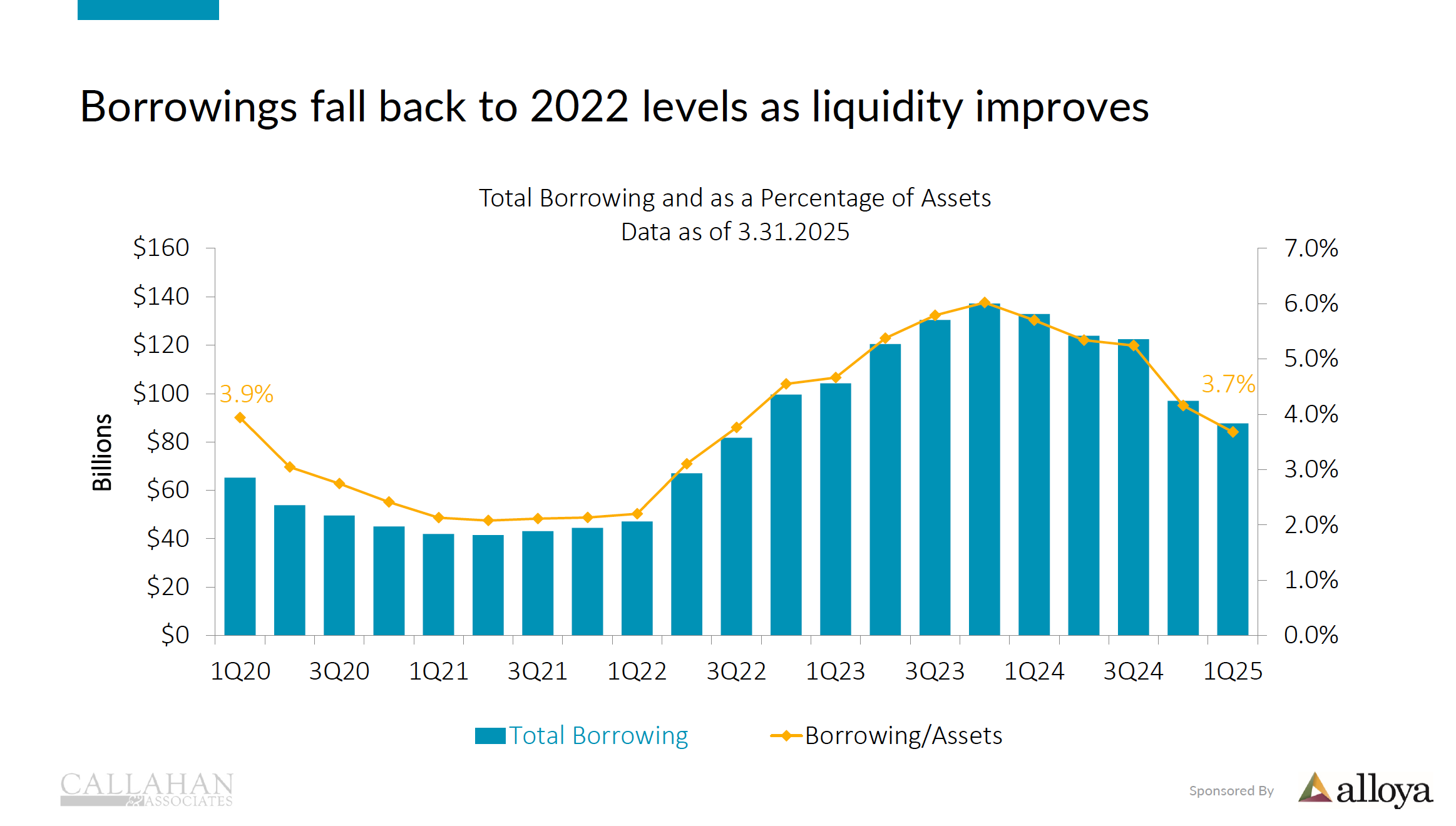

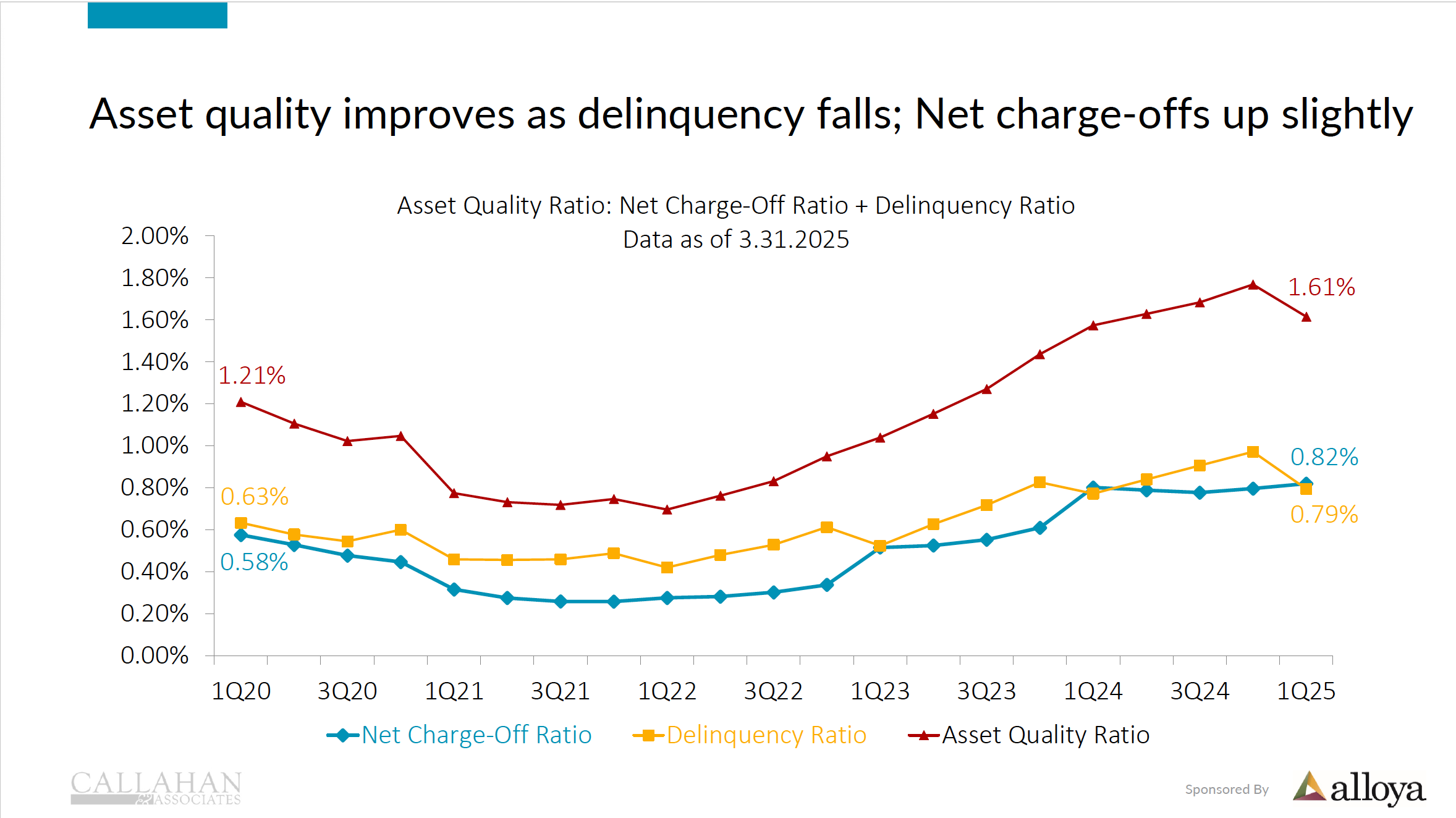

