The cooperative spirit is a financial super-power. It is a passion that enables even small firms to have enormous impact. Affinity Credit Union in Des Moines, IA is example of this capability in action.

Chartered in 1949, its annual meeting is a celebration with members even as the required business items are covered.

This year’s meeting highlighted three vital Affinity success factors enabled by this spirit:

- Respect for the member-owner;

- Pride in the Affinity’s legacy and mission;

- Exceptional leadership in the board and senior management.

All Are Invited

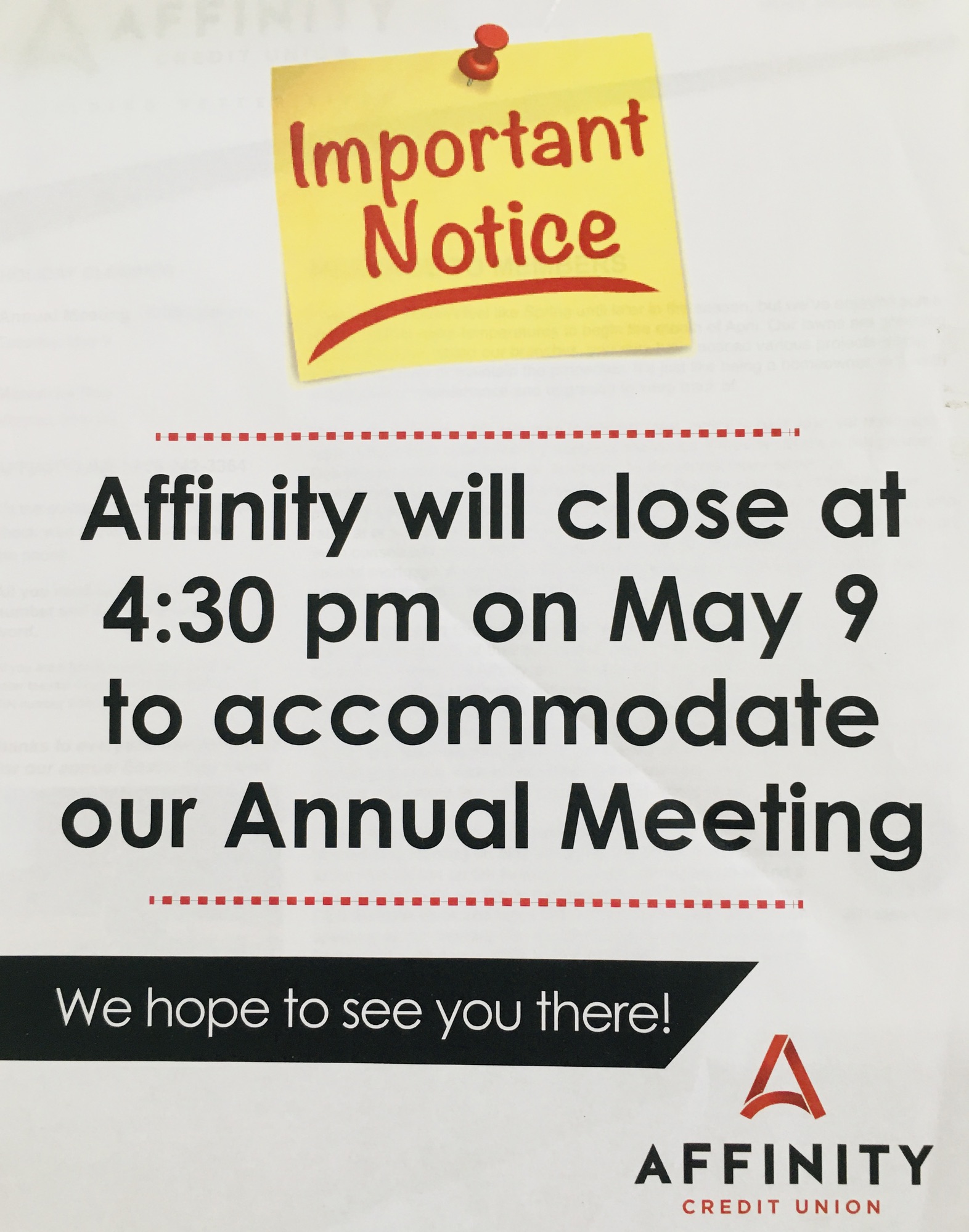

The credit union made special efforts to draw members to their annual meeting:

