There have been pivotal years in credit union history, none more so than 1984.

NCUA and credit unions celebrated unprecedented market place, legislative and industry financial success. NCUA issued over 100 press releases over the 12 months. These announcements covered credit union performance, agency initiatives, and multiple press and political comments on the cooperative system. Here is a very small sample, in date order, of these Agency communications:

Jan 4: American Banker reports credit unions grow faster.

Jan 11: CLF pays quarterly dividend of 9.0%.

Jan 16: NCUA Acts to recover Penn Square losses

Feb 15: Credit Union Stamp Released in Massachusetts

Feb 29: Symposium on College Student Credit Unions

Mar 6: Financial Performance Reports a Hit

Mar 9: NCUA Board to Meet in Tucson

Mar 14: Credit Unions Fastest Growing Financial Institutions

Mar 21: Callahan Testifies Before Senate Banking Committee on Insurance Fund Capital

Mar 24: NCUA to hold First Conference of Federal and State Examiners

Apr 4: Banking Committee Approves Capitalization Bill

Aor 18: NCUA Names Koppin Supervisory Examiner of the Year

Apr 30: Credit union Statistics for March

May 15: NCUA Central and Regional Office Realignment

May 24: NCUA Investment Hotline Unveiled

May 30: Credit Union chartered for Cannon Hills Employees

June 19: 50th Anniversary Celebration

June 22: President Issues FCU Week Proclamation

July 18: President signs Bill to Strengthen Insurance Fund

July 26: NCUA 1985 Budget down 4.9%

Aug 21: FCU Growth Surges at Midyear

Aug 31: Two Per Credit Union Limit Placed on Las Vegas Conference

Oct 9: Board Adopts Capitalization Rule

Oct 12: Credit Union Membership tops 50 Million

Oct 22: Credit Unions Most Popular Financial Institutions

Nov 15: Board Slashed Operating Fee Scale 24%

Nov 23: Seger, Breeden, Connell, Pratt Announced as Speakers at Las Vegas Conference

Dec 18: American Banker Reports CU’s Growing Faster than Thrifts

Over 70 additional releases about key Agency and credit union events were issued.

