Summary: Hanscom FCU’s proposed bank purchase raises questions of financial and business soundness, transparency and whether it benefits the credit union’s member-owners. While writing this follow-up, I became aware of a unique group of member-owners who for over 18 months had been documenting and asking hard questions of the credit union’s board and management about the credit union’s performance. This included the bank purchase. The group’s name is Hanscom Loyal. I reviewed their communications. Their ongoing efforts, which are much broader than the bank transaction, is what makes this situation a valuable example for all credit unions.

On February 7, 2025, I wrote a post, Time to Ask WHY? about the announced purchase of The Peoples Bank ($306 million), in Chestertown, MD, by Hanscom Federal Credit Union ($1.8 Billion), headquartered on Hanscom AFB in Massachusetts, with its operations center in Littleton, MA.

This sale was singled out in a Washington Post opinion article by the former FDIC Chair Sheila Bair as an example of credit unions’ tax-free status thriving at public expense.

The more important question: Is this a wise, sound transaction in the member-owners of Hanscom FCU’s best interest?

Why a $50 Million Price?

The Peoples Bank announced the $50 million price in their 2024 Annual Report. Hanscom FCU has released no information other than a single press release from December 20, 2024 about the purchase.

Because Hanscom FCU will be paying the 619 owners of Peoples $50 million in cash in return for the firm’s assets and liabilities, the first question should be, “Is this price justified?”

Because Peoples is a public company with their stock traded daily (PEBC), we have much published data on their performance. There are several ways to analyze this purchase amount.

On a price-to-12-month earnings ratio, the sale price amount is 15 times the bank’s $3.3 million net income in 2024. That is, if current earnings continue, the time to earn back the $50 million cash outlay could be as high as 15 years.

A second ratio is price-to-book value. The $50 million is 1.4 times, or a premium of $15 million, on the net equity reported in the audited statements on December 31, 2024.

Because the bank’s stock price is traded, we can compare the market’s valuation (market cap) before and after the December 20, 2024, purchase announcement. Prior to the release, the stock had traded in the $31 to $33 price range for a total market capital value of approximately $24 million (729K shares outstanding). That is, it traded below book value. Upon news of the proposed sale, the stock price jumped to $60 per share and closed last week at $58 for market value of $42.2 million. That market cap is still less than the $50 million being offered by Hanscom FCU.

These ratios will be subject to valuation and other adjustments. For example, since Hanscom FCU pays no federal or state income tax, should that amount ($960,153 in 2024) be added to projected earnings? Or, are the balance sheet assets of good will and deferred income taxes of any value to a tax-exempt credit union?

The bottom line is that the 619 bank shareholders are getting a good deal. We can see why they would want this sale to go through. The question is whether this transaction is in the best interest of the member-owners of Hanscom FCU. Their $50 million cash outlay to the bank’s owners is 22 times the credit union’s 2024 net income.

What Is the Business Case?

There has been no information from Hanscom FCU other than the press release referenced earlier to support this $50 million investment. In that release, CEO Peter Rice promises more investments in Peoples: “Through this combination, we expect to expand Peoples Bank’s ability to invest in its communities across Kent, Queen Anne’s and Talbot Counties.”

Other than cash, what expertise does Hanscom FCU bring to this 110-year-old community bank serving three mostly rural counties in Maryland? How do Peoples’ business priorities align with Hanscom FCU’s strategy? Its 15 locations are mainly concentrated around metro Boston, with one small branch in a restricted access building at MITRE in McLean, VA. The three rural Maryland counties Peoples serves are 400 miles away from Boston in a very different demographic and economic setting.

Peoples has two business lines. As a community bank, only 0.5% of its loans are to consumers ($872K), 50% to residential real estate and 38% to commercial real estate, development and general commercial loans. The commercial loans include agriculture for land, cattle, ag equipment and waterman loans for people who make a living from the ocean and farming. This traditional, long-time commercially focused bank contributed 64% of 2024 net income and managed $301 million in assets.

Their insurance segment is managed by a subsidiary, Fleetwood Insurance Group, and offers a full range of insurance coverage to businesses and consumers. The business has two offices, contributed 36% of the holding company’s 2024 net income, and managed just $7.8 million of assets before intersegment eliminations.

