On December 28th, 2020 the 85-year, $35 million Post Office Credit Union (POCU) in Madison, Wisconsin ceased to be an independent charter. After voting, the 3,196 members and their savings, loans and abundant reserves (22% net worth) were transferred to the $26 billion PenFed Credit Union in Virginia. (Source: Seeking 25 Credit Union Faithful)

As detailed in The Problem We All Share, this merger proposal was too rich for the CEO to pass up:

“The Wisconsin credit union, chartered in 1934, has a net worth ratio of 22%, seven employees, one branch and serves all of Dane County. It is sound, well-run and lonserving. https://www.pocu.com/our-story

“In the October 15, 2020 Special Meeting Notice, the required disclosures show that the CEO will receive a five-year employment contract with an increase in annual salary to $125,000; the Vice president has a comparable gain.

“Select” employees will get a 10% retention bonus and all, a three-year employment offer. If either the CEO or Vice President terminates employment, they are eligible for one-time payments of up to $614,900.

“Each eligible member will get a one-time $200 capital distribution “if the merger is approved and consummated.” This would be from the credit union’s 22% net worth of $7.6 million and is estimated at only 8% ($640,000) of this total. (or in total less than the onetime payments to the CEO and Vice President). The remaining $7.0 million reserves transfers to PenFed as other operating income, that is free money.

“The payments are in plain sight, all contingent on a merger. The member notice provides not a single rate, fee or factual service benefit from this action. In the merger Notice the wording about the future of the single office location is vague: “PenFed intends to maintain the current POCU branch at. . .”

But now we know the rest of the story not just the branch’s status, but for the promised betterment of the 3,200 member-owners

The Rest of the Story

A week ago I received a text from a former CUNA employee and member of PenFed at their Madison branch. He asked if I knew what had happened to the former POCU head office after finding an earlier post I had written about the merger.

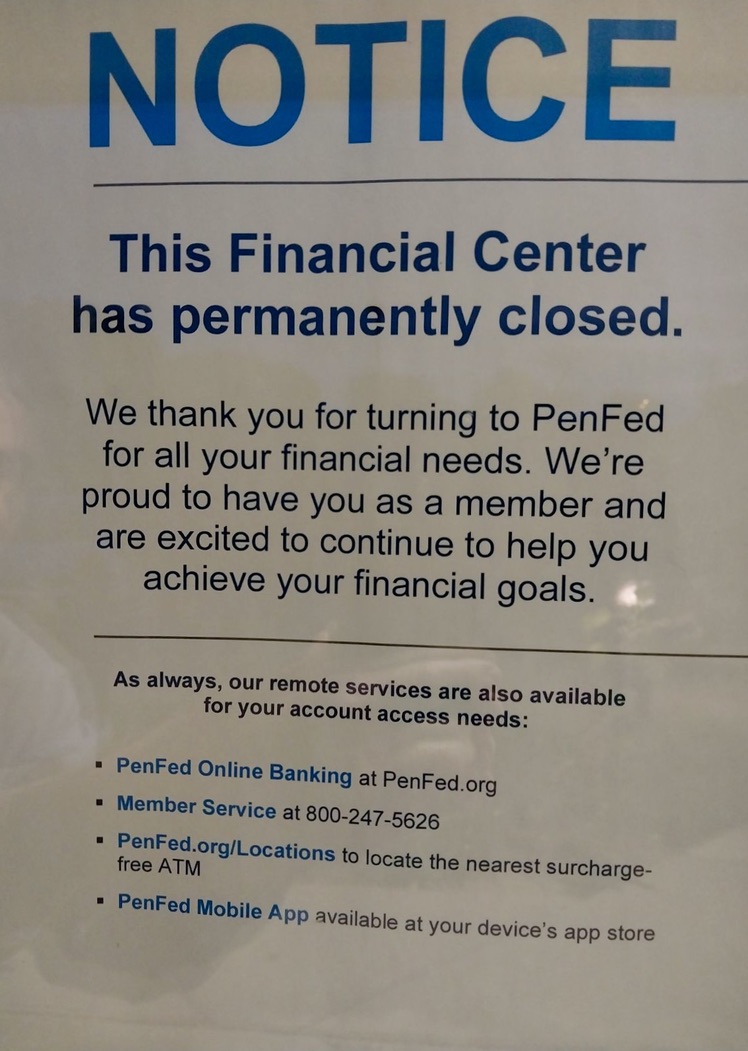

He sent this picture of the branch’s status:

He had seen this sign when he visited on August 2, saying the branch would close forever on August 23, 2024 at 1:00 PM. He had opened his account in-person and received no closure notice. Two other members he knew who had opened their accounts online and also had no notice.

The land and building were owned by POCU/PenFed, the location right across the street from the main Post Office. Presumably it will now be sold with PenFed booking a gain on the book value of the property. This is the final act of what is commonly called “asset stripping” when a takeover occurs and the buyer keeps the most valluab;e assets and sells the rest.

The branch with blank signage.

Office equipment disposed, not donated.

