This is the comment George would have written about the Vermont State Employees Credit Union merger proposal with New England FCU.

We all remember George Bailey from the holiday film classic set in the fictional Bedford Falls. Here is a quick synopsis from a writer who maintains the story is a dire warning about today. And perhaps the credit union movement?

It’s A Wonderful Life (Jared Brock)

For those who haven’t seen the movie — no judgment, but what are you doing with your life?! — it’s a story about an angel who is sent from heaven to help a desperately frustrated businessman by showing him what life would have been like if he had never existed.

But the B-story is a prophecy about the times in which we live.

George Bailey (played by the great Jimmy Stewart) runs the Bailey Bros Buildings and Loan Association, a company that contributes to the community by building affordable homes for owner-occupiers.

Henry F. Potter hates George’s guts. Rather than contribute to the town of Bedford Falls, Potter’s full-time job is extraction — he owns the bank, the bus lines, the department stores, and plays slumlord to a tenement called Potter’s Field.

While Potter dreams of bankrupting the Baileys so he can create a housing monopoly to milk the middle class to permanent poverty, George Bailey dreams of building “airfields, skyscrapers a hundred stories high, bridges a mile long.”

But George Bailey’s day-to-day goal is singular:

To help every working family own their own home.

The Member’s Appraisal of the Merger

Donald Kreis, a long-time credit union fan, responded to VSE’s proposal to end the credit union’s 75-year charter. His comment letter as filed with NCUA:

Greetings from New Hampshire – birthplace of the U.S. credit union movement!

From the other side of the Connecticut River, the plan to merge the Vermont State Employees Credit Union (VSECU) out of existence seems like a bad idea, and I will be voting “no” on the proposal. Here is why.

Why I care about VSECU

VSECU – which I first joined when serving a judicial clerkship at the Vermont Supreme Court in 1997 – is one of the five credit unions to which I belong. I have only one rule when it comes to financial services: I don’t do business with banks, at least not voluntarily.

Investor-owned banks are in business to extract profits from their customers. I have always wanted to share my financial resources with my neighbors (or fellow employees), and I would like them to share their resources with me. A credit union is a financial institution that exists to help my neighbors and me do that, in a manner that we democratically control for our mutual benefit.

My First Loan

Thus, when I needed to buy my first car almost 40 years ago because my employer, Associated Press, was transferring me to a place (Portland, Maine) where I could not function without an automobile, I secured my first-ever loan from the AP Employees’ Credit Union. I was still a kid, fresh out of school, and not terribly desirable as a credit risk.

But a loan committee comprised of my fellow AP employees understood the need as well as the high likelihood that a young wire service newsperson would not renege on a promise to his colleagues. So, I got the loan.

Unfortunately, the AP credit union is long gone. Almost every credit union to which I have ever joined since then is indistinguishable from a bank. The neighbor-to-neighbor, colleague-to-colleague quality is gone. The organs of democracy have atrophied, and annual elections have become an empty formality.

There is only one exception, and it’s the Vermont State Employees Credit Union. Over the years, it has taken the idea of democratic member control seriously. It is the only credit union to which I have ever belonged that actively and enthusiastically promotes its annual election process.

What Beats Jet-Skis and Snowmobiles?

I don’t think it’s a coincidence that the VSECU is the only one of my five credit unions that actively promotes “green” lending. While other credit unions send me flyers and e-mails urging me to borrow money for leisure purposes (snowmobiles, jet-skis, extra cars), VSECU understands that what consumers really ought to be doing is borrowing money to make their homes both more energy efficient and self-sufficient.

This resonates profoundly for me, as the state official in New Hampshire (the Consumer Advocate) whose job is to advocate for the interests of residential ratepayers. Electricity and fuel prices are soaring right now, a result of our over-reliance on natural gas and other fossil fuels. But consumers are reluctant to borrow money to pay for things they can’t see, hold or drive around.

A credit union that is serious about the welfare of its member-owners will strive to educate them and encourage them to make long-term commitments to things that will make them wealthier and more secure over the long run.

