Collaboration is the unique cooperative advantage. What one credit union would be unable to do, several working together can accomplish.

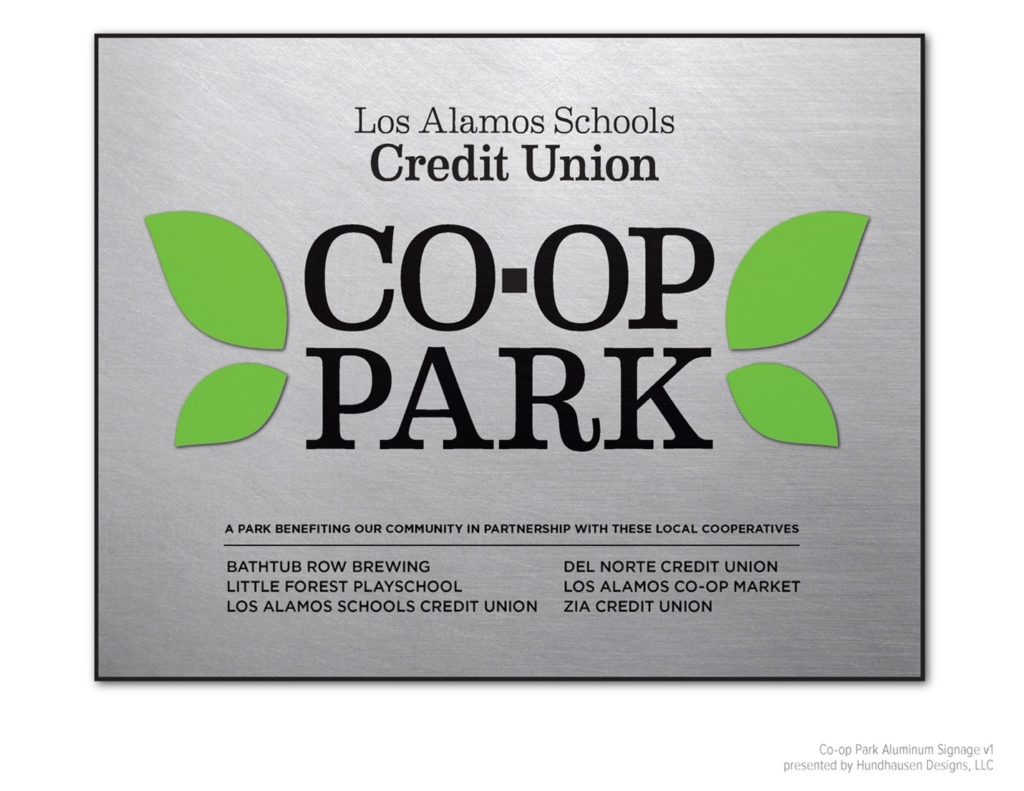

This latest example, a cooperative community park adjacent to Los Alamos Schools Credit Union’s new head office, was enabled by seeds planted almost a decade earlier.

In 2012 Del Norte CU learned that members believed their cooperative structure mattered. Their Net Promoter Score surveys revealed that “promoters” valued service and that the credit union was locally owned–a co-op not a bank.

Their marketing department used that finding to differentiate themselves. In Los Alamos, New Mexico where DNCU in 1954 began serving the Los Alamos National Lab employees, they discovered three other co-ops: Little Forest Playschool, founded in 1951 by the wives of the Los Alamos National “Labbers,” Los Alamos CO-OP Market and the newly formed Bathtub Row Brewery CO-OP.

In just one meeting in a coffee shop, adding Zia and Los Alamos Schools Credit Unions, all agreed that co-ops should support each other. Over the years they worked together to invest in their communities, serve their members and educate the public about the cooperative difference. https://www.keepitcoop.com

Building a Cooperative “Commons”

Matt Schmidt, CEO of $23M Los Alamos Schools CU purchased land in the town’s center to build out a new main office. The site included adjacent space that Matt believed could be converted to a CO-OP Park and community gathering place.

The concept was reinforced by the pandemic. “Isolation, he stated, had led to a craving for connection.”

The two-phase plan includes a community gathering space, outdoor concert stage and room for a beer garden. It was a bigger concept than his credit union alone could realize, so Matt approached the Keep It CO-OP group. They gave their immediate support.

Cooperative Education

Each contributing organization believes cooperation among cooperatives is vital. Matt said the group and this project are like planting seeds. “We trust they will grow, for these projects show our belief in each other and the community.”

Matt believes his credit union’s focus on educational employees and students makes its role in informing the community about cooperative design even more appropriate. “This shared space allows us to tell the story of why you should join a co-op; the value we bring together. It is a concept that could be adapted to any community in America.”

A gathering place in the wake of a pandemic that drove us apart.

*The six cooperatives in Los Alamos that make up the Keep It Co-Op movement have deep roots in the history of Los Alamos, New Mexico. They are:

Little Forest Playschool. Founded in 1951 by a group of local moms in the American Association of University Women. The first playgroup was composed of 15 children and cost 10 cents for juice and supplies. Little Forest is a cooperatively managed preschool for children aged two to five. Children are given the opportunity to learn the same way they do naturally, through exploration and play.