The commitment to keep the office open, with its employees, local convenience and legacy relationships lasted three and a half years. All the transition expenses of the merger, the payouts, the conversion costs to new systems, the termination of vendor contracts are “sunk costs.” There is no enhancement to member value.

The merger itself ended all local governance and representation. The closure of this local presence means no local oversight of investments or loans in the community, no further ( if there was ever any) of the promised $50,000 annual local donations , no employment and no participation in the credit union system in Wisconsin.

PenFed made no announcement of this closure. In the quarterly call reports, it states its FOM potential is the entire population of the US. So members in Madison now have a relationship no different from any other person who joins remotely. And all they got from this deal was $200 to give up their extraordinarily successful 85-year charter.

The rest of the story is that PenFed acted in its self-interest to close a location that it must have deemed “unprofitable” and/or contrary to its focus on digital first members.

That is not what was promised. But we now know, as we did then, that all the promises were nothing more than phony baloney. Here is an excerpt from the initial story link above:

How can one know this is not a considered, well intentioned decision to enhance members’ future? After all, the Post Office board of directors affirmed in their Notice that the merger is desirable for the following reasons:

- Our board evaluated strategic possibilities to ensure that you our member, will continue to receive the full range of products and service you deserve.

- We have been diligently seeking to find alternatives.

- Only one option meets the full range of our objectives: growth of membership, expansion of product offerings, infusion of investment in IT cybersecurity, improved training and enhanced community service. . .PenFed is in the best interests of our members.

The director’s closing assurance of its considered judgment is given in these words:

“It is the recommendation of your Board that you vote “yes” to approve the merger. Please be assured that you are our valued member, and we have every confidence that you will be pleased by the level of commitment service, and value that you will receive from PenFed etc. . . “

If the financial facts were not sufficiently self-incriminating, these words expose the dishonesty of the Board’s actions. There was no due diligence of PenFed that caused them to choose this from “ a range of options.” How do we know? Because these are exactly the same representations word for word sent to the members by Sperry Associates and Magnify, PenFed’s two most recent mergers. And the explicit “assurance” contained in the Notice, “we have every confidence that you will be pleased,” is exactly the same as in these two prior mergers.

PenFed assisted in the drafting of these notices. Since NCUA approved these wordings in the past, it will do so in the future, regardless of their veracity. NCUA endorsed Post Office Board’s assurance of due diligence even though there are no facts in the notice that would confirm this assertion. NCUA’s dereliction in ratifying these exact duplicates of alleged diligent representations of member interests, raises the question whether the agency has any clue about events.

Destroying Credit Union’s Moral Capital

So the POCU branch closing is nothing more than a continued pillaging by PenFed of the institutions whose leaders it pays to turn their members’ assets and relationships over to them. It is a pattern repeated again and again in over two dozen PenFed mergers, A local, long time, financially sound credit union is merged via CEO inducements, and then closed and stripped of its best assets.

PenFed is one example, albeit a leading one, of credit unions preying on their own system. This strategy undermines the whole cooperative advantage and model. There is no evidence it is even a successful growth strategy for the continuing credit union.

A prior NCUA board member stated the agency’s merger oversight responsibility as: “Our focus is on ensuring member interests are protected through the regulatory process.” That is obviously not happening.

I think a more accurate description of the situation is Mark Twain’s assessment of human motivation:

“Some men worship rank, some worship heroes, some worship power, some worship God and over these ideals they dispute and cannot unite–but they all worship money.”

from John Buckley, Jr, CEO Gerbers FCU:

Chip – Isn’t the real issue the inability of smaller, community focused institutions to find the next generation of leadership? With the NCUA, CFPB, State regulators, etc. all telling you how to do your job, who wants to sign up for that level of responsibility for a pittance of what one can earn in community banking? And for the Boards of these institutions, as a huge cohort of leadership prepares to retire, who is lined up to take the mantle? The NCUA has made it very clear they would rather supervise a smaller number of very large CUs than get down in the weeds in smaller communities throughout the country. Just my two cents.

A perspective of one member’s experience with PenFed’s Madison WI branch sent via email:

Shortly after the first of the year, Pentagon removed the ATM at the Madison branch claiming that it wasn’t used enough. They told members that they should go to Walgreens and use an Allpoint ATM because it offers both cash withdrawals and deposits. The problem is, you can only deposit cash, not checks. When I complained, the employee said that he didn’t know and that is what Pentagon staff told them to tell the members.

A former employee told me that Pentagon representatives paid a visit to the office earlier this year and assured staff that they had no intention of closing the location. Staff apparently believed it, because when I complained about the ATM they said that they were trying to get it back.

A former employee told me that the Madison branch employees were offered a severance package and at least one employee was offered a work-from-home position. However, most employees were not offered jobs.

After the closing was announced, I asked an employee if the original Post Office Credit Union members were angry. The employee indicated that they were, but they pretty much expected they would close the office, so it didn’t come as a surprise.

Your article is correct in that Pentagon made no effort to market the credit union after the merger. As a member, I never received anything from Pentagon other than my monthly statement and was never solicited for additional product or service.