The golden calf in biblical stories is a symbol of idolatry. In these tellings, the statue is worshipped by a people or nation that has forgotten the values they held together. These idols include the temptations of earthly riches, political domination and worship of false gods.

Currently, Trump literally holds court with the public and press in a gilded Presidential office.

The credit union system also displays the appeal of glitter. Every week there is a new PR release of a credit union climbing the never ending ladder of state or national asset rankings. These steps upward are not from internal growth, but from a just completed external acquisition.

Concerns Being Raised

Credit unions’ exemption from state and federal income tax implies an obligation of public duty. The cooperative option was not intended as just another financial choice. But instead, an alternative to the for-profit system driven by ever greater market share and superior financial returns.

Here is an AI generated Edward Filene critique of credit unions’ tendency to adopt banking practices. Created by a concerned coop CEO. (link)

(https://www.youtube.com/watch?v=3lBPV3tx_WM&t=21s)

In this time of misplaced or lost public purpose, some feel called to be truth tellers. They seek to transform the priorities of wayward coop activities. Some of these credit union believers are member-owners. They call out the abandonment of member value being replaced by institutional glory. And the frenzied search for more golden calf acquisitions.

They speak the truth that credit unions were formed to provide consumers a financial home that would avoid the excesses of the for-profit sector. Today, some coop leaders believe that to beat the competition, a credit union must become the competition.

With coops, the owner-customer design can be an unmatchable competitive advantage. That is, until members are treated like customers whose relationships are routinely bought from or sold to third parties.

Truth Renews Hope

The American cultural anthropologist Margaret Mead said: “Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it’s the only thing that ever has.”

She emphasized that significant cultural and institutional shifts always begin with a few individuals who act as catalysts, demonstrating new behaviors and inspiring others.

Coop strength is an example of Mead’s observation. A credit union’s viability is from roots planted by a small committed group and nurtured with generations of member loyalty.

Some of these member-owner voices are being raised to challenge their institution’s monopoly of corporate power, not subject to their governance.

They are raising alarms in their local press and sometimes in national media. Some concerned CEO’s are no longer willing to follow their industry’s call to be still about their objections with their predatory peers.

Standing up for Democracy

In multiple institutional pillars today (media, universities, military, business) democratic norms are under attack. Voices are reminding credit unions of their purpose– to offer each member a financial home where their “daily bread” is the priority versus an insatiable drive for growth.

Even in the uncertainty of misdirected events these individuals are joining hands and linking arms to return the coop model to its counter-cultural economic responsibility.

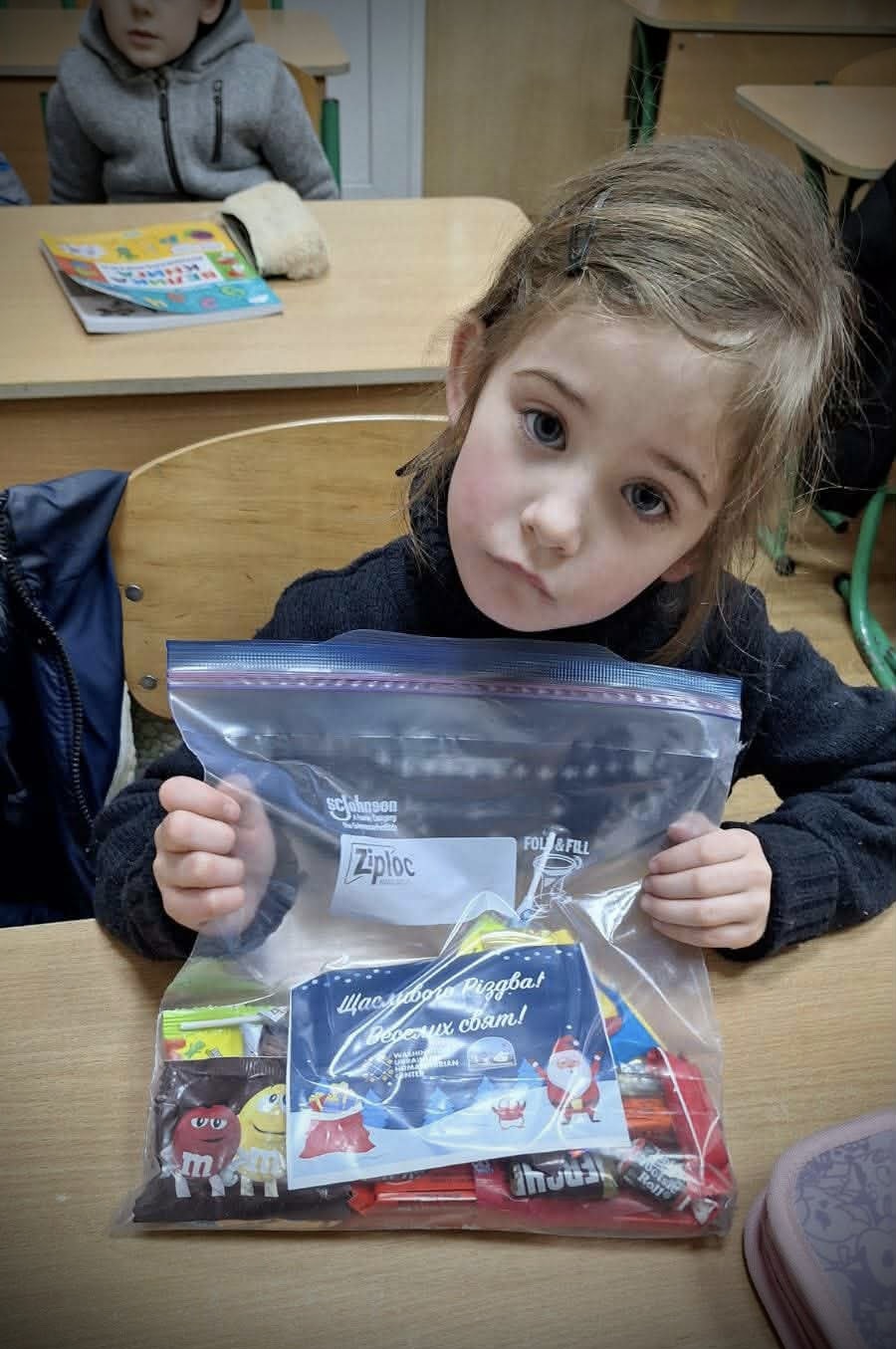

Credit unions will once again be recognized as a safe place where people, even when on the edge, can find hope.

This cooperative public spirit has transformed lives and the well-being of millions. It is an option that has attracted over one hundred million Americans as member owners and billions of their savings dollars.

But will this effort to rekindle credit union purpose succeed?

Martin Luther King stated the challenge this way: Truth when crushed to earth will rise again. This is the credit union’s public promise, even as some bow their knee to the altars of gold.