Financial oversight policy by the federal government is often presented as two distinct opposites: deregulate so the free market can work its wonders or regulate to prevent the worst instincts of capitalism from harming individuals or the greater economy.

However, there is a third policy option. I call it fake regulation. The regulator takes action to prevent some excess or outright harm from occurring, but then never enforces the rule. The market quickly sees these are only pretend guardrails. And the predatory behavior expands in ever increasing incidents.

The Merger Problem Becomes Public

In 2017 the situation of credit unions buying out and paying off their kin was written about by a number of commentors in articles such as:

The Dark Side of Mergers, by Peter Strozniak, March 27, 2017 Credit Union Times

Time to Talk About an Ugly Truth in Mergers by Frank Diekmann, March 6, 2017 CUToday

Credit Unions for Sale? By Chip Filson, February 14, 2017, Credit Unions.com

In response to the growing disclosures of large payments by credit unions openly seeking acquisitions, in June 2017 NCUA proposed an updated voluntary merger rule. Folllowing a lengthy comment period the final rule was adopted in June 2018.

It is helpful to review the specific statements and intent of this final rule when looking at concrete circumstances today. For many actual events seem to suggest the rule isn’t in force. There are no longer any regulatory roles or constraints being exercised.

What the Final Rule Required

The rule included important statements about NCUA’s role and scope of authority when approving voluntary mergers. For example:

“Several commentators . . .suggested that NCUA’s role is limited to safety and soundness concerns. These comments are not accurate. The FCU Act explicitly requires the “Board’s prior written approval” before FICU mergers with another FICU. Moreover, as detailed in the preamble. . . the FCU Act requires the board to consider six factors in determining whether to approve FICU mergers. Clearly, the FCU Act expects the Board to consider the effect of the proposed merger on the credit union members, and gives the Board authority to deny mergers that do not, in their judgment, serve members well. . .

Several commentators stated. . .that members have no right to the net worth of a credit union except in liquidation. This assertion ignores the reality that hundreds of credit unions annually return excess net worth to members. . .A credit union in good condition has the option of voluntary liquidation instead of voluntary merger. . .

The Board agrees that mergers should not be the first resort when an otherwise healthy credit union facing succession issues or a lack of growth. . .

The Board acknowledges however that not all boards of directors are conscientious about fulfilling their fiduciary duties. . .

The Board also confirms that for merging credit unions, the NCUA’s regional offices must ensure that board and management have fulfilled their fiduciary duties under 12 CFR$701.4.

In contrast to commenters’ assertions, the statutory factors the board must consider in granting or withholding approval of a merger transaction include several factors related to safety and soundness, such as the financial condition of the crediit union. . . and the general character and fitness of the credit union’s management. . .

Concerns with Financial Disclosures

The impetus for the updated rule was driven in large part by the financial incentives being used to acquire other credit unions. In the initial June 2017 draft proposal, the staff was asked by a Board member what percentage of recent mergers reviewed involved increases in compensation? The staff response said 75% to 80% had significant merger related payouts often in the low seven figures.

The final rule in 2018 had extensive examples of “merger-related financial disclosures” that must be provided members. Several comments explained the scope and reasoning included in the new rule:

A “but for” test determines whether the senior management official or director would not otherwise receive the compensation “but for” the merger. . .

Disclosure includes, “all increases in compensation or benefits that a covered person has received during the 24 months prior to the date of the approval of the merger plan by the boards of directors of both credit unions. . . “.

The rule applies to all compensation or benefits received in connection with a merger transaction including early payout of pension benefits and increased insurance coverage. . .

. . . the proposed rule requires both the merging and the continuing credit union to submit board minutes to NCUA that reference the merger during the 24 months preceding the date of the approval of the merger plan by the boards . . .In several recent mergers, a review of board minutes has shed light on potential conflicts of interest, including a situation where a credit union chief executive officer voted on a merger proposal that included significant merger related compensation for himself. . .

Furthermore, members’ interest in the transaction extend beyond practical matters of access and service, because the merging FICU’s net worth belongs to the members. . .