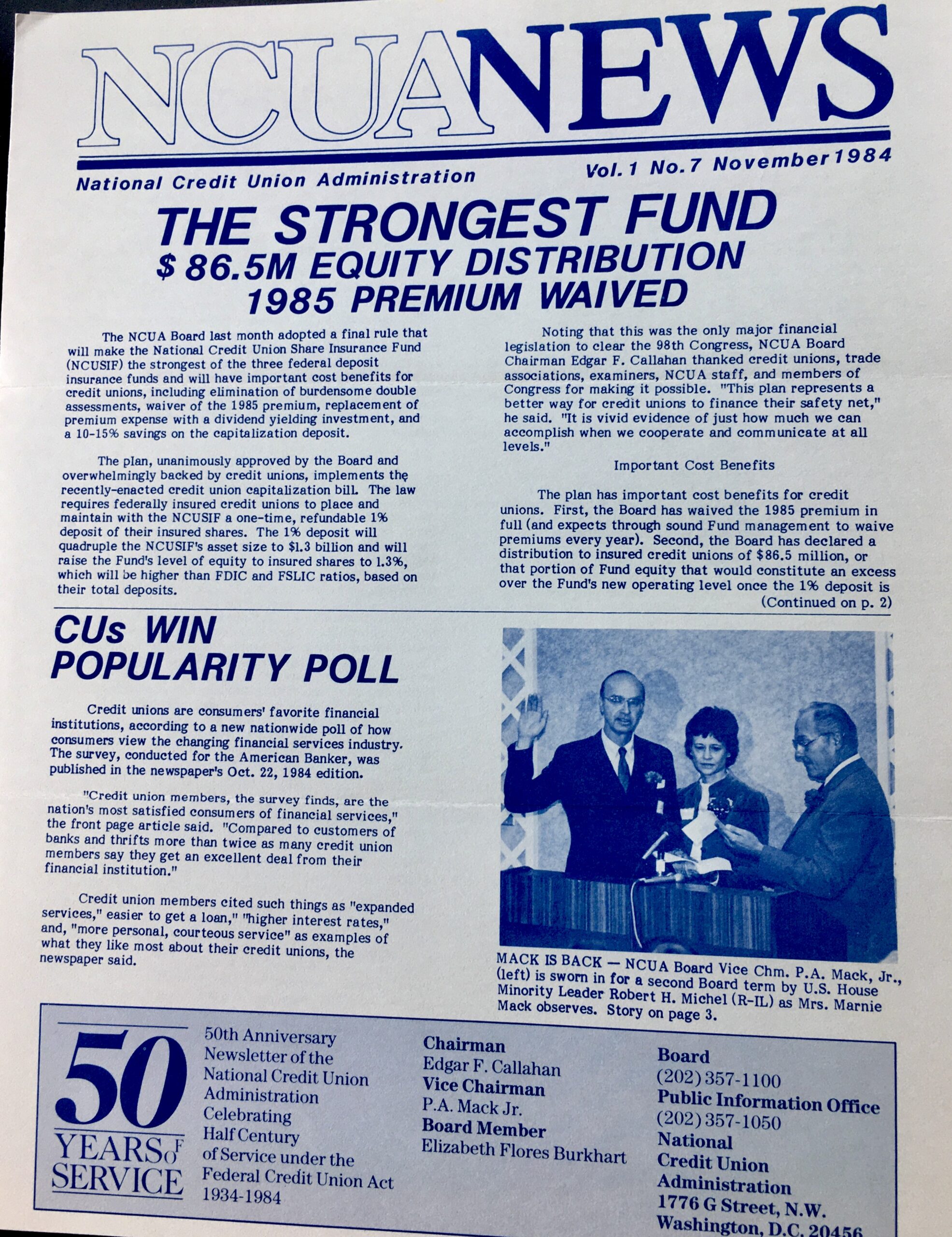

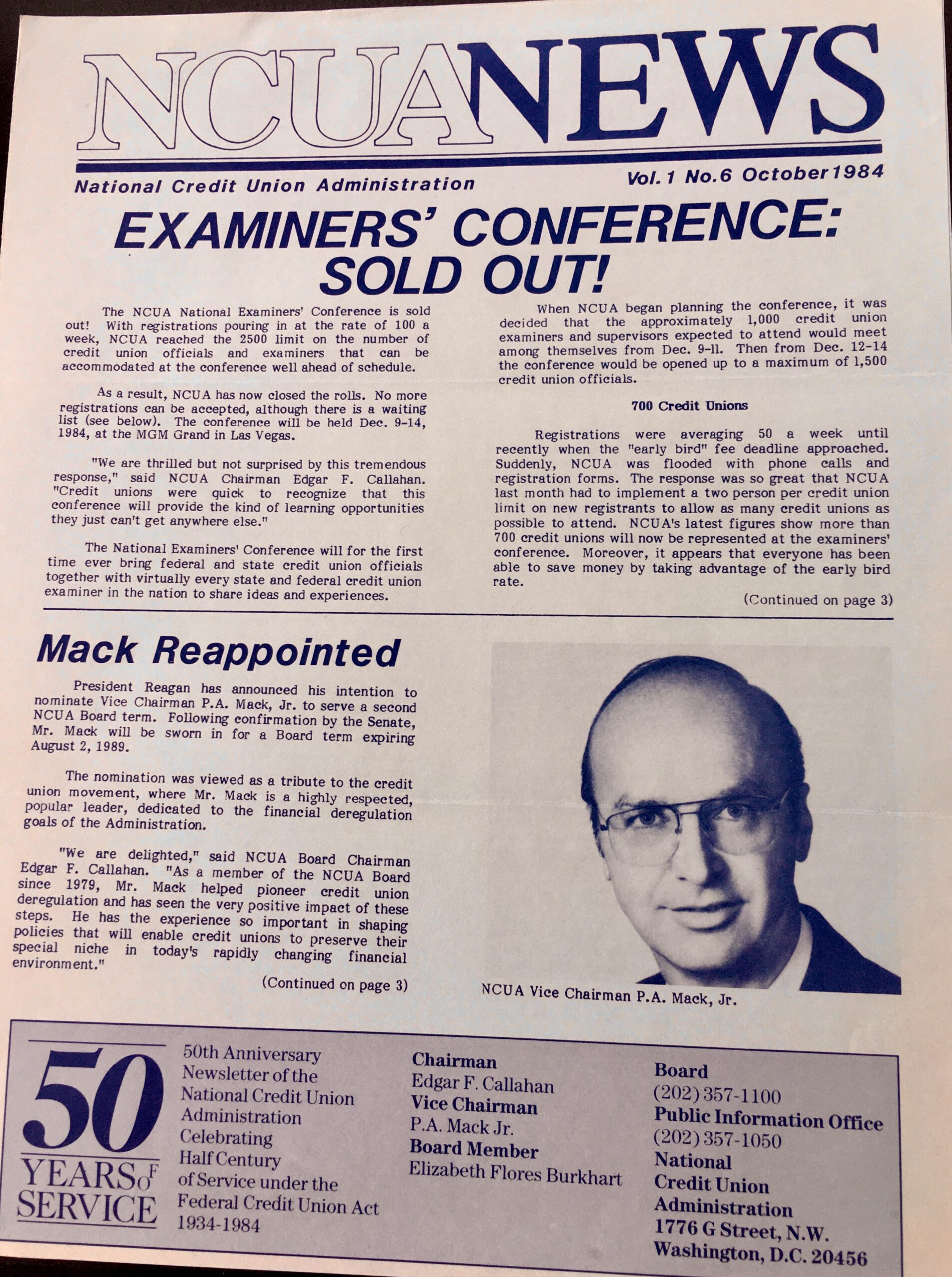

All of these releases were amplified in the monthly NCUA News sent to all credit unions as shown in the samples below.

Additionally, NCUA created a Video Network in which the Agency communicated significant changes and events both internally and with credit unions. Here is the brief opening segment of an hour long video introducing the recapitalized NCUSIF.

(https://www.youtube.com/watch?v=Wsq74FkMrPQ)

Forty Years On and Context for Today

In 1984 there were over 16,000 active credit unions. All FCU’s were examined annually overseen by six regional offices and a staff of just over 600. The brief excerpts above of the Agency’s wide-ranging activities and reports are a tiny sample of the interactions and communications with the credit union system, Congress, the White House and the public press.

These events occurred in the third year of Ed Callahan’s chairmanship which began in October 1981. The NCUA board, Bucky Sebastian, Executive Director, and the Senior staff believed that public service is a public responsibility. Senior employees were available, willing and eager to engage with all constituents. And most importantly. accountable to those who entrusted their funds and members’ futures to the regulator for oversight.

A highpoint of this interaction was the December 1984 National Credit Union Conference organized and led by NCUA with the support of the credit union system. It was a first for NCUA, and the largest conference ever held at that point in credit union history. The event was a coming together to celebrate the cooperative system’s growing relevance and success. And to share views about the future of the movement by all those who were dedicating their lives to their members’ well-being.

In 1984 as this year, there was a Presidential election. Everyone remembers the outcome. NCUA’s leadership and its results in 1984 are a reminder that good government is also good politics. An example especially relevant now, four decades later.