This is a three-part look back of a January 26, 2022 article on the transfer of $10 million of members’ capital to a non profit by the CEO and Chair as a result of merging Finance Center Credit Union.

Part I summarized the previous events and articles offering principals’ explanations.

Part II below presents data subsequent to the merger from the Foundation and CEO Duffy’s activities through January 2024.

Part III will address what happens now?

Part II: Updating the FCCU2 Story To the Present

How is the newly expanded Valley Strong Credit Union doing? After the first full year post-merger, (ending December 2022) the credit union was going gangbusters. However as of September 2023, the same indicators suggest the credit union has hit a brick wall.

Ratio/ Measure December 22 Dec ’23

Loan growth % 49.1% -6.6%

Share growth 8.7% 1.5%

Members 16.4% 6.8%

Total Assets 21.3% -3.8%

Net Income (46.0%) 8.6%

ROA .44% .44%

Net Worth 8.1% 8.5%

Loan Originations 58.5% (51.4%)

Delinquency 1.1% 1.2%

Net C-O loans $25.4 M $68.8 M

# employees-FTE 625 570

Two notes from 4th Quarter numbers. The credit union reported a non-operating gain of $15.2 million or 84% of total net income on which ROA is computed.

The compound four year CAGR annual ROA growth (2019-2023) is negative 18.9. In the same period the annual CAGR for average salaries and benefits grew 12.2% per year.

The two years’ trends show a dramatic slowdown in key balance sheet accounts, rising loan charge offs and a staff reduction of 50 employees. Mergers can create an initial “sugar-high” growth appearance, but sustainability depends on a firm’s ability to develop relationships, that is grow organically. How FCCU members view their new credit union is hard to discern from this macro data.

The Data from IRS Filings

The 990 IRS non profit filings for FCCU2 and Valley Strong (both for 2022) provide important data.

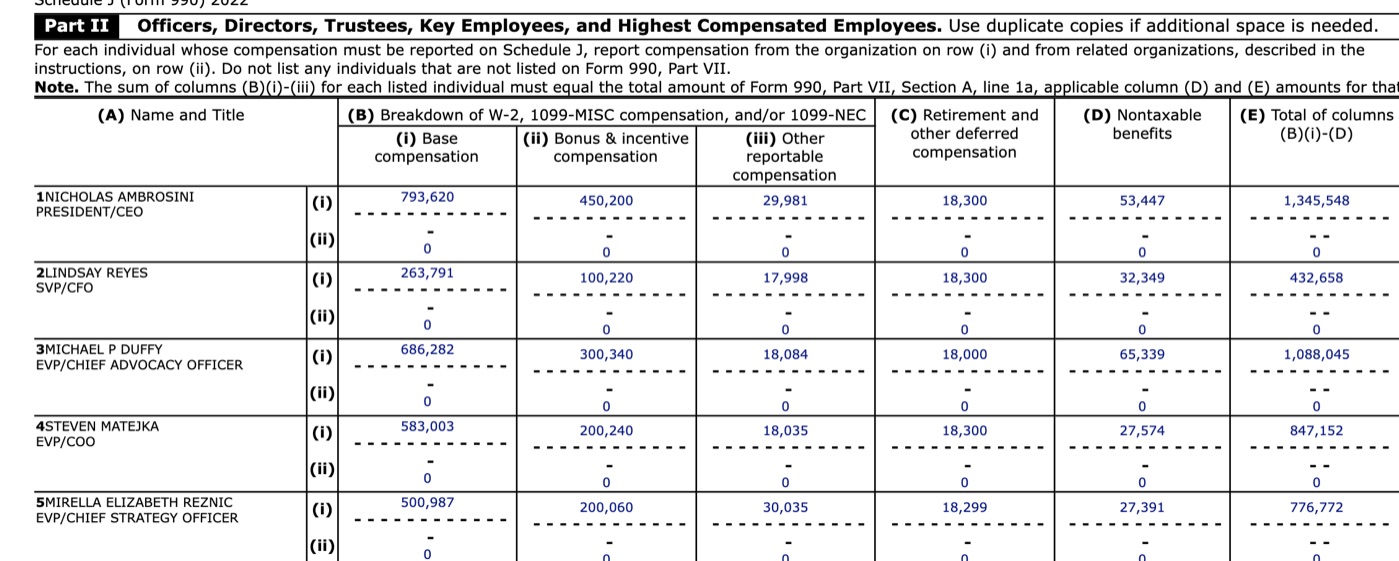

From Valley’s 990, we learn that all of the senior FCCU employees listed in the Member Notice, remain employees and qualified for their $800,000 in total 2021 merger bonuses. Their total compensation for 2022 is listed as :

Michael Duffy, EVP Chief Advocacy Officer $1,088.045.

