In response to last week’s post on the impact of mergers on the future of the cooperative system, this former NCUA senior executive sent the following comment.

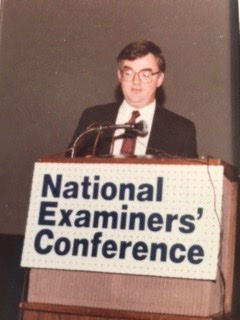

Mike Riley, December 1984

“Creative destruction” is uncomfortable to see in print. But it existed before Adam Smith, Malthus, Marx. Keynes, Schumpeter, and others began to try to explain the economic drivers and motivations that shape our world.

Cultural changes seem to be the main driver today. The personal seems to have switched to the impersonal, i.e. give me what I want on my terms with not much regard to others. Fast and low cost are the motivators. (disclaimer: I love Amazon.)

We have to deal with what we have. I am concerned about sound credit unions merging. When I was a new examiner, I had 30 -40 credit unions who were below $100,000 and none of the rest I had were over a million. And no, I did not start in 1934.

This was in the seventies. They were basically in small towns or in rural areas where there was a factory of some sort. As I visited them (most were happy to see me, albeit a regulator, to hear about the outside world), it was obvious that the Board and Committees were involved in the credit union. Their members and the Treasurer were most involved of all. They were making loans on washers, dryers, refrigerators. Most of their members had no real access to credit except at an exorbitant rate. No savings accounts available to the members.

The credit unions really cared about their members. I remember one credit union was trying to decide on whether to make used car loans. They wanted some advice from me. About 8 months later I came back and before I could start the exam they wanted me to go out and look at this used car and meet the borrower.

They were so proud of this accomplishment. (As a good regulator, I did check to see if the loan was to a Board member or family member.) It seemed to be a good loan. Not to get maudlin, but this shaped my views of what credit unions are. And fortunately, the larger credit unions were much the same.

After I moved on, I tried to keep track of these credit unions. Around 1990 I put together a list of where these credit union were. I couldn’t find a few; but a little other 20 had liquidated because the factory closed down or the key people left or retired. Another 30 or so had merged either voluntarily or involuntarily. About 6 were still alive and functioning. To be fair, at the same time the American economy was undergoing a major transformation and jobs and manufacturing were moving overseas.

Ongoing Mergers

This ongoing march continues. The merger of two sound credit unions without some legitimate reason doesn’t seem to be member oriented. I still think of the members of those small credit unions who received services such as buying a washer that no one else would do.

Bigger is not better if the member does not benefit. How many of these mergers produce lower loan rates , higher dividends, or distinctly better products at a lower price? Carried to the extreme we will be left with 20 credit unions that are no different than large banks.

NCUA’s Role

Schumpeter opined “If someone wants to commit suicide, it is a good thing if a doctor is present.”

Thank you, Mike! We did not always agree when I ran the National Federation of CDCUs, but I appreciate your perspective. Cliff