The Good: 125% Risk Based Capital Ratio for a $6.6 Billion Credit Union

If you were ever curious about the difference between a state and federal credit union regulatory environment, the open public meeting of the North Carolina Credit Union Commission the past Tuesday, April 9, is an eye-opener. (It was online).

In 90 minutes a listener received comprehensive, transparent. and timely information from multiple presenters. The topics covered state and national legislative priorities by a League representative and a thorough state-of-the industry review for all 29 state charters (ratios with and without SECU) by the Commissioner. There were updates on the status of the state system: sixteen credit unions have the low income designation and one pending merger.

Administrative briefings on the Commissioner’s office including an examination update (one done, six in process, and 22 to go), examiner training and staff openings.

At the agenda’s completion, the chair solicited comments from the attendees. Credit union members presented concerns about the Administrator’s oversight of SECU bylaw changes. One questioned the Administrator’ support for House Bill 410 to change the operating authority for North Carolina state charters.

The meeting showed the accessibility and transparency of the state’s regulatory environment. All were welcome. It was an open town hall with democratic participation and citizen oversight.

An Up-to-the-Minute Market Update

One of the most interesting reports for me was by Fred Eisel, CEO of Vizo Financial Corporate which serves the Carolina market and credit unions in 40 other states. His information was timely, positive, and specific. Several of his points: liquidity is growing in credit unions with corporate shares up and borrowing by members down. Vizo’s financial results are strong enabling increasing returns for members. Credit union operations are stable.

However, the number that struck me was Vizo’s Risk Based Capital Ratio at March end of 125%–that is not a typo.

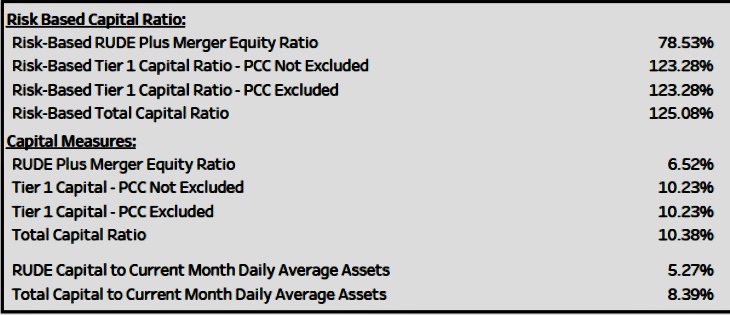

Vizo financials through February are posted on their website. It has extensive disclosures of balance sheet and income statement details, shows total available liquidity of $6.5 billion, and includes nine measures of capital adequacy.

Fred sent me the March 2024 numbers showing the 125% RBC ratio.

Vizo’s Multiple Capital Calculations

The NCUA’s RBC requirement for well-capitalized corporates is 10%. Vizo’s ratio is twelve times that standard. Moreover, the corporate’s total capital exceeds 10% of assets.

Vizo CEO’s presentation of March’s final data just seven working days after month end, is extraordinary. It is a disclosure practice documented with web posting, that every credit union might model for their members. The timeliness is a tribute to the credit union’s management. It is also a standard NCUA should emulate in its reporting of the three funds it manages for credit unions.

The Bad:

Coffee hit a 30-month high today. The commodity is up 16% so far this year. One of the reasons is a heat wave in Vietnam.

Cocoa has been soaring due to weather problems in Africa. Cocoa is up 150% so far in 2024. (source: stocks at Night by CNBC Pro April 11, 2024)

The Beautiful: Eclipse Pictures

From my driveway by Luis Escalante who was repaneling my workroom in Bethesda, MD. Luis used my eclipse glasses to cover his camera lens.

From the shores of Lake Ontario by Scott Patterson, CEO Credit Union Student Choice.

His commentary on being in the moment: Clouds didn’t cooperate to see the sun much, but we did get total darkness for a few minutes. Very eerie. The expansive lake view let us watch the darkness line approaching across the water and then see the full daylight on land in the far distance. A thrilling experience.