Nora Stroh, Legacy Ambassador $361,814

Steve Leiga, VP Accounting $354,748

David Rainwater, Sr. Project Mgr $362,747

Amanda Verstl, HR manager $353,542

The data is from Valley Strong’s 2022 Schedule J partially shown below.

Total compensation of the five senior FCCU executives on this schedule is $2, 521, 696.

The FCCU2 IRS Information-A $2.0 Million Bonus Contribution

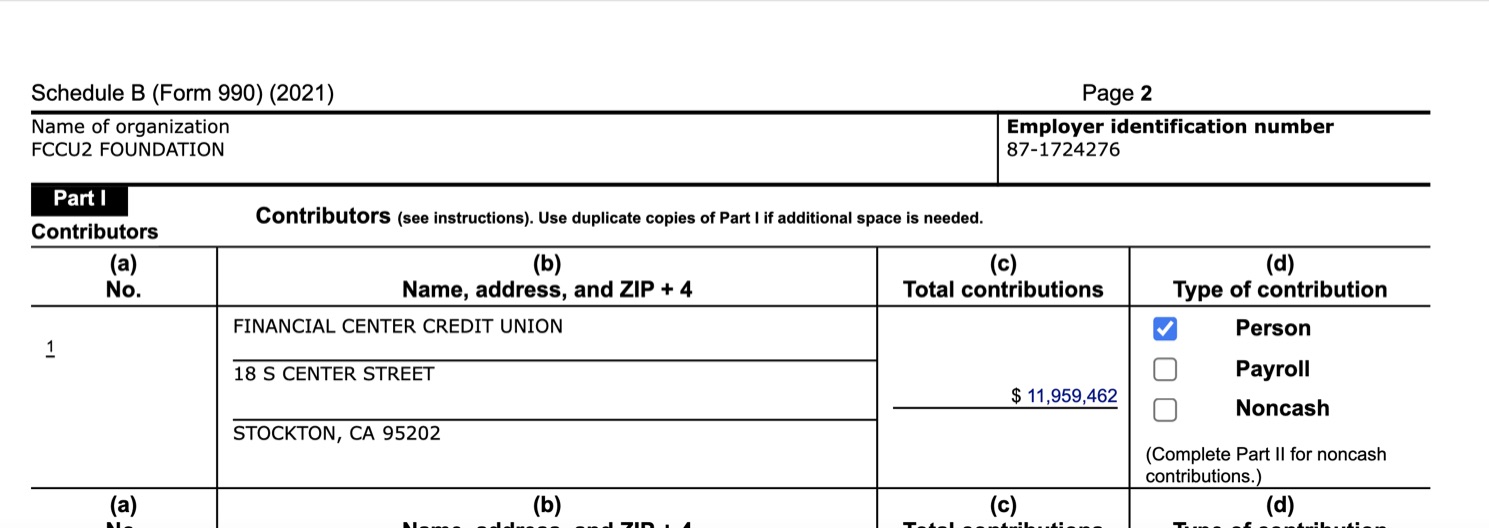

The FCCU2 foundation’s 990 for 2022 provides information about the transfer and use of FCCU members’ funds from the merger.

- The most stunning fact is that the Fund did not receive the $10 million listed in the official Member Notice. Rather the total sent to the foundation in 2021 was for $11,959,462 or almost $2.0 million more than disclosed to and voted on by members.

No explanation is provided where these additional funds came from? Why were they taken from members or not transferred to Valley Strong as part of the equity transfer? Who approved this $2.0 million additional amount? What was NCUA’s role?

- In the same 2022 IRS filing we learn:

