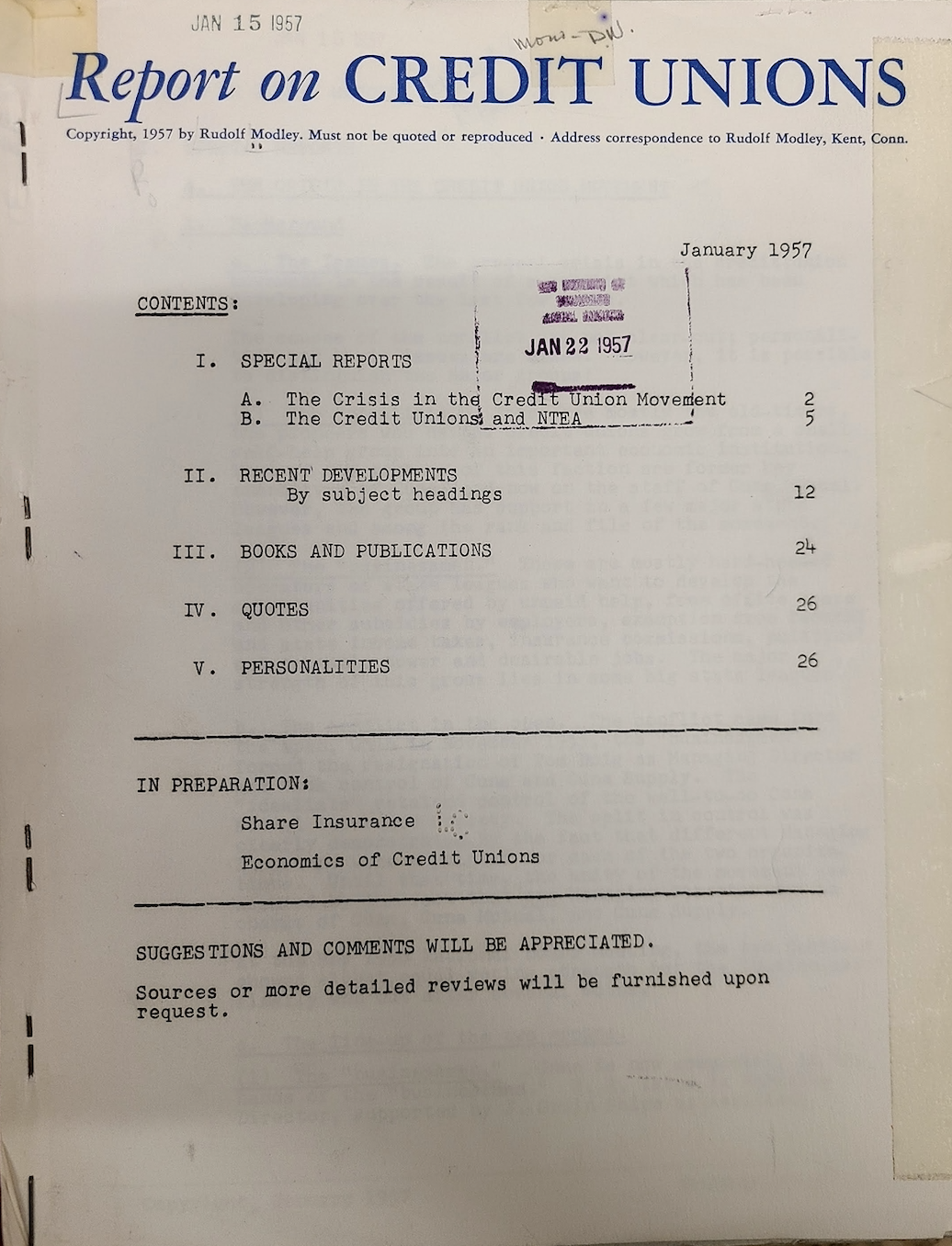

Recently I contacted the Library of Congress (LOC) to see if they had copies of Report on Credit Unions. This monthly printed publication was begun in January 1957 and continued through the mid 1980’s.

Here is what the librarian found in the search of their records:

I am sending you the title page of the Report on Credit Unions published in January 1957–the only issue we have in the collection. I also noticed that it was cataloged as a monograph, not a serial.

