(This is the second of two posts on the first and only National Examiner and Credit Union Conference in December 1984 organized by NCUA. Part one is here.)

In March 1984 when NCUA announced its organization of the first ever National Examiners’ Conference in December in Las Vegas, much skepticism was heard.

The first concern was “You will need professional planners or you’ll never pull it off.” But NCUA central, regional and field staff put the conference together piece by piece without hiring a single consultant.

To get the lowest possible hotel room rate, NCUA booked the MGM Grand Hotel for early December. The critics were not optimistic. “Credit union people will never come to Los Vegas two weeks before Christmas.”

And the ultimate quip, “You think credit unions are going to pay to meet with their regulator?”

Once the marketing started, a limit of two per credit union had to be imposed. As one credit union explained, “I knew it would be a sellout so I reserved 12 slots up front so I could take all my volunteers. We’ve never been to a credit union conference and a lot of things are coming down the line. I thought it was extremely important for them to see what was going on.”

By October the conference limit of 2,500 had sold out. No new registrations were possible. A wait list was set up.

Examiners Come First

More than 900 federal and state examiners and regulators met from Monday through close of business on Tuesday. The goal was sharing experience and expertise. One theme of the conference was the changing economy. America was moving into a new era transitioning from an industrial economy to an information one.

Financial transactions were about moving information for members. Credit unions were at the center of this change. According to the most recent American Banker consumer survey, they had become America’s favorite financial institution.

Chairman Callahan opened these initial sessions saying, “Better trained examiners and better communication between federal and state regulators and credit union officials are essential in a deregulated financial environment. This national conference is a chance to discuss current concerns and share problem solving techniques.”

Some examiners had been on the job for years; others for just months. One commented about this joint effort: “We’ve always been first cousins but never knew each other. I was surpirsed to learn how much we have in common.”

One professional challenge was the increase in examiner responsibility. NCUA had been delegating to the regions and their field staffs greater responsibility for safety and soundness. The need as one NCUA executive stated was “to get close and stay close” to credit unions.

Case studies were presented in breakout sessions to practice analysis and problem solving approaches. The Early Warning system of 1 to 5 ratings was reviewed. NCUA was the first federal regulator to share its individual ratings with the institutions it supervised. Not all agreed this was a good idea. One regional director said some credit union managers used the ratings as a measure of personal performance and for negotiating higher salaries.

Dual chartering came up at several panels. Private coop insurance representatives sat alongside NCUSIF examiners. The focus on choice of charter was critical to the evolution of the credit union system. Share insurance options were an essential component of a meaningful dual charter choice which provided a check and balance on each system’s responsiveness. It was pointed out that deregulation of savings accounts, field of membership options, and broader investment choices had occurred first in individual states before these were adopted in the federal system.

The Grand Convocation

On Wednesday 1,500 volunteers and professionals joined for panels, workshops, and informal conversations. There were over 300 speakers and 60 different breakout sessions. While some of the sessions were repeated, the plenary sessions and many of the panel discussions were filmed, edited and then rebroadcast on the conference’s 24-hour video magazine. These excerpts were shown over the MGM Grand’s in-house television giving attendees a chance to watch sessions they couldn’t make. The broadcasts also included live interviews and comments from attendees.

Major topics included the future of the common bond with a panel of both state and federal regulators; how to monitor investments and find useful information; whether deregulation was beneficial for consumers and financial institutions. Breakouts covered mergers, the role and future of CUSO’s, and changing examiner skills and new analytical data base resources.

Richard Breeden, the Vice President’s Deputy counsel for Financial Institutions, moderated the panel Is the Regulator Obsolete? Will technology and the speed of money transfers make it impossible to track critical changes in a timely way?

Federal Reserve Governor Martha Seeger described how deregulation had changed the role of regulators: “We must think of ourselves as business advisors, not as policemen. To me, examiners and credit union mangers are partners in fostering depositor trust and we have just got to work together in this.”

Popular sessions at both parts of the conference were led by Rex Johnson, the president of a newly charter credit union in Illinois. He had been deputy supervisor for the Chicago office of the DFI before taking over the cu startup. His had provided training for NCUA examiners using actual examples of credit underwriting prior to this conference. Rex’s unique collections of case studies generated a lot of interaction. He noted, “We had a lot of fun in the breakouts, but more important we learned a lot from each other”

The Bottom Line and Bigger Story

One of the guest speakers was former Marquette basketball coach Al McGuire. He remarked: “You’re a family; you’re a team and there’s no “I” in team. Credit unions are on a fast break and have unlimited potential. You must make the maximum effort and you must be together.”

The conference was a gathering where people could translate a belief in themselves and their credit union into practical terms. Comments included: I’d give it four stars , , , because of the enthusiasm of the people and the direct involvement of NCUA Chairman Callahan himself. Usually people at that level don’t become involved. He lit one hell of a fire in Las Vegas.”

That fire was because this first National Conference of examiners, supervisors and credit unions showed that their efforts were all part of a bigger story. Everyone contributes, no matter their credit union’s size or time on the job. What each does individually adds to the greater purpose of the cooperative system in America.

Selected Photos

Dick Ensweiler, President of the Illinois League, Callahan and Board Member Mack. The League presented Ed with a framed motto on his departing for NCUA, that read We Don’t Run Credit Unions. It was in the Chairman’s office at NCUA.

Larry Blanchard then editor or Report on Credit Unions. He worked for Austin Montgomery at NCUA, ran a credit union and has been involved with multiple credit union firms from TruStage to Callahans–still to this day.

