A Member-Centric Approach to Overdraft fees: The Unicorn Theory

Fees are now front and center as a political and hence regulatory topic, not just a business decision. Chairman Harper has said he intends to shed some light on the practice in credit unions by collecting data.

AT SECU (NC) the credit union developed an approach to this money management issue that was designed to help the member, not create a borrowing dependency.

Here is Jim Blaine’s description of the program which I assume is still in place. If you read his following day’s blog, he describes SECU’s $5.0 billion draw of the Federal Reserve’s Bank Term Lending Program (BTLP). The analysis includes the other top five credit unions by assets and their use/nonuse of this option.

The NCUA Board’s NCUSIF Discussion

Yesterday’s board meeting had one primary topic, the state of the NCUSIF and the related responsibility of setting the NOL.

Unfortunately the live stream broadcast cut out during Harper’s initial comments and then permanently as board member Otsuka began her comments.

The NCUSIF had its best year in a very long time. Record net income, no insurance losses, rising income and an NOL at 1.3%. All that was missing was a dividend for the owners.

There were two disappointing aspects. CFO Schied said the increase of credit unions in CAMELS 3 category was due to “liquidity, interest rate risk and risk management.” He then announced that the latest portfolio maturity of $700 million would be invested in two tranches-50% in overnights and the rest in the traditional ladder out to 7 or 10 years.

Since December 2021 the NCSIF’s portfolio has been underwater. The earnings of the NCUSIF have suffered greatly from this robotic IRR approach to portfolio management.

But no one apparently has learned anything from this ongoing underperformance, now in its third year. The board members just nodded in tandem as this decision would produce a “good source of future income.” The board’s inability to even address their IRR oversight was a failing to take proper care at best; or at worst irresponsible.

The second shortcoming was the failure to review and reset the fund’s Normal Operating Level(NOL). This has been the standard bpard process every December. The board would review staff’s five-year model with its various scenarios and then approve a cap for the next year.

Not this year. Schied who presented the modeling in year’s past, made an excuse about staff needed to do “more analysis.” Harper who controls the agenda, obviously did not want the NOL to be reviewed as all the data would show the traditional 1.3% cap was more than sufficient. If reset this historical limit would likely provide a dividend for credit unions in 2024 given the much higher earrings from the fund.

Hauptman in the December 2022 board meeting in responding to Hood’s suggestion that the level should be 1.3% said it wouldn’t make any difference. He implied the fund could not possibly reach or exceed that level, so it didn’t matter whether it was 1.3 or 1.33.

This year his approach was even more cavalier. He failed to note for the record that the staff had did not present their standard analysis of the NOL, the first time since 2017. Then in a series of flippant remarks said in effect “I don’t know what the right number should be. Is it 1.34? of 1.35 or 1.36?”

Since 1984 NCUA board members have had no difficulty setting a limit, a decision well understood and documented for forty years. This cap limit really matters to credit unions now. Each basis point above 1.3% equals $175 million that could potentially be paid in dividend to credit unions.

Hauptman did not call out the chair’s failure to put the item on the agenda and just let the current cap slide through. His dismissal of the staff process which he supported in prior years suggests either a lack of conviction or courage, or both.

In the end it probably doesn’t matter that the livestream went out. There wasn’t any real engagement on matters of substance before the lights went out.

