Whether one calls the current period a time of transitions, transformation or just multiple uncertainties, there is a sense that national and credit union futures seem to be nearing a precipice.

Washington’s political divisions are heightened by increasing consumer anxiety. Economic uncertainty is created by the federal government’s policy shifts and attacks on opponents, ending key social programs and assaults on leading private institutions.

Trump 2.0 is not the same as the first term. He is turning the entire executive branch into his personal fiefdom installing loyalists in every department and agency of the federal bureaucracy. That is, when their functions are not being downsized to feebleness.

NCUA is no exception to Trump’s government onslaught. The lone republican board member became Chair on January 20th. His two democratic colleagues were subsequently fired so the White House could directly control NCUA actions. This ending of an independent agency’s leadership is now in the hands of the Trump dominated Supreme Court.

Chairman Hauptman’s term expired in August. At the same time the agency initiated a reduction in force that led to at least 20% of staff leaving. The agency now holds no regular board meetings. Regulation is by rote or reptition rather than design or intent. The role of NCUA is at best cloudy and at worst, irrelevant to credit unions’ future.

The largest trade association ACU has a new CEO, Scott Simpson, a veteran of the league system. He is introducing himself to credit unions speaking of unity, advocacy and defending the status quo. The credit union Defense Council (DCUC) is trying to position itself as a new national voice for the industry with daily press release postings.

With the economy and consumers both showing contradictory signals, the momentum for America’s economic outlook seems fuzzy even with record stock market highs.

In this period of transition in both public policy and AI generated business disruptions, credit unions third quarter results showed stability and resilience. However there are multiple concerns rippling across cooperative waters as the industry’s new national leaders take over.

Symptoms of Growing Coop Fissures

- The absence of a vision for credit unions’ unique capacity and purpose to address urgent member needs:

- The merger frenzy based on a faulty premise, which is that mergers are growing the movement’s market share. Rather it is simply consolidation largely fueled by CEO ambition and in a number of instances personal greed.

- The absence of new coop startups and the steady decline in credit union charters and local presence;

- The exclusion of member-owners from any meaningful governance role or even awareness of democratic coop design.

- The use of member funds to purchase whole banks often at premiums to prior market valuations.

- The lack of credit union initiated and controlled innovations and instead relying on third party vendors for both operational orginations and enhanced member value creation.

Hope For a Cooperative Future Vision

Those in leadership can wait and watch. Try to keep pace by doing more of the same.

And, hold tight until market forces or political challenges force a change of direction.

Or, create a new cooperative vision that becomes a rallying point for those concerned about current trends,

A Lesson From the Past

Credit unions have been mired in uncertainty before. Sometimes the confluence of external events; other times by internal shortcomings marked by grasping for false advantage. For example the effort to convert to mutual bank charters in the first decade of this century—an option taken by over 30 credit union CEO’s, of which only one survives today.

History suggests the gift of cooperative hope is more likely to come from the passion of insiders rather than the hired experience of other industries. These Insiders should know cooperative history, its multiple strengths, proclaimed values and commitment to member and community wellbeing.

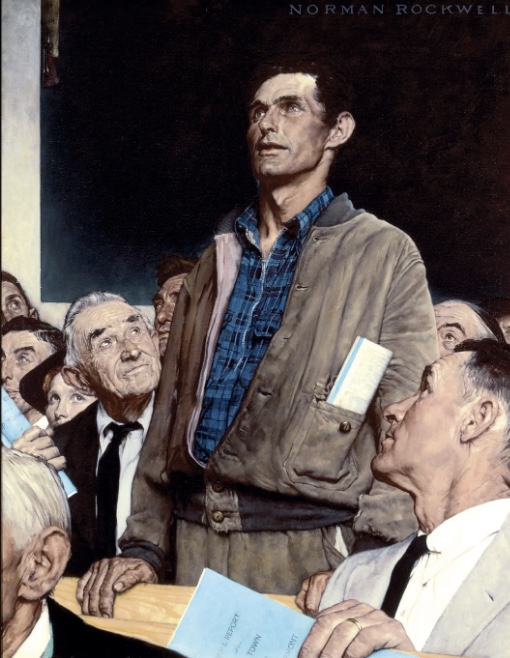

Moreover any “updated” vision must be fought for, not just proclaimed. It wil require repeated articulation and conversation to define a better direction than following the status quo crowd.