The Case for the Merger – Platitudes and Generalities

Thus I was frankly shocked to learn earlier this year that the board of the VSECU had voted unanimously to merge our democracy-and-green-energy loving credit union into the much larger (and much more bank-like) New England Federal Credit Union (NEFCU). It seemed so out of character.

Naturally I assumed there were facts and circumstances of which I was unaware. When I inquired, I was told that to the extent I am entitled to information that would help inform my vote, the insights would be contained in the official document I then received. It is entitled “Notice of Special Meeting of the Members of Vermont State Employees Credit Union and Plan of Merger.”

The official Notice document does indeed make a compelling case for the merger – but only if you are willing to accept platitudes and generalities.

In the section of the Notice labeled “Reasons for merger,” VSECU states that “both credit unions are financially strong” but “face many of the same obstacles and challenges, including an aging Vermont population with slow to no growth; rapid and accelerated technology changes; environmental, economic and social change; and increased competition from out-of-state financial institutions.”

Fair enough, but this begs the question of what advantages the merger would confer as the new mega-CU seeks to confront those challenges. Answer: having swallowed up VSECU, the former NEFCU will be “better equipped to tackle the challenges facing financial institutions in a rural state.”

The Notice goes on to promise “economies of scale and combined resources” that will lead to unspecified “further improvement and opportunities” in eight listed areas – everything from “expanded branch and ATM access,” to “improved homeownership and financing initiatives to reduce energy consumption and environmental impact,” to “favorable rates and lower fees to members.”

These justifications are unpersuasive. Note the lack of promises or concrete examples of things that VSECU cannot simply do as a stand-alone billion-dollar credit union.

Economies of Scale and the CU Merger Frenzy

The “economies of scale” claim is especially troubling. The usual route to merger-related economies of scale is for the newer and bigger organization to trim staff to avoid duplication of effort. But in this instance the Notice promises that “all employees will keep their jobs and current salaries as part of the proposed merger.”