The basis for NCUA’s concern about financial disclosure follows with emphasis added:

The prospect of a significantly higher salary at the continuing credit union could be a motivational factor in an individual’s choice to advocate for a merger both internally within the credit union leadership and with members. Credit union management may well have considerable influence with members, who may look to management for trusted opinions and advice about whether the proposed merger is in the best interest of the credit union and its members. It is not unimaginable that the prospect of a significantly higher compensation package could affect an individual manager’s thinking about the desirability of the merger. . .

Houston, We Have a Problem

The Space City CU merger proposal with TDECU violates a number of these explicit statements as well as the intent to protect members’ interest in NCUA’s merger rule.

The initiative was led by the CEO. The CEO and COO are paid directly by TDECU $850,000 in the transaction, a direct conflict of interest. These are described as “non compete agreements.” This is a nonsensical justification. Neither has ever worked for TDECU. Now they turn over their entire operations to TDECU after “competing” with this $4.8 billion firm for 30 years and are paid to “non-compete.”

The CEO is to be paid $3.5 million for not working for the next ten years. In fact he was the person who decided to close the credit union and turn over operations to TDECU and leave the workforce. The amount, as stated was in “honor of his retirement and in recognition and appreciation of his long tenure and outstanding performance.” This rationale is belied by the facts. Of the credit union’s net worth, only 39% is from his operational earnings and 61% from the net worth transferred by four other credit unions in mergers.

The members who own the net worth receive $346 each on average, or about 25% of their total ownership stake. TDECU has announced a definitive acquisition agreement to purchase Sabine Bank five months before the CU merger announcement. The bank owners will certainly receive their entire net worth plus a premium.

However, the credit union owners are asked to approve the same exact economic sale transaction as the bank owners, but will receive only a fraction of their ownership stake. The five employees arranged to pay themselves an amount $1 million greater than the 12,000 members whose loyalty built the credit union. Management is acting like owners, free to do whatever they wish with the credit union, and not as stewards for the members’ interests.

TDECU is showing credit union member-owners they are less worthy of equitable payment than bank owners.

The Manipulated Voting Process

Space City’s final defense and where the regulators could justify their intentional inaction is that the “members voted for it. “

But member voting is a process without substance. All of the critical financial disclosures were revealed only six months after the September 2024 joint announcement of the agreement. Once presented the facts, there was no opportunity to organize and find other options or learn critical factors in this decision.

There was no factual information why this was in their best interest or any relevant reasons why TDECU was the best option—or whether any other options were even considered.

In the Member Notice, it is “recommended” by “your” board of directors to vote yes. And for that vote, members would receive between $100 to $1,000. Vote no and you will get nothing and the implied continuation of the same leaders who decided to close the credit union.

The required member vote is nothing more than a managed event to ensure there is no time or ability for anyone opposed to raise questions or mobilize a counter view. Management in these so-called elections holds “all the cards” and resources. Management does not respond to questions from the press or members.

The only requirement to approve is that a majority of those who bother to vote, vote Yes. There is no minimum number as for example the 20% requirement in other charter changes. So only a tiny fraction of members participate. Normally the majority of votes are by mail-in ballot where the board says to vote Yes.

To call this one-time vote by members democratic in any sense of that term is a mistake. It is the same voting process followed by authoritarian governments in such well known democracies as Cuba, China, and Russia.