According to Hanscom FCU’s chairperson Teresa Conrad’s quote in the May 29, 2025, press release, this business was an important part of the acquisition: “The Hanscom team is also finalizing the Peoples Bank integration, ensuring a seamless transition and united experience for every member. With the Peoples Bank acquisition, we will fill a critical gap in our financial offerings with the addition of a new insurance company that offers a robust set of new products and services.”

There are two major issues to this goal of “filling a critical financial gap in offerings.” The first, how does a two-office insurance agency in rural Maryland serving small towns and businesses with long-time, local relationships compete in greater Boston’s saturated insurance market? Why not just buy an already established agency in that market?

Secondly, that “seamless transition” is not in the business plan announced in the December press release: “Following the close of the transaction, Peoples Bank branches will be regionally managed and continue to operate under the same name and brand. The Peoples Bancorp. Inc.’s common stock will no longer be listed on any public market.”

Instead of “seamless,” the intent is to continue with the Peoples name and brand and business model. Not only is this a dubious legal way for DBA positioning, but it also begs the question of any operating savings from inter-company efficiencies. It suggests that post transaction, the financial operations will become a standalone effort drawing more cash from Hanscom FCU as a “parent” company.

The business case is completely undocumented. It is a collection of generalities that suggest little effort for how the future of the two organizations will be managed. That should concern Hanscom FCU’s member-owners.

The People Bank’s 619 owners have their $50 million in cash while the credit union’s 100,000+ member-owners are left to ask: Can their leadership actually manage an acceptable a return on this investment of their funds?

This purchase appears to be a very risky, big time financial wager with the members’ money. Whatever the price tag, if as presened below, Hanscom is unable to achieve a stable, minimum return on the assets it now has, then the whole insitution-and its member owners-suffers by just buying more at a premium price.

Hanscom FCU’s Financial Trends

I reviewed the track record of Hanscom FCU under CEO Peter Rice, who replaced the long-serving David Sprague in 2022. Sprague’s service was profiled in this press release:

Sprague has been Hanscom FCU’s top executive since 1996, a well-loved and respected senior leader managing over 250 employees. The credit union’s assets have grown to $1.7 billion, and membership has more than quadrupled to over 90,000 members during his 25-year tenure. He has steered Hanscom FCU to become the fifth largest credit union in Massachusetts.

Since year-end 2021, the final year of Sprague’s tenure, the following are the major firm trends under Rice for 2022 through Q1 2025 or three and a quarter years performance:

- Shares have declined from $1.610 billion to $1.560 billion (Q1 2025)

- Loans have increased slightly from $1.405 billion to $1.497 billion (Q1 2025)

- Employees (FTE) have fallen a bit from 243 to 230

- Number of branches has fallen from 22 to 15

- Membership has grown from 91,577 to 102,714

- Net worth ratio has increased 9.59% to 11.66%

- ROA in 2021 was 0.80% and for full year 2024, 0.13%

The December 2024 bank purchase announcement coincided with the poorest financial performance in Hanscom FCU’s recent history. Annual growth in shares and loans was negative. The net income of $2.3 million (0.13% ROA) was down 90% from the $23.2 million in 2023. Hanscom FCU is five times the asset size of Peoples but earned $1.0 million less than the bank in 2024.

These negative balance sheet growth trends continued in Q1 2025. That quarter’s earnings of $952,000 (0.21% ROA) were down 66% from the prior year’s first quarter. Peoples Bank again had higher net income, even after reserving for taxes.