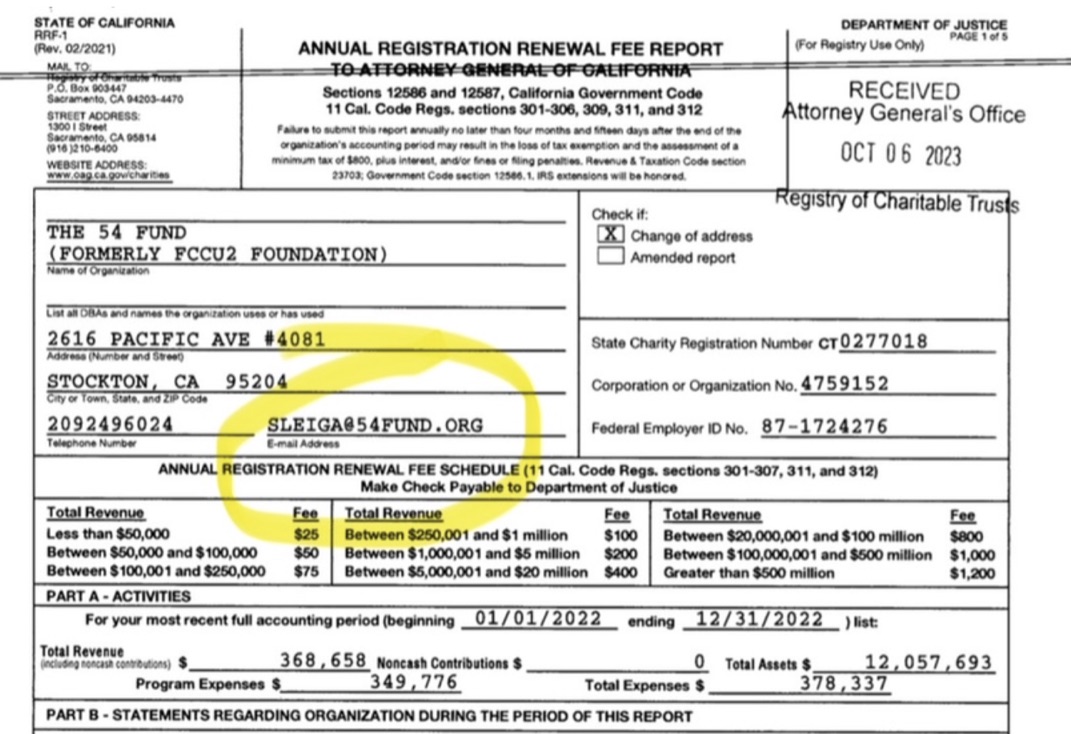

- The Foundation has changed its name to The 54 Fund. No public explanation of the reason can be found in any media.

- The address is no longer at the former credit union’s office but in the building below, that is 2616 Pacific Avenue #4081. It is the local post box not an office.

- The new foundation lists no website address or other contact information. When I emailed Foundation director Steve Liega on the IRS return, I received no reply. When dialing the phone number, it is “not in service.”

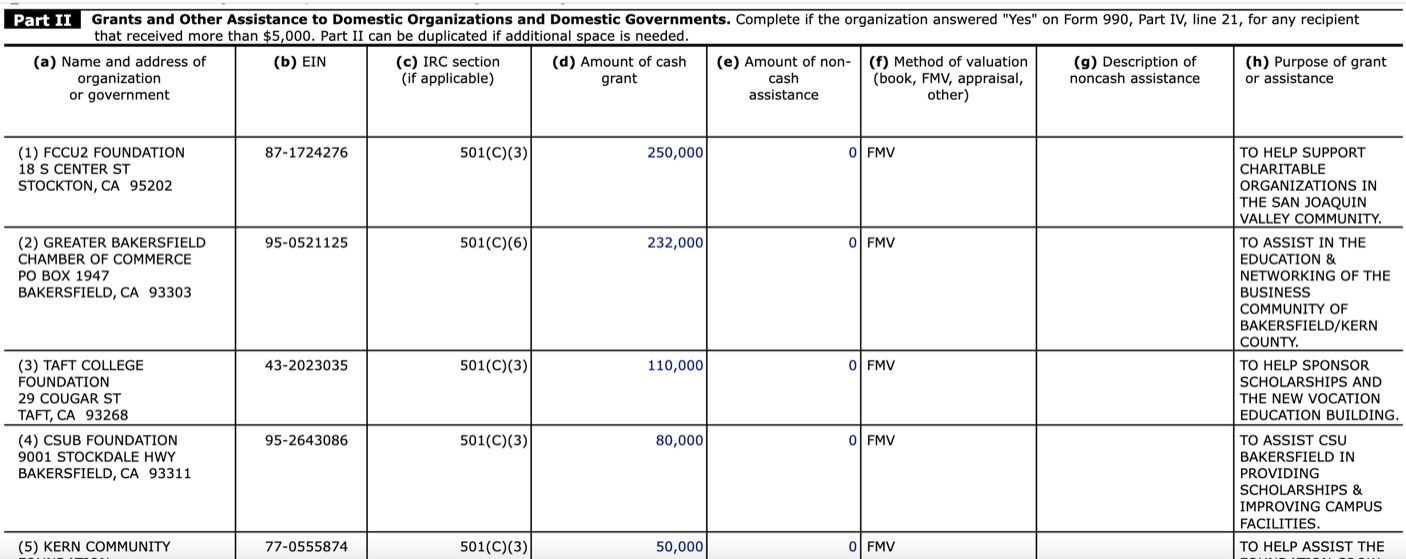

- We do see the $250,000 donation listed in Valley Strong’s contributions, its largest single grant.