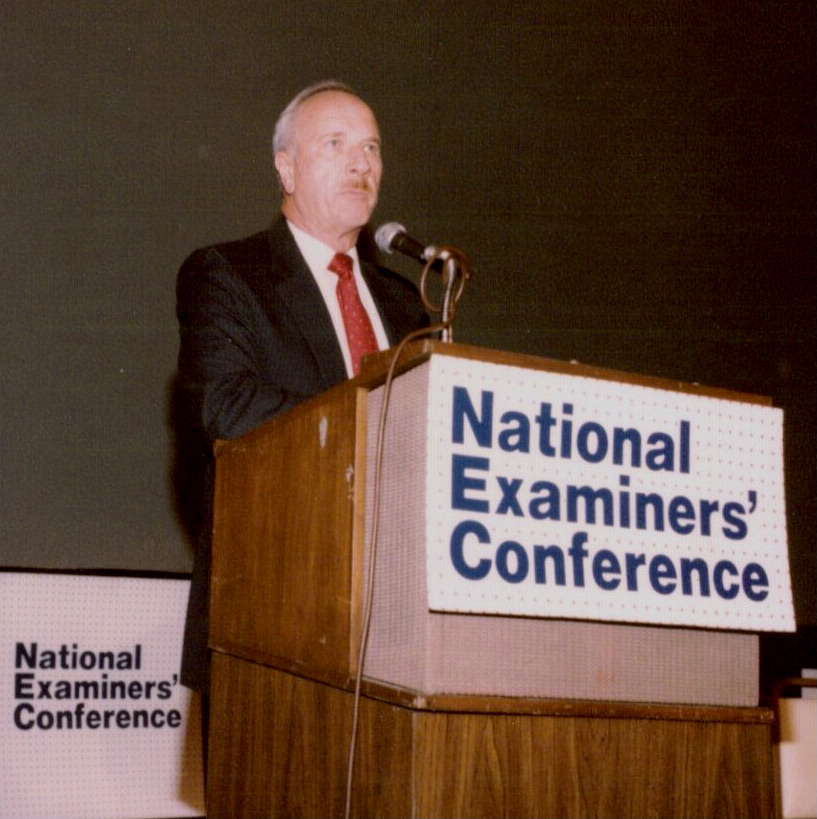

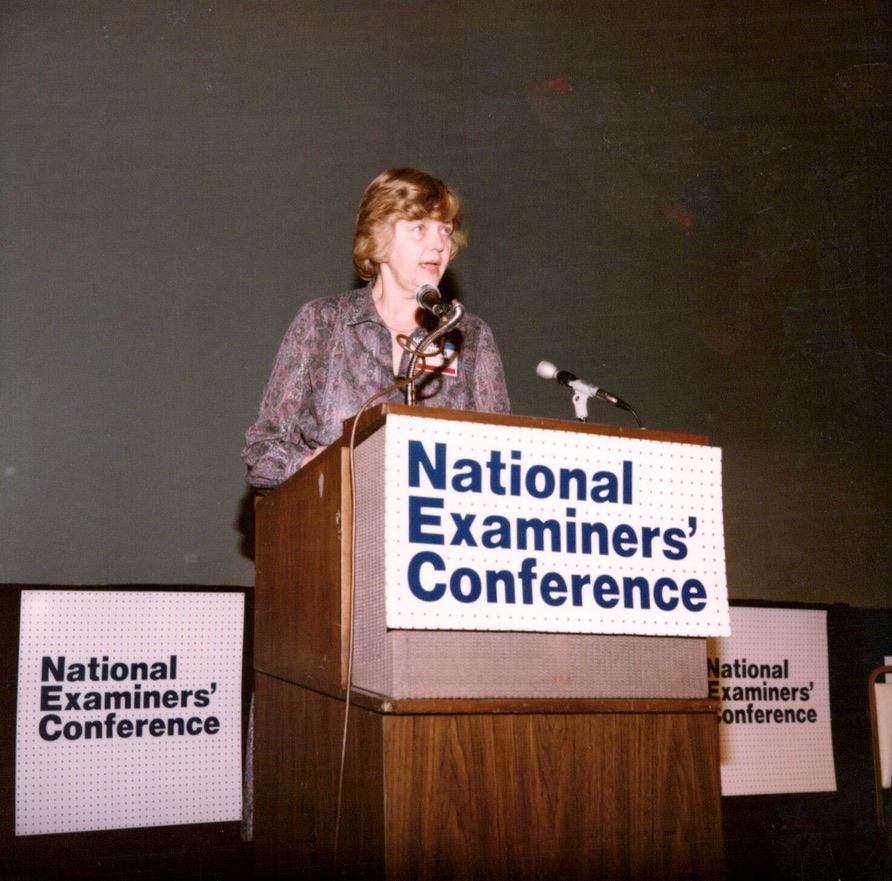

Federal Reserve Governor Martha Seeger speaks to the full conference.

NCUA Executive Director Bucky Sebastian with regional directors Carver, Riley and Skyles.

Texas credit union Commissioner Pete Parsons and NASCUS Chair on a panel on dual chartering.

Carmen Hyland, credit union attorney, mother of Gigi. (corrected from first description) Her daughter became counsel for a corporate credit union, NCUA board member and President of the National Credit Union Foundation.

At a reception: Ted Bacino, NCUA Director of the Office of Administration, Laura Rossman, Senior Advisor to PA Mack, and Callahan.

There are two NCUA videos of the conference plus more than 300 more photos if someone wants to use in a more detailed report on the event.