Del Norte Credit Union. Founded in 1954 as Los Alamos Scientific Lab Credit Union and serving as the first financial institution in Los Alamos. The organization became a community charter in 1981 and expanded financial services and offerings to surrounding communities.

Los Alamos Schools Credit Union. In January of 1955, Ruby Meaders founded the Los Alamos Schools Credit Union out of her home just after the unveiling of the “Secret City” of Los Alamos. She was more than glad to help with the need for non-governmental businesses like grocery stores and financial institutions.

Zia Credit Union: In 1955, a group of approximately 200 individuals from Zia Company, support contractors for the Los Alamos National Laboratory, organized and founded Zia Credit Union as a special interest group, a common practice for that time in the credit union movement. The contractors felt they needed their own financial institution. In 1975, management at Zia CU decided to expand its field of membership by serving the entire community.

Los Alamos CO-OP Market. Opened in 2011, their mission is to serve Los Alamos County and surrounding communities by providing fairly priced, wholesome foods and other goods in an ecologically sustainable, socially responsible and economically appropriate manner.

Bathtub Row Brewing CO-OP. Thanks to three years of hard work and the investment of its membership, Bathtub Row Brewery CO-OP was up and running in 2015 as Los Alamos’ first craft brewery and the fourth cooperatively run brewery in the United States.

Note: Thanks to Denise Wymore who alerted me to this project.

The term “deregulation” is worrisome for people like me on the Left. It is a constant, painful reminder of everything that can go wrong with the economy, as has been borne out historically. Deregulation generally hurts jobs, workers, families, renters, mortgage holders, and every other person or group who are left to forage through the remains of the economy after one more industry gets deregulated.

There are some advantages of deregulation in some limited cases. Deregulation of the old AT&T was said to help foster new telephonic technology and other innovations. Superficially that appears to be the case, based on the historical sequence, but one wonders if those changes were inevitable anyway.

Deregulation of the airlines is another example. For a number of years in the late 1970s and early 1980s, one could fly from Newark NJ to Buffalo or Syracuse NY for $29 one way, and sometimes as little as $19 during supersaver sales (one time, even $9! I am not kidding), thanks to cut-throat price competition driven by newcomer startup airlines like People’s Express. The illusion of deregulated competition’s resulting economic miracles is quickly shattered once one notices that People’s Express Airlines are no longer (having been swallowed up by Continental).

The dark side is that now pilots are poorly paid, especially those flying for the smaller, regional feeder airlines, many of whom earn so little that they cannot even afford discount hotel rooms when they have a layover. I have personally witnessed missing seats in older aircraft still being used by UA and AA (I’m talking tail-draggers with no air conditioning while planes are loaded and readied for take-off).

Has deregulation really helped the credit union industry? What I see are endless mergers, with increasing numbers of smaller credit unions being swallowed up into enormous regional, sometimes almost nation-wide credit unions, Wall Street raider style. Credit union managers of these mega mergers hauling down enormous salaries and perquisites like those of their commercial bank brethren and sisthren. Could smaller independent credit unions have survived to this day without all of these mergers?

As Chip Filson reminds us repeatedly, in many different ways, credit unions are not supposed to be operated like huge, multi-national commercial banks. They are meant to be local and have a focus on local. The recent stories on this site about community parks and local alliances of co-ops are examples of the actual intentions of credit unions.

What was supposed to be the domain of the public, what was meant to provide the economic financial commons of the people, is increasingly being buried by these new megaliths. Do we wait until disaster occurs for the credit union industry, in some manner analogous to the 2008-2009 GFC, or should we just relax and heed the advice of those oracles of finance who continually assure us that capitalism and competition will magically solve any challenges down the road?

Somehow, I can’t see a Biden administration — or any other future US administration — pumping trillions of dollars of liquidity into some future failed credit unions (that were too big to fail?) that ended going the way of every other deregulated industry. Why do I think that?

Well, let’s see now, there used to be these thingies called “Savings and Loans” — or am I just delusional? Oh, that’s right. That was different. Different because… uh… because… oh, I don’t know. Because they weren’t commercial banks; they were intended to promote home ownership, not make the ruling class wealthier. Hey, this is capitalism. You want local control and that nonsense, go move to a communist country. Something like that.

No, it is much more likely they would claim (as they usually do) that market forces PROVED that credit unions needed to die so that proper, respectable owner-class economics could continue to do what they have done so well for so long: Allow the owner-class to continue to do what they have done for so long.

Look how well that has served us.

As part of the Callahan administration that ushered in the deregulation era for credit unions, I believe the track record would show that members and their institutions did succeed and prosper. That is not to deny that some of the concerns you raise are indeed valid. Today’s members and leaders will need to step up to the plate if these challenges are to be successfully addressed.

This is really weird. It’s as if my comments on these 2 articles got swapped — they are on each others’ pages.

With regard to the other article, it notes that deregulation of the credit unions “has come primarily in the form of interest rate ceilings being eliminated from the accounts of federally chartered CUs.

“The results? Membership, loans, and savings in CUs are growing, while operating fees charged CUs by the agency are shrinking.”

Sure, in this regard, it was artificial limits that were eliminated, which definitely helped the credit unions. Those limits were placed on credit unions, it seems reasonable to think, to ensure that commercial banks had better customer (member) prospects. THAT kind of regulation I can live with!

Sorry, meant “de-regulation” at the end of my last comment.