On May 22, the NCUA held its first public board meeting with its one and only member, Chairman Hauptman, overseeing staff reports.

This was the first public meeting since February, where the only agenda item then was the NCUSIF update. Both March meetings were closed. The March 27 and April 17 open meetings were cancelled. On April 16 President Trump fired the two democratic board members. That event is now being challenged in court with no specific timetable for resolution.

Observations from the May 22 Meeting

At the meeting’s conclusion Chairman Hauptman assured the public that NCUA was fully capable of meeting its statutory responsibilities. He repeated the message from an earlier NCUA press release on April 18:

Please be assured that the NCUA has precedent and standing delegations of authority in place to continue performing all operational and statutory requirements under the authority of a single Board Member.

During the Bush Administration (2001–2002), Chairman Dennis Dollar acted as a sole Board Member. He held a Board meeting, voted, and took several actions, both administrative and operational.

However the circumstances between these two situations is entirely different. In 2002, both nominees filling the expired terms were known and required only Senate confirmation. That happened very quickly in March. This time, confirmed nominees have been fired creating two “vacancies.” These two board members are challenging the President’s removal in court.

Chairman Dollar held only one board meeting in which he received an NCUSIF briefings and then tabled three other actions until a full board was in place.

Moreover, in a May 25, 2005 Delegation GEN 5 update by General Counsel Bob Fenner, all delegations of Authority in the final paragraph is subject to the phrase “In a state of national emergency, all authorities retained by the board are delegated to . . .” Are we-NCUA- in a state of national emergency?

Hauptman’s situation is unique in how the vacancies occurred, the seemingly open-ended time period for single leadership, the dramatic internal staff and reorganizations underway, and the uncertain legal status of the fired members-especially if returned to their positions.

Board Item One: NCUSIF Update

The publc format of the March financial NCUSIF update was changed. A series of “dashboard” charts showing five-year trends for key balance sheet and performance ratops was unveiled.

