The Lead: Almost all CU savings are now insured

“More than 99% of the total savings at CUs are now insured by either NCUA or a state share insurance fund, according to the 1983 State Share Insurance Yearbook. That translates into about $75.5 billion.

“By mid-1983, the yearbook says, only about 200 CU’s in the entire U.S. will be without share insurance. Only 319 of the almost 20,000 CUs in operation at the end of last year were not insured. That number will decline this year as share insurance becomes mandatory in Indiana, Nebraska, and New Jersey. Insurance is now required of state CUs in 44 states and Puerto Rico.

“NCUA insurance covered all FCUs in 1982 (11,631 active charters) and 5,036 state CUs, while 17 state insurance plans were provided for 3,121 state CUs in 21 states and Puerto Rico.” (Total all insured credit unions 19,788)

Source: Credit Union Magazine, June 1983, pg. 18.

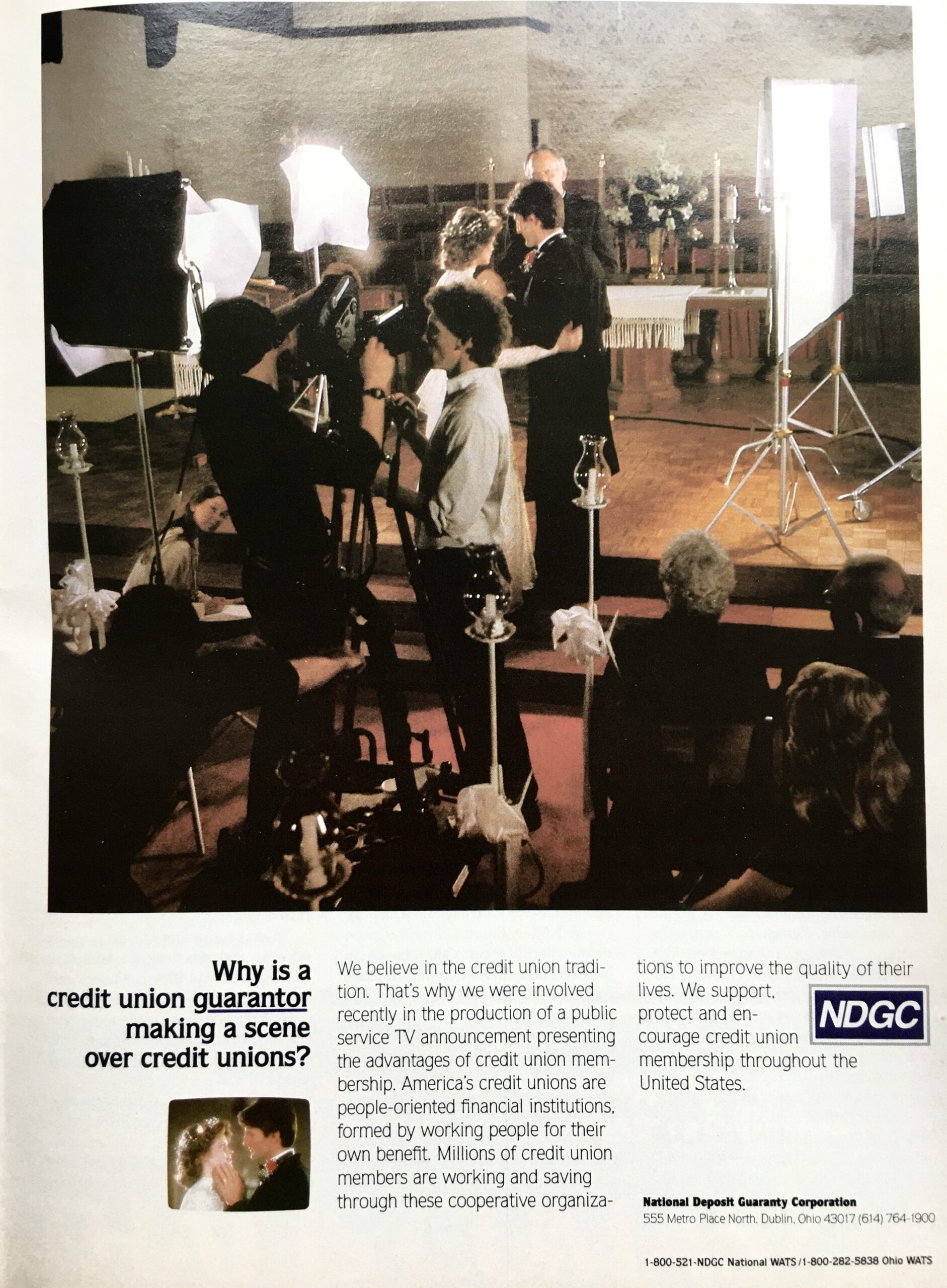

An advertisement for one of the 17 state-chartered insurance funds.

Milestone or Turning Point?

Today, the NCUSIF is an insurance monopoly for all but a few state chartered credit unions.

The insurer has become the regulator. NCUA leaders routinely pronounce their number one priority-“North Star”- is to protect the fund.

The NCUSIF approval is now the biggest entry barrier for new charters.

This prioritization of insurance has changed the focus of many credit union leaders. Instead of a social movement designing alternatives for members’ financial needs, credit unions have become me-too financial providers.

Credit unions are now fully entitled members of America’s financial system with access to governmental and market options similar to most banks.

Some continue to prioritize member well-being and their challenges of financial equity. Others embrace the open-ended opportunities to pursue the market ambitions of their competitors.

A number of credit union leaders and academics have interpreted the insurance requirement (primarily NCUA) as the most important factor in the evolution of the cooperative financial system-for good or otherwise.

I will look at these assessments in later blogs.