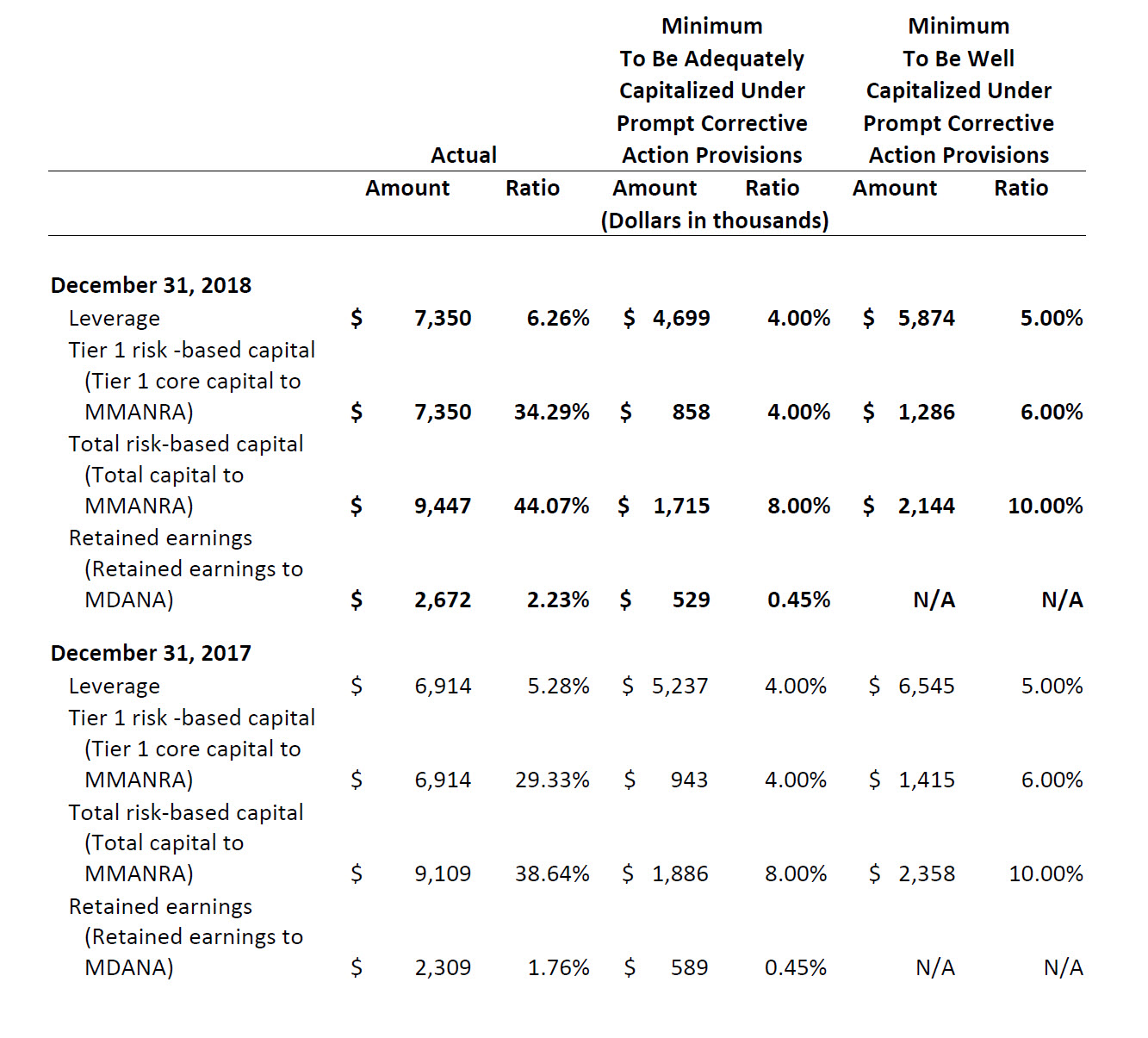

Corporate credit unions have labored under a very detailed risk based capital rule (RBC) for almost eight years. At the end is a footnote from a corporate’s audit showing the reporting required by the rule which demonstrates four very different outcomes:

- Leverage ratio

- Tier 1 risk based capital

- Total risk based capital ratio

- Retained earnings as % of capital

As of December 2018 these ratios range from 6.26% (leverage) to 44.07% (total risk based). These single numbers actually simplify the multiple ways the ratios can be presented by using different ways to calculate the average asset denominator.

Two other columns show the regulatory minimum ratios to be considered “adequately capitalized” or “well capitalized” under the rule..

There are a total of 12 numbers for a reader to compare to evaluate a corporate’s capital status at a point in time—before undertaking any trend analysis.

With a range of outcomes from 6.26% to over 44% as indicators capital sufficiency, one must ask if the numbers have any meaning at all.

The Delay in Risk Based Capital for Natural Person Credit Unions

In June the NCUA board approved a two-year delay in RBC rules for credit unions. Among reasons given was consideration of yet another leverage rule for complex credit unions in addition to PCA. That would make the rule more complicated, not less.

As shown by the bank regulatory agencies and even more clearly by the corporate RBC rule, the outcomes are so complicated that the data fails to clarify any dimension of capital adequacy; for example does this corporate have too much or too little capital?

It is a tool that confuses, adds burdens and ultimately locks credit unions into a legally-mandated assessment of relative risk among all asset categories.

Natural person credit union balance sheets are many times more complex than corporates whose balance sheets are almost all investment securities. These all have relatively easy market based values for referencing.

Risk based approaches are not only confusing, they can also tilt credit union decisions to increase exposure to whatever the regulatory “safest” relative risk of the day might be.

The simple leverage ratio has served the industry well for over one hundred years including more than 50 since deregulation. RBC might be useful as a tool; but it could potentially drive credit unions off a cliff if it were to be a rule.

CORPORATE FOOTNOTE 11 – REGULATORY CAPITAL

The Credit Union is subject to various regulatory capital requirements administered by the NCUA. Failure to meet minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators that, if undertaken, could have a direct material effect on the Credit Union’s financial statements. Failure to meet minimum capital requirements would require the Credit Union to submit a plan of action to correct the shortfall. Additionally, NCUA could require an increase in capital to specific levels, reduction of interest, and ceasing or limiting the Credit Union’s ability to accept deposits.

The Credit Union’s actual and required ratios for December 31, 2018 and 2017 are as follows: