Authority attracts followers. The power of a position is a reality whether that role is CEO of a credit union, a company, a regulatory agency or an elected official including the President of the United States.

People and the public have an instinctive respect for those in authority. But the process of validating one’s leadership is different for those in elected versus appointed positions. For appointed roles, there is a presumption of industry expertise or other skill that warrants the responsibility. The first steps matter.

Getting After It

Whichever path to leadership most will act quickly to affirm their new authority, sometimes dramatically. It both enhances the role and the perception of being in charge.

President Trump claims an electoral mandate “landslide.” In just one week he has issued dozens of executive orders, traveled widely across country, spoken to an international conference all in a very deliberate campaign to show there is new Sheriff in town. Getting after his agenda in a very public and energetic way, enhances Trump’s claims and intent to exercise his vision for the country.

NCUA Board Leadership

This impulse to demonstrate newly awarded executive power is also practiced by incoming NCUA board chairmen. This is especially the case when board appointees have little or no previous relationships with credit unions.

In February 2021 shortly after appointed chair by President Biden, Todd Harper announced his promotion in a Commander’s Call address to the Defense Credit Union Council.

As the COVID-19 pandemic rages on, we must smartly, pragmatically, and expeditiously address the economic fallout within the credit union system. To that end, when I first became Chairman, I issued my Commander’s Call to the agency.”

Time and again Harper used the imminent threat of “economic fallout” during his leadership independent of the industry’s performance and or critical mission issues.

In this same tradition, several days after being appointed Chairman Kyle Hauptman published his eight priorities in a press release. Many read like summaries from prior board meeting statements. Like Harper, he wanted to put his views out immediately.

These initial pronouncements were an assumed first step in asserting the authority of an appointed versus elected position in government. NCUA chair’s will routinely reference a restatement of safety and soundness oversight. Or in some cases an adaptation of the Administration’s governing priorities.

In Hauptman’s new role an important question will be how Trump’s priorities for the federal bureaucracy shape his administration. This is especially true for personnel policies and appointments, agency spending and regulatory and rules review. Will he assert NCUA’s independent agency status or try to implement Trump’s efforts to reform what the president calls the deep state?

The Most Critical Agenda Issue

While these opening statements are part of the ritual when appointed to NCUA leadership, the most important question that all chairs must answer is, In whose interest will they serve?

Will it be incoming administrations? The agency staff? Or the needs of credit union member-owners and their communities? Each constituency wlll have its special claims and interests.

When NCUA leaders arrive without a track record of working within the credit union system, the assertion of agency priorities can easily overlook the most important issues the industry faces. It is easy to repeat the regulatory mantra of safety and soundness without having to explain what that means. For example, from 2007-2024 the losses to the NCUSIF have averaged less than 1 basis point per year. So what are the underlying performance issues?

The Credit Union Way for Developing a Relevant Agenda

I believe the most important priority for NCUA leadership should focus on the credit union member-owners. “It’s the member, stupid” is how one prior leader explained the challenge. But how does one put members first?

The answer lies at the heart of the cooperative model. Leaders within the credit union system must talk with and listen to credit unions. For a relevant regulatory agenda, NCUA and credit unions should be co-creators for setting the priorities to enhance the mission of the cooperative system. And the well-being of its owners.

Not all credit union decisions involve a regulatory issue. But credit unions need to recognize individual actions can have system wide consequences on the reputation and public support for their special status in financial markets.

Just as Hauptman has drawn up his initial talking points, so too are credit unions, or their lobbyists, asserting their priorities: protecting interchange fees, the tax exemption and reducing over-regulation.

But are these the primary issues that should form a collaborative agenda for the next four years? How do credit unions balance their increasing financial stature with the absence of any effective member owner governance?

Is the growing mergers of sound credit unions and removal of local roots in the long term interests of the members? What is credit unions unique responsibility, if any, in addressing the needs of individuals left behind or the macro issues such as the national shortage of affordable housing?

Ultimately an effective leadership agenda is a collaborative process. No institution has all the answers. Listening to competing agendas and reaching a consensus is the art of political compromise.

Some “leaders” will want to avoid this task preferring to assert the power of their appointed or earned positions. Getting after it may work in the short run. Americans respect authority implied by the rule of law. But it is not a formula for lasting change as we see the current approach of a new administration just overturning the priorities of the former.