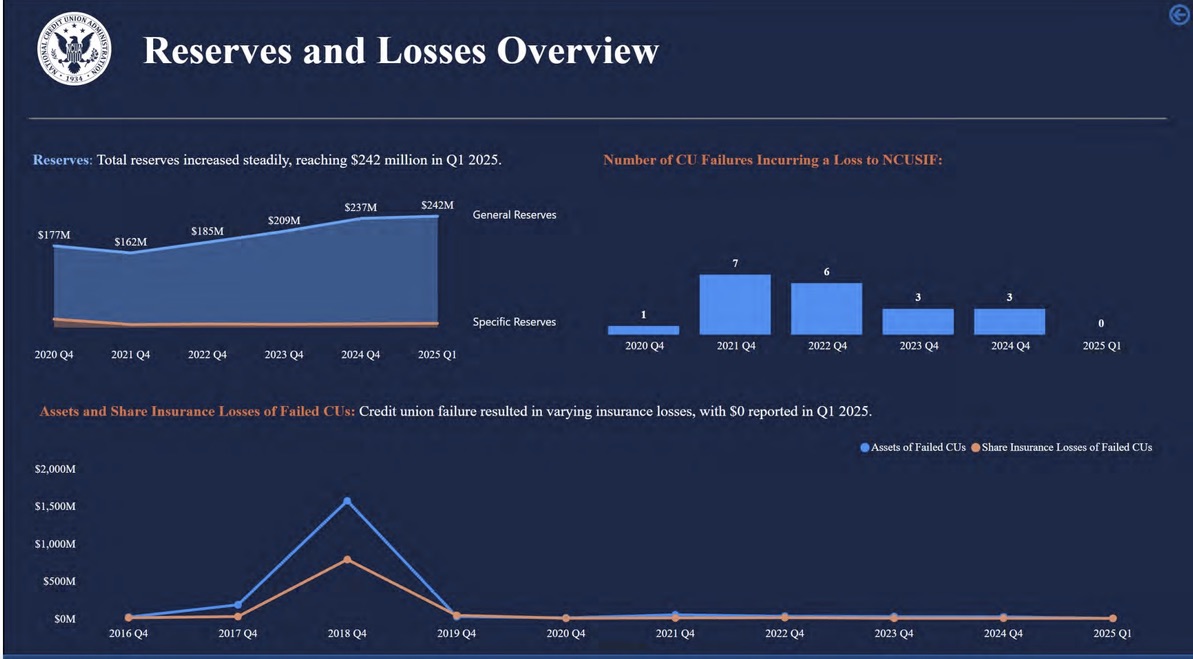

These presentations provided interactive “eye-candy” but no increased transparency for how critical numbers such as the increase in loss reserves of $5.4 million were calculated. The loss reserves to insured shares ratio far exceeds the long term loss rate on insured savings.

Most importantly while reporting zero losses in the first quarter, there was complete silence on the recent liquidation of the $ 47 million Unilever FCU. This was finished in such haste that there was no conservatorship or apparent effort to find a willing merger partner. The situation echoes the $13 million unexplained loss (20% of assets) at the $65 million Creighton FCU in mid 2024.

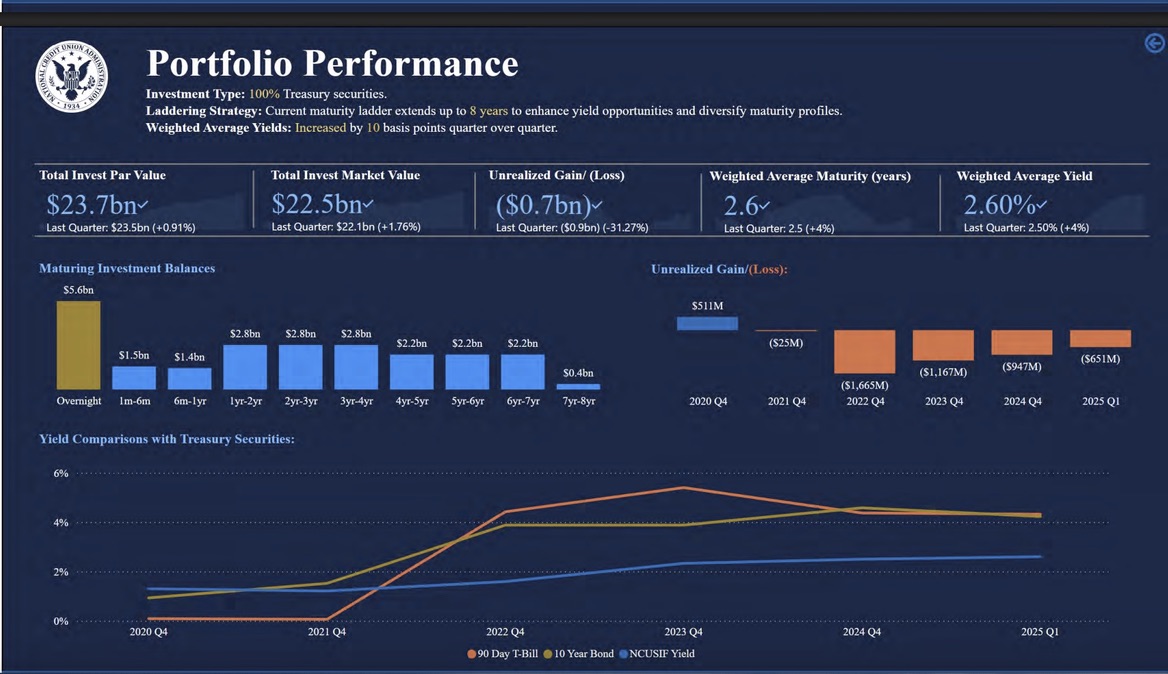

The most important issue, the underperformance of the NCUSIF portfolio, was documented in the new dashboard slide Portfolio Performance. It shows the NCUSIF’s return has trailed significantly the 90 -day T bill rate since mid 2022. The year-to-date yield in the first quarter of 2.59% is significantly below the overnight return as well.

NCUA CFO Schied said staff’s policy was to continue the investment ladder out as long as ten years in order to ensure “a steady fund income.” This ladder generates “steady income” that has trailed market returns by over 2.0% or more as shown in the bottom graph for over three years.