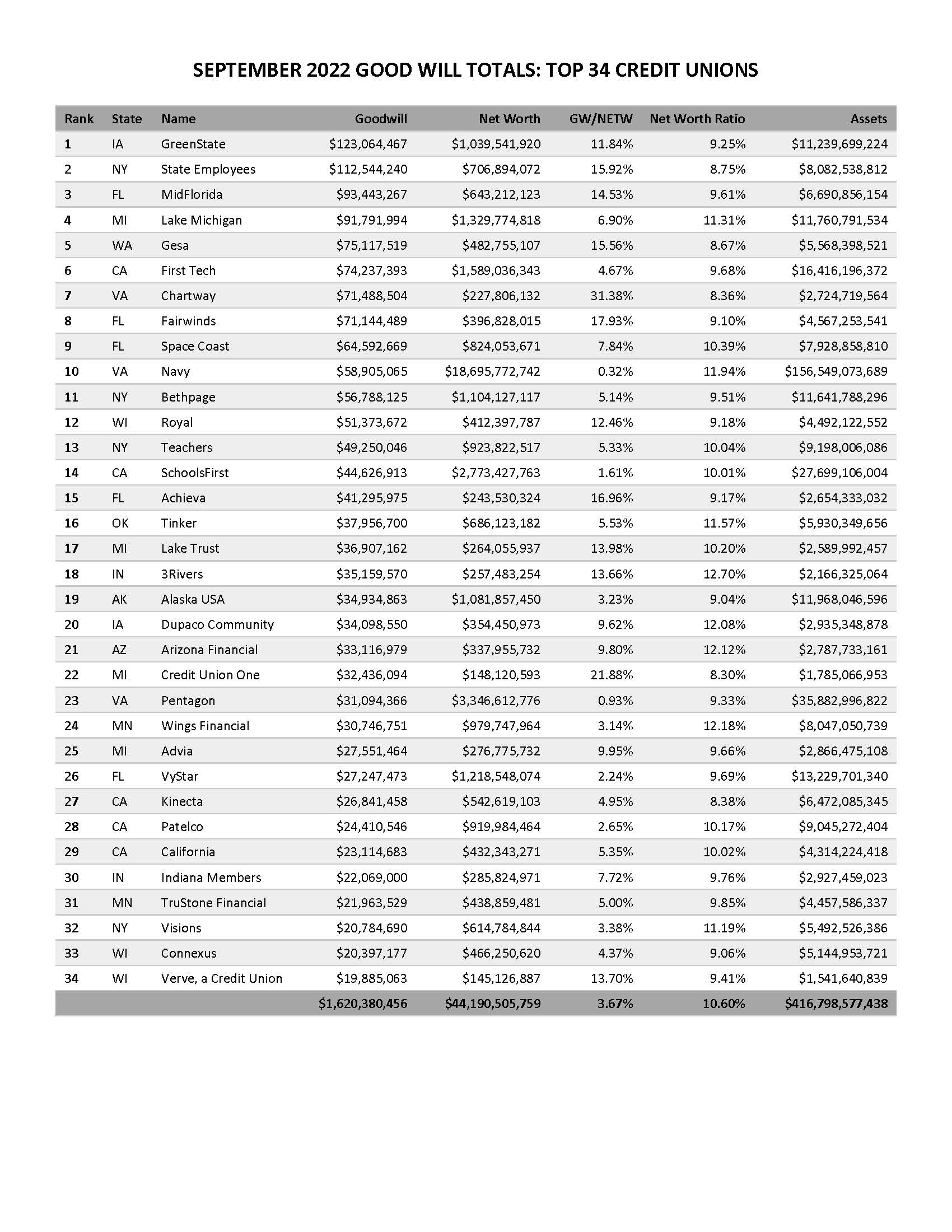

Economies of scale are indeed a ‘thing’ in the world of credit unions, but the proposed demise of the VSECU stands out. According to the trade publication Credit Union Times, the National Credit Union Administration (NCUA) approved no fewer than 86 credit union mergers during the first half of 2022 – overall, credit unions are stampeding to combine with one another – but the proposed VSECU deal is bigger than all but one of them. And in that biggest deal of the first half of 2022, VSECU’s New York counterpart – the $5.5 billion State Employees Credit Union – is taking over the smaller Cap Com Federal Credit Union.

Most of the credit union mergers in the current frenzy involve much smaller institutions. And, indeed, the consensus among industry insiders is that a credit union with less than $300 million in assets should indeed consider merging with another CU in the interest of amassing the resources to confront technological change and industry competition.

A $1.1 billion institution like VSECU already has, or already should have, all the economies of scale it needs.

Not a Merger of Equals-Equity Transfer

Although VSECU claims the proposed deal is not a takeover of our CU by the NEFCU, here is how you know that claim is wrong. If this were truly a merger of equals, then the members of both CUs would have to approve it. Because VSECU members are surrendering control of their financial institution, they and only they get to vote.

If you don’t believe me, consider what this deal would look like if both institutions were publicly traded, investor-owned businesses. The board of the ‘new’ credit union will have 11 members, six of which are from NEFCU. In the for-profit would, that would be considered a surrender of control – effectively, a takeover.

The $3 billion NEFCU intends to pay no consideration whatsoever to the current owners of the VSECU for the right to control what used to be their credit union. According to the latest 2021 balance sheet in the required Notice, VSECU members have built up $95.3 million in equity over the years – not a dime would be paid out to them in exchange for surrendering control of their credit union to its bigger and more bank-like Vermont competitor.

Such a payout would be easy enough to achieve by liquidating some of the $434 million in investments the combined credit union would have, above and beyond the $2.5 billion in loans on the books.

But, instead, the proponents of the merger are asking the members of the VSECU to surrender control of their credit union to a former competitor for free. No board of an investor-owned business would ever dare recommend such a proposal to its shareholders.

What’s at Stake? The Very Soul of the Credit Union Movement

In a sense, the impending vote on the takeover of VSECU should be seen as a referendum on the future of the U.S. credit union movement itself.

As I have already noted, VSECU stands out as a credit union that takes its cooperative identity seriously, along with its fidelity to the Cooperative Principles – the key principle being democratic member control. The New England Federal Credit Union is just another credit union that is content to operate like a bank does.

Why is this so important to me? After all, I no longer live in Vermont. I belong to four other credit unions and I even serve on the supervisory committee of one of them. So I could easily just sign and turn my back on VSECU.