I ran another search in the Ulrich’s Periodicals Index using the ISSN number–I have attached the record from Ulrich’s as well. Ulrich’s shows a different publisher, but the original publication might have been bought at some point by CoVest Reports, Inc. listed in Ulrich’s. The serial appears to have been a bi-weekly newsletter which might be the reason it wasn’t collected by the Library.

I searched Google books and found the title mentioned in several publications:

Congressional hearing from 1963 which refers to volume 5, issue no.3, dated March 15, 1963 published by Reports, Inc., Kent, Conn.

In-plant Thrift and Loan Services by Banks and Credit Unions (1959) by Rudolf Modley – the name on the 1957 issue–cites several articles from Report on Credit Unions.

That is the extend of the governmental records of the Report’s “first draft of credit union history” published during this consequential time of credit union expansion including the era of deregulation.

The Report was cited in Congressional testimony, linked above, as part of the debate during the President’s tax message in 1963. The reference to the Report was not about taxation but rather the necessity for supporting quality supervision of credit unions citing an Illinois example.

The Absence of Historical Records

When attempting to write a brief account of Ed Callahan’s years as Chair of NCUA I learned there was no repository for trade association publications or the numerous private newsletters that tracked the industry prior to the era of online media.

CUNA Mutual had sent their records to the Credit Union Museum. NAFCU when it closed down in 2024 apparently had no repository of their numerous magazines and weekly newsletters to chronical their founding in 1969. Similarly I could not locate a source for CUNA’s weekly and monthly printed publications. State league newsletters were similarly not kept.

I contacted NCUA to see if the 21 NCUA Video Network VHS tapes created in the Callahan era had been saved. No copies could be found of these special reports which, among other recordings, included live excerpts of the first, and only, national examiner’s conference. There were two hour long live recordings of sessions with examiners led by Rex Johnson and a Harvard Business School professor to enhance examiner analysis and supervision skills.

Why the Past Matters Now

History may not repeat itself, but it does rhyme. At the moment NCUA leaders are confronting the challenge of becoming more focused and efficient following policy guidance of the Trump Administration.

In 1981/2 the Agency faced a similar challenge but for very different reasons. The credit union system was in crisis. “Survival” was the priority according to CUNA President Jim Williams when introducing new Chair Ed Callahan at the February 1982 GAC convention.

The broad policy agenda was for credit unions and NCUA to respond to the new era of deregulation. For NCUA this meant a complete reorganization of the agency to prioritize field examinations and supervision led by the six regional directions. The DC head office reduced the number of staff departments from 16 to 2, an Office of Programs and an Office of Administration. The Executive Director, Bucky Sebastian, was also the General Counsel.

The recently created DC consumer examination team which planned to employ as many as 50 personnel was in turn transferred to the RD’s. Every examiner had responsibility for completing an annual safety and soundness and compliance exam for every FCU,

The result of this reorganization placed operational responsibility on the RD’s, not central office staff. It led to a reduction in agency budgets for three consecutive years along with the lowering of FCU operating fees annually. The agency including the CLF and NCUSIF had been designed for the open competition in which the credit union system completely outpaced their banking and S&L counterparts for the decades to come.

The Relevance for Today

Instead of trauma and closed door board discussions, these 1982 changes were done openly and with clearly stated administration and policy goals. The messages were delivered via the video network with the first tape a credit union panel discussing the challenges of deregulation.

Public board meetings were taken “on the road” with the first held in historic Faneuil Hall In Boston MA in 1982. Weekly press releases covered both agency initiatives and credit union progress.

But finding the contemporary public record of these events is very difficult. When the past is lost, or worse ignored, then the present is left adrift. When there is no understanding of how past events, there is a tendency to believe that only the present matters.

When disruptions occur whether from market or economic forces or changes of administration, the tendency is to protect the status quo, the known. This is the result of bureaucratic incumbency. It is only human nature for those at the top of an organization or career to protect their legacy.

The best way to understand the need and inevitability of change is to know the past. This is particularly critical if those with ultimate responsibility are not familar with credit union, let alone NCUA, history. That familiarity can not only provide lessons but olso hope that change is necessary for an even better future.

That was the outcome of NCUA’s 1981-1985 makeover. One would hope it would be the result in today’s NCUA leadership deliberations.