NCUA has published a dynamic excel spreadsheet to be used with merger applications. It is titled Merger Related Financial Comparison.

Its purpose as stated in the first sentence: This comparison form can assist you in determining if you are required to disclose any increases in compensation due to the merger in the member notice. You are not required to submit this form in your merger application; however, you are encouraged to do so. The information you provide may help NCUA process your request more efficiently. (underlining added)

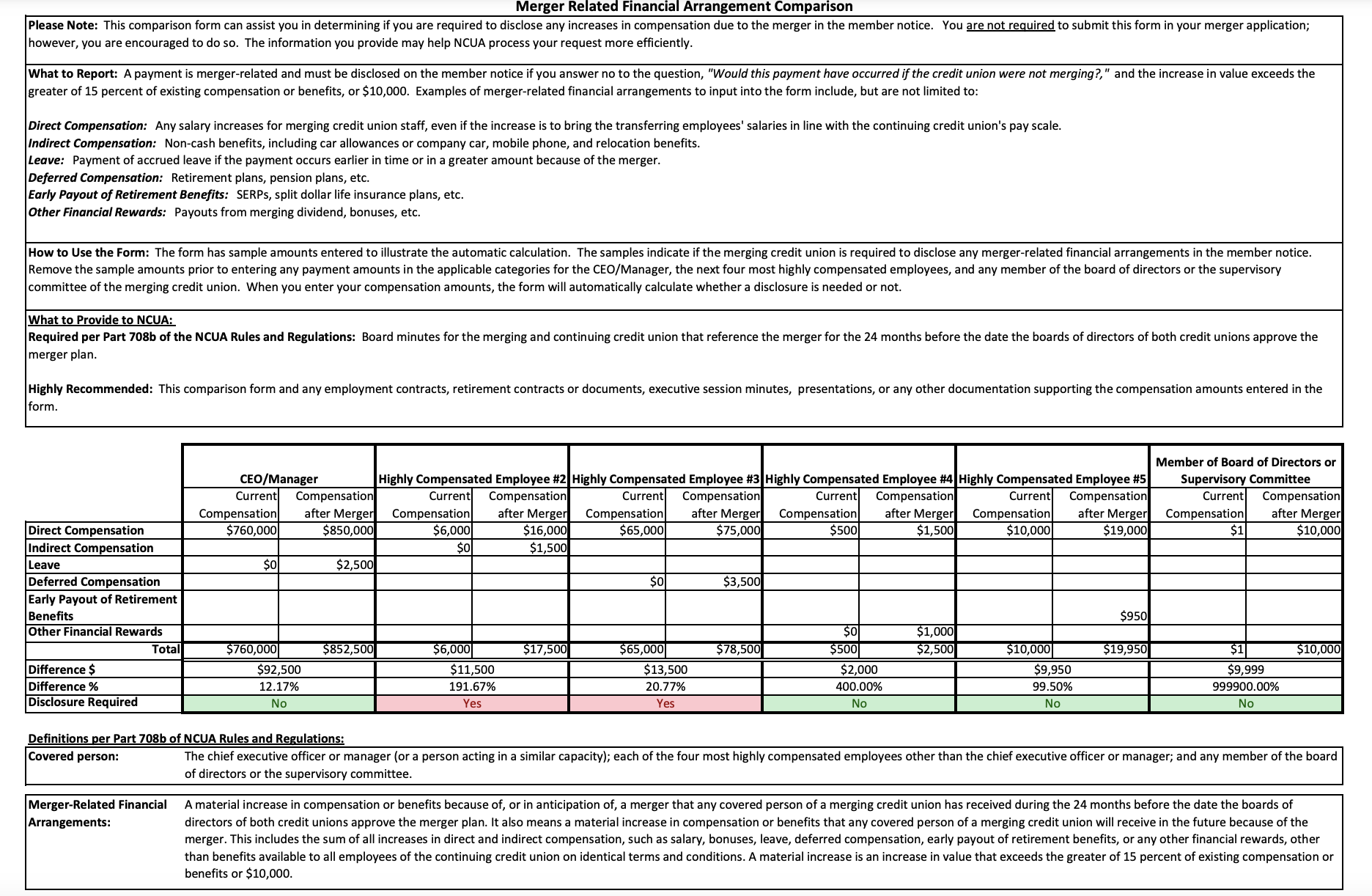

Here is a copy of the form. If it is too small to read, this is a link to a PDF. There is no NCUA number on the form or other information, such as when issued.

What the Form Says

The instructions about what compensation must be disclosed in the Notice of merger is answered with a question: Would the payment have occurred if the credit union were not merged?

The Form’s directions and simple examples plus the Agency’s encouragement to submit illustrate its intended use. The spreadsheet is a tool to help credit unions game the system to conform with NCUA’s requirement that only increases of 15% and greater from all compensation need be disclosed to members in the official meeting Notice.

