A critical strategic advantage for most credit unions is location, a place members can see and access as necessary. A local office serves a different and broader role than just convenience. While telephone or virtual web access are necessary, they are not the same as a unique presence.

A credit union office serves notice to the community that the credit union is theirs. Members not only have interaction with employees but also with each other. Many credit unions use signage and participation in events to reinforce being part of the community. Local emloyeess and directors provide real time market knowledge that are impossible to acquire in other delivery channels.

Following are two examples of service experiences, one remote and one in person. Both involve a member trying to resolve an issue.

A Remote Service Experience

Even before I read your article on Credit Union 1, I have been preparing to leave for another credit union. The credit union has become just a computer Bot. Call member service and it takes 15 minutes to get around the automated phone responder “LUNA”. You can repeatedly ask for a member service rep but she always has another set of buttons for you to press. I’m not against automation and use it often to transact much of my personal business. But when you need to talk to a person that is not an option.

Recently the credit card company they use overcharged me. I called CU1. Immediately they put the transaction on hold and referred the problem to the Credit Card Bank. After filling out several reports to file with the card bank and months (June to October) of waiting for them to remove the charges I was notified that they were going to go ahead and put the charge on my credit card as they did originally.

Contacting CU1, they gave me instructions on how to deal with my credit card bank and the airlines to maybe solve the issue. We’re talking about $775 and no help from the credit union. And I do not like the card processor. More electronics and fewer personal assistance.

I know this sounds like someone from the past not being up to date with what is going on in the present; but really I make many of my daily transaction payments with my Apple watch; having connected voice over internet protocol for my home phone service; and many more. I do like the speed and direct processing that the new electronics offer, but it can’t replace a person for everything.

Remote Islands, Microsites and Personal Service

Tongass FCU, Ketchikan, AK serves Southeast Alaska with locations in a region of islands (the Alexander Archipelago) and the Tongass National Forest. No roads connect these islands!

At September 30, 2024, the credit union reported $228 million in assets from 13,710 members served by 13 branches and 85 employees.

CEO Helen Mickel has worked at this 61-year old credit union for 22 years. For the credit union the distance to the nearest branch often requires a small plane or ferry.

It has developed Community Microsties to meet the financial needs of remote coastal villages. Microsites are built upon a relationship between TFCU and the local community. The community invests in TFCU by opening accounts and providing a free space to operate, while TFCU provides an ATM, lobby hours, and local jobs.

The future: TFCU seeks to build community-microsites and branches to promote prospering communities. We believe that a financial institution is a pillar of a community. It brings education, opportunity and financial access to the remote villages and towns of our beautiful state.

Here is a story with pictures from Helen of what this sometimes requires in practice.

A Grumpy Member

It started with a very grumpy member threatening to close her account, to one of the best visits I’ve had with a member!💯

The mail is tricky in southeast Alaska and our statement vendor is in the lower 48.

This grumpy and worried member told me over the phone she was going to pull her money out on Monday because she still hadn’t received her monthly statement for August. I told her I’d like to meet her when she comes in and asked what time she would be at the credit union.

She said she heard the weather was going to turn and maybe she wouldn’t come down after all. She uses a cane and has 45 stairs to navigate when she leaves her home.

I offered to bring her a printed statement and introduce her to our assistant branch manager, Sabrina, so she wouldn’t have to leave her house. She liked that idea.😊

When I called to make sure she was okay with us stopping by, she said, “Yes! I’ve been waiting for you!”

