Part III

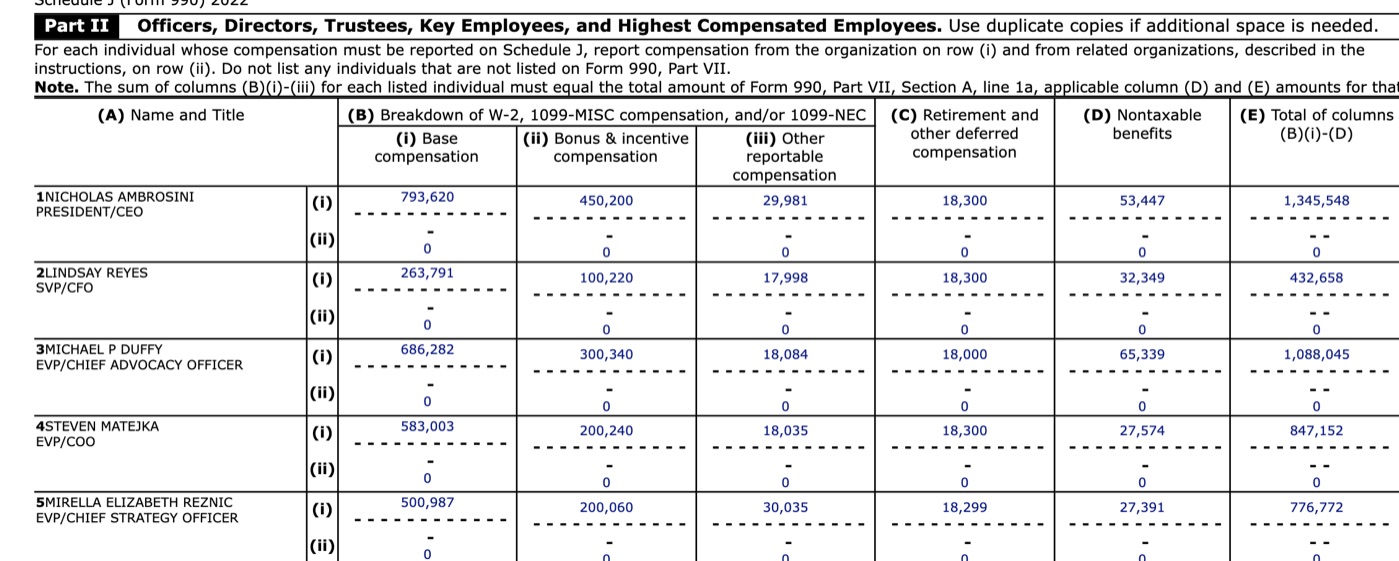

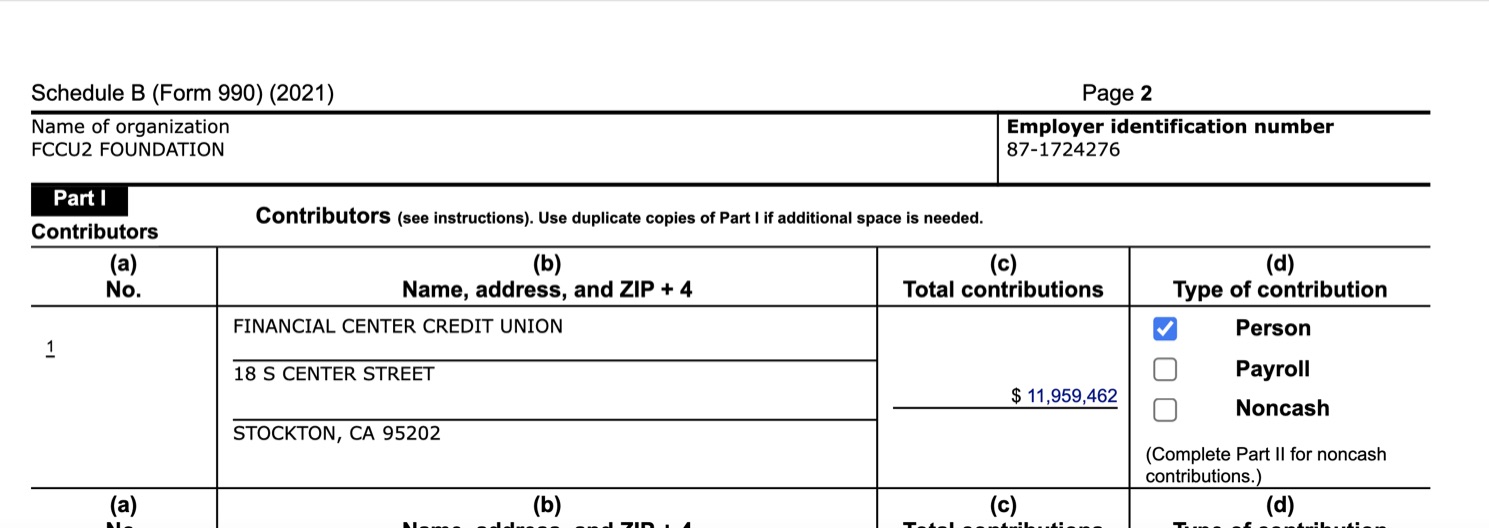

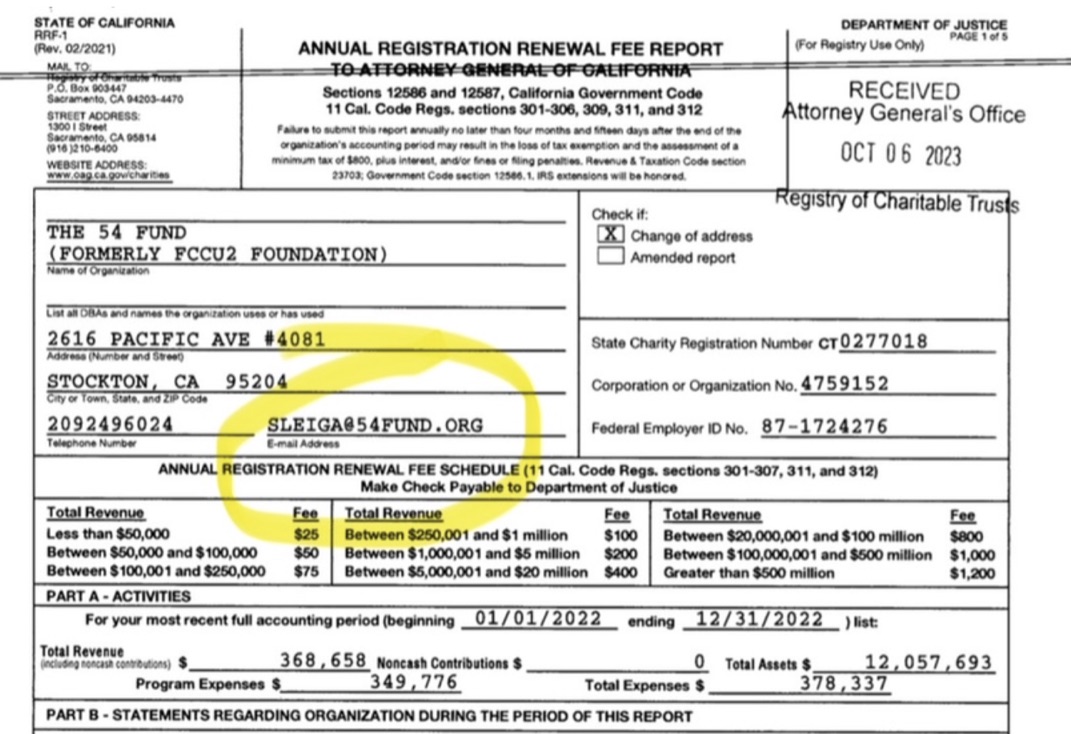

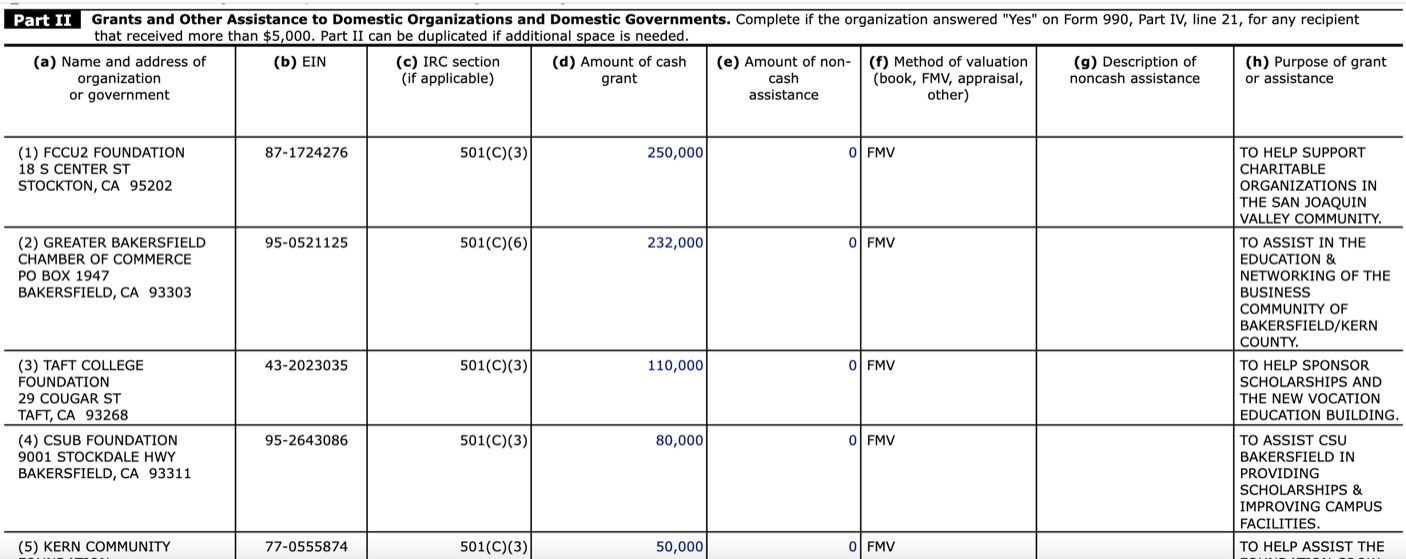

Previous parts I and II have provided a factual review how FCCU’s CEO and board chair diverted $12 million to their control via a new organization when merging the credit union. While this example is discouraging, it is symptomatic of a much broader challenge for credit unions.

A Game Without Rules

The FCCU/Valley Strong merger is a current and common example of the private, insider deal making around mergers of successful, long serving institutions. The CEO’s and boards arranging these transactions put their self-interest and ambitions ahead of their member owners. Their actions are covered with rhetorical reasons about scale, technology investments and competition threats.

CEO Duffy’s skill at deflecting any criticism is shown by how he positions those whose official duty and/or fiduciary roles would be to protect and ensure the members’ best interests to support his action.

