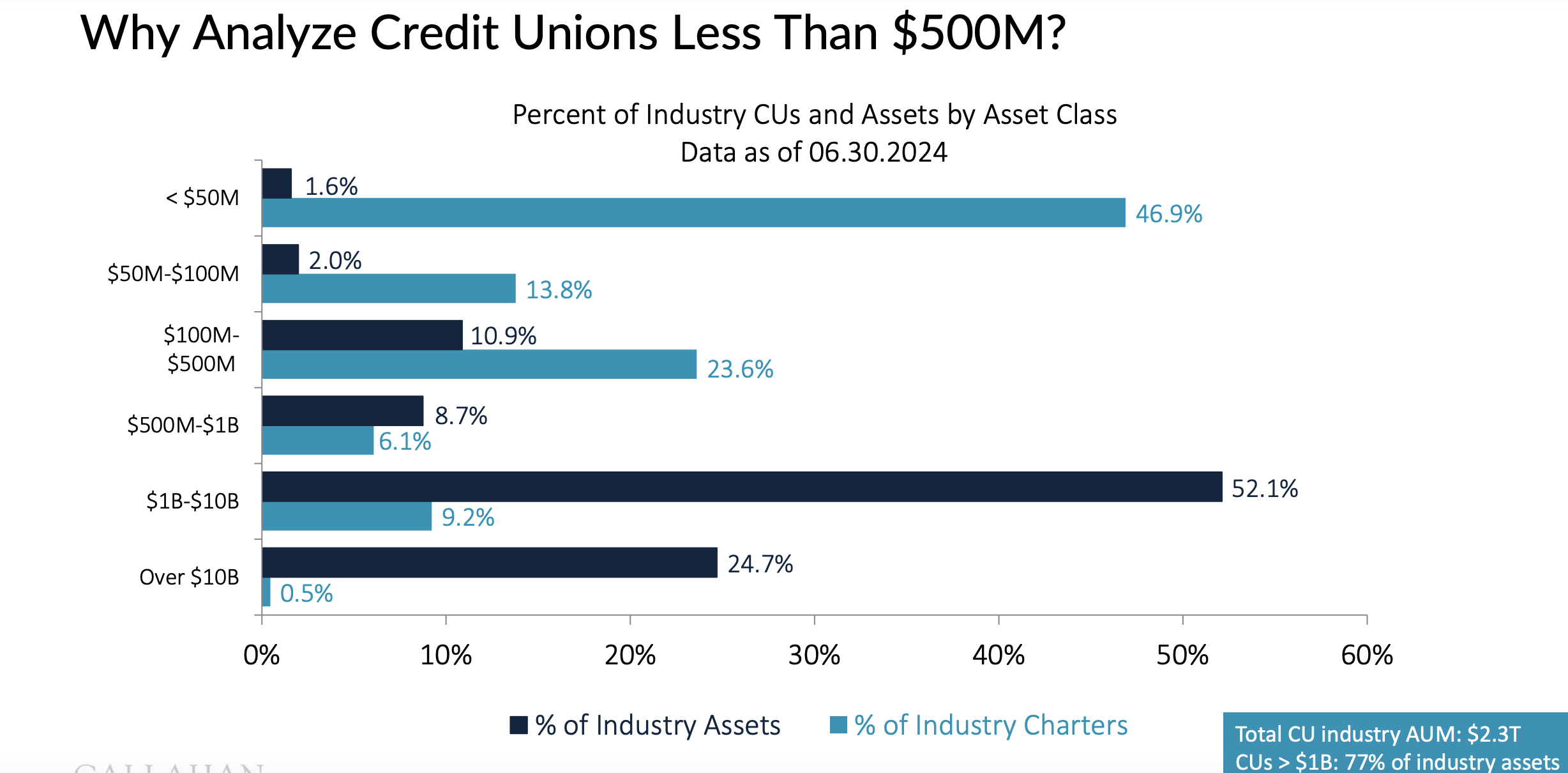

Synopsis: This detailed analysis of Credit Union 1 (Illinois) presents a pattern of declining financial performance covered up by multiple merger acquisitions, one-time sale events and rented capital. The future fortunes of eleven local sound credit unions have been destroyed in just two years. I believe this kind of predatory activity, left unexamined by all those in positions of responsibility, will lead to a reassessment of the advantages of the credit union charter by external legislators.

