In a January 2024 blog, I described NCUA’s approval of bylaw changes for Navy and Pentagon FCU’s that effectively eliminated the ability of member-owners to nominate directors for board openings. (link)

In the post Who is Responsible for Credit Union Democracy, I summarized these changes:

The two largest FCU’s quietly changed the required number of signatures for member nominations for the board. In both situations the change removed the 500-signature standard bylaw and replaced it with a percentage of members. For Navy this new signature requirement was 26,000 and for PenFed 5,800 based on their latest reported member counts.

Now the trifecta for the three largest credit unions is complete. In 2023 and 2024 SECU NC had contested board elecrtions. In the first year, member nominated candidates defeated the board selected ones. The next year the board nominated candidates won with tens of thousands members casting ballots.

In 2025 there was no contested election at SECU. The board chosen candidates were seated by acclamation. In this post Jim Blaine, a member and former CEO, gives a summary of this voting process (link) titled The SECU Annual Meeting: Isn’t this a Losing Struggle?

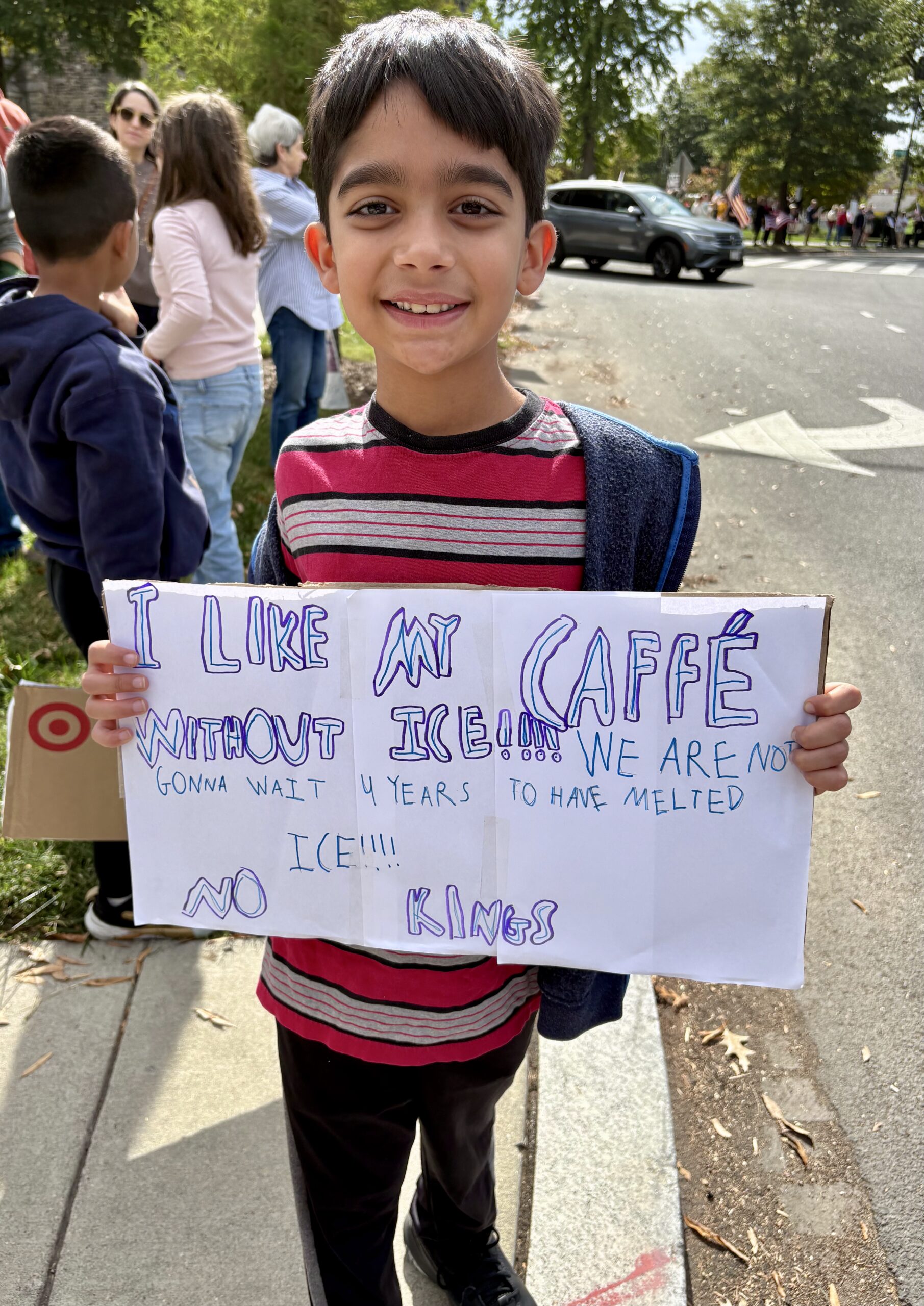

It is not just the Big 3 who have shut down member elections. It has become the standard operating practice for all but a few credit unions. So does it matter? Why worry if everything seems to be going OK?

Why Voting Matters for the Future of Credit Unions in America

- It empowers members in their role as owners. You are more than a customer.

- It implements the democratic design of cooperative governance via member oversight.

- It opens director leadership positions to the widest possible selection of candidates.

- Voting gives current and potential candidates a chance to state their visions for the credit union.

- Without a vote, the director nomination and selection becomes a “closed loop” that perpetuates existing leaders and their self-chosen adherents.

- The Board’s standing to carry out its oversight and policy roles is not presented to members and increasingly makes directors totally dependent on management.

- Without elected board leadership, the default arbiter of vital decisions about credit union activity is the regulator-e.g. bank purchases, mergers and even operational priorities.

- With voting negated, there is an accountability gap that isolates credit union leaders from the consequences of their operational decisions and performance outcomes.

Voting determines who holds the political power in the credit union. Without choice, power is concentrated in directors and CEO’s who assert responsibility but not answerability to the owners. The credit union model becomes compromised, and leaders gravitate away from member needs and value to their views of organizational success.

Absent proper governance via director elections, the cooperative model descends into a system of autonomous, independent financial oligarchies. They take generations of member-generated collective wealth to run their personal private organization. Credit unions are increasingly financial islands protected by seawalls from taxation and the traditional market indicators or measures of accountability.

Managing financial wealth is an intoxicating and addictive activity. It symbolizes and enables the exercise of power in every sector of society. For many individuals, it is the ultimate indicator of personal success and meaning.

What was once common wealth has become privatized. The cooperative model is merely a veneer from a prior era of innovation. And to keep the critical advantage of no taxation.

Ultimately the perversion of this primary check and balance by coop owners will lead to safety and soundness issues where credit unions combine out of fear or greed. The public perception will be that multi-billion dollar credit unions no longer serve a unique public purpose or need.

For some this is the inevitable outcome n a society that worships capitalism and wealth accumulation. For others, it will be an opportunity to innovate and find new ways to bring the common good to areas of personal needs.