His board of five, on which he sits, had to approve the merger. They are all given subsequent sinecures. The senior staff who might have aspired to succeed in leadership is guaranteed bonuses and jobs in the continuing firm-at higher salaries and lesser responsibility (legacy ambassador vs COO). The lawyers and accountants dutifully earn their fees for blessing the numbers and transactions. Like the trade associations, no one wants to lose a paying client.

And those in the community who lost their home- grown 66-year old cooperative, are not going to bite the hand that gave them an occasional handout (usually $1,000) or annual political donation.

Two Members Said: The Emperor Has No Clothes

To oppose someone in authority with literally millions in resources to fight back requires persons with more than insight, it takes unusual courage.

This merger confirms the modern day reality of Hans Christian Andersen’s most memorable fairy tale. And the tale’s relevance is even more appropriate as shown by newspaper accounts of “banker” Duffy’s recent Stocksonian award. Both “leads” open by describing his professional appearance, “looking dapper in a gray, tartan-style suit and stripped red bow tie.”

But just as in the fairy tale, the two members saw the CEO’s plan had no substance. And they said so out loud, so all could see. But no one wanted to note the obvious. Here are their names, excerpts of some of their concerns, comments and questions as recorded in the CU Today story from NCUA’s website.

A FCCU member, Larry Matulich, posted his objection on NCUA’s website in part as follows:

I am against the merger for several reasons. I feel we must protect the financial stability of our local credit union. The loan to asset ratio of Valley Strong is 3 times the loans to total assets, while FCCU is only 20% of our loans to assets. We do not need their loans, but they do need our assets. Let’s protect our money and keep it here in San Joaquin County. Frankly the real strong credit union is not Valley Strong, but our FCCU. . .