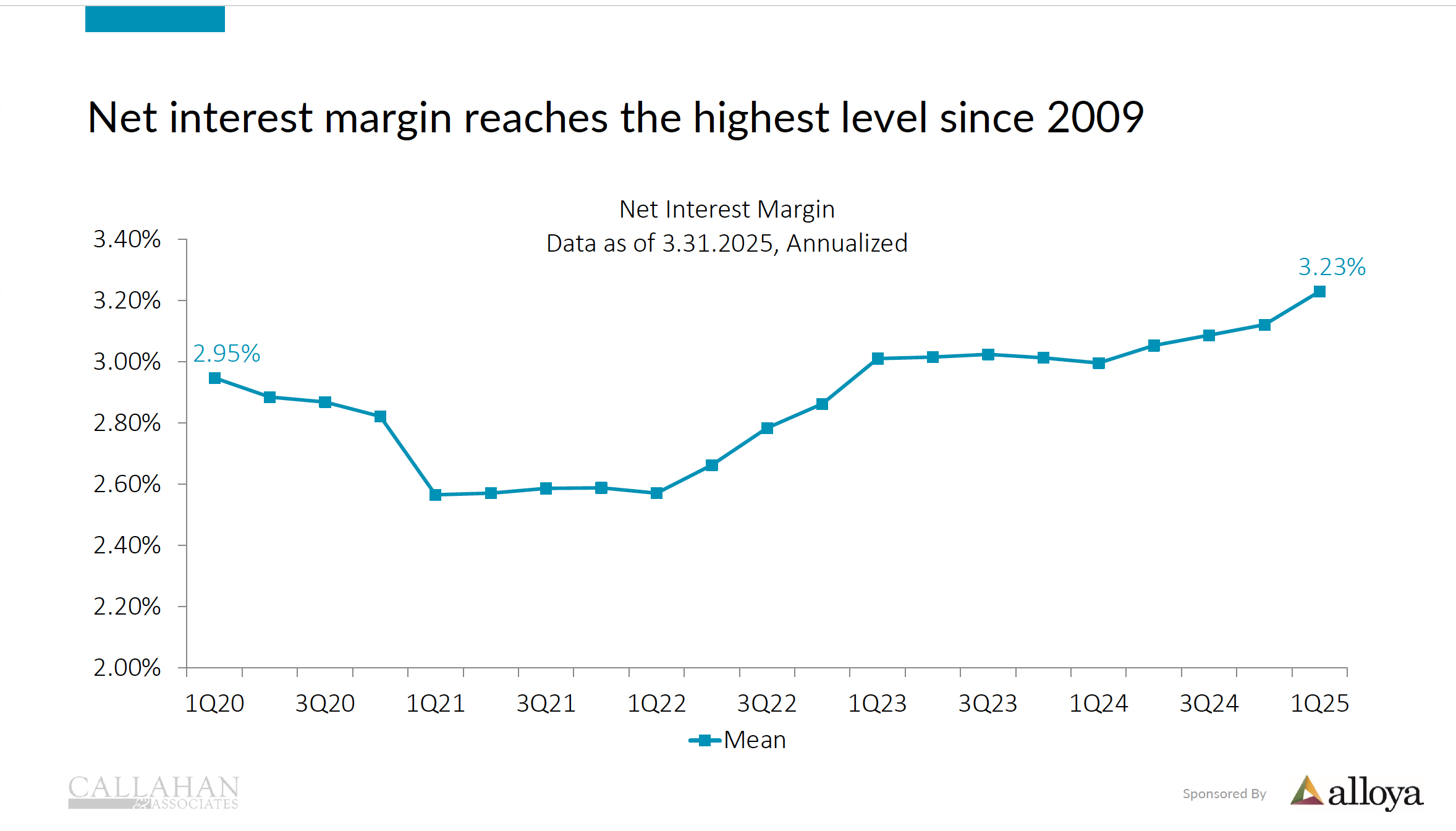

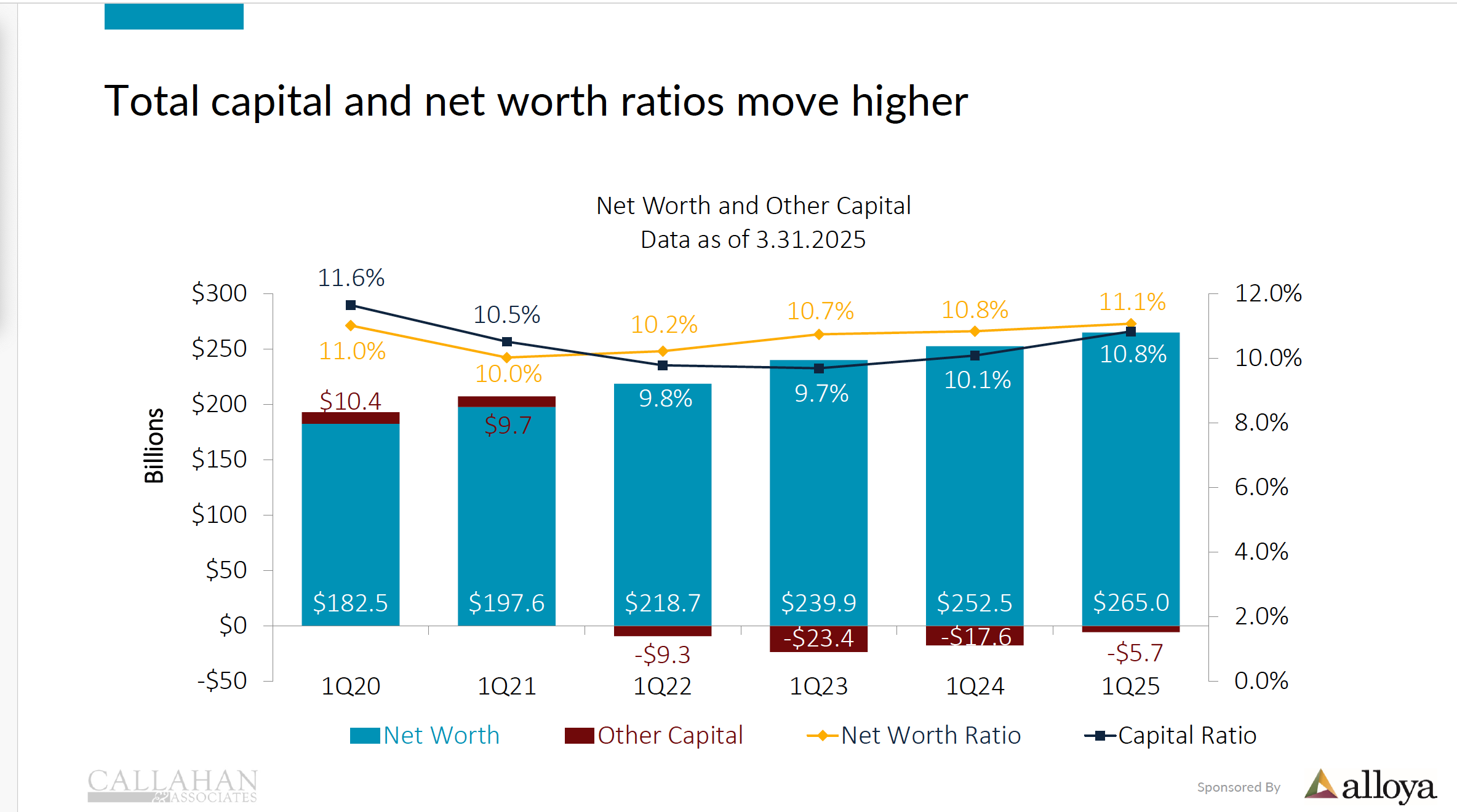

Last week Callahan & Associates presented credit union’s first quarter 2025 financial performance. Here are some excerpts from the full presentation.