There was no reference to either interest rate risk (IRR)or ALM, the two basic factors in managing any portfolio. Especially one which cannot be adjusted once invested. There is an obvious need for better policy and experienced investment management.

Chairman Hauptman likes to describe NCUA as an “insurance company.” It would be helpful if there was much more transparency and thoughtful discussion about how this “company” manages its $23 billion asset on behalf of credit unions. This underperformance damanges both the fund’s finances and credit union’s returns.

Board Item Two: The Voluntary Separation Program

The staff stated that the voluntary layoff program had been agreed to in the March 21 closed full board meeting. By the May meeting the employee responses were known.

A total of 250 employees elected to leave voluntarily. There were no forced departures. Almost all will be placed immediately on administrative leave with full pay and benefits but doing no work. This paid leave status extends until December 31, 2025. This means most of these departing employees will be paid in full while not contributing for at least six months orlonger.

To incentivize the two options, there was a $50,000 bonus provided to each participant. In addition, all will receive their 2025 merit bonus which will average $15K for junior staff and from $29K-$42K for senior staff.

In addition Hauptman announced there would be no restrictions on these employees’ future employment so they might find another job while on leave. He commented, “They might even be paid more than what they earned at NCUA.”

As explained by Executive Director Larry Fazio, the program was designed by the staff for the staff. There will be no budget savings for 2025. The special severamce benefits will fully utilize the NCUA’s operating funds for this year. The estimated total of $75 million in potential “savings” means the average cost for the 250 departures was $300,000 each.

Staff was ambivalent about whether there will actually be anything close to these savings in 2026. The gross cost of $75 million paid departing employees will be offset by new contracts, salary increases, new hires, technology investments and other expenditures setting up a new future state for the Agency. In other words any savings are yet to be determined. And the generous terms of the 2025 voluntary departures will leave no surplus from the current year.

There were no specifics provided for how NCUA’s future organzarion will be structured. No departments closed or consolidated, no programs (eg. consumer exams, DEI conferences, etc) to be reduced. No reference to any DOGE recommendations for eliminating unnecessary expenses.

There ws one specific example of change however. Thiswas to extend the time between on-site exams based on a credit union’s net worth. For credit unions $1-15 billion in assets, the exam interval would be from 12 to 18 months. For less than $1 billion, the period between field contacts would be 14 to 24 months.

This one concrete step will reduce the agency’s in person safety and soundness exams as long as the net worth seems sufficient-above 10%. This first line of defense for the NCUSIF is being weakened at a time when the sudden falures of Unilever and Creighton FCUs are still unexplained.

Flying Solo & Landing Safely

Thia is not a business as usual moment in this era of single board leadership. This circumstance is exacerbated by the fact that Chairman Hauptman’s term expires in August of this year. What happens then? An acting Chair? Who designs and follows through on NCUA’s future state? Staff whose 25% voluntary separations outcome used up this enire year’s budget?

In a March 3, 2025 CUSO Magazine article, Hauptman’s agnostic approach to the future of credit unions was presented:

On the topic of the NCUA’s future, Hauptman declined to speculate or advocate for one outcome or another, noting that while he does not shy away from controversial topics, he keeps himself from getting into debates when he has no authority over the outcome. The fate of the NCUA, he argues, is outside his control and lies in the hands of Congress and the White House.

Congress created the NCUA in 1970, and there were 27,000 credit unions operating before then…my only view on it is that it is important for people to understand that credit unions are different. So whoever in the future is going to be regulating needs to be aware of this.”

In an April 23, 2025 memo to All NCUA Staff, Hauptman wrote in part: NCUA will be returning to the headcount that it had a few years back—but be assured we know it takes teamwork and creativity to “land the plane safely.” And NCUA is doing that quite well thus far.”

The outcome from the first solo board meeting since 2002 suggests that there is still a great deal of turbulence. It is not clear who is piloting the plane or where it is trying to land.

This first flyby of the pubic landing zone with credit unions leaves more questions than answers. The future of NCUA with its implications for credit unions and their 100 million members seems at best cloudy.