Larry Connell, appointed by President Carter as the first NCUA Board Chairman in 1977, died this past week in New Hampshire.

After graduating from Harvard in 1958 with a BA degree in economics, Connell worked for the Comptroller’s office(OCC) in ban k regulation. During this time he earned his JD degree from Georgetown University.

Connecticut Governor Ella Grasso appointed Connell as Bank Commissioner in 1975. In that office he supervised commercial and savings banks, credit unions, and loan companies as well as acting as securities commissioner.

The Credit Union Years

President Jimmy Carter’s appointment of Connell as Chairman of the National Credit Union Administration (NCUA) came at a pivotal time for both credit unions and federal financial regulation. Congressional legislation converted the NCUA from a single person administrator to an independent federal agency with a three person, Presidentially appointed board.

The same legislation established the Central Liquidity Facility (CLF) within the NCUA. This was the cooperative system’s public-private partnership establishing lender of “unfailing reliability.” At that time credit unions did not have access to the national clearing system or to the Federal Reserve

The first NCUA full board included PA Mack, a senior advisor for Senator Birch Bayh, and Dr. Harold Black an associate professor of finance at the University of North Carolina’s School of Business Administration.

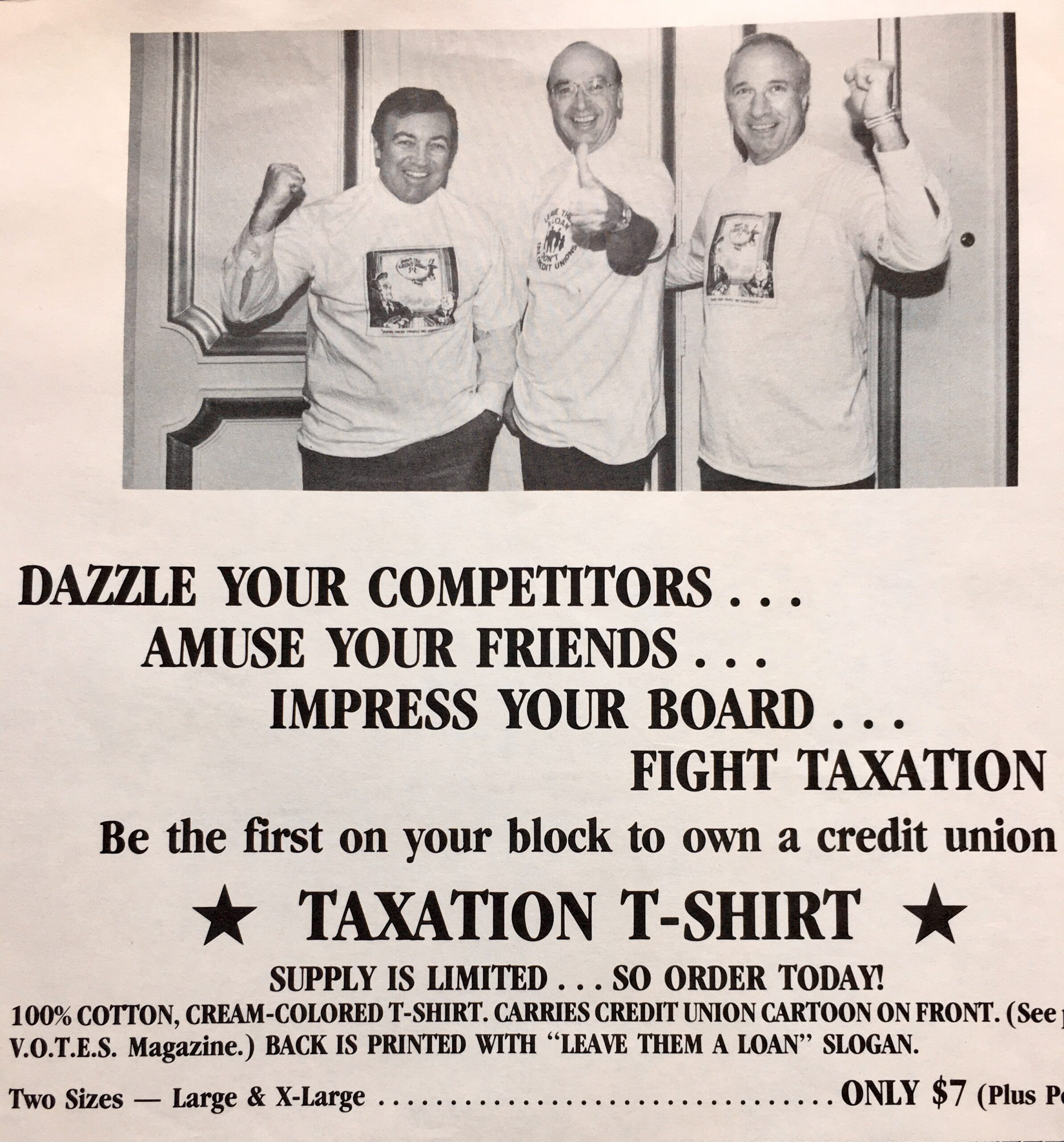

The First NCUA Board in 1979

As NCUA chair Connell was also a member of the Depository Institutions Deregulation Committee (DIDC) which was charged with the deregulation of rates and terms on the savings accounts of all federally insured deposits. He was Chairman of the new congressionally chartered National Consumer Cooperative Bank (NCB) until his departure from NCUA in early 1982.

In March 1979 Congress established the Federal Financial Institutions Examination Council (FFIEC) to bring consistency to multiple regulators’ oversight of rules and call reports. Connell was vice chair. That same year he asked if I would serve as the state representative for credit unions. The term was for two years and included periodic visits to Washington for state liaison meetings. The primary discussions were about the wording for the new Truth in Lending and Truth in Savings rules.

A Career in Public – Private Banking Oversight

After leaving NCUA, Larry became President/CEO of the $2.5 billion Washington Mutual Savings Bank in Seattle. This began a peripatetic 12-year career in bank crisis management as CEO or Director for banks and S&L’s across the country from Washington, Texas, New Hampshire, Maine, Illinois, Michigan and Washington DC.

After his work for domestic inistitutions Connell was deployed as Senior Advisor for the U.S. Treasury Department’s Office of Technical Assistance. In this role he advised governments on bank privatization policies and practices in eastern and central Europe, as well as in Russia, Turkey, Colombia, South East Asia and Africa.

At the Founding and the Transition

October 1981 welcome reception for Ed Callahan with P.A. Mack and Larry Connell

Larry was at the founding of the NCUA as the agency transformed to an independent board. At his departure his successor, Ed Callahan, spoke of his vital contribution:

While Larry Connell’s departure will be a major loss to NCUA and to the credit union movement, his visionary ideas will continue to influence the financial community. Larry’s expertise in so many areas–economics, law and banking–helped to elevate the stature of NCUA during one of the watershed periods in American financial history.

An ever expanding group of people—from government, industry and the media—now actively seek the Agency’s views on a variety of economic and financial matters, not just credit union affairs. I can’t pay him a higher compliment. (The NCUA Review February 1982, page 1)

However Larry did continue serving credit unions. He was an original trustee of the TCU family of Mutual Funds launched in 1988 by Callahan & Associates.

Larry laid the foundation for responsive, experienced, and professional NCUA leadership. He believed in credit unions as a vital alternative for individuals and communities left behind by the for-profit sector. He was a friend, a colleague and always open for intelligent conversation.

The NCUA Board’s leadership and support of credit unions.