The System’s Problem

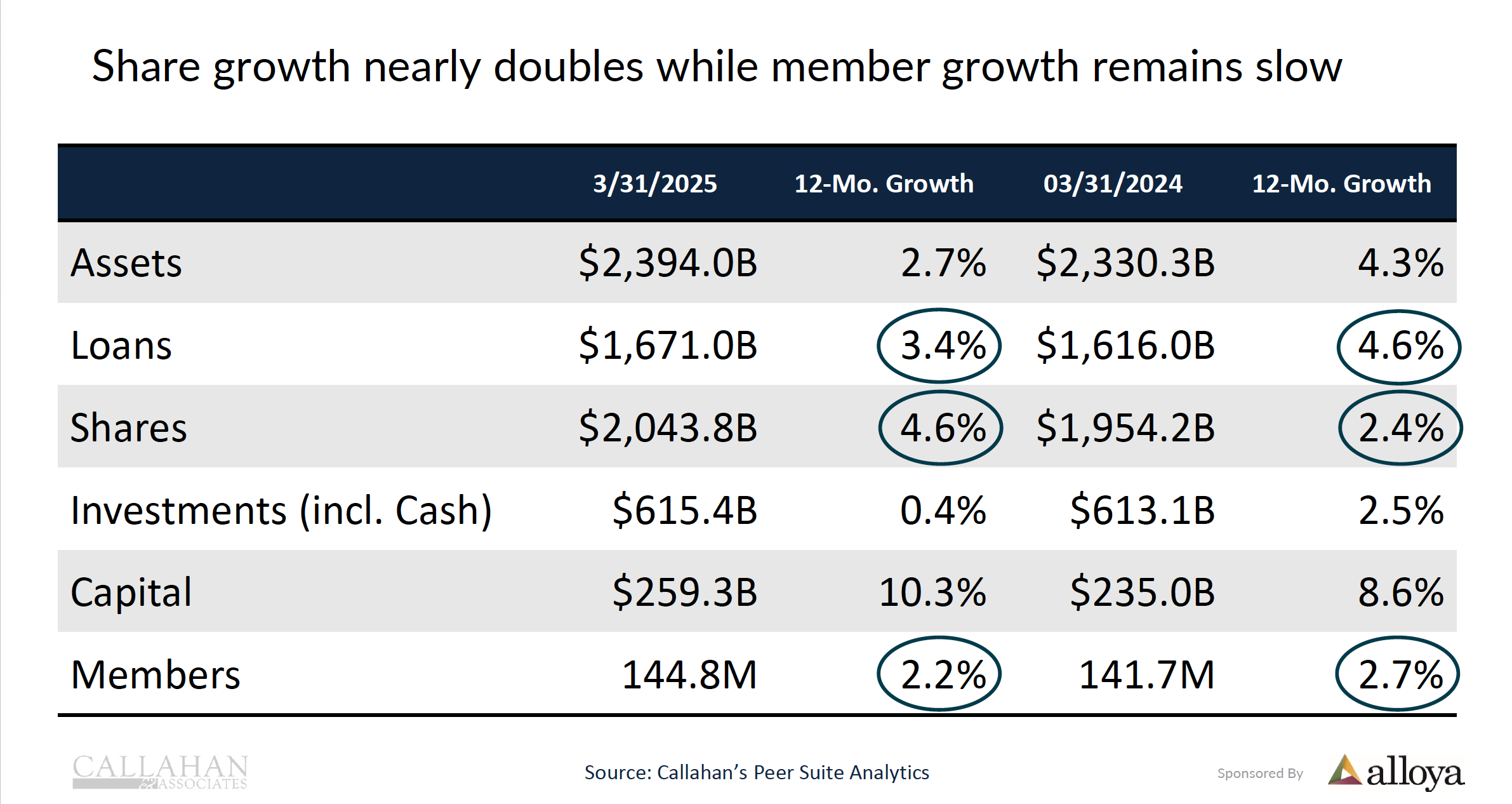

This relatively small voluntary merger of a 60-year old, financially viable credit union, may seem inconsequential for a $2.4 trillion system. But the details demonstrate the complete absence of any the oversight NCUA clearly lays out in its rule.

The two credit unions publicly declare the merger must pass regulatory approval, implying all they present and do has received the blessing of NCUA. However, it is a blessing in absentia. The data and reasoning is misleading, overtly self-dealing and provides no substance for a member-owner to make an informed decision. But what the heck–the regulator approved it.

The Absence of Regulatory Oversight

There is still one final step in NCUA and the Texas Credit Union Commission’s role. They must approve the final charter cancellation. In the past this is a nonevent. Regulators have not even required the results of the vote be disclosed when members ask for details.

Will either the state or NCUA look at the totality of this event and decide if, under the rule, members’ best interests are being served? Is this cooperative charter termination with these payments the best option? Might a small fraction of the planned $11 million payments be used to find new management, request new volunteer leaders from the 12,000 members and give the owners back their credit union?

That would be the common sense and right thing to do. It would take courage. And if done, it would send a signal to the entire movement that the era of self-dealing and hypothetical future visions is over. If a credit union wants to buy another credit union and take over all of its resources, then members need to have a real ownership say and return.

Today there is an absence of any regulatory presence and studied inaction in the face of misinformation and self-dealing. This silence has encouraged mega mergers by competitors in local markets, across state lines and, in one case, across the country.

