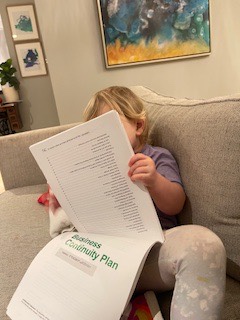

This is how one family introduces their children to credit unions, from a post earlier this week.

The parents take their role seriously. The baby is growing up. They are now helping her become familiar with credit union leadership responsibility.

She is looking to find the page on youth programs.

Here it is. One hopes more senior credit union volunteers spend this much time reviewing their board policies, especially on succession planning.

A High School’s Entrepreneurship Program

I graduated from Springfield High School. It never had a program like the one described in the SHS student newspaper from January 25.

The opening introduces a dedicated teacher helping students learn about the realities of small business.

For years, students have been restricted by the confines of the educational system, simply following the “status quo” and doing the bare minimum just to graduate. As time has passed, schools have developed their programs and have prepared students to genuinely pursue opportunities that never seemed possible for a regular high school student.

Springfield High School has developed a plethora of programs for students to grow their experience for potential careers, one of which is the entrepreneurship program.

Karri Devlin, a veteran teacher at SHS, runs this program with the intention of helping students reach their full potential as a business owner. “We try to emphasize the importance of leadership and creativity in regards to starting your own business. We talk about how to promote your business, and how to manage it financially. They also learn how to sell a product and collect the money. Students can pick their marketing team and sell their own product on what’s called Market Days at lunch. They’ll set up their products at lunch and we’ll try to sell them to the student body. We have some grant money that helps buy the supplies but the students pretty much have to come up with the money for the supplies I don’t provide. They also have to determine the markup and how much they’re going to sell it for to make sure that they can cover their costs.”

After describing one student’s efforts, the article closes with this observation:

From Mrs. Devlin’s entrepreneurship program, to creating their own businesses, student entrepreneurs have proven time and time again that they have an unstoppable drive. . .With their innovative young minds, they are the future of the business industry. And to those who do not possess the entrepreneurial spirit, support your classmates by buying local!

This high school in Springfield, Illinois would seem an ideal opportunity for credit union partners in this hands on, real world of “classroom” startups.

Update on the Federal Reserve’s Special Bank Term Lending Program (BTLP)

A week ago I reported that credit unions with only 9% of total financial assets, had taken down 27% of the emergency BTLP.

Also that financial firms were now arbitraging the special fund by borrowing and reinvesting the funds in overnight reserves, earning a spread. Borrowings had grown from $129 billion at yearend to $168 billion this week, in a period of quiet markets.

That opportunity is now over. The Fed announced the facility will close on March 11. The 307 credit union borrowers of $35 billion (as of September 2023) will have to pay off their loans or shift borrowings elsewhere.

Point well made Chip, thanks.