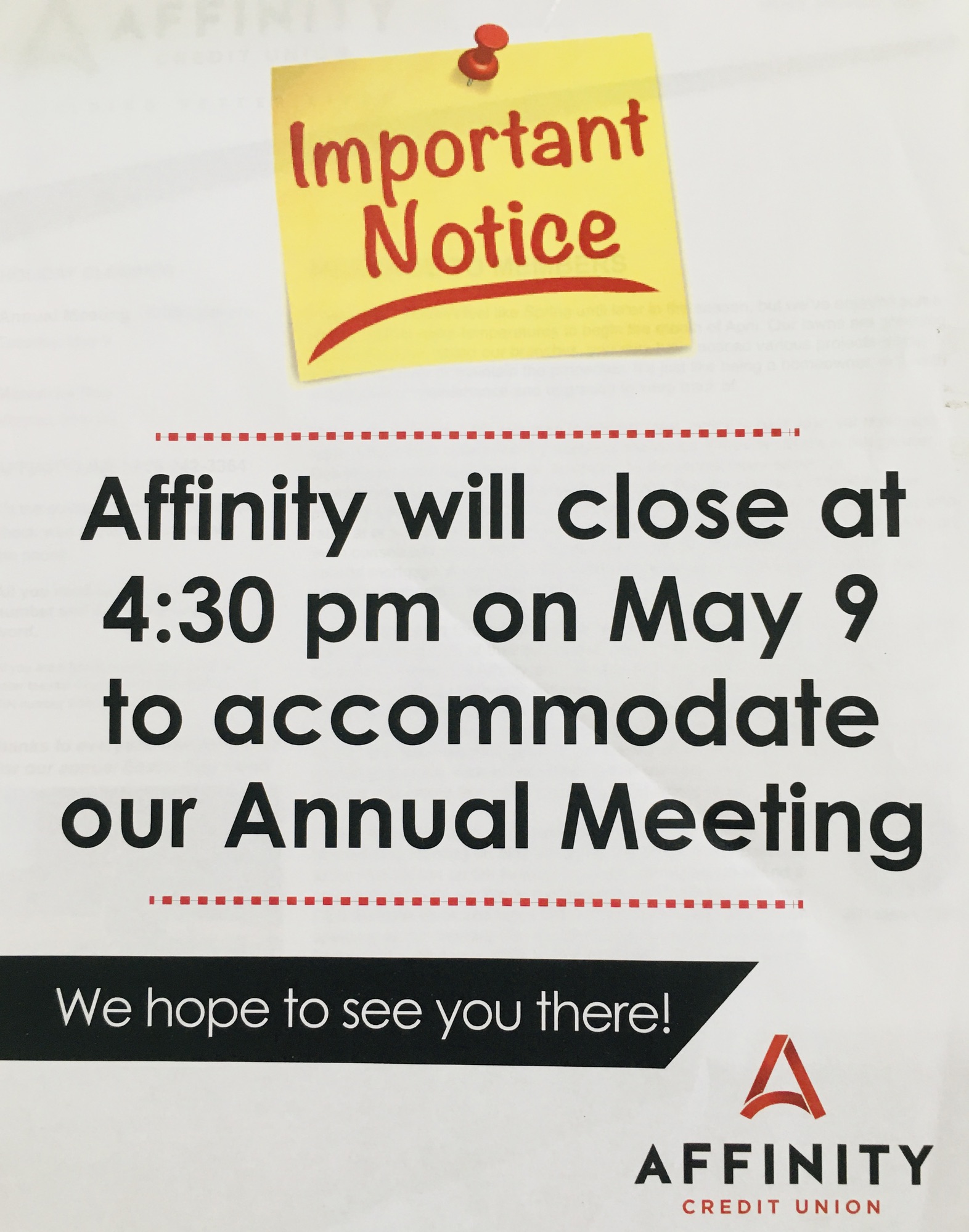

- A reminder email was sent to all on the day of the meeting: “The 2023 Affinity annual meeting is tonight. We look forward to seeing you there!”

- The announcement in the Members’ May Newsletter by the CEO: “Thank you to all who registered to attend our Annual Membership Meeting on May 9th at the Top of the Tower Ballroom. . .you can still register to attend.”

- The sign taped to the front door of the main office when members came to be served:

When members arrived at the meeting they were given a 10-page Annual Report that included a 14 item agenda; the board’s “promises” and biographies; committee reports; financials for 2022: and pictures describing Affinity’s role in the community.

Each Report included two raffle tickets for the post- meeting drawing for cash prizes. To kick off the event there was a free, full buffet meal for attendees before the speeches and business began.

I talked with members who had joined as far back as 1963 and an older couple, retired from state government, who joined just two years ago. Several families brought their children. One member brought a date, even though she was not yet a member.