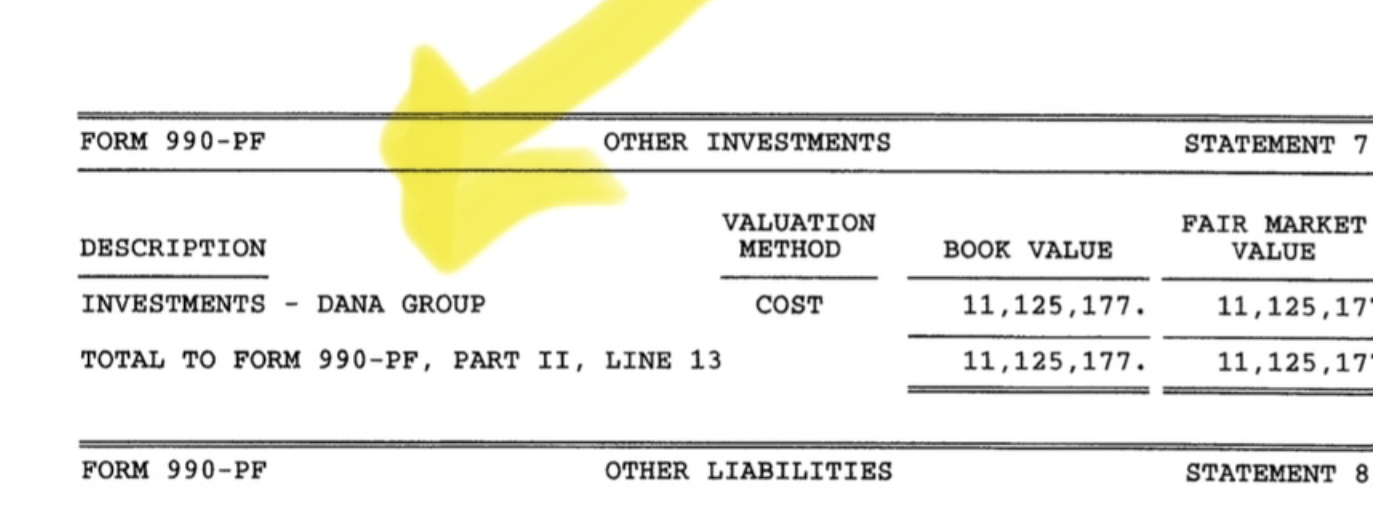

We also learn all of the initial funds were invested in a firm called the Dana Group. What does this have to do with credit unions or prudent investing?

After adding $2.0 million more of members’ funds, all these registration/location changes further remove the Foundation from public scrutiny and accountability. The only information available is from the IRS 990 filed in October 2023, ten months after year-end.

In contrast credit union call reports are public and received quarterly. Annual state and federal exams validate reported data. The 990 provides additional information on donations, political contributions and executive salaries. In contrast, the financial details of the new 54 Fund are available once per year and then ten months after year end.

The 54 Fund Spent $0.38 for Each $1.0 Donated

Even though limited, the Foundation’s first full year report gives insight how it manages its activities.

Total revenue was $368,658 including the $250,000 donation from Valley Strong. Total operating expenses were $105,858. Charitable donations were $272,479. For every $1 in donations, the Fund spent another $.38 on operating expenses.

The $272,479 donations were distributed in 86 grants ranging in size from $1,000 (45) to three at $25,000 each. The recipients include churches/temples of all denominations, multiple private and public schools, private social agencies, and the United Way of San Joaquin. The 54 Fund at 2022 yearend had more assets than at the beginning ($11.974 vs $12.058 million)

The purpose stated for all grants is “general support.” Other than seven over $10,000, the much smaller 79 amounts might be characterized by the term, “walking around money.”

Of the nine 54 Fund directors chosen by Duffy, four are former senior FCCU employees, now at Valley Strong. In 2022, all five former senior FCCU executives listed in the Member Notice received much greater annual compensation from Valley Strong than the Fund’s $272,492 in total donations to help its 29,000 former members. Is it just proving the adage “charity starts at home?” Were these five positions and pay, or others, “at will” or negotiated in contracts? Did the executives guarantee their success and not member benefits?