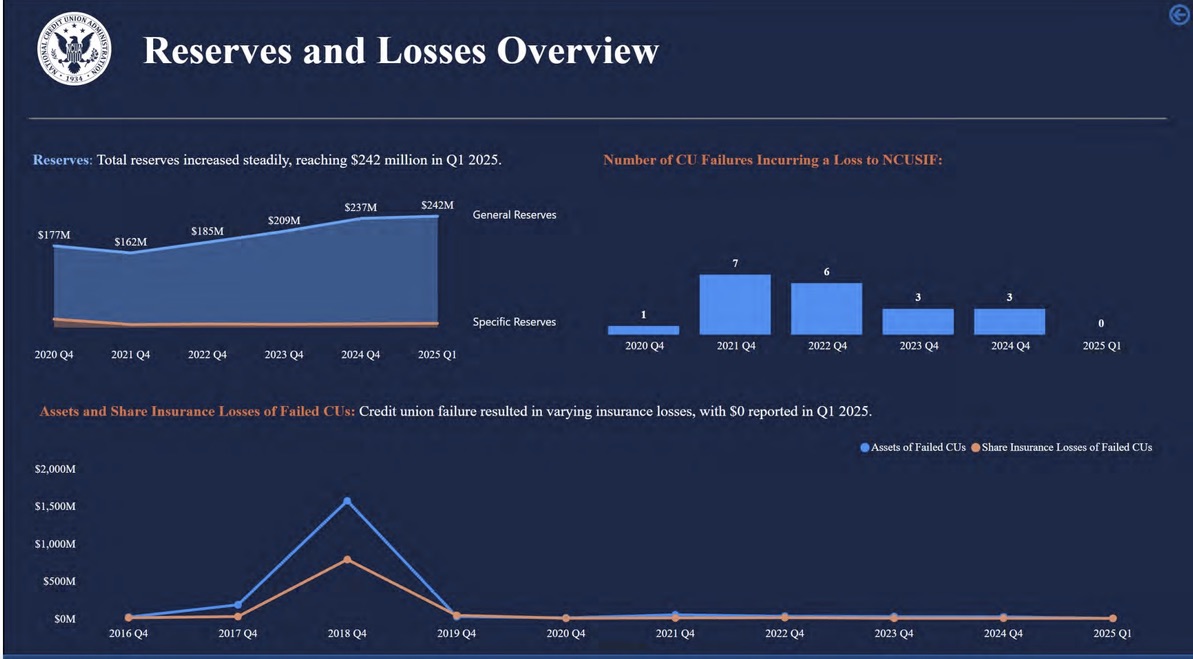

The most concerning first quarter outcome was HFCU’s $10.8 million in net charge offs, up 642% from the $1.5 million in 2024’s quarter.

In sum, the new CEO’s leadership in the last three years has been marked by inconsistent performance and by a sharp decline in critical financial indicators over the last 15 months.

This erratic performance raises two questions. Why is this decline occurring? With this uncertain track record, what justifies sending $50 million to the Peoples Bank owners, to purchase a firm that would seem to have no geographic, strategic, or business similarities to Hanscom FCU’s core market?

Why the Instability in Hanscom’s Financial Performance?

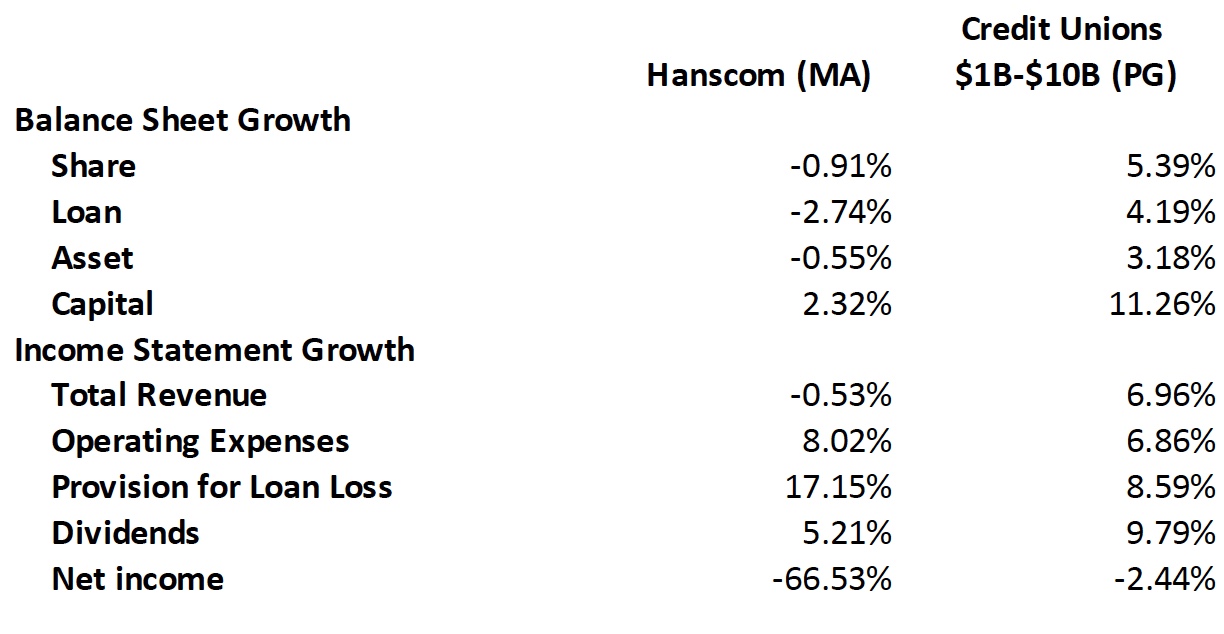

Here are the last 12 months of Hanscom FCU’s financial trends compared to all credit unions in the $1 to $5 billion peer group range. This comparison shows that the industry continues to grow positively on key balance sheet and income statement indicators, but not Hanscom FCU. Why?