The article’s length is to present as much of the facts from these events so readers can make their own assessments. The situation summarized is I believe an example of internal industry reckless actions which present a false perception of success. The question for readers is: Does something need to change?

When there are no guardrails for a financial institution, anything goes. It is the law of the jungle; or what some describe as free market capitalism.

The dictionary definition of rogue is “an elephant or other large wild animal driven away or living apart from the herd and having savage or destructive tendencies.” Another reference is to unprincipled behavior by a person or persons.

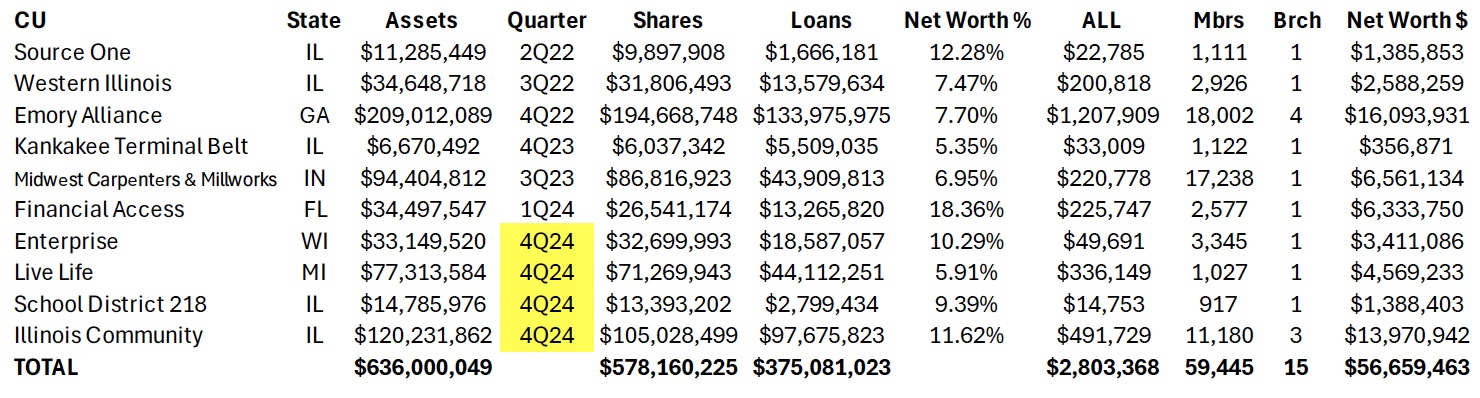

This word rogue came to mind as I reviewed the activities and results of Credit Union 1 in Lombard, Illinois, since its conversion from ASI share insurance to NCUSIF in February 2022. A summary of the credit union’s merger tempo since this insurer changeover is shown in the following table for the ten already completed or scheduled to be by the 4th quarter of 2024.

In its October 2024 Member Notice, Synergy listed 23 Credit Union 1 branch operations in six states including the head office in Lombard, Illinois. The two furthest branches are in Bradenton, FL (1,230 miles) and Henderson, NV (1,750 miles apart).

Other new or ongoing initiatives along with this accelerating merger expansion activity include:

- The credit union’s continuing and new sponsorship and marketing promotions with four outside organizations:

Official Banking Partner of Notre Dame Athletics

Naming rights to the UIC Pavilion, Chicago, for 15 years and $750,000 in scholarships for a total of $10 million

Credit Union 1Amphitheater, Tinley Park naming rights

The Western Conference tie-in: On October 3, 2024 the Big West Athletic conference announced Credit Union 1 had become its official financial and literacy partner and the entitlement partner for the Mountain West Basketball Championships and all Olympic Sports Championships.

- On June 3, 2022 Credit Union 1 announced agreement to purchase the $311 million NorthSide Community Bank, located an hour north from Lombard in Gurnee, IL. Both boards approved the transaction subject to regulatory and bank shareholder approval. The deal was not completed. There was no public explanation.