The Speakers’ Messages

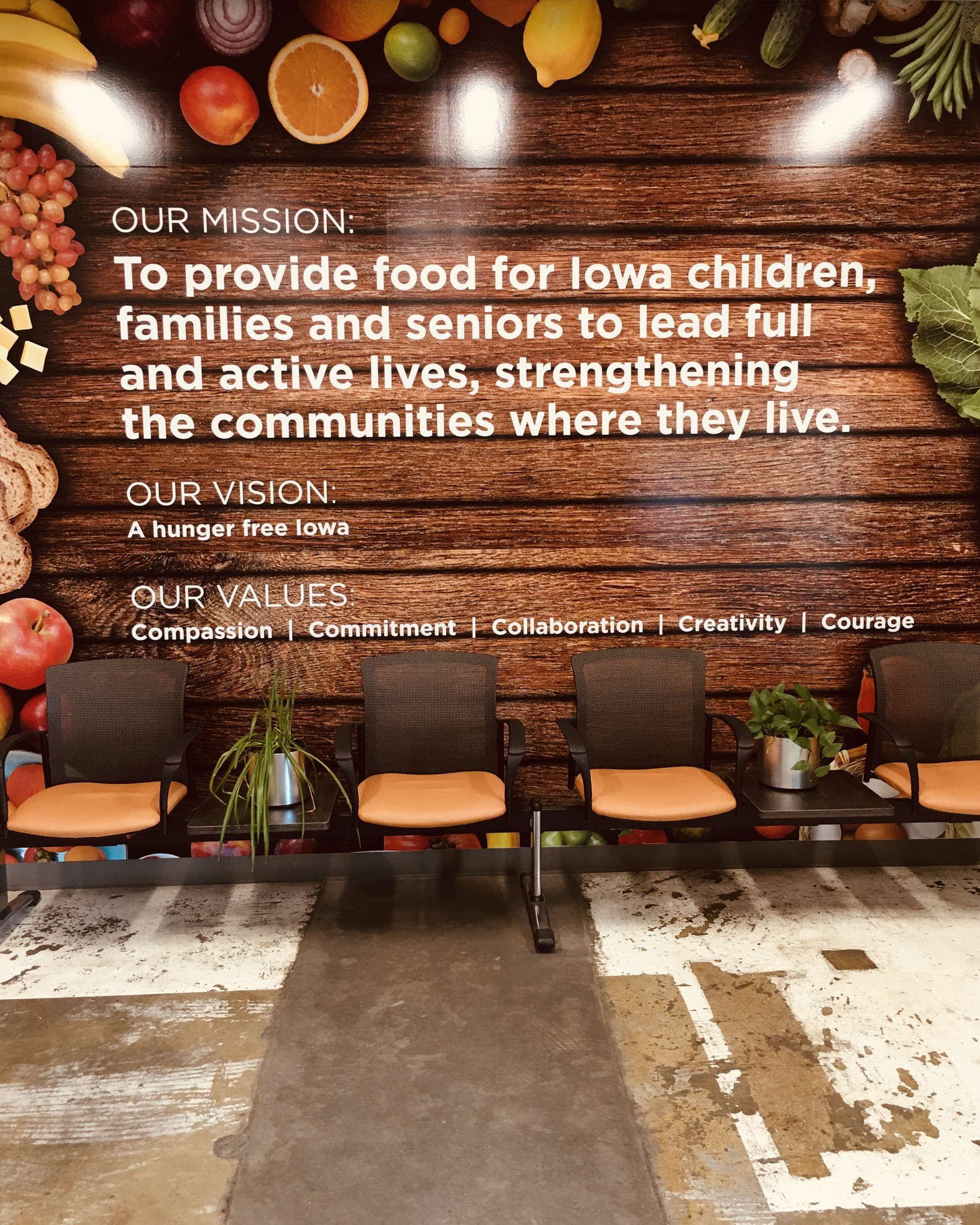

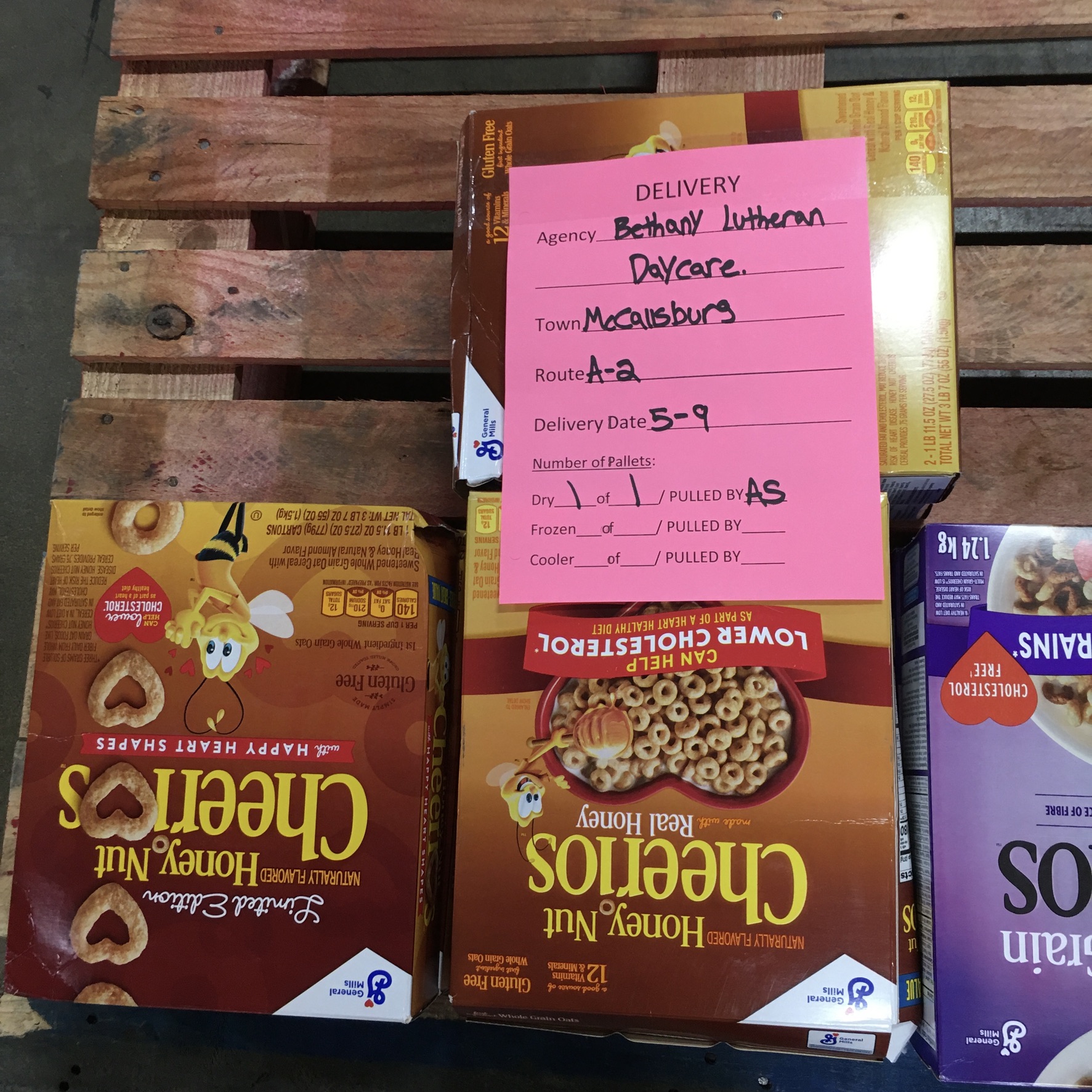

Outside speakers offered different aspects of Affinity’s impact. Michelle Bock, President of the Food Bank of Iowa, presented the challenge of food insecurity that 10% of Iowans face each year. Affinity’s CEO Jim Dean sits on the Bank’s board.

Katie Averill, Superintendent of Iowa Credit Unions, affirmed the strength of the Iowa system in the wake of recent, large bank failures. Of the 80 Iowa credit unions and $33 billion in assets, 72 are state charters holding 97% of the state’s total. The system has grown by double digits over the past five years.

Five Iowa charters are over a billion dollars in assets. Affinity at $145 million ranks number 22. Averill summarized Affinity’s evolution since its 1949 chartering as USW Local 301. Her listing of regulatory actions including FOM expansions, name changes, and mergers was a tribute to the credit union’s longterm standing in the community.

The respect for owners was shown when the Chair opened the meeting, under new business, for comments from members. Multiple questions were raised from the floor. Some were minor–will free movie tickets be restarted? A number were substantive about the financials–unrealized losses on investments and loss reserves for loans shown in the Report each attendee received. All were answered openly.

Pride in the Cooperative’s Contributions

At the check-in desk for the meeting, the credit union’s founding story was shown in a display case. A lunch pail used in the early years to collect funds and make loans during shifts at the Firestone tire plant was included with the founding story: “Here is a resource created by workers for workers that feeds families, futures and trust.”