The inconsistent trends plus the current declines in operational outcomes raise the questions about the credit union’s leadership, the CEO, and senior management, along with the Board and Supervisory Committee’s oversight of processes and procedures.

For example, one looks in vain for any transparency or explanation to Hanscom FCU’s members or the public about this $50 million transaction. The Peoples Bank owners get a full confidential term sheet to approve the sale; the buyers paying the bill are given nothing.

I have not been able to locate a 2024 Annual Report or detailed information about the annual meeting for Hanscom FCU members, apart from a brief website announcement. There also does not appear to be any readily available confirmation of the election of directors or minutes from previous meetings. The May 29 chairperson’s statement includes no context to understand how or to whom the message was intended. It is full of marketing and PR spin about community activity, but no mention of Hanscom’s steep financial decline.

Those Closest to the Action Speak Up

In response to my February post on the Peoples Bank purchase, I received an email from a group called Hanscom Loyal. They describe themselves as a cohort of approximately 40 current and former credit union employees, many also member-owners, deeply concerned about Hanscom FCU’s leadership.

They did not go public with their concerns. Instead, they sent detailed communications, including letters and emails, to Hanscom FCU’s individual board members, Supervisory Committee members, and copies to NCUA examiners. The FDIC was copied after the bank purchase was announced.

These multiple communications contain specific examples of violations of bylaws, board, and credit union policy, as well as questionable personnel and account transaction events. As these employees saw and experienced actions of senior management and the Board’s role, if any, the group alerted those with authority over the institution to their concerns. They did not act like whistleblowers creating public alarm. They simply asked those in positions of responsibility to investigate the factual events they listed.

Over 18 months they documented an absence of internal controls, lack of following in-place processes, and regulatory compliance failures. Their examples included specific instances of improper transactions with member accounts. They included examples of incorrect information in web and other communications. One example they provided was a credit card promotion mailer stating that Hanscom FCU was FDIC insured.

Leadership and Staff Turnover

Their primary concern focused on the continued turnover and forced departures of experienced credit union personnel. The majority of Sprague’s senior team with experience has left the credit union. In instances, the resignation demand was presented as a choice: voluntarily resign to retain benefits or immediate dismissal with none.

On March 25, 2025, one employee filed suit for her dismissal. Another has submitted a formal complaint to the Massachusetts Attorney General’s Office concerning unfair wage withholding.

Such turnover in the past three years, estimated as high as 50%, is not normal. Even Hanscom FCU’s chairperson in her 2024 summary remarks acknowledges 44 internal promotions within a constant staff size of 230. This continuing exodus not only undermines morale, but it also can result in new hires or promotions without relevant experience and knowledge for the new positions.

Such internal turmoil undermines institutional performance. When informed of such institutional problems by outsiders, often the response by those in authority is to dismiss a group like Hanscom Loyal as disgruntled former employees or “troublemakers.”

Certainly, all members would or should be disappointed with these performance shortcomings. This group invested great effort to document wide-ranging examples of leadership and institutional shortcomings, with facts, not opinions. Their stated goal is to return Hanscom FCU to its prior level of member focus and service.

Both FDIC and NCUA have acknowledged receiving Hanscom Loyal’s specific detailed complaints of the past 18 months. One of NCUA’s responses on August 21, 2024, included the following:

I just want to confirm receipt and assure you we take these concerns seriously. As you are aware, we are responsible for enforcing certain rules and regulations. Employment matters, in general, are not under our purview and are governed by state law. As frustrating as those issues might be, they are not matters we regulate or enforce. Those are more matters for the credit union’s Board and your legal counsel, should you choose that route.

The Regulator’s Oversight

NCUA’s characterizing these detailed concerns as merely employment matters completely misrepresents the internal management issues that Hanscom Loyal described in detail. Suggesting these events are only for the Board and Hanscom Loyal’s legal counsel to address dismisses the ‘M’ for management, in the NCUA’s CAMELS rating. This exam component specifically assesses senior management’s performance, firm governance, and procedural oversight, including member annual meetings.

