On October 15, Callahans offered a free webinar that analyzed the macro trends of all credit unions with less than $500 million in total assets.

The link to the recording and the slides can be found here. The significance of this macro-micro analysis is two-fold.

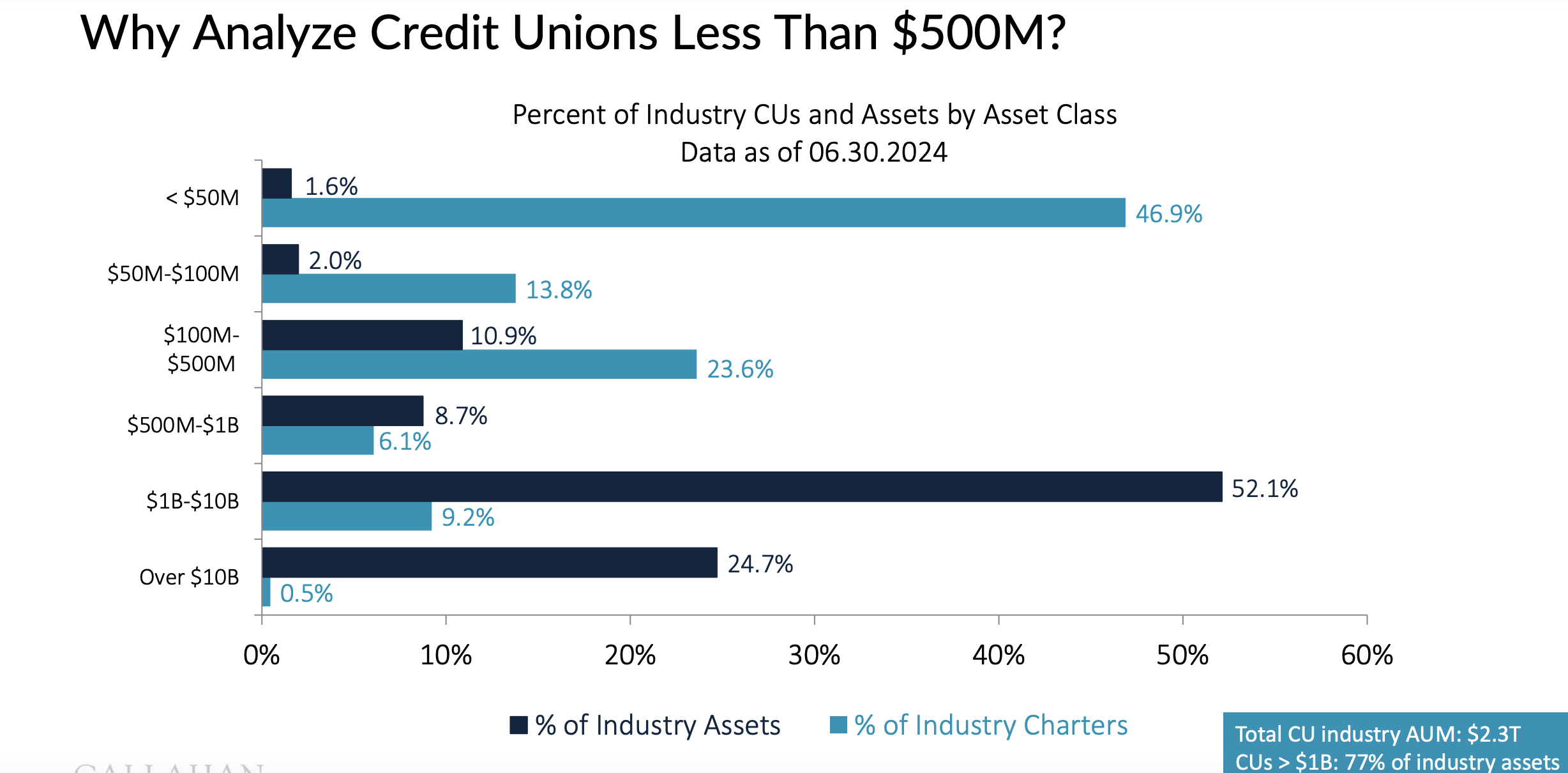

As shown below, this segment makes up over 84% of active charters. Secondly, as you listen to the analysis and comparisons with all credit union trends, the differences are not as dramatic as one might assume. On a number of indicators, this segment outperforms all credit unions since 2019 (eg. delinquency and charge offs).