A brief video testimonial of long-time member James Reasoner was shown. His financial journey recovering from near bankruptcy two decades earlier was highlighted. He was also one of four members elected to the board that evening.

Pride is evident in the credit union’s physical presence. The main office is still less than a half mile from the Firestone plant. Photos of the Firestone facility are mounted throughout offices that have been remodeled surrounded by careful landscaping.

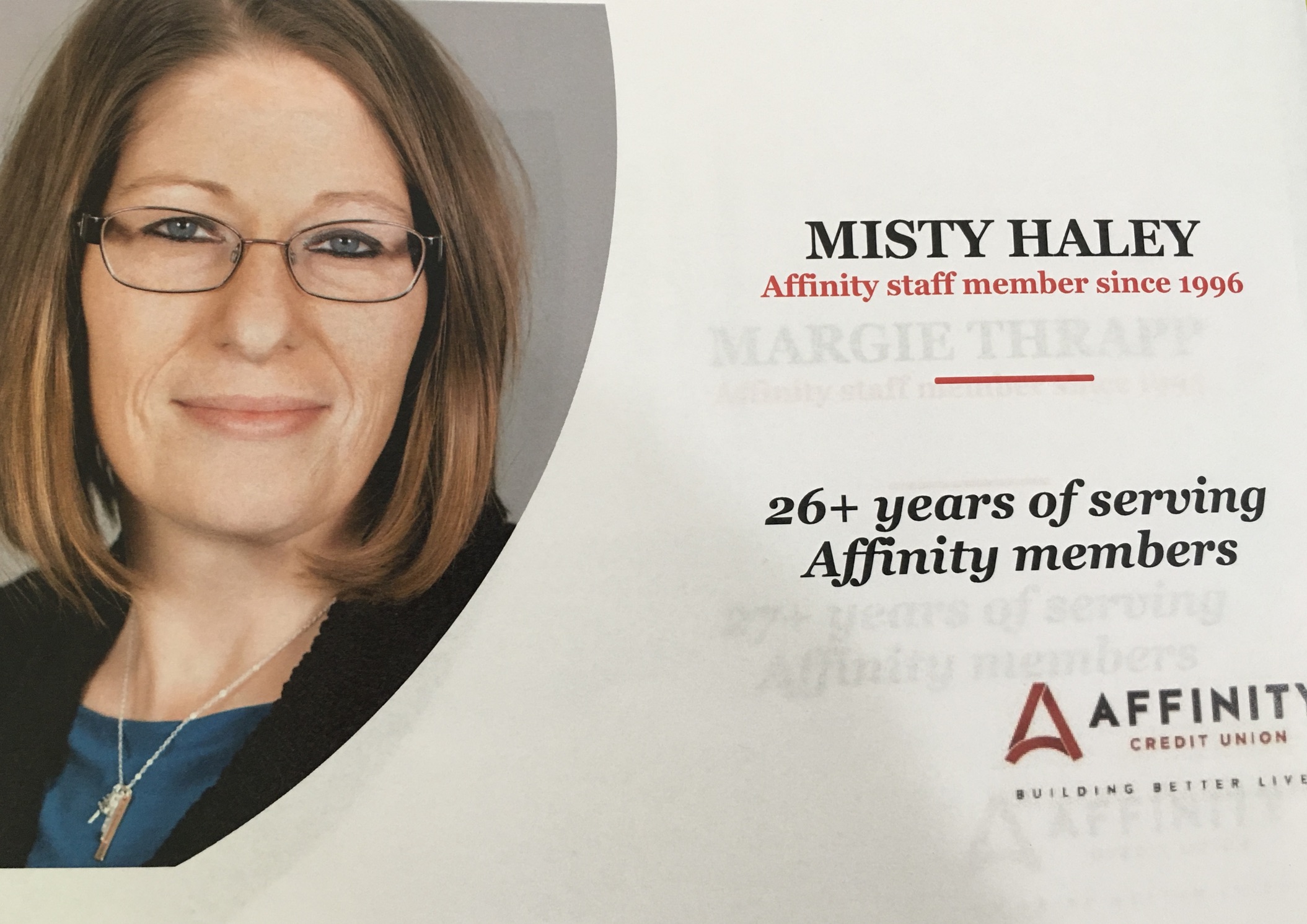

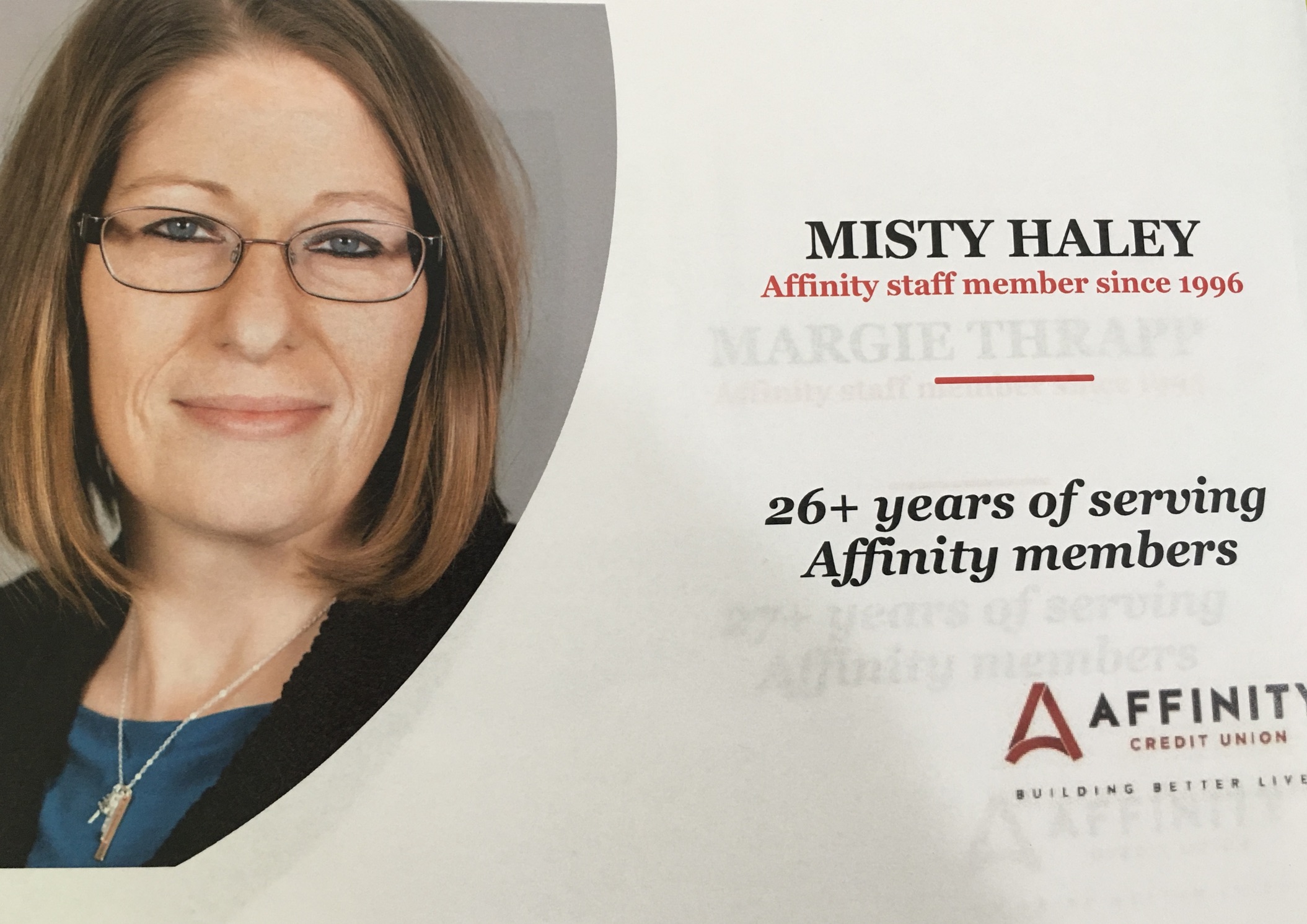

The board’s “promises” start with employee education. Wednesday mornings are late openings to accommodate training. Three employees who had worked over 25 years for the credit union were recognized at the meeting. Misty is the person who helped new board member James Reasoner in the video twenty years ago.