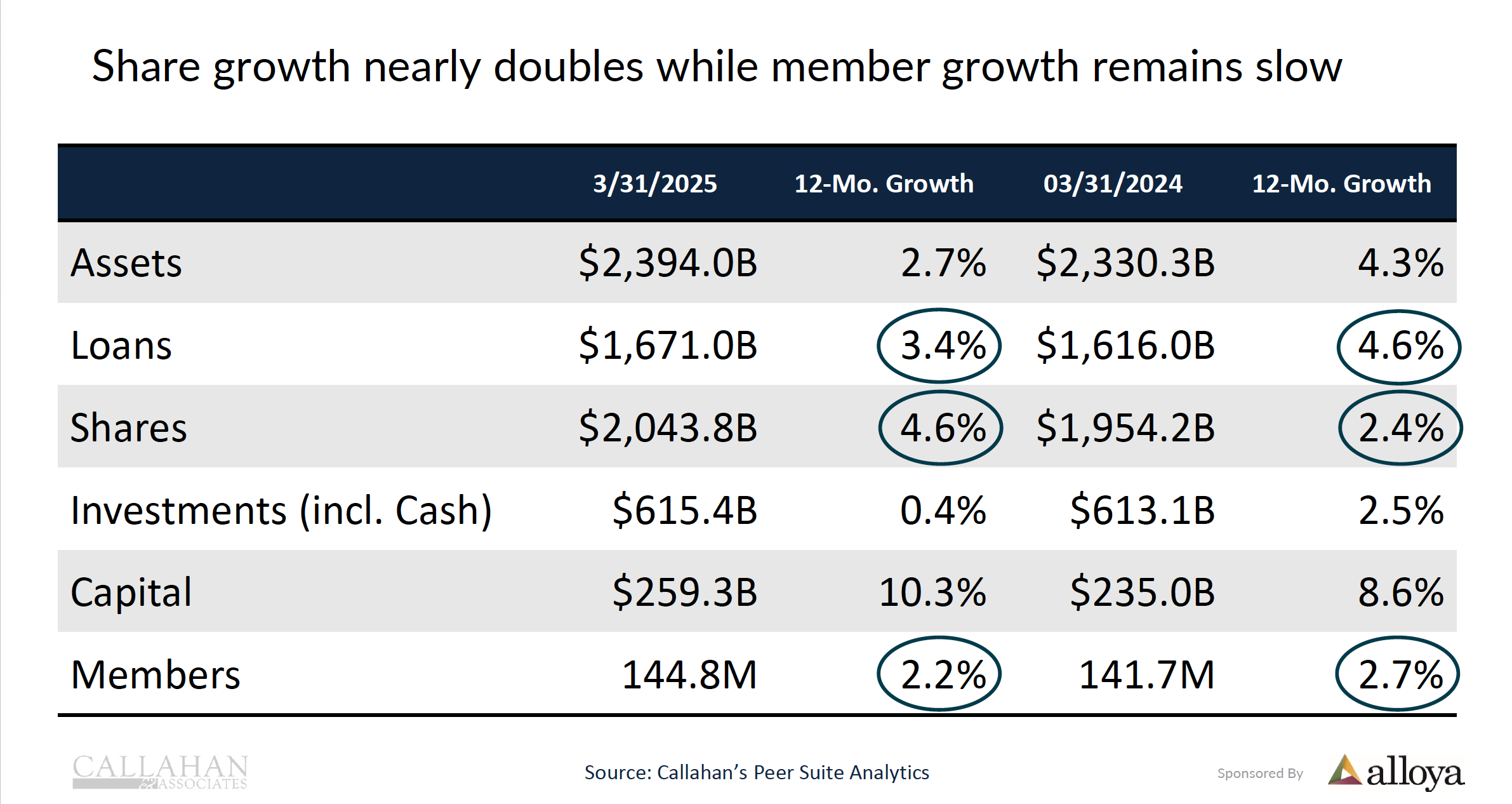

Note that all of the trends are positive begining with the key blance sheet totals compared to 2024.

Will these positive trends be reported as the context for the NCUSIF financials at the same date?

Agenda Item Two: Staff Reorganization

The issue will be how were the reductions achieved? What reorganizations are necessary? What are the operational priorities guiding these changes?

Will the focus be on areas where activity seems to be redundant or non-existent? Why two legal staffs? Can the CLF, which has had no activity for over a decade, be combined with other supervisory roles? Why is a separate AME office necessary when for almost its entire life this function was part of the regional office staff? Are contracts being used to replace staff functions thus giving the appearance of lower headcount but spending levels remain the same?

Finally, who is in charge? The board’s job by statute is to manage the agency. If a person has a question about any area of activity, who are the persons with line responsibility? Can an org chart be published?

I would listen for any discussion about the board’s functions, scope and duties during this period of leadership uncertainty. What is the legal position of the General Counsel for a solo Board’s authority?

So tune in Thursday via zoom at 10:00 AM. Or better yet, go in person.

From an accountability/transparency standpoint your final point re: org chart/area contacts seems particularly pertinent.

Can you provide the link to access the public meeting?

It’s a webex 🙂

#retro

Go to NCUA.gov tomorrow and a link will pop right up to the board meeting.