I care about this because of something said to me by the CEO of the credit union on whose supervisory committee I serve. When I first met the CEO, I told him about how much democratic member control, and the other six Cooperative Principles, meant to me as a volunteer credit union leader.

In response, the CEO pulled out a cell phone and waved it in my face. The CEO mentioned an adult daughter – this executive’s go-to proxy for a typical credit union member. “Do you know what she cares about?,” asked the CEO. “It’s not voting. It’s this.”

The “this” to which the CEO was referring was the credit union’s phone app that allows members to do their banking from the device they carry around with them in their pockets and purses.

If that’s truly what all of this comes down to, then I give up and so should everyone else in the credit union movement. Credit unions can and should strive to keep up with the convenience-enabling technology deployed by the mega-banks.

But if credit unions can’t deliver value to members above and beyond the convenience that for-profit financial institutions already offer, there is no reason for them to exist.

In other words, if the $1.1 billion Vermont State Employees Credit Union cannot stand alone, cannot be just as convenient as a bank while giving members more value and more control than a for-profit financial institution can, then combining with another credit union is a waste of time. Instead, the Board of VSECU should just pay out that $95 million in member equity and turn over its loan portfolio, its deposits, and its checking accounts to some ultra-convenient bank.

Do Not Succumb to Cynicism and Fear

Indeed, maybe we no longer deserve VSECU as we have come to know and love it. Maybe we are unworthy of a democratically controlled financial institution.

When VSECU first announced the merger, and the skeptics began speaking out, the Board and management circled the wagons instead of treating member activism the way it deserves to be treated – as a welcome expression of commitment to the institution they collectively own.

In that sense, the leaders of VSECU are no different than the board and management of every other cooperative that has had to deal with members who flex their ‘democratic control’ muscles and question their elected representatives.

Maybe it’s just human nature – but, if so, then maybe “democratic member control,” and other Cooperative Principles like “education, training, and information” (which suggests members should be fully informed about the business realities their cooperatives confront), are just outdated platitudes.

We live in cynical times. So, it is not surprising that, even in Vermont, both the proponents and the opponents of the buy-out of VSECU by a bigger credit union question the motives and integrity of the other side in this discussion. I refuse to succumb to that cynicism.

Thus, I am grateful to the VSECU Board of Directors for presenting this proposed merger to us for a vote, and for making its best case for why we should ratify the deal. They, in turn, should understand my frustration over not having access to all of the information they had at their disposal as they deliberated.

Lacking that information, or any other compelling reason to vote in favor of consigning the Vermont State Employees Credit Union and all it stands for to oblivion, I vote “no.” I urge my fellow VSECU members to do likewise, in the hope that the VSECU of the future will look less like a bank and more like a cooperative.

If this credit union, with its commitment to cooperative culture and public service, cannot survive and thrive as an independent, community-owned, democratically controlled financial institution, then all is lost. I refuse to believe that.

END

Donald Kreis, a “George Bailey” Credit Union member:

He has served since 2016 as New Hampshire’s Consumer Advocate, heading up a small but feisty state agency whose purpose is to advocate on behalf of the interests of residential utility customers before the state’s PUC and other bodies (including FERC). Previously he served as general counsel at the New Hampshire PUC, as a hearing officer at the Vermont PUC, and as a professor at Vermont Law School, where he still teaches on a part-time adjunct basis.

Prior to becoming a lawyer, he was a full time journalist for nearly a decade, first with Associated Press and then at the fabled newsweekly Maine Times.

He served for eleven years on the board of the nation’s second biggest retail food co-op (the Hanover Consumer Cooperative Society) including three years as president. He was a nine-year trustee of what is now known as the Cooperative Fund of the Northeast, a CDFI that loans money to cooperatives.

He believes credit unions ought to live by the cooperative principles – and take democratic member control seriously.

His custom when joining a new credit union is to follow up about a week later with a request for the CU’s bylaws and express interest in seeking election to the board. That has inevitably been met with something on the continuum between bewilderment and hostility, except at the CU that invited him to join its ALCO and Supervisory committees.