Callahan’s Trend Watch Update for 2023

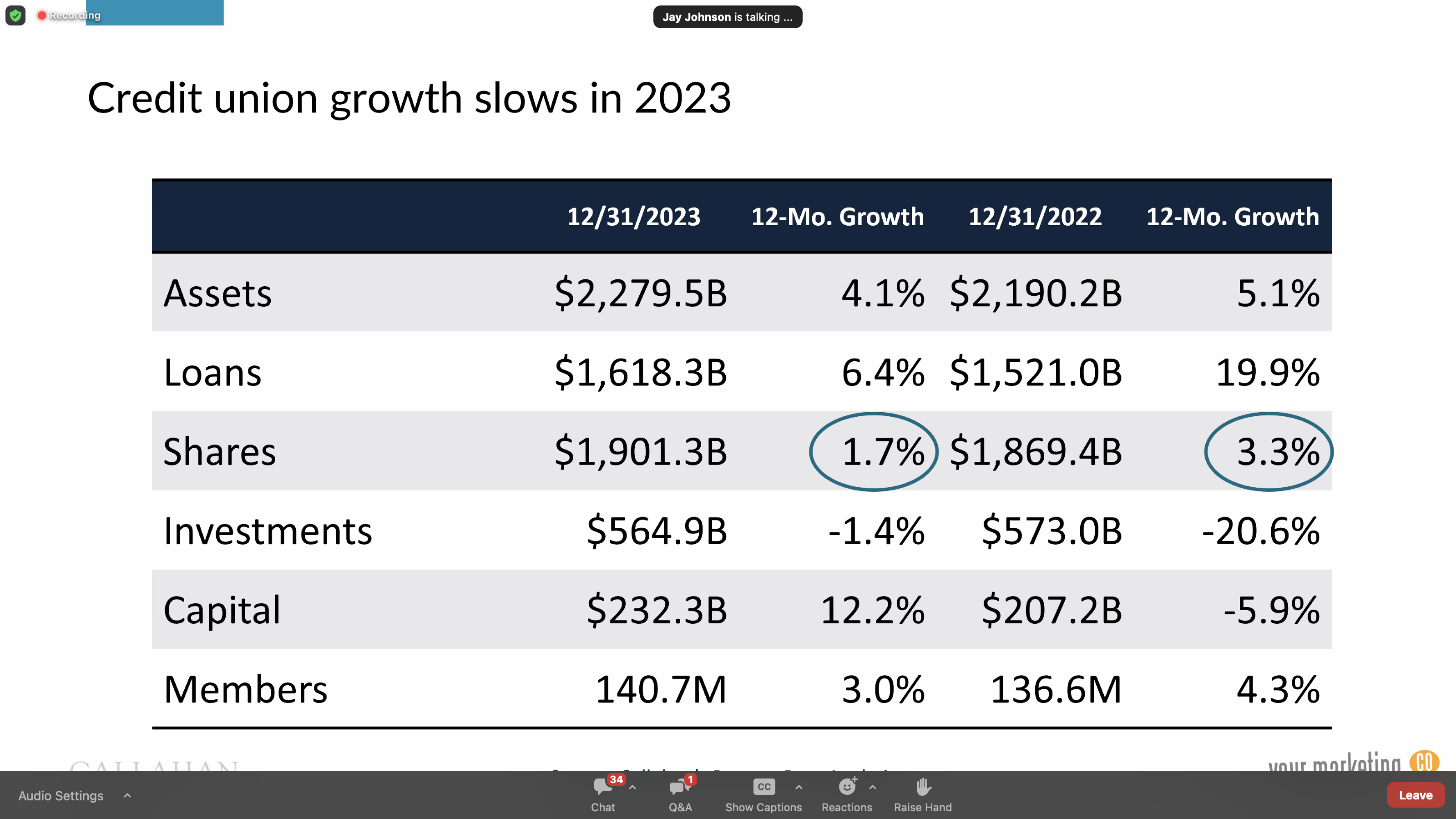

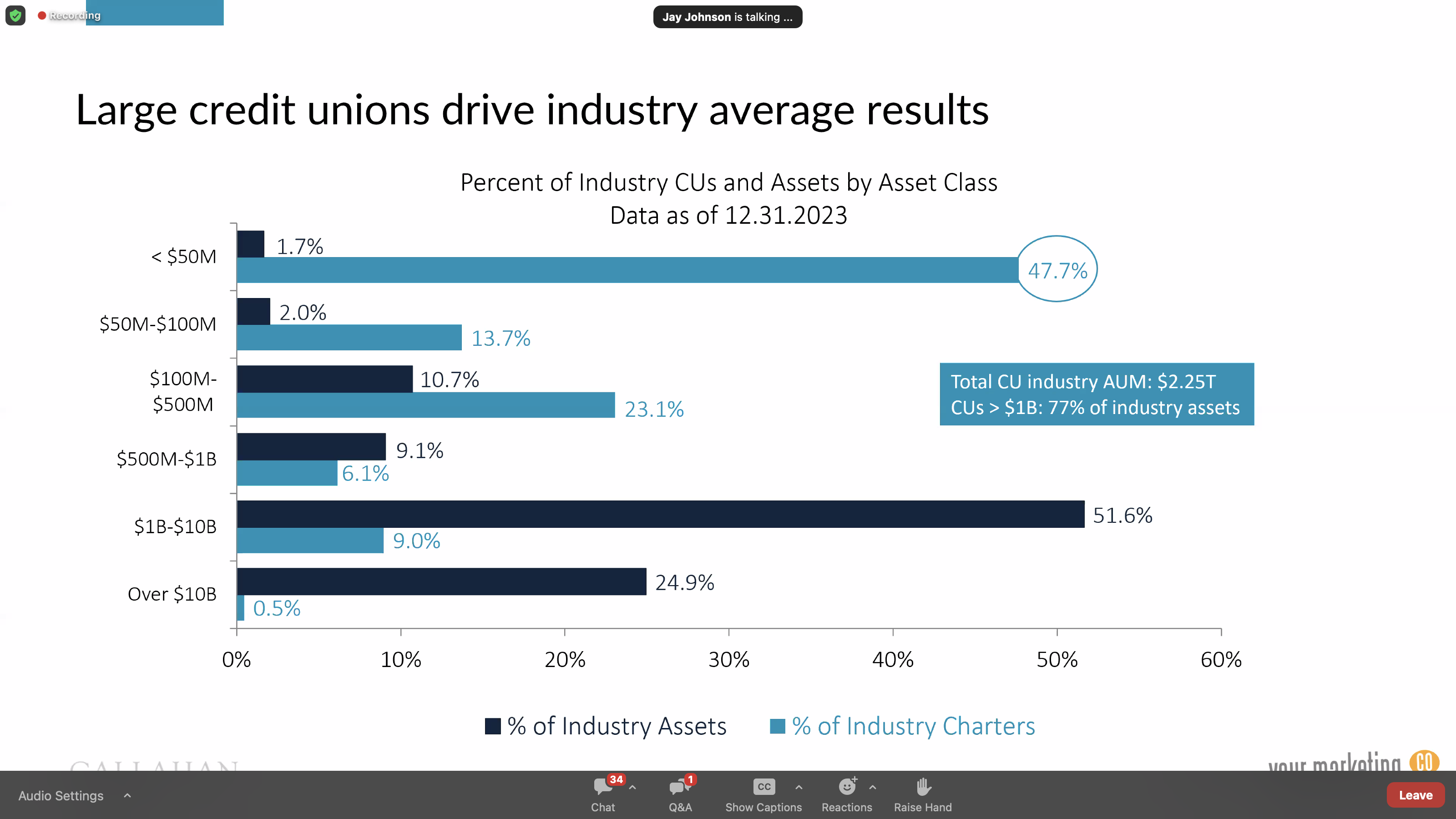

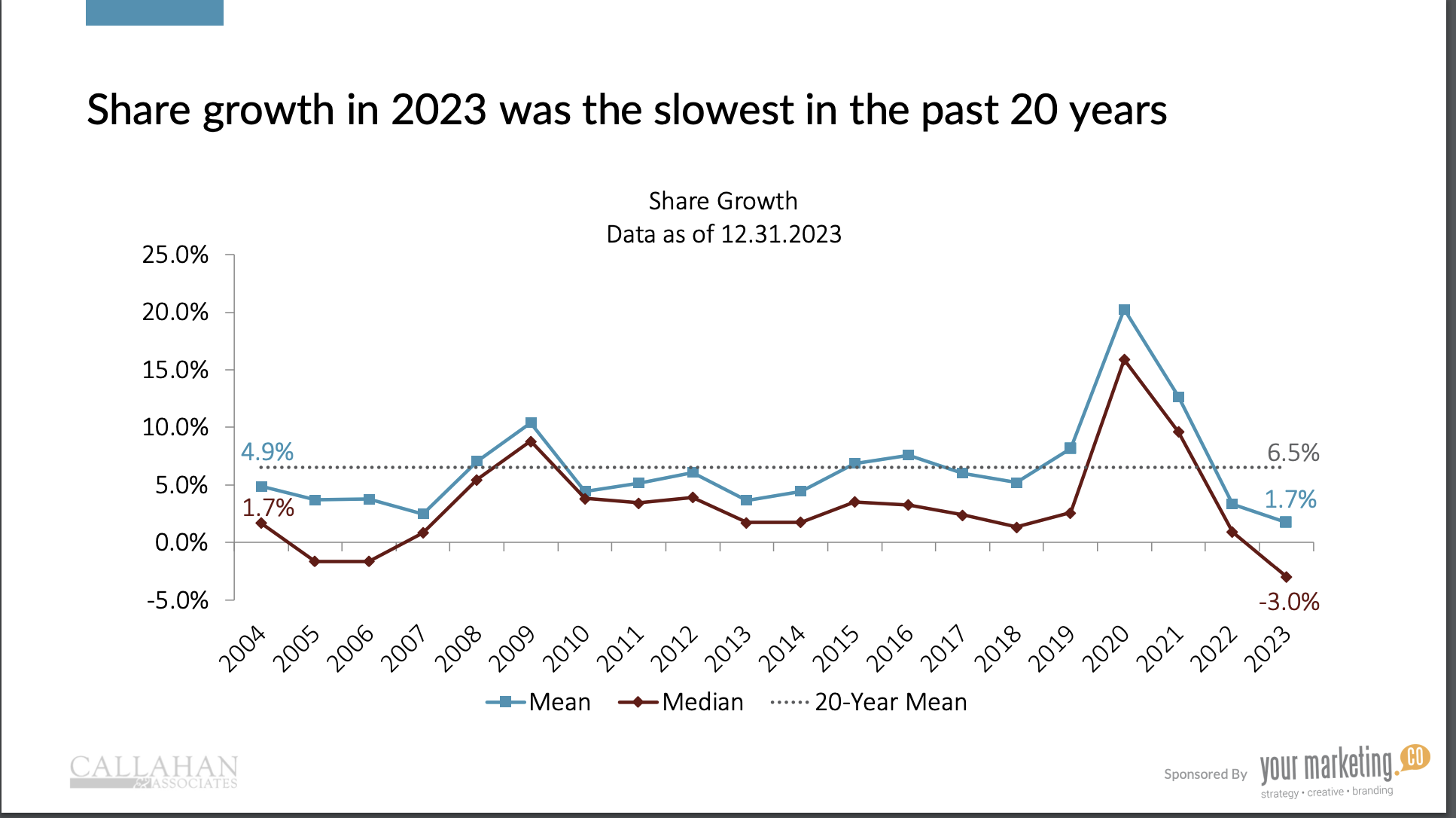

Yesterday’s 2023 yearend industry analysis by Callahans was a very useful summary of the sound state of the industry. There were the standard summary slides showing macro trends. These reflected a slower growing system.

The presentation included a new effort to show how larger credit union’s dominance of averages can be better understood by including the mean outcome for every ratio.

Finally there were several slides with a 20-year time horizon that demonstrated the inherit cyclicality of performance such as delinquency or share growth.

The full set of slides and the recording can be downloaded here. https://go.callahan.com/rs/866-SES086/images/2023_Trendwatch_SlideDeck.pdf?version=0

The recording: https://creditunions.com/webinars/trendwatch-4q23/