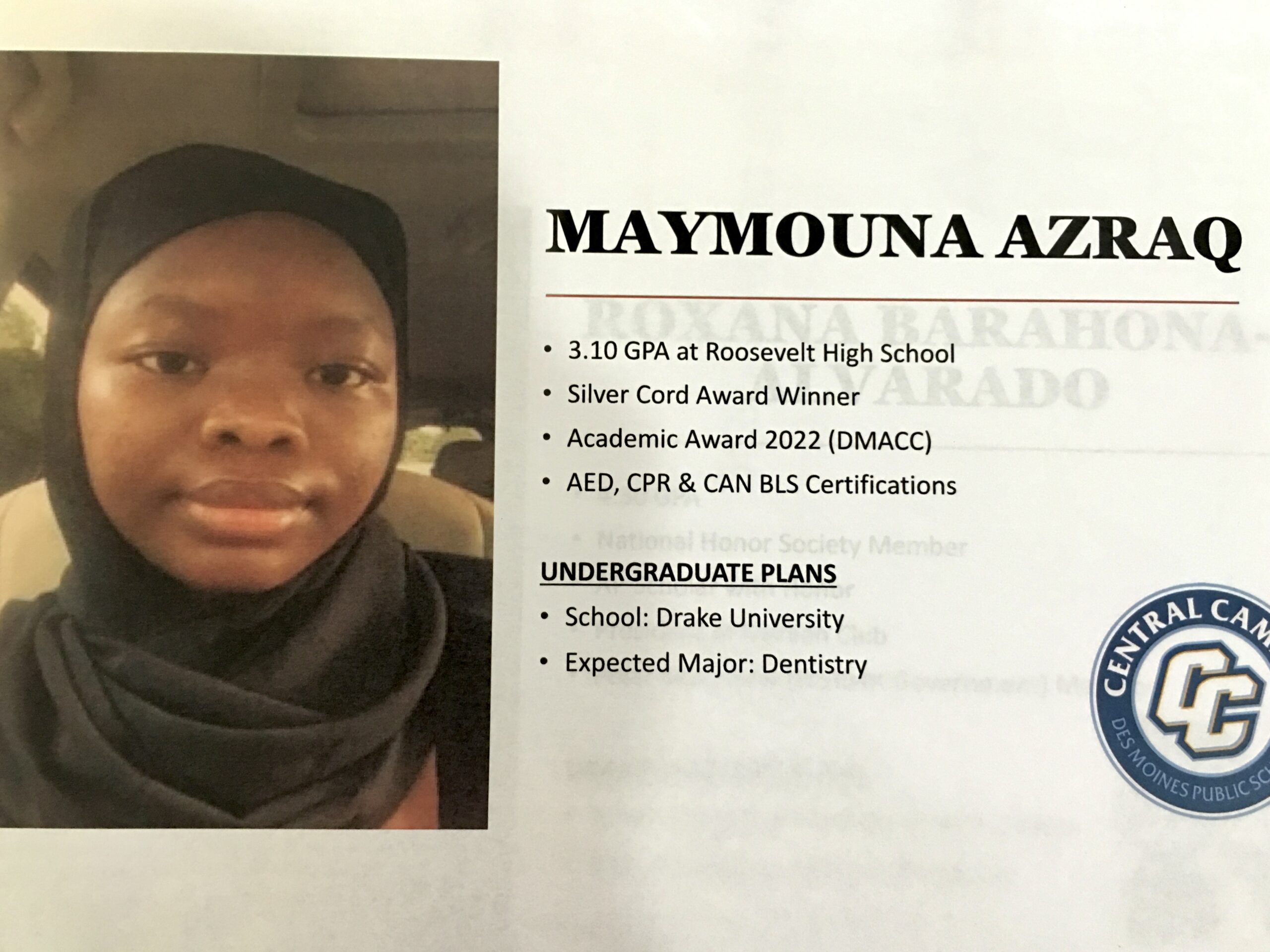

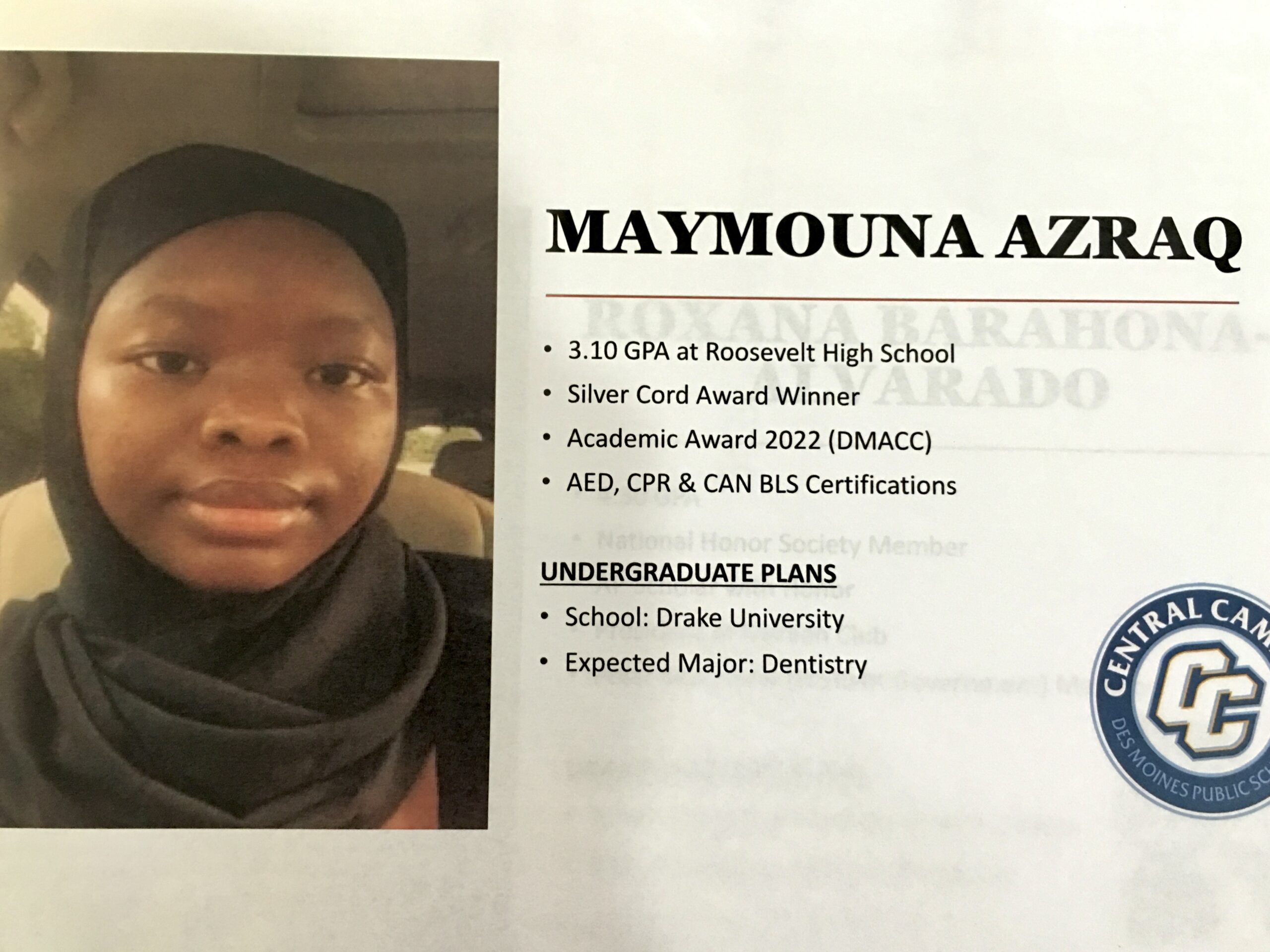

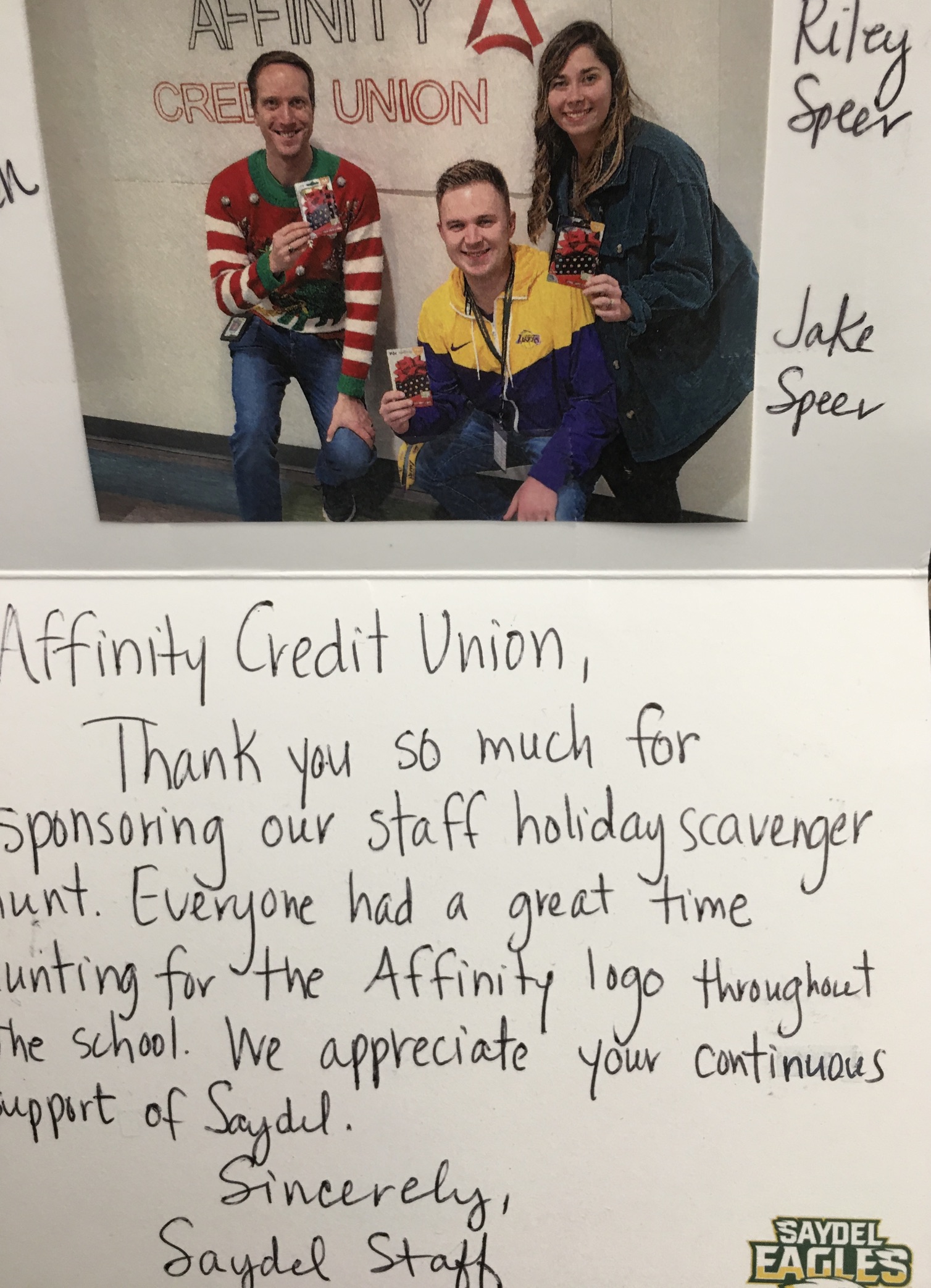