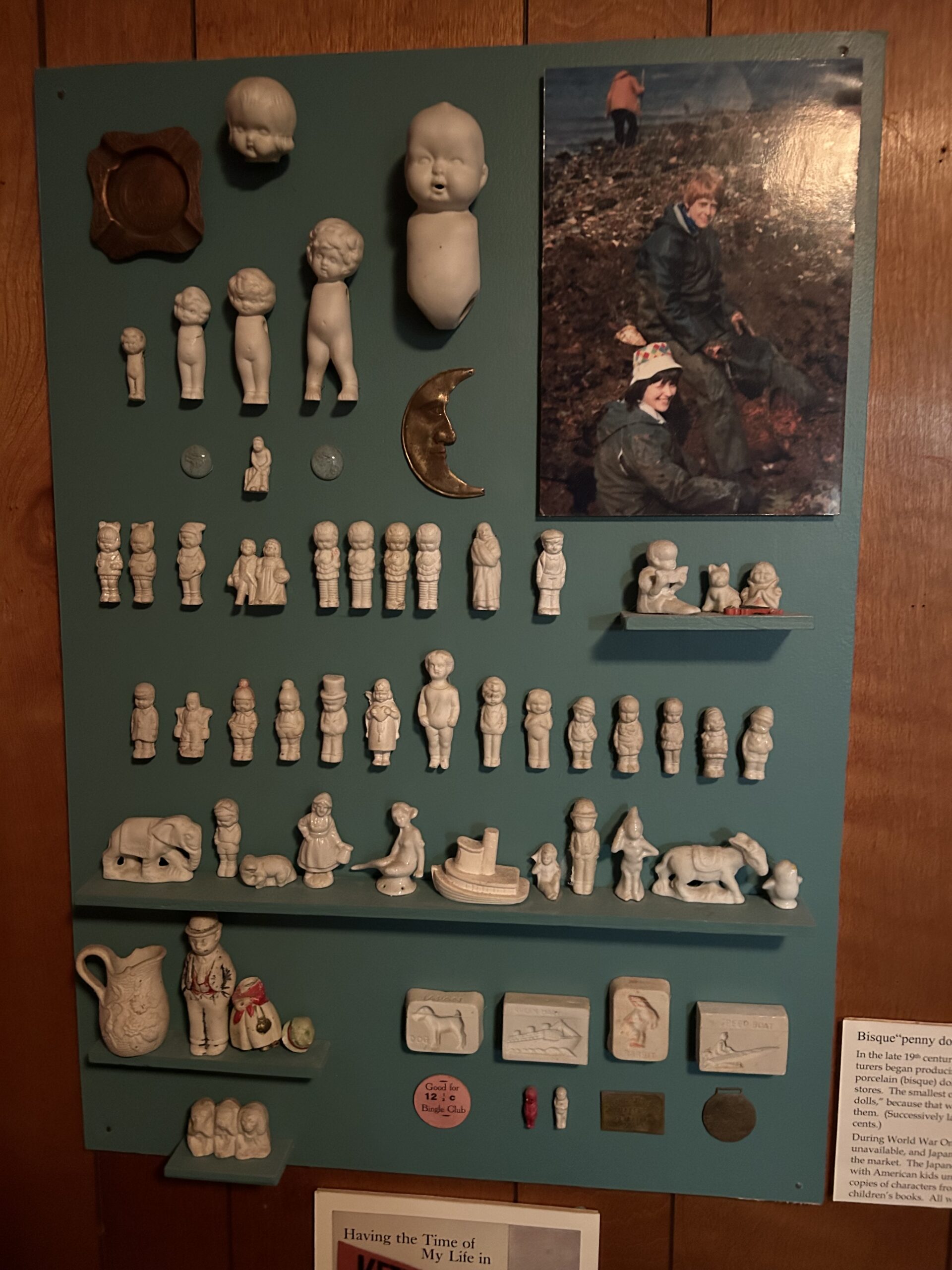

The Member’s Museum

What a wonderful time we had! We worked out our business problem and then got a tour.

She had a “museum” of artifacts she had dug up on beaches and old community sites all over southeast Alaska! We talked about the good old days of early Ketchikan and shared stories.

I took pictures and told her I would be posting them and she was okay with that. She has lived in her home for 80 years – her whole life. It was the “cabin” for the first house that was built by her family on the side of a mountain.⛰️🌲

Pioneer members are some of my favorites. I love it when something difficult turns into a blessing for everyone! I couldn’t have started the week off better! ❤️