The all-industry five-year trends reflect the performance of credit unions over $500 millions as these account for 85% of industry assets. However the differences are small (eg. ROA). In some cases the differences have nothing to do with scale, but rather business strategy. An example in the webinar was the higher apparent member increase in larger cu’s; however, the analyst attributed this to third party loan originations, not organic growth.

Listen to the presentation. If one were to view these 84% of charters as the movement’s seed corn, the opportunities for the future would seem promising. Especially in the 4,000 or more groups and communities they serve. What will be critical is that existing institutions and approaches support the feeding and tending of these institutions. And not their acquisition by performance-challenged larger institutions.

This is the webinar’s initial data slide showing the segments by percentage of institutions and asset size as of June 2024.

(Note: See current article in CU Today, Small Credit Unions Beating Big Credit Unions in Key Performance Area for latest confirmation of the webinar’s thesis)

The top 100 US-based Coops by 2023 Annual Revenue

From the Report’s Introduction: Since 1991, the National Cooperative Bank (NCB) has published its annual NCB Co-op 100®, highlighting America’s top 100 cooperatives. In 2023, these member-owned, member-controlled businesses generated revenues of $325 billion, a slight increase from 2022. Many of these cooperatives that appear on the list are household names and are known throughout the world.

The full listing begins on page 10. Credit unions hold 4 of the top 50 positions as follows: Navy FCU # 9; State Employees NC # 28; PenFed # 33; and BECU # 44.

Nine credit unions are in the second 50. I will let you look them up here.

I found interesting that while credit unions account for 13 of the 18 institutions in the finance category, there are five other financial cooperative charters serving specific sectors of the economy such as agriculture.

The NCB Report provides an overview of the role of major coops, many familiar to consumers: REI, Ocean Spray, Land ‘O Lakes and ACE Hardware. This summary is a quick and useful introduction to areas of the US economy which have coop options.

A Brief History of Women and Credit in the US

Fifty years ago, it was legal to deny credit to a woman without a male co-signer.

Read how this situation was changed by Congressional legislation. Since women such as Louise Herring played a vital role in the creation of the cooperative alternative, one might assume that “free market” innovation or competition can be relied upon to rectify prior shortcomings. That is not always the case. Until finally corrected by rule, generations can be denied lifetimes of equal opportunity.

Sometimes the market is only “free” for those who already occupy positions of power and advantage.

What is your “Plan B” If Your Presidential Preference Finishes Second?

This question was asked at a recent conference in which the current campaign was a primary topic. The one answer I heard was by a person who would invest his time and effort into local organizations and issues. He believed this provided a better opportunity for compromise and creating shared solutions versus the ideological divides at the national level. He also believed that this is where democratic practice is learned and becomes a foundation for change at higher levels of political leadership.

Supporting this thesis is a movie just released on Netflix called Join or Die. The film chronicles what it calls the “unraveling” of the country’s social fabric and seeks to answer the question: “What makes a democracy work and what can I do to help?”

David Brancaccio interviews the film’s co-producers in this brief article. I will be seeing the movie this Sunday at a local church. One of the film’s messages is on the importance of community connections. I will be looking to see if credit unions are one of those local organizations mentioned.

Enough reading for one weekend! Get ready for Halloween.

We need these “smaller” credit unions. The work they do for their members as well as their performance is critical to the credit union movement!