The country is going through the political throes and formal processes of a complete changeover of executive and political leadership in DC. This includes NCUA.

In late 1981 Ed Callahan had been confirmed as the next NCUA Chair. Before he had been formally sworn into the job, I asked what would be his toughest challenge would be.

Ed had been leading the Illinois Department of Financial Institutions for almost six years. In the Department, the credit union division oversaw 1,200 state charters. During this time the Illinois system had navigated multiple market and legislative changes implementing deregulation.

I assumed his response to my question would be about greater scale of responsibility, from one to 50 states and from 1,200 credit unions to 16,000; or, the increased size of the agency budget and staff; or, the more complex institutional and political environment in DC. This involved Senate and House hearings and NCUA membership of interagency committees such as the FFIEC or DIDC.

Ed’s Number One Challenge

His answer mentioned none of the above areas. His biggest challenge he said would be communication. That is to explain the direction he believed the NCUA and credit unions should undertake and why.

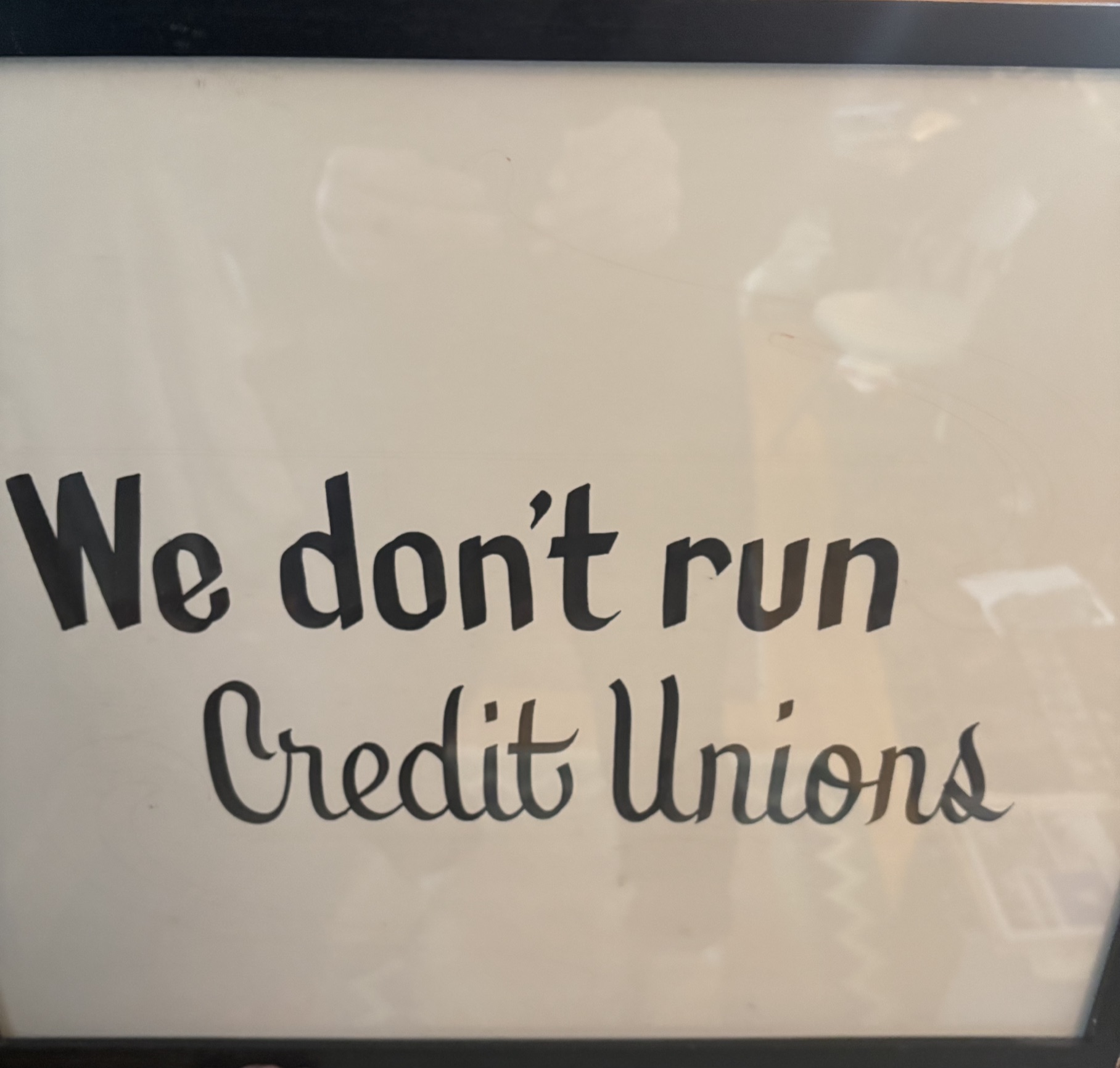

Callahan’s track record and leadership of Illinois cooperatives was described as deregulation. At a dinner celebrating his appointment before going to Wasington, the Illinois Credit Union League presented Ed with a framed sign he then hung in the Chairman’s NCUA office. It read:

Leadership of a Transition

However, what would deregulation look like on a national scale and all at once?

The first effort communicating this approach was a videotaped panel discussion arranged by the Illinois Credit Union League on January 8th, 1982. The title: Deregulation, What Does it Mean?

(https://www.youtube.com/watch?v=S09QkeNYgBU&t=4s)

The video is 24 minutes. This conversation was the beginning of a dialogue to change the entire direction of the prior 50 years of federal credit union regulatory practice.

Several factors in this video are noteworthy. It was a joint NCUA-movement project. The Illinois League sponsored and produced the video. The panel included Jim Barr, the head of CUNA’s Washington office as moderator, three credit union CEO’s, and Chairman Callahan and NCUA Executive Director Bucky Sebastian.

The format is Q&A. Hard questions are asked. The dialogue is authentic due to the openness of the conversion.

The most important moment may be at minute 16. A CEO responds to Callahan’s deregulation approach by asking how much influence will credit unions really have in deciding this policy? Ed’s reply from the February 1982 NCUA Review, which printed a transcript of the video:

“Even though I think credit unions want deregulation, I am more committed to the fact that we have to respond to their needs. If they don’t want deregulation, we will see that it doesn’t happen.”

A second question by Jim Barr is simply. Why now? Go to minute 18 for the response.

This video was the first of 20 NCUA created during Callahan’s three and one half year tenure. It was one of many efforts to inform credit unions and the public about NCUA actions. To succeed, this approach required a leader who was accessible, informed and willing to listen to the industry.

The result was a tenure characterized by joint NCUA-industry efforts that repositioned the system for an entirely new era of market competition.

This video is one example of how the regulator and the industry collaborated so that the movement could thrive well into the future.

Communication went to all constituencies. These included the public and credit union press, the members, credit union leaders and other agencies of federal and state government, The outcome included some of the most consequential cooperative system innovations since the first credit union charter in 1909.

Leadership is never easy, especially in public positions. Developing and seeing through a successful tenure begins with the very first communication. In this transition. that began with a video that still provides meaningful lessons decades later.