“Enrich our communities” is another board promise. Six seniors from different high schools were awarded scholarships to further their eduction. Here’s one.

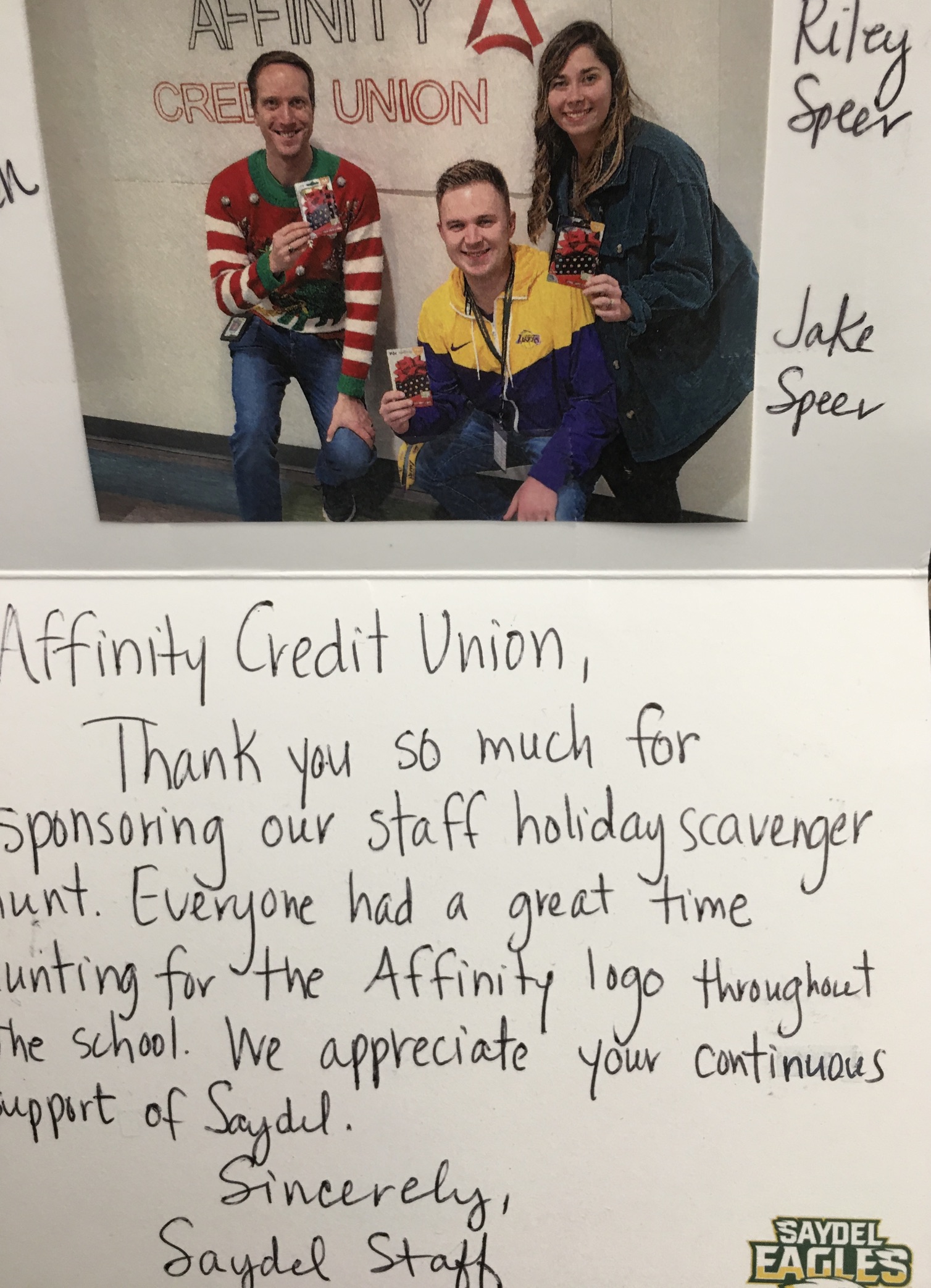

The program included multiple examples of Affinity volunteers in action.