- In May 2023 Credit Union 1 announced it would serve New York cannabis entrepreneurs who plan to open marijuana businesses as part of the state’s CUARD coalition. The same CUTimes article reports, “Credit Union 1 has been selected to participate in the Illinois Department of Commerce’s Cannabis Social Equity Loan Program and is also the preferred banking partner of the Chamber of Cannabis in Las Vegas..”

- In April 2022 DEI and Credit Union 1 announced plans to build three new branches in Chicago, Springfield, and Southbend, IN.

The Merger Frenzy

Even with these multiple marketing and business initiatives, the core of Credit Union 1’s growth efforts are mergers. The operational intensity of acquiring and converting 11 credit unions (six outside Illinois) and all associated member and vendor relationships in just over two years would be a major operational challenge for any organization.

The immediate question is how will the members of the merged credit unions benefit?

In the Member Notices posted on NCUA’s website for these combinations, the wording used under Reasons for Merger, Net Worth and Share Adjustment or distribution are identical. Members’ collective reserves are never distributed to owners even when the merged ratio is higher than Credit Union 1’s.

But zero is not what several of the merging CEO’s and senior staff are gaining.

Rewards for the Enabling CEOs

In the case of the $34.4 million Enterprise CU in Brookfield, WI, the 24-year tenured CEO, Jeff Bashaw, will receive a minimum ten-year contract with a base salary increase of $38,000 on top of his current compensation. I estimated (absent the required 990 IRS filing) that to be a minimum of $125,000 per year plus a $100,000 bonus upon closing. Total minimum amount $$1,350,000.

The credit union is in sound shape at 10.6% net worth, a profitable, single branch with low delinquency. After turning over his CEO responsibility, Bashaw’s role if any will be a branch manager or other honorary title. This ten-year contract with a pay raise seems merely a lengthy sinecure. The 8 employees and 2,815 members receive nothing-except the retiring CFO who will receive a bonus and severance of $110,000.

A Minority Depository Institution Leader?

At the $34 million Financial Access FCU in Bradenton, FL, the situation is more complicated. The credit union prior to merging, reported a 1Q ’24 loss of $517, 310. However, its net worth was still high at 18.4% ($6.4 million) and delinquency of only .39%. Was this a temporary loss or other problem?

In this merger CEO Sherod Halliburton is receiving a total of $3.2 million composed of a bonus of $125,000, an eight-year employment contract at $200,000 per year, and 100% immediate vesting of a $1.5 million split life benefit plan. He no longer has any CEO responsibility as the credit union will become merely a branch operation. The 15 employees and 2,577 members of Financial Access received nothing for their loyalty.

In a CEO Profile published by Inclusiv in February 2022, prior the merger efforts, Halliburton is lauded for his leadership. The article remarks on “his strong community ties and business acumen and how he decided to “bet on me” when offered the CEO position” eight years earlier. Further he points out that he is “one of a limited number of African American men running a financial institution and he accepts the great responsibility accompanying that honor.”

The profile lists his efforts “toward racial equity and responsibility.” He states, “We’ve gone from a somewhat negative perception . . . to now being viewed as a vital part of the economic infrastructure.” The credit union received two technical assistance grants to upgrade technology to meet his goal to double membership in three years. He closes with this affirmation: “We’re here to change lives. I want that to be the enduring message even when I’m gone.”

This Bradenton community credit union which he described as “a vital part of the economic infrastructure” no longer exists. Halliburton is now a Market VP for Credit Union 1 for the next eight years.

An October 2024 Approved Merger

The most recent example of CEOs cashing in is the $116 million Illinois Community CU with over 11% net worth and delinquency of .5%. In this acquisition, CEO Thor Dolan will receive a minimum in immediate total benefits of $1,904,494.

This total is described in the Member Notice as follows: a retention bonus of $150,000; deferred compensation of $50,000; a salary increase of $33,724 added to his 2023 reported 990 compensation of $245,770 or $279,494 per year (no employment length given}; and immediate 100% vesting of a $1,425,000 split dollar 20-year life insurance benefit plan.

