In June 2018, the NCUA board approved a new merger rule. The rule was extended to all FISCU’s because the agency believed there were safety and soundness risks if a merger was not done in the members’ interest:

For example, members of a merging credit union who discover, after the fact, that they were inadequately informed about the details of the merger may become disgruntled. The dissatisfied members could create bad publicity, creating a reputation risk for the continuing credit union. Unhappy members could also choose to stop doing business with the continuing credit union, affecting earnings projections.

In contrast to commenters’ assertions, the statutory factors the Board must consider in granting or withholding approval of a merger transaction include. . . the general character and fitness of the credit union’s management.

Members Reacting Post Merger

There is no “after the fact” process for NCUA to learn members’ reactions to the merger of their credit unions. The following comment posted on January 14, 2022 to Just a Member is an example of one reaction:

Comment:

Recently, Teresa Freeborn has left Kinecta to manage her Daughter’s Business interests. The merger of Xceed FCU and Kinecta was a disaster. After months of wait, the transition was a bust. Poor customer service. Problems with online access and mismanagement of credit cards from XFCU visa to Kinecta Mastercard. I paid off my Visa and the balance rolled to the unactivated Kinecta Mastercard. I had to file a complaint with NCUA to get it resolved. I have now closed my accounts and ended an over 40-year relationship with XFCU. I have found better banking deals at BOA and Citibank. I think you have made a smart decision, Teresa Freeborn, to exit credit unions after protecting your interests and abandoning the Credit Union members!

George E. Skelton

Today’s social media options provide multiple sources for members’ post-merger experiences.

When PenFed merged with Postal Employees in Madison Wi, in April 2021 the following comments were provided about the subsequent service:

NameWithheld

August 30, 2021

Lousy place. Abusive. Fails to do what’s requested. Online phone help just as bad. Says being done but not. Waited 65 days for free personal checks that never showed. Still waiting for refunds and account closures. Worse place ever in my 45 years of banking. Local Person at Madison Wi extremely abusive. Place needs to be shut down. Don’t waste your time here. Consider a class action lawsuit.

PETER SCHNEIDER

August 24, 2021

POOR customer service…..so impersonal….hate being treated like a number and not an individual.

PenFed’s Merger with Miramar FCU

Years after the May 1, 2017 merger between PenFed and Miramar FCU, members continue to compare their post-merger service to that received prior to the event:

February 8, 2021

The employees here are nice but the service is not efficient – employees do not know procedures for certain requests or processes. When it was Miramar FCU the staff were more equipped to answer questions and work through solutions with members.

Also, the hours are incorrect. Penfed office of Miramar is closed and there was no update on the website nor any message to inform members. Penfed, please update your information on your website and your employees on procedures.

Joanne

July 31, 2020

It is 1245 on a Friday afternoon and the hours are stated that you are open until 1pm. so why is no one picking up the phone? have been on a continuous ring and redialing for the 15 minutes, until 1 pm. a business is supposed to answer it’s phone. this never happened to me in the the days of mfcu.

Brad Hines

April 9, 2020

This was a topnotch organization when it was Miramar FCU. Since PenFed took over there’s been a complete overhaul of the staff – and not for the better! I’ve had numerous times where tellers have made mistakes, or they just didn’t know what to do and had to ask for help. Most recent situation was transferring a large amount of funds out of a CD that had matured. The teller didn’t know the procedure, so had the manager come over to help. She explained that my best course of action was to put the funds into a “premium” savings account which yielded decent interest. I authorized this, and the teller made the transaction (after the manager had left). Several days later I just happened to check my account online only to see that that large amount of $ had been put into a “regular” savings account that had very poor yield. Fortunately when I called the national help desk they were able to fix this – but what a gigantic error and problem this would have cost me if I hadn’t discovered it!

A member’s report of service at a former branch of Ft. Belvoir FCU, now merged with PenFed, and the credit union’s response:

Chandra G a month ago

I would like to say that I was so hurt when I left the PenFed on Davis Road. A teller was helping me with an issue. I needed a letter to send to my other bank so she had to refer me to a manager. Before I went into the office, I told the teller that I needed that document back when they were done with it.

By this time I was walking in the office with a manager and a member service representative. The teller is so kind so she wanted to tell the manager that I needed the document back. Before she could say anything, Regina Lawton told her, “you don’t need to be in here. Go back out there.”

She then repeated it two more times, “You don’t need to be in here. Go back out there and help them. You don’t need to be standing in here.”

The teller was just attempting to tell her that I needed the document. She was providing excellent customer service!

I couldn’t imagine working for Regina Lawton. If you speak to your employees like that in front of customers, I can only imagine how you speak to them privately. TERRIBLE

Also, the teller DOES NOT know

I’m reporting Regina Lawton. I went to my car, after the incident, and my conscience wouldn’t allow me to leave knowing someone is being treated like this.

Response from the owner a month ago

Hi Chandra, thank you for bringing this to our attention. We will share this with our branch leadership team. We appreciate your membership and feedback.

Google reviews of PenFed’s merger with a Georgia Credit Union

Yasmin 4 days ago NEW

No customer service whatsoever. I’m a patient person so I waited 30 minutes to eventually walk away and take my business somewhere else. But what I don’t tolerate is when you have 2 customer service reps just staring at the group of people waiting for membership services. No, we will be with you. No, thank you folks for your patience. Just no acknowledgement whatsoever or managing expectations. Then for some reason, they were done with the prior members, it had been about 10 minutes, and they didn’t come for the next group. Not efficient at all. So rude.

Jason Boyd 3 weeks ago NEW

This is a federal credit union that is united but you can’t do business with your other credit union accounts (such as safe federal credit union) unless you have an account with them directly. Not only is that greedy but a poor business model. I will never bank with you and I will make sure no one I know does either. Oh, and thanks for the 15 minute wait for nothing too btw.

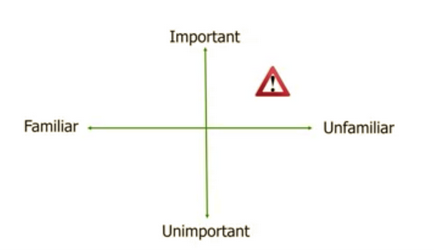

Where’s the Problem?

NCUA’s statement that poorly done mergers create bad publicity and soundness risks affects more than a merging credit union’s members. The reputation of the credit union system is stained.

But the problem is not just badly executed mergers. When mergers are pursued as an acquisition strategy, institutional ambitions easily become more important than the members’ best interests.

There are fundamental gaps in NCUA’s oversight of its merger rule. Board member Metsger stated at the time of the revised rule:

“Our focus is on ensuring member interests are protected through the regulatory process.”

However efforts to protect member interests are not evident in NCUA’s supervisory oversight. Egregious self-dealing and hollow future benefit promises are routinely approved.

The member comments above are indications that something is amiss in regulatory oversight. A later blog will provide some examples of self-dealing, at the members’ expense, routinely approved by the agency.