A second member Frederick Butterworth posted in part:

Vote No on the proposed merger until the provision to transfer $10 million of member assets to a non-profit foundation for “community outreach” is eliminated from the proposal. Member financial assets of any amount, especially of any amount, especially $10 million , should not be given away for any purpose. If Financial Center Credit Union is so flush with cash that it wants to give away $10 million, then that amount sould be distributed to the members. I’ve written twice asking for the rationale for given away $10 million. They have failed to answer me. . . The so-called FCCU2 Foundation was created less than two months ago setting uup Duffy in his new give-away-our-asseets role. . .

Both saw that the rhetoric promoting the event was not supported by the facts. Other employees and members knew these realities, but Duffy managed to outmaneuver any scrutiny, even by the regulators.

Regulatory Neglect Is Not Benign

This week NCUA announced the banning of a former president/CEO from forever participating in the affairs of a federally insured financial institution. This CEO’s misdeed was that between 2018 and 2020 she used the credit union’s credit card for personal purchases “totaling more than $12,000.”

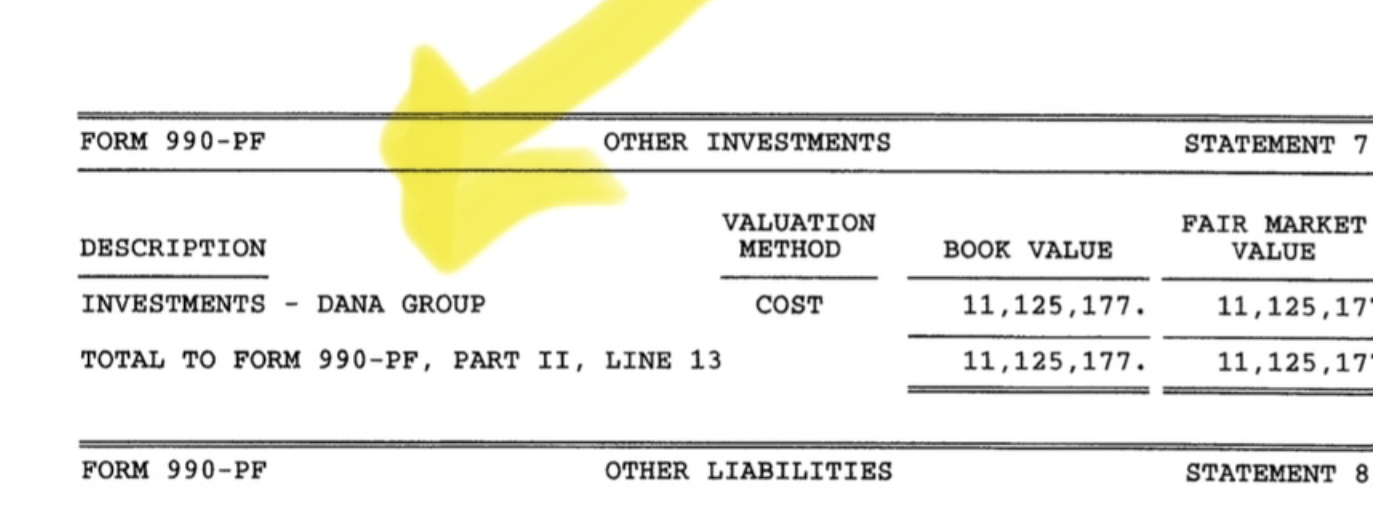

In FCCU2’s foundation setup, the diversion for personal use was first announced as $10 million. But when the deed was finally reported to the IRS, an additional $2.0 million was added to total $12 million.

When asked, NCUA’s anonymous defense in the CU Today story was this transfer is “a business decision left up to the credit union’s board of directors.” And further on, “ultimately in a voluntary merger (this action) is up to the members themselves.” When asked to explain its oversight, NCUA shows a regulatory middle finger to every FCCU member by stating “86% voted in favor of the merger.”

Moreover this reference to a supposedly democratic process demonstrates how disconnected from on the ground realities NCUA leadership is.

Duffy has been politically adroit placing the regulators between himself and his self-dealing with the members’ money. “Duffy said neither the NCUA nor the DFI raised any red flags over the transfer of the $10 million to the foundation. There was nothing to question.” For NCUA to followup now, it would first have to investigate itself-what it already knew. An internal review few organization’s leaders are capable of doing. Rather it may require a congressional hearing or a CNN story.