This salary increase is despite the fact he is no longer CEO, either managing branches or a regional rep, both with no CEO operating responsibilities. Every additional year he remains employed will add another $280,000 to the package. There is no indication the 38 employees (except the CEO and CFO) gain any assurances of employment; and the 10,482 members receive nothing.

The Fates of the Merged Employees and Members

Each Member merger Notice posted by NCUA which I reviewed includes two standard assertions:

- The credit union’s branch location(s) will remain open and become a part of Credit Union 1’s nationwide branch locations.

- Employee Representation: Employees of the credit union will be offered employment with Credit Union 1.

However intended, neither of these statements have proved lasting in practice. Comparing the branch listing in the August 2023 Kankakee Valley Notice with the latest listing in the Synergy’s October 2024 Notice, six of the branches in the earlier Notice no longer exist, including three for Emory CU in Georgia and three for Illinois credit unions with single branch operations.

As for employees’ fate, for the twelve months ending June 2024, Credit Union 1 reported a reduction of 67 FTE from 418 to 351.

As a result of Credit Union 1’s merger strategy, there will be eleven fewer local charters which were operating well, a reduction of 70-80 volunteer directors and member committees, and loss of all local relationships and legacy brands.

All member savings and loans, collective capital, liquidity and fixed assets are now in the full control of an institution for which the members have no connection or first-hand knowledge. And in some cases thousands of miles distant. Ironically, Credit Union 1 states in all its promotions that anyone can join, so if members really thought this was a better deal, they could join anytime. But that would be a much harder marketing task than just purchasing the business by paying the CEO—and getting the members’ accounts and accumulated reserves for free.

Members also have a totally new financial institution relationship to navigate. The Credit Uniion 1 material sent to each member post-voting is a 15 page pdf system conversion process and timeline. Member instructions include setting up new payment and loan options, establishing digital accounts and using online financial tools.

Depending on the version usent, the membership agreement for each merged credit union is a minimum and 20 pages. It contains essential information about fees, rates, funds availability, mandatory arbitration and multiple other disclosures which few will be able to read through. The members will learn through experience how everything has changed.

An important difference in Illinois state versus federal charters is the use of proxy voting in all member required elections, including mergers. For Illinois credit unions, proxies are controlled by the board. I did not see this fact disclosed in the FCU mergers, where proxies are not permitted. In essence, FCU members turn their voting governance power over to a new board. These directorst can routinely reappoint themselves without any member vote. More about this later.

Implementing a Capital Markets Strategy-Without the Risk

Credit Union 1’s merger campaign is an adaptation of a traditional capital market strategy of hedge funds and investment firms. Except these buyouts of numerous, smaller independent firms in an industry (think hospitals, barber shops, rental housing, or local HVAC firms) require putting their own capital at risk. These new hedge fund owners then burden their acquired firms with the debt used to finance the buyouts, strip and sell the highest value assets, reduce costs and services to pay for the debt coverage, and ultimately resell the merged business back to the market for a capital gain.

Credit unions reverse this model in mergers—they use the acquired assets, not their own members’ capital, to finance these acquisition sprees. Except when buying banks. The equity in these “mergers” is often transferred in full with no payout to the owner-members. The only necessary sales pitch required is to convince the CEO to bring the board along. There is zero risk to the continuing credit union. The “acquisition” is free. The members lose all their financial and institutional legacy and become subject to the control of a board and CEO that will be completely new to them.

We learn in the Notices that no staff or board due diligence or alternatives is presented. There is rhetoric about “technology and systems that align with members needs.” And, how “internal core values align with our own and . . . confident (that) members will experience a much needed upgrade in the quality of service.” No facts, just vague promises.

These same words were used in the eleven Notices showing the abdication of any director or CEO independent assessment. The words are merely a formula from previous transactions to pass regulatory approval. The members are given no objective measures or specifics that would identify better rates, fees or specific services. Just indefinite promises.

As for core values, institutions don’t have values, people do. So the acquirer’s goal is to find CEOs willing to cash out of their leadership role, rather than evaluate what is in the members’ best interest.

The Numbers Show the Urgency in Credit Union 1’s Merger Efforts

Some readers may believe this is just another example of self-dealing in mergers. It is. But there is a major financial imperative driving this effort.