Three other 54 Fund directors are former FCCU board members including the Chair Manual Lopez. Another director is Ed Figeroa, listed as Executive Director, who received a salary of $46,667. Figeroa had recently retired as CEO of St. Mary’s Dining Room. In 2020 the charity received a $100,000 donation from FFCU as part of the credit union’s Stockton Strong donation (see video from Part I).

By comparison, Valley Strong CU made total 501 C3 contributions in 2022 over $1.1 million including $250K to the 54 Fund. These grants were made without the need for a foundation.

As a tax exempt organization there is no purpose for a credit union to establish a separate foundation to expense grants. This raises the question of motivation. Why was a new foundation needed “to advance and support the needs of the members”-Duffy’s characterization in Part I.

The “Tragedy of the Commons”

Why was the FCCU2 foundation established just a month before the merger announcement when it was unnecessary for charitable grants in the credit union’s previous 65 years of operations? Or at Valley Strong now?

The separate foundation registered by CEO Duffy (along with his former employees and board directors) keeps total control of the funds by Duffy. If the money had been returned to the members or transferred to Valley Strong, the ability to continue to cultivate an image as a civic patron would not be under Duffy’s control. This transfer of $12 million “privatized” members’ common wealth.

The 54 Foundation was the vehicle used to promote the personal philanthropic reputation of the FCCU CEO once he left his leadership role. His previous political and public grants activity had been funded from his credit union’s resources. He needed a new funding source.

Two examples of this reputation motivation are in recent articles. In January 2024 Michael Duffy was selected as Stockton’s 69th Stocktonian of the year. The story begins:

“Dressed in a gray plaid suit and a red striped bow tie, the former president and CEO of the Financial Center Credit Union became the 69th person to receive the award for service and positive impact on the city.” The paper provided a series of pictures of the event.

The article cited Duffy’s past as CEO of FCCU (a responsibility he had exited 28 months earlier) and his position at Valley Strong. There is no reference to Valley Strong’s recent charity or the Foundation as the source of Duffy’s donations. But he gladly accepts the praise and publicity for giving away a tiny fraction of the $12.0 million set aside from the former FCCU members’ collective savings.

A longer article reporting the same award was published by the Stocksonian on January 29, Banker Michael Duffy Surprised by selection as Stocksonian of the Year.

He is now described as a “banker” a higher calling apparently than a former credit union CEO.

He is quoted in the article saying: “I love Stockton, and so I find every which way to be a part of Stockton,” Duffy said. “If it’s from the north, to the south, the east, the west, the tiny neighborhoods, the big events, the very small not-for-profits, the very big ones, if I can be there enjoying this city with everybody I’m there.”

Neither article notes that after gaining his living for 28 years from the credit union, he and his board failed to seek a successor to lead the city’s 66-year old and largest local cooperative financial firm. That would be standard industry best practice when CEO’s decide to leave. It is also a fiduciary duty of the Board of directors.

This is a recent case of how CEO succession normally proceeds, especially for financially strong credit unions. FCCU’s capital ratio of 16% was twice the ratio of Valley Strong.

But that process would mean Duffy would be out of a job which had been paying him over $1.0 million per year. And he would no longer have access to members’ funds to show his civic “love.”

A Financial Pied Piper Leads Members and Resources to Bakersfield

The term Pied Piper refers to a person who is able to charm or lure others through the use of their skills and ability to manipulate them for their own gain.

Instead of sustaining the credit union to serve its founding community, Duffy engineered the transfer of 29,000 Stockton’s members’ $635 million locally owned assets and their $110 million accumulated capital. A new board and executive team 250 miles away now controls how these resources will be used.

When initiating this change of control to a credit union with no local roots, Duffy set aside $12 million of his members’ surplus for his direct control in the 54 Fund.

He turned the Robin Hood model of wealth distribution into a financial round robin game. He first retains money, not using it for member benefits, to build reserves more than 100% higher than peers. From this extraordinary capital surplus, he directs $12 million into the new organization he controls. To justify this diversion, he says it to help those from whom he withheld the earnings benefit in the first place.

When CEO, Duffy short-changed members’ returns by building capital ratios twice the industry average. He turns to this same source for the 54 Foundation funds. Truly a double blow for those who entrusted their financial futures to his credit union leadership.

In Part III I will discuss what happens next. And share the names and writings of two persons who saw through this whole financial flim flam from the start.

(Editor’s note: Valley Strong data for December 2023 updated on February 3, 2024)

Amazing story Chip. Where was the California state credit union regulator?

Unbelievable! Oversight of credit union execs and Board members is still a huge weakness of the credit union industry.

I really appreciate the research you do to bring our attention to organizations that have lost the mission of “not for profit, not for charity, but for service.” Thank you.