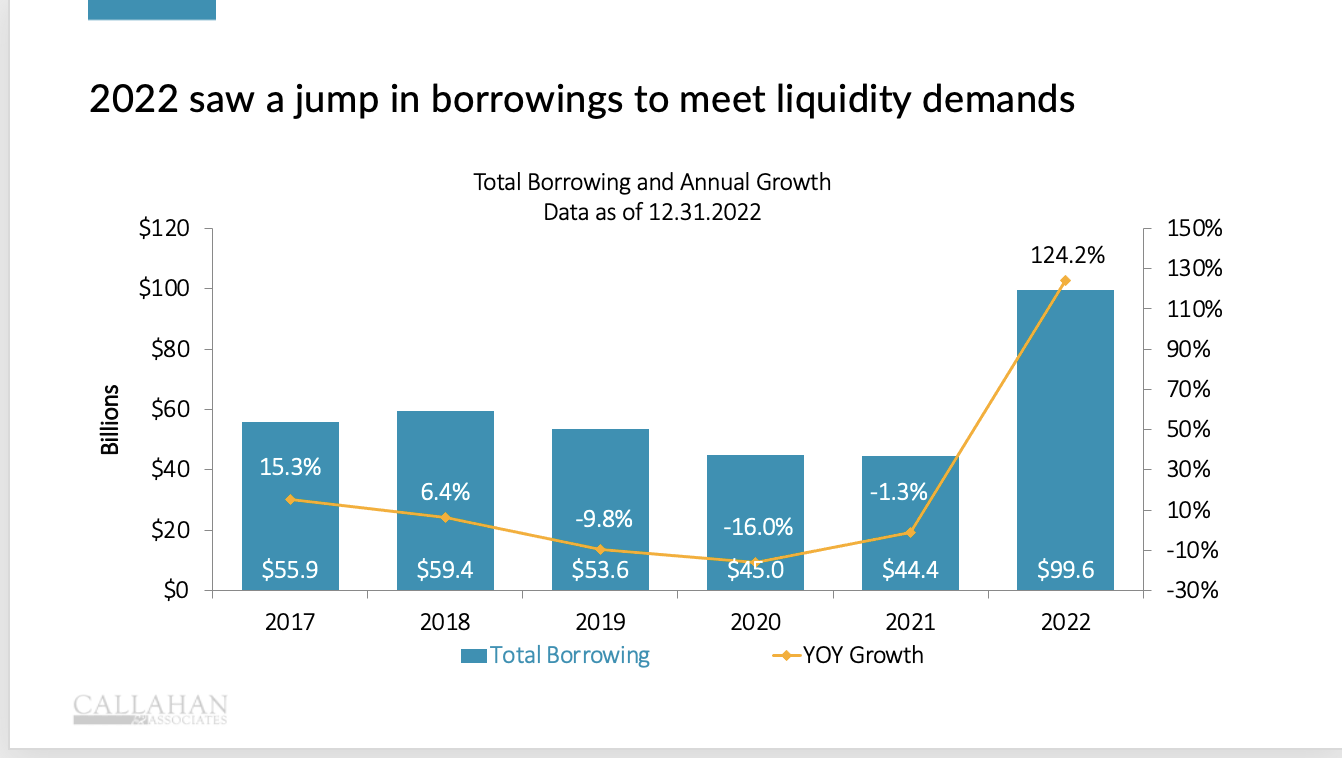

In 2022 subordinated debt issued by credit unions grew to $3.381 billion, a 257% increase from December 2021.

The number of credit unions using this form of temporary capital grew from 105 to 150. They represent about 7.3% of total system assets.

While still a very small percentage (1.4%) of the system’s total year end capital, its use is highly concentrated in a few credit unions.

NCUA is presenting a final rule on subordinated debt at this Thursday’s board meeting. A point of interest will be how much detail is given the board and public about how credit unions used the funds, the various sources, and the reliance on this debt to meet capital compliance ratios.

These details are especially relevant today when bank failures wiped out not only all stockholder equity and retained earnings, but also all bond debt.

Rented Capital or Buy Now, Return Later

By rule subdebt is an unusual financial instrument.

Subdebt is reported as a liability, that is a borrowing, on the credit union’s books. But because of the structure of the debt, NCUA considers it to be capital when calculating net worth for RBC-CCULR and low-income credit unions.

Subdebt can be sold to other credit unions as well as outside investors. Purchasers perceive it to be an investment, but technically it is a loan to the credit union which makes it as an eligible “investment” for credit unions to hold.

In the event of credit union failure, the subdebt is at risk if all the credit union’s capital is depleted.

A Financial Growth Hormone

Unlike traditional retained earnings capital, subdebt is not free, with the interest rate varying depending on the structure and the credit union’s financial situation.

Because its inclusion in computing capital ratios is time-limited, the most common justification given by credit unions for raising the debt is to accelerate balance sheet growth. Book the capital upfront, then leverage it for additional ROA to have increased earnings to repay the “borrowed” capital down the road.

This financial leverage requires raising more funds matched with earning assets to achieve a spread, or net interest margin, to make the process earning accretive. Buying whole banks is one obvious tactic to accomplish both balance sheet growth goals at once.

The process refocuses credit union financial priorities from creating member value to enhancing institutional financial performance through leverage.

Most Use Is by a Few Large Credit Unions

Community development credit unions are major issuers of subdebt. The two charters under the Self-Help brand have together raised over $700 million. Hope FCU in Mississippi and Latino in North Carolina have issued over $100 million each.

Bank purchases have been an important part of other credit union’s use of debt: VyStar, GreenState, and George’s Own for example.

In other situations where the amounts are more modest, the intended use is less clear. Is it just a form of “capital insurance” to meet the increased capital ratios of RBC/CCULR? Is it to “test the waters” to see how the process works? Issuing subdebt is not a simple effort as for example, opening a FHLB account.

The Most Important Missing Rule Requirement

Subdebt has been bought by banks, insurance companies, investors and even other credit unions.

Sometimes the events are announced publicly either by the broker facilitating the transaction or the credit union. The purpose is rarely specified other than to seek new opportunities for. . . and then fill in the blank with a generality.

It is the members who pay the cost of the debt. The interest on the debt is an operating expense that comes before dividends. If the only use is capital insurance or assurance, then the members should be informed as to the terms, cost and role of this approach to meeting regulations. It is a management and board responsibility to be transparent and accountable to their owners.

If the goal is more ambitious, to capture new growth possibilities, the disclosure is even more critical. Financial leverage, especially non-organic growth, increases risk.

In both instances the commitments undertaken can extend as far as ten years. That term reinforces the need for full disclosure so members are aware of the commitments being made on their behalf.

The most important requirement that should be part of the revised subdebt rule is for full transparency for each transaction. The purchasers of the debt are given all the details of the borrowing as their funds are at risk should the credit union fail.

Shouldn’t the member-owners also be informed of the commitments and terms made using their long-standing loyalty which, in reality, is underwriting the transaction’s terms?

It’s an opportunity for credit union members to be treated as actual owners, not just customers.