Last week I posted the final video, Edition XX from NCUA’s Video Network created during the Callahan era from Oct 1981 through May 1985. The 30 minutes is a summing up of the major internal changes that took lace during this initial period of deregulation. Three themes stand out: change requires will, teamwork and documented results.

But the real foundation for the successes in this final video was laid in the first film the network distributed in cooperation with the Illinois Credit Union League: Deregulation-What Does it Really Mean?

This initial communication presented a new regulatory policy and the approach for how it would be pursued—cooperatively and in dialogue. The panel includes the NCUA Chair and General Counsel, three credit union CEO’s and Jim Barr who was CUNA’s Washington spokesperson.

This video portrays what is required to state and implement a path of hope and progress in an era marked by uncertainty, rapid change and new leadership.

The video is an example of leadership in a cooperative system. It is as relevant today, as when it was created over forty years ago.

Here is the link.

We live in odd times.

hashtag#CEOs, I know you’ve had frustrating encounters with auditors and regulators. They can feel burdensome, even annoying. But this latest move from National Credit Union Administration (NCUA) isn’t a win for the reduction of “regulatory burden”—it’s something far more concerning.

Although the headlines highlight the elimination of reputation risk, please read further. In addition to eliminating reputation risk as a rating, NCUA has discontinued assigning ratings to all seven risk categories:

• Credit

• Interest Rate

• Liquidity

• Transaction

• Compliance

• Reputation

• Strategic

Imagine someone removing all the smoke detectors from your building and telling you, “Don’t worry, we’ll let you know when we see fire.”

The purpose of these risk ratings was never busywork. At the aggregate level, they provided field offices, regions, and national leadership with a top-down view of where risk was accumulating. From a staffing standpoint, if a credit union’s liquidity risk was rated high, it signaled the need for additional expertise at the next examination.

Examiners and ERM professionals assess each category based on quantity, direction, and the quality of risk management. The point was never to penalize higher-risk profiles. It was to ensure that if you accepted a higher risk, your management practices were robust enough to handle it.

America’s Credit Unions, NASCUS, and American Association of Credit Union Leagues

How is this a win for the members and the safety and soundness of credit unions? Why do we only hear about tax status, and none of these moves requested are discussed with the same intensity?

A couple of foot notes: NCUA Credit Risk Webinar

On July 15, 2025, in an NCUA (https://lnkd.in/ednAJjCE) credit risk webinar, an examiner (Min 13:49) discussed the benefits of key concepts like risk appetite, risk tolerance, and risk capacity. Those are excellent tools for boards and executives. They’re the backbone of modern ERM.

But here’s the contradiction: NCUA is now saying those concepts are helpful for credit unions to adopt, while simultaneously discontinuing examiner use of risk ratings for the seven categories (credit, liquidity, interest rate, compliance, transaction, reputation, and strategic).

National Credit Union Administration:

Additional Actions Needed to Strengthen Oversight

On Sept. 23, 2021, the Government Accountability Office issued a report stating NCUA has opportunities to improve its use of supervisory information to address deteriorating credit unions. By more fully leveraging the additional predictive value of the CAMEL component ratings, NCUA could take earlier, targeted supervisory action to help address credit union risks and mitigate losses to the NCUSIF. As of today, one of the recommendations is still open, and another is partially addressed.

END

As Hauptman tries to burnish his reputation with the administration’s anti-government ideology, the dangers of a single political point of view determining regulatory priorities in a so-called independent agency becomes clear.

This press release is not about ensuring the safety and soundness of members’ funds or enhancing the cooperative systems critical roles. It is simply posturing for another assignment in an administration bent on governmental disruption.

The financial and institutional integrity of the cooperative system requires a competent, active regulatory oversight. Institutions that manage financial assets for others are especially vulnerable to self-dealing. That is why almost every form of money lending, transfer, safe-keeping and advice is subject to governmental licensing and oversight.

Without effective supervision not only will credit unions continue to be lost, the playing field will become crowded with internal and external predators trying to cash in on the abdication of, and disrespect for, regulatory oversight.