Credit unions and the regulator are at their most effective when each uses their special skills and experiences to work cooperatively furthering the best interests of members, not a partisan agenda.

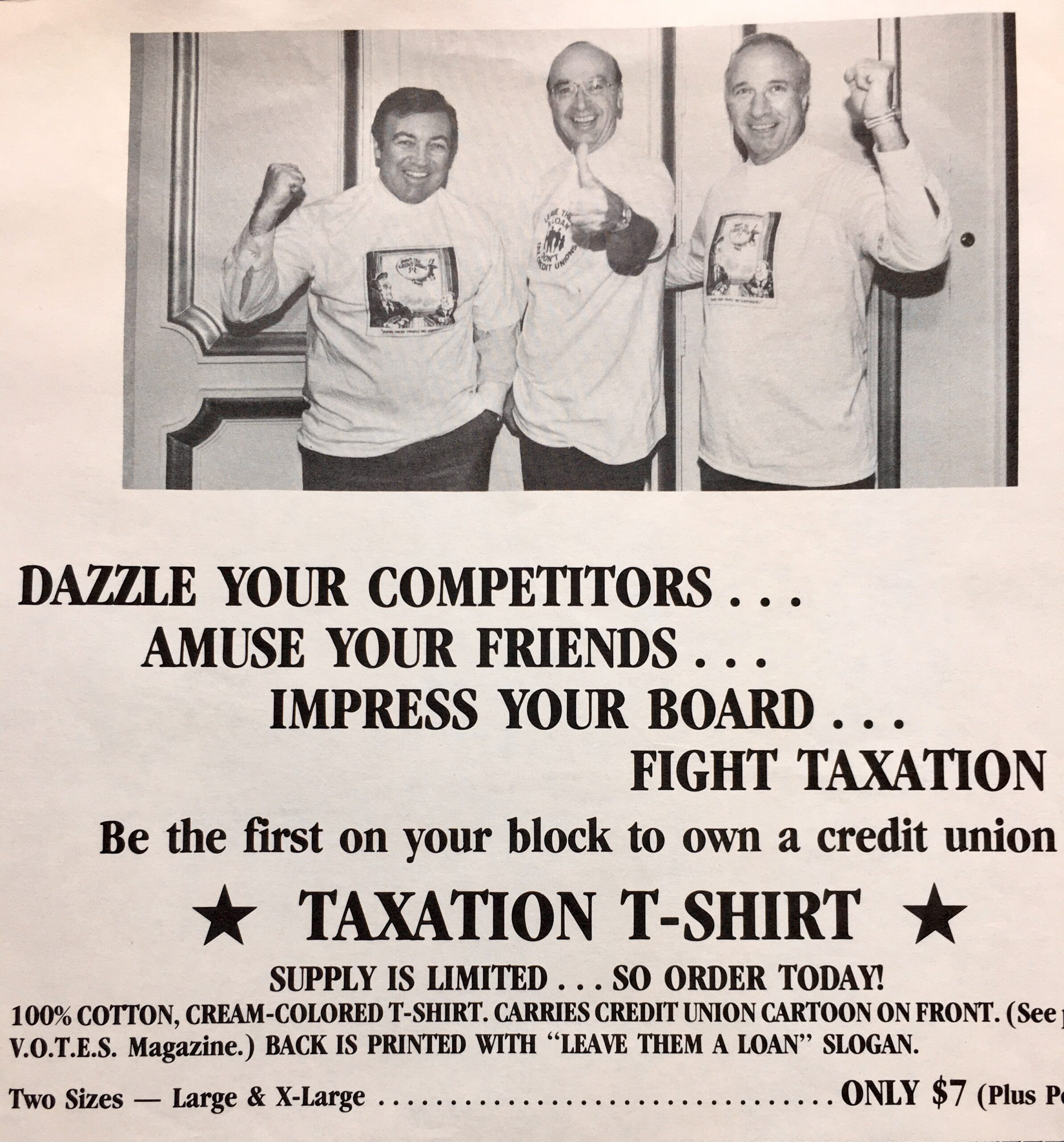

Here is an example of how an NCUA board and credit unions responded to the issue of the movement’s federal tax exemption in a prior administration transition.