In CUInsight’s Sunday jobs report, there are credit unions listing 10 to as many as 40 job openings in this weekly post. In addition to individual senior management positions, the most recent numbers ranged from a high of 23 to a low of 7 openings per credit union.

Finding and keeping employees is getting tougher. In a recent presentation by Economics Professor Alan Gin from the University of San Diego, some of the macro trends show why today’s labor market is so competitive.

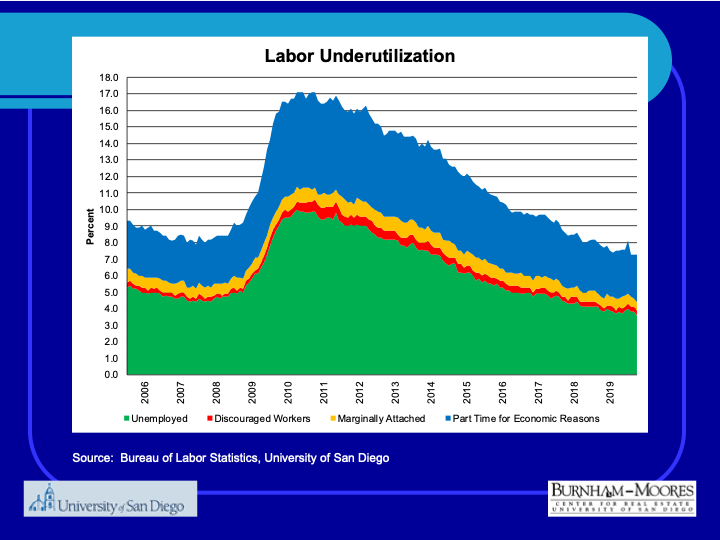

All traditional measures of under or unemployment segments are the lowest levels in the past 15 years.

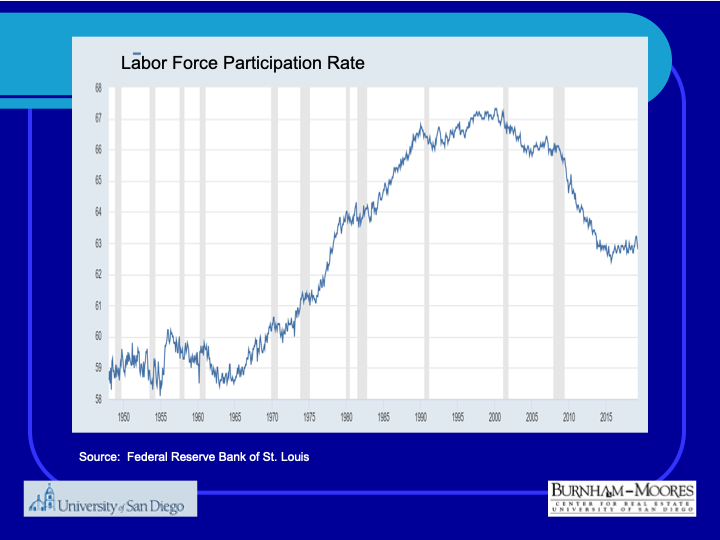

Secondly, the labor force participation rate is at its lowest since the 1980s. He cites four factors contributing to this structural decline:

- Baby boomer retirements;

- Fewer students working;

- Disability leavings;

- Affordable Care Act enabling persons to be insured when leaving a company plan

The Human Factor Challenge

Tactics for responding to this tight labor market are vital. Retaining and growing current staff becomes more urgent.

Other efforts include automation (how many credit unions answer the phone with a live person), moving jobs to different areas with less tight labor markets, process and productivity improvements, and outsourcing.

Whether the situation is short lived or a more permanent feature of the evolving economy, the need for new ways to find and retain the right staff will be a critical factor in many credit union’s ability to grow and to serve members well.