These proposals involving credit unions with tens of billions of assets are not because some superior business benefit is now feasible for members. These mergers are by credit unions with all the necessary resources and capability to carry out any business initiative that would better serve members.

Mega mergers only benefit is to the ambitions of CEO’s and their boards who believe size correlates with success. That view shows they have not looked at the track records of their billion dollar peers about the actual outcomes when exteral acquisitions are prioritized over internal growth. The record of the largest credit unions shows that internal growth is stronger, more stable and effective than external firm buyouts.

The Combinations Undercut Cooperative Advantage

Moreover, these mergers of sound credit unions ignore the most important system reality. In these combinations, not a single new member is added, there is no market share gained, and no new markets entered.

Rather, these combinations reduce the number of independent firms with their own volunteers and market strategies, eliminate leadership opportunities for employees and volunteers, reduce independent community contributors and most critically, destroy the collaborative legacy of generations of members who sought more control over their and their children’s financial futures.

These mergers reduce the diversity and roots that have made credit unions a unique force in financial service options for America.

Who believes that the 12,000 members of Space City will now have a better financial relationship opportunity as part of a 380,000 member organization (soon to be 470,000) versus their current circumstance? And if someone wants that option, they can join TDECU today. But why eliminate the more intimate, personal option now available?

Transparency Does not Erase Wrong Doing

Since the 2018 voluntary merger rule was passed, transparency has illuminated an increasing cycle of cooperative self-destruction driven by institutional self-interest.

The regulators have abandoned the standards they explictly laid out as the foundation for their updated meger rule. The rationale appears that if you tell people you are taking the members money for whatever reason, then conflicts of interest, self- dealing or simply exhorbitant enrichment are fine.

I know of no illegal activity that is absolved by disclosing the facts of the deed. But that seems to be NCUA’s interpretation. CEO’s are increasingly brazen, as in the Space City example, to ignore all fiduciary standards.

There is no cop on the beat. The temptations will only worsen. In one California merger the CEO and Chair transferred $12 million of members equity to their sole control as part of the merger distributions. NCUA said and did nothing.

Merger stories are clothed with common PR phrases about similar cultures, values and enhanced opportunities for innovation in an evolving marketplace. There is nothing more than marketing rhetoric in these so-called merger plans.

How Healthy Mergers Damage the System’s Soundness

But the current harm is real. Mergers of sound, long serving credit unions destroy the legacy of relationships on which every firm depends for success. They wipe away the past commitments and memories. New brands then try to portray a new reality but often show how shallow the relationships have become. For example, Empeople credit union or the retirement community sounding EastRise FCU.

For cooperatives, legacy matters. It is a design chosen by a community of interest wanting to take control of their future with collective action. Carrying that legacy to the future perpetuates this human effort as opposed to the cycles of firm destruction accepted as part of capitalism. A credit union instead conserves and passes to the future the shared interests founded on local focus, knowledge and community spirit.

Instead of building on this foundation to work together, merging stable credit unions results in just another generic financial institution removed from any past connections, constantly seeking new markets to conquer or expand. The past is over and done with.

While this approach might appear to work for a while, it sacrifices the most important foundation for any successful enterprise, the power of human agency. Agency means being part of a collaborative effort, that is a person’s belief that I am accomplishing something important in my life. This kind of relationship creates institutional resilience that no amount of resources can achieve. Sometimes we call these outcomes trust and hope.

Space City is just the latest poster child of this growing Art of the Steal. Its reasons are ridiculous and it may generate member resistance far beyond Houston. For the wider problem revealed in these transaction is that some credit union leaders don’t seem to know for whom they work.

One Voice

A Space City member with deep concerns with this merger called and asked, Who do I go to for help? The person had spoken up, answered press questions, encouraged her friends to vote no. But she felt all this was in vain. Just her alone.

My response was you are doing exactly what democracy requires. It is not about creating a popular uprising to overthrow entrenched leaders in a moment of confrontation or voting.

One person standing up and publicly raising their voice will be seen. It will encourage other like-minded persons to learn their concerns are shared. Her courage will become contagious. It might even spark a regulator to do the job they are empowered to do.

Just one voice. It only takes one match to light a fire. Then watch the members respond with hope and goodwill. Credit union democracy needs many more such member-leaders.