Credit Union 1 is desperate for mergers not simply for growth, but because its financial performance is a house of cards. For the past five years it has been unable to generate a normal operating net income from its own balance sheet assets. As a result, it has turned to non-operating gains, acquired and borrowed capital (sub debt) and other financial options that disguise its very poor or sometimes non-existent internal rate of return. Here are some of the numbers.

At December 2021, Credit Union 1 had $106.8 million net worth ($98.9 Undivided Earnings -UDE- and $8 m other reserves). The net worth ratio was 8.7%. Net income of $13.8 million that year was largely driven by a $7.5 million non-operating gain on sale of fixed assets.

At June 2024, the credit union reports just $88.6 million in undivided earnings, $8 million in other reserves for a total $96.6 million, that is $10 million lower than at December 2021 total.

To report an acceptable net worth ratio the credit union now includes $20.5 million in subordinated debt (borrowed capital), $45.1 million in equity acquired from credit union mergers, and a $7.1 CECL transition reserve. Without these non-operating additions to reserves, Credit Union 1’s net worth ratio would be only 5.8% versus the reported 10.2%.

But even the $88.6 million in UDE at June 2024 is misleading. At yearend 2020 the credit union reported $16.9 million in land and buildings. Three and a half years later, June 2024, the total is just $2.9 million. In the same period the credit union reported $15.1 million gains on sale of fixed assets. In the 18 months ending June 2024, the credit union also had non-operating gains on loan sales of $4.6 million.

It is not possible to determine how much of these sales are from Credit Union 1’s own assets or from the loans and fixed assets acquired via mergers. These sales amount to almost $20 million of the $88.6 reported UDE in June 2024. These are one-time events that are reported in net income thereby adding to retained earnings, but in fact are non-operating, one-off gains.

Safety and Soundness Questions

If these one-time gains are subtracted to show actual operating net worth generated from continuing operations, the net worth ratio from internal operations would be only 4.6%. Hence the credit union’s drive to raise external capital (sub debt) and acquire other credit unions’ reserves. Its dependence on external capital and one-time sales raises significant safety and soundness questions.

Internal operations are not generating sufficient capital to maintain required net worth minimums. For example, in the full year 2023, the credit union would have reported an operating loss of $429,000 except for the one-time gains on sale of fixed assets and loans. Through the first six months of 2024, the credit union’s ROA is only .39% or just .23% without extraordinary gains. (all data from NCUA tables)

The financial results are in even steeper decline than what is presented. If one considers the impact of adding merged shares and loans from the preceding four quarters prior to June 2024, there are critical balance sheet trends. These five mergers added approximately $210 million in loans and $346 million in shares to Credit Union 1’s balance sheet. Without these external gains, the credit union’s decline in outstanding loans for the 12 months ending June 2024 would have been $288 million or 24%. For shares, the falloff would be $73.3 million or a negative 5.5%, not the 4.6% increase reported. The credit union also relies on $35 million in external borrowings for funding.

Since converting to NCUSIF, the credit union has reported growth and acceptable ratios only through the acquisition and then sale of fixed assets and loans, and using the free transferred capital to maintain its required net worth.

What to Do About a Runaway Credit Union?

Once NCUSIF-insured in 2022, Credit Union 1 has been on a merger and marketing binge which is hiding serious financial performance shortcomings.

In all credit unions the Board, as a group, holds the direct, legal fiduciary responsibility for the performance of the credit union. The Board members approve all policies and hire the leadership. The buck stops with the Board members – all of them.

This is especially true in Illinois which has an unusual provision in the state act that allows the board to collect proxies from all its members, thus giving the board full decision-making authority in all areas, including mergers.

This is the reason for the extended proxy explanation in the Notices of Merger of the five Illinois chartered credit unions which reads in part:

Illinois permits voting on merger proposals only at the meeting or by proxy. If you do have a proxy. . . you may do nothing, and the board will vote in favor of the merger in your sted. . . If you have a proxy on file, to vote NO you must revoke that proxy by giving written notice to the board secretary. . . and then assign a new proxy to an attending member.