It was NCUA itself that described multiple situations of self dealing and failure of fiduciary responsibility by boards and CEO’s in approving its merger regulation. If either NCUA or DFI had bothered to look under the covers, it would find this merger violated one of the oldest rule on the books: thou shalt not steal.

Consequences and a Solution

Credit unions compete in a capitalistic system described by the fictional character Gorden Gekko as fueled by self-interest: “Greed, for lack of a better word, is good. It captures the essence of the evolutionary spirit. Greed in all of its forms; greed for life, for money, for love, for knowledge has marked the upsurge of mankind.”

The temptations are all around, even for member-owned coops.

At all levels of this process, the members’ trust and confidence have been violated. In so doing, the cooperative reputation of thousands of credit unions that serve their members every day with commitment and purpose is stained.

Instead of stockpiling excess capital as done by FCCU, hundreds of credit unions pay special dividends explaining,” Our annual giveback bonus is what differentiates us from a typical bank.”

The system’s overall safety and soundness is lessened when more eggs are put into a single basket.

Everyone connected to this transaction loses something. The 29,000 members, their credit union; the city of Stockton a 66-year long relationship with a locally-owned financial cooperative.

Valley Strong’s senior management and Board, seduced by the prospect of adding $634 million in assets and free capital of $100 million, are now struggling when the tide of free money went away. They thought the only cost would be several years FCCU executive salaries and $2.5 million in donations to the Duffy fund. But nothing is free in life. Valley Strong’s CEO, will now have to knuckle down and run a credit union versus buying up others’ assets.

Credit unions’ public reputation as member-first organizations is contradicted by these facts. And the regulators’ conduct exposed as supervisors who “have no clothes.”

Duffy’s endgame benefitted him and some of his closest enablers. But they will learn giving away other people’s money is a losing game when the funding drys up and the lights turned off.

Is There A Cure?

The only bright light in this case are the two members who spoke up with the truth about the event. The solutions must empower the members with information and total transparency so that they are not just mere bystanders.

The single most important reform that would change the whole process, is to require that a minimum of 25% (or more) of members must vote in any election to end a sound credit union’s charter.

Today a minority, usually in the single digits, bother to vote. And a smaller minority actually approve charter surrender. In a democratic process, presumably a majority should approve transferring their collective wealth to another party. But in credit unions a minority of members, and and even smaller group can approve 100% or total transfer of value for everyone.

According the FCCU’s certification of the vote sent to NCUA, only 9% (2,680) of the 29,672 members voted. Of this amount just 7.7% of all members supported giving up the charter. Compare this with NCUA’s characterization of 86% of voters “in favor of the merger.”

Transparency and Options Create a Truly Free Market

First, much fuller disclosures should be mandatory. All of the documents required by NCUA in their review should be part of the public record for every member to see. All contracts for future service for any employee or board member should be public. If an FCU is involved, they should be required to disclose the same information as a SCU files in the IRS 990.

Second, all credit union members should have a choice to take their pro-rata share of accumulated capital and close their account if the merger is approved.

Third, once the disclosures are public, members should have the opportunity to seek proposals from other credit unions who would be willing to make better offers.

Fourth, merger agreements should include specific performance objectives so members can track whether the value promised has in fact been delivered. For example lower operating expenses, increased loan or savings opportunities, enhanced delivery options and their usage.

Fifth, the board of the continuing credit union should be required to report to all members at the annual meeting the impact of the merger on the institution after the first 12 and 24 months.

Mergers today are the wild west of credit union activity. They are marketed by intermediaries offering to facilitate the benefits for the selling institution and the niceties of the regulatory process–for a share of the action.

Duffy’s example is not an exception, albeit the foundation was a unique creation. Rather with no rules, everyone feels entitled to whatever they can get.

In a true market this insider dealing would not happen. For example when credit unions buy banks, the deal is often very public and the benefits to the bank’s owners very clear.

Just this week Beacon Credit Union announced that it planned to acquire Mid-Southern Savings bank for $45.1 million in cash. The bank’s total capital at third quarter 2023 was $28.9 million for a sale premium of 150% of book for all the bank’s owners.

In the official Member Notice Duffy and the FCCU board sent to members announcing the mrger, the headline under the credit union’s name reads: Better than a Bank. Except when it comes to selling out the charter and all capital in return for nothing but promises and future charity.