Hanscom FCU’s declining financial performance, lack of routine transparency with members, and the Board and Supervisory Committee’s failure to address documented concerns suggest a dysfunctional management team and a board and supervisory committee unable or unwilling to fulfill their responsibilities. To propose that member-owners may need to hire legal counsel is a parallel failure by NCUA to acknowledge their supervisory obligations.

Should Hanscom FCU’s $50 million proposal to purchase a bank be approved by NCUA? This effort to acquire a bank 400 miles away — without a clear business plan demonstrating any benefit for its member-owners — appears to be another example of poor management judgment. Moreover, paying out $50 million in cash adds significant financial, operational, and market risk to the credit union, already in a financial stall.

This transaction does not appear to be a carefully considered strategic initiative; instead, it appears to be a reaction to an opportunistic proposal from brokers eager to strike a deal with a cash-rich credit union.

If the 729,000 shares held by Peoples’ 619 shareholders receive the same pro rata of the $50 million purchase, the per-share price would be $69 dollars. That is more than double the bank’s market value before the offer. So how does this transaction serve Hanscom FCU’s member-owners whose funds would pay out the bank’s owners?

What’s Next? Who Will Own Responsibility for the Credit Union?

The Hanscom Loyal group has provided Hanscom FCU’s Board of Directors, Supervisory Committee, and federal regulators with details of documented mismanagement that directly affect the credit union’s financial performance. This is most evident in high employee turnover and specific examples of questionable practices that have been shared.

Hanscom Loyal has acted as member-owners should. They collected facts and brought these documented issues to the appropriate parties. Despite NCUA’s onsite annual supervisory exam and the Board’s awareness of the group’s forwarded operational issues for over a year, Hanscom FCU’s leadership nevertheless proceeded with the Peoples Bank purchase announcement in December 2024, approving it unanimously.

It should be clear to even a casual observer that Hanscom FCU’s member-owners would be best served if the credit union first put its own house in order. Spending $50 million now sends a message to concerned members that the cooperative system is not working for them. Annual meetings appear, at best, closed in-house affairs with no transparency for the owners to become involved.

NCUA’s cursory advice to members to hire legal counsel if they receive no response from the credit union is an abdication of their responsibility to ensure the safe and sound operation of the credit unions they examine.

The NCUA’s August 21, 2024, email acknowledgement to Hanscom Loyal’s list of concerns included this:

We will certainly consider any matters violating areas we are charged with overseeing, as well as evidence of fraud. All examination results are confidential and cannot be shared.

I encourage you to submit the matters below to the Supervisory Committee and the Board of Directors of the credit union, if you haven’t already. The Supervisory Committee is the “watchdog” of the credit union and is responsible for independently investigating such complaints.

What are credit union member-owners to do when there is no Supervisory Committee watchdog responding to their concerns, no Board elections that are open to all members, and no meaningful evidence that NCUA exams address either specific operational issues or an institution’s leadership shortcomings?

Instead the opposite message is sent to member-owners when the credit announces it is investing $50 million to buy banking assets in a rural market 400 miles distant.

If anyone with internal responsibility for the credit union or NCUA in its external examination findings had given any credibility to the group’s many messages, this bank purchase offer should not have seen the light of day.

Credit union leaders’ failures to respond and impotent regulatory oversight is, unfortunately, not uncommon in the credit union system. In previous blogs I have provided examples such as yesterday’s Space City merger with TDECU. Individual members spoke up, wrote their credit union and regulators with deep concerns, but were treated as “nobodies.”

The difference in this case is Hanscom Loyal’s organized effort, the volume of factual examples and a commitment going on two years to make things right. They are doing this in the right way not in public outbursts.

As uncomfortable as this example may be for some, every credit union would benefit from member-owners who believe in their credit union so deeply that they are giving time, effort and energy to make their coop better.

Hanscom FCU’s entire operating context suggests that this proposed bank purchase should be dropped immediately. The leadership issues would benefit from having persons with the expertise and commitment of Hanscom Loyal added to internal oversight roles.

Everyone’s overarching goal should be to restore the credit union as a true cooperative whose priorities serve member-owners best interests, first and always.

Note: In writing this follow-up, I have reached out to both Hanscom FCU and The Peoples Bank but have not had a response. Should I receive responses, I will update this post. The Hanscom Loyal group’s email is: hanscomloyal@proton.me