This limitation is completely contrary to the intent of Chairman McWatters’ when proposing the rule in 2017:

“the agency should require all merger solicitation documents to provide, without limitation, a discussion of any change-in-control payments and other management compensation awards and agreements, and that such disclosures are written in plain language and delivered to voting members in a reasonable time prior to the scheduled merger vote” (Source: Time to Talk about an Ugly Truth in Mergers.)

In virtually all mergers when the institutional’s legal charter ends, all existing employment contracts, benefits, retirement plans will cease to exist. Change of control clauses or immediate vesting options may occur in benefit plans. The continuing credit union will rewrite employment contracts and conditions, including bonuses, responsibilities, incentives and benefit packages.

To fulfill McWatters’ intent, all of these renegotiated terms should be provided to owners whose approval is required for the changes to be effective. The logic is simple. NCUA requires this information for its due diligence and approval, shouldn’t the persons who own the assets and must vote on their future management, also have this same data?

The Data NCUA Receives

The form requires that all current compensation indirect compensation, leave, deferred compensation and early payment of retirement benefits and other financial rewards be entered on the form for the CEO and four highest paid managers.

Member owners receive none of this data.

NCUA requires that all these same areas be reported post merger. The Member-owners receive none of this detail. The only required disclosure per this Form is a single dollar amount if all these post-merger payments exceed 15% of the executive’s total prior to the merger.

Take the example of CEO compensation already entered on the form. The CEO’s salary increases from $760K to $850K after the merger. (A typical CEO merger salary?!) Adding more leave, this total increase of $92,500 (12.17%) does not have to be disclosed to members. It is below the 15% threshold. The member-owners receive none of this calculation or data.

Another completed example is directors’ and supervisory members’ compensation . In this case the directors received $1 before the merger and $10,000 post. But this change does not have to be reported. It falls below the minimum change of $10,000. Another executive example shows a 400% change that is not given members, but a 21% increase that must be.

In all these examples, the member-owners receive none of these calculations.

The form states clearly what is required and highly recommended to be sent NCUA:

“Required per Part 708b of the NCUA Rules and Regulations: Board minutes for the merging and continuing credit union that reference the merger for the 24 months before the date the boards of directors of both credit unions approve the merger plan.“

“Highly Recommended: This comparison form and any employment contracts, retirement contracts or documents, executive session minutes, presentations, or any other documentation supporting the compensation amounts entered in the form.

The member-owners receive none of these required and highly recommended submissions of compensation and board minute details.

Why There Was a Merger Rule

When proposing the rule in 2017, NCUA staff analyzed many recent mergers and concluded that a significant portion were influenced by incentives paid to executives.

It is a human reality that those in charge of managing money can be tempted by self-dealing. In the early years of state charters, prior to passage of the FCU act, some state laws prohibited managers and boards from borrowing from their own credit union. Instead “central credit unions” were organized to meet those needs.

The NCUA call report today collects the aggregate number and amount of Loans outstanding to credit union officials and senior executive staff (Account 956). Section 4 Investments paragraph 11 shows the total of the credit union’s securities to fund employment benefit and deferred compensation plans including SERPS and other insurance.

Finally all state chartered credit unions are required to file IRs form 990 annually which details all executive and board compensation. Federal charters have no such requirement-yet.

These disclosures are all efforts for transparency about the compensation executives receive as stewards of others’ financial assets.

Smoothing the Paths to Temptation

Transparency in total compensation is critical to preventing the ever-present danger of acting in one’s self interest versus that of the member-owners

NCUA now withholds from member-owners, who must approve the life or death their chater, the most critical information NCUA requires for its approval in the first place.

Denying Members The Rights of Ownership

NCUA has taken over the role of the member owners. Members are left totally in the dark about the scale of compensation commitments being entered into. Instead of providing members with this same vital information, NCUA offers a spreadsheet to enable credit unions to manipulate the very minimal disclosures now required.

NCUA is explicit about the facts it requires to allow the transaction to proceed. But the members receive none of this vital information.

NCUA has preempted members’ right to make an informed choice. The merging credit union does not have to “sell” its compensation plan outcomes to the members. It just has to “sell” the terms to NCUA in private.

The credit union self-dealing that brought about the 2017/2018 merger rule update has not ended. It has just been totally obscured and more critically, facilitated by NCUA. The Agency seems powerless to understand and correct its supervision deficit over what is taking place.

But the credit union industry sees clearly. When nothing meaningful is required to be disclosed, nothing is forbidden. The members are kept in the dark. The ever-present temptations to cash out will only grow.

In case after case the member-owners lose control over their enormous financial legacies; they also have lost all their future choices.

These combinations will inevitably short change the credit union system’s options going forward. They are wounds on the soul for why credit unions were created in the first place.