This is why all mergers of Illinois’ state-charters are reported as virtually unanimous. The process also puts a higher standard for due diligence and fiduciary responsibility on board members as they are now acting directly for the member.

There have been several recent class actions against credit unions around improperly disclosed overdraft fees and cyber breaches. When merged Credit Union 1 members confront the reality of losing their independent cooperative some may be deeply upset. With their board’s unilateral actions and failures to document their duties of care and loyalty, these transactions could become fertile ground for such actions.

Where Are the Regulators?

Except for the several federal charters merged, initial approval is by the state as Credit Union 1 is Illinois chartered. Most of the credit unions merged in MI, WI, GA, IN and IL are state chartered. All the data cited above is in public call reports and in multiple year analysis formats on NCUA’s website.

The trends for Credit Union 1 are clear, the extraordinary payments to CEOs presented in the Notices, the copy-book wording in the Notices all the same, and the vigorous public marketing communications easily reviewed for this nationally aspiring credit union.

NCUA routinely signs off on all mergers even those characterized by extraordinary self-dealing (eg. CEO contracts with change of control clauses), no clear business logic or member benefit, and Notices with misinformation, disinformation and missing critical facts for any member to make an informed vote on the issue.

There are indications that this hands-off response is the NCUA staff and board’s preferred laissez faire policy. The outcome is fewer credit unions by encouraging smaller credit unions to merge with larger ones driven by monetary payouts to achieve their policy of industry consolidation. But of course there are no asset limits as recent merger announcements have demonstrated.

The explanations for this dual chartering supervisory failure are wanting. In some instances, it may be a repeated failure by staff to do any elemental analysis. To my knowledge, there has never been a regulator “look back” to see if any of the merger commitments were followed up—even in a situation involving $12 million in members’ capital diverted to the merging CEO and Chair’s newly organized non-profit.

Regulators appear to lack a common sense understanding of events, not wanting to see or address the obvious conflicts of interest and board fiduciary failures. They thereby become part of the problem, abetting the worst aspects of cooperative leadership.

The result is no regulatory guidance or even backbone to stand up for members‘ interests or rights. There is no director-board check and balance on CEO’s ambitions or performance. And no regulatory effort to hold accountable those credit union CEOs who use their positions of power and institutional wealth to take advantage of the member-owners of acquired credit unions.

A System Circling the Political Drain?

Instead of expanding member economic opportunity, credit unions are imitating the tried and profitable capital market efforts to roll up their smaller locally focused brethren though payoffs and the rhetorical promises of better service through—even if only virtual.

Credit Union 1’s “purchased members” have lost the heritage and identity their cooperative predecessors passed on to them. Trust and loyalty earned over generations is gone. Members will vote with their feet when they learn there is no more advantage to being with Credit Union 1 versus dozens of other online financial offerings just as easily accessed.

Credit Union 1 has maintained its regulatory financial requirements only by acquiring other credit unions’ capital reserves, one-time sales of fixed assets and loans, closing local branches and letting employees go, and borrowing sub debt capital. These are efforts to buttress its balance sheet and cover its inability to earn an acceptable return on its own assets for its member-owners.

This practice will eventually be found out, the mergers will end. and the credit union’s safety and soundness will be much more closely scrutinized.

However, in the meantime, eleven local credit union charters are destroyed, their professional and community leadership roles ended, members’ long-time relationships to their credit union dissolved and the industry’s reputation put at political risk.

As Credit Union 1’s financial short comings become increasingly apparent, their external relations with Notre Dame athletics, the U of I Chicago campus, the new WCC partnership and Tinley Park Amphitheater will be in jeopardy. So too the industry’s public image.

I believe Credit Union 1’s actions are a threat to the future of the cooperative model. Every system has “bad actors.” That is why there are regulators. When directors fail in their fiduciary roles, and supervisors abdicate their appointed oversight responsibilities, the system’s integrity is at stake.

When other credit unions remain silent, state regulators default in their oversight, and NCUA appears unconcerned about the consequences of these events, it is only a matter of time until cooperatives forfeit their unique role in the American economy.

And should that day of reckoning come, thousands of credit unions trying to do the right thing will be end up in the same reduced status as their rogue colleagues.