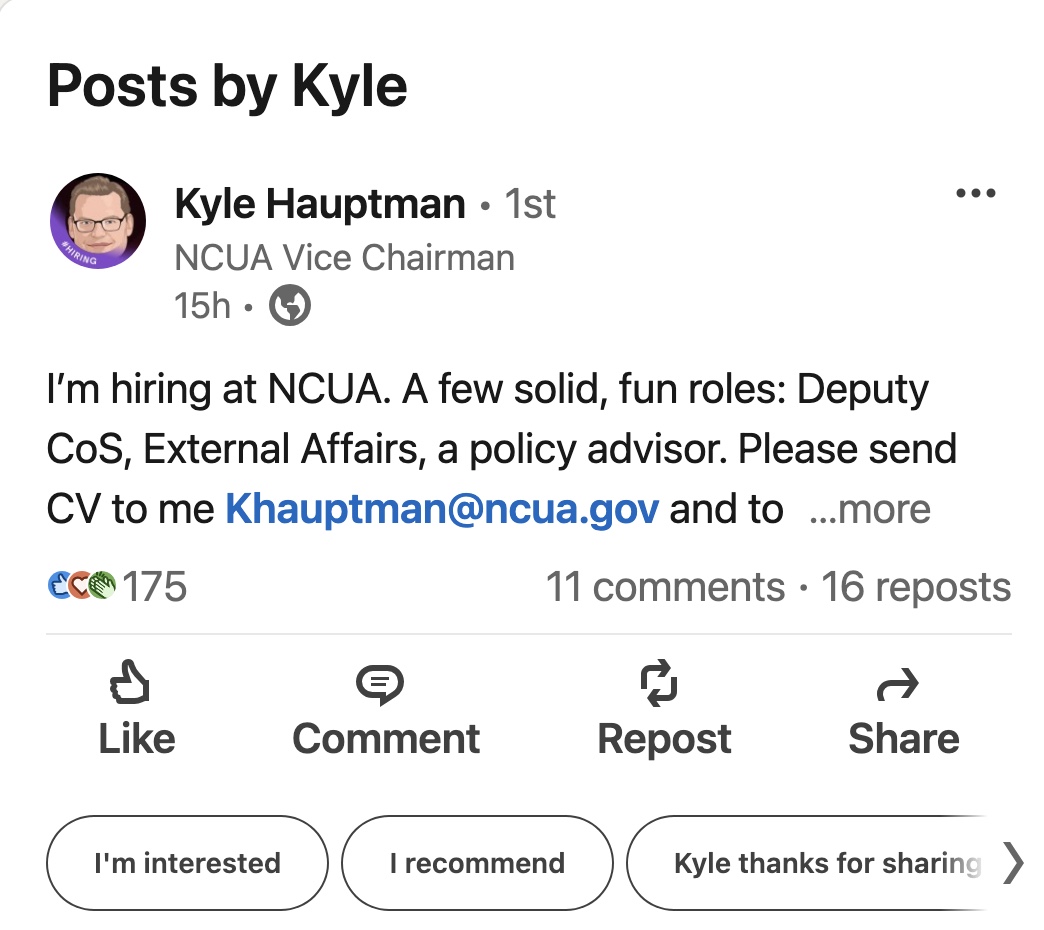

From LinkedIn yesterday:

An unusual approach to assembling a leadership team for a government agency.

Persons interested might review his positions and priorities from a speech on September 9, 2024 to the ACU Congressional Caucus. In the opening paragraph he remarks that his term ends in August 2025 and his search for ideas for his “remaining days:”

Good morning and thank you. This conference is one of my favorites. One reason I’m here is to get ideas on how I should focus the remaining days I have left in this job. Around this time next year, the White House will likely announce a new Board Member. That’s because my term on the NCUA Board ends next August, so I have less than a year left. Whew, I was worried that would be an applause line.

Later he notes his regulatory approach:

in America, you deserve protection from an overbearing government. . .

If NCUA or other agencies ‘get over their skis’ and interfere in the private financial affairs of credit unions and their members, the resulting credit union use of NSF and overdraft services could have the paradoxical effect of limiting access to financial services for those who need it most.

Governments often have coercive powers far beyond any financial institution. . .

I want to mention two fascinating new technologies that we often hear about: Artificial intelligence, and blockchain and digital assets, which includes cryptocurrency. I’ve made clear that the NCUA shouldn’t be a technophobic agency. . .

In reading the full speech, there is no reference to credit unions as cooperatives and any role that design has in his regulatory agenda.

I saw his LinkedIn post yesterday and had the very same reaction. I wondered if I had missed some sort of early appointment news. With the most recent OD/NSF memo Harper released as perhaps his last foray, Hauptman’s remarks about government overreach are welcome to most credit unions.

I agree with Josh McAfee. Hauptman has been a strong advocate for the things small credit unions hold dear. It is clear he “gets it” when it comes to social justice initiatives NCUA has joined forces with the CFPB to fight. I hope they hang on to Hauptman.