Leadership by the Board and CEO

Few organizations can thrive, let alone survive, without dedicated leadership.

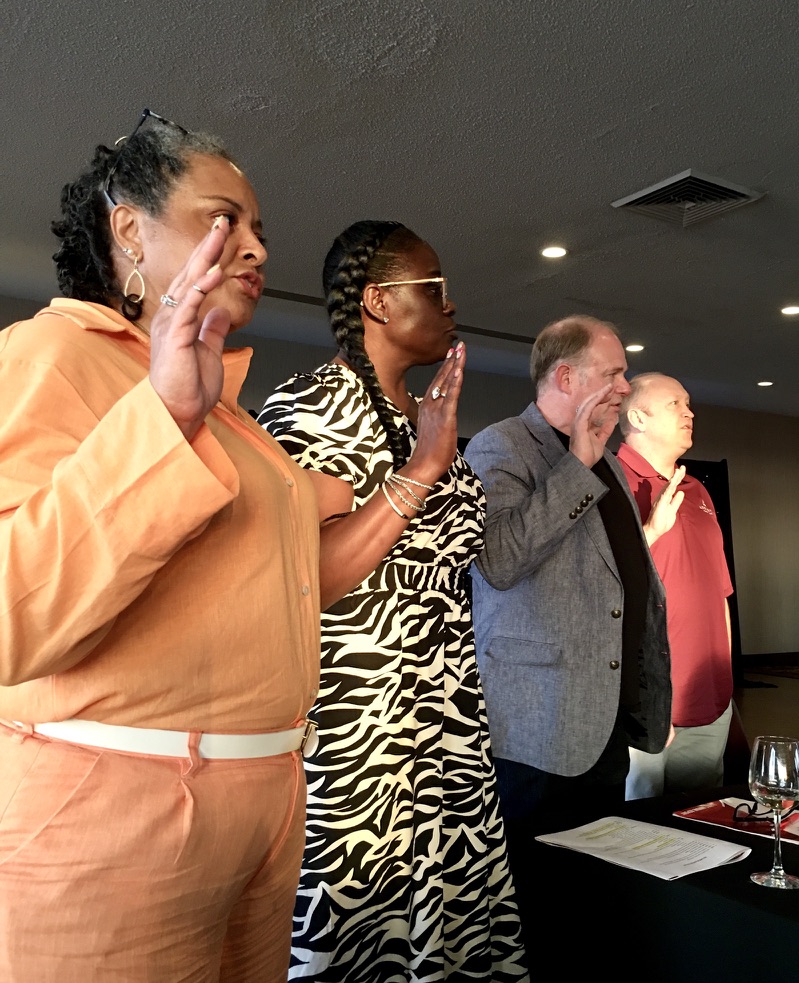

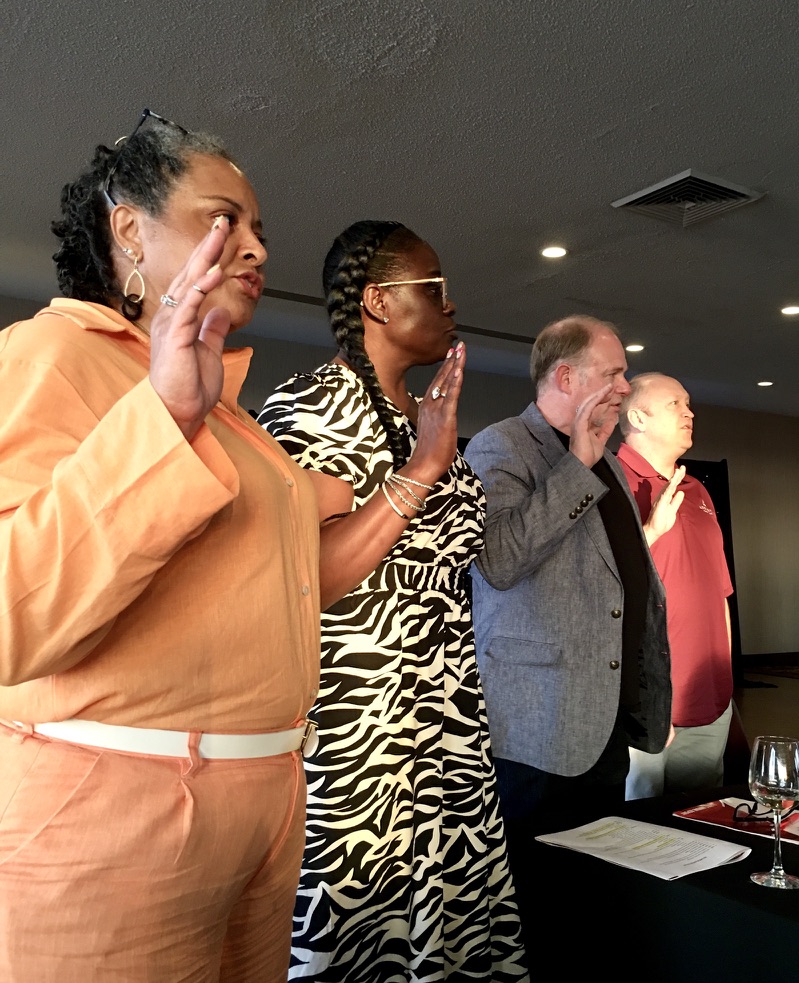

The four board members elected this meeting have leadership responsibilities in their professional lives. James Reasoner’s story is told in the video link above. Bridget Neely is the CEO of Big Brothers, Big Sisters of Central Iowa. Cara Harris is the Administrative Coordinator of Cortiva Agriscience in Johnston, Iowa.

Webster Kranto is a small business owner who was born in Liberia. It took three years as a refugee to gain immigration to the US where he graduated from Iowa State University. In 2019 he was appointed by the governor to a 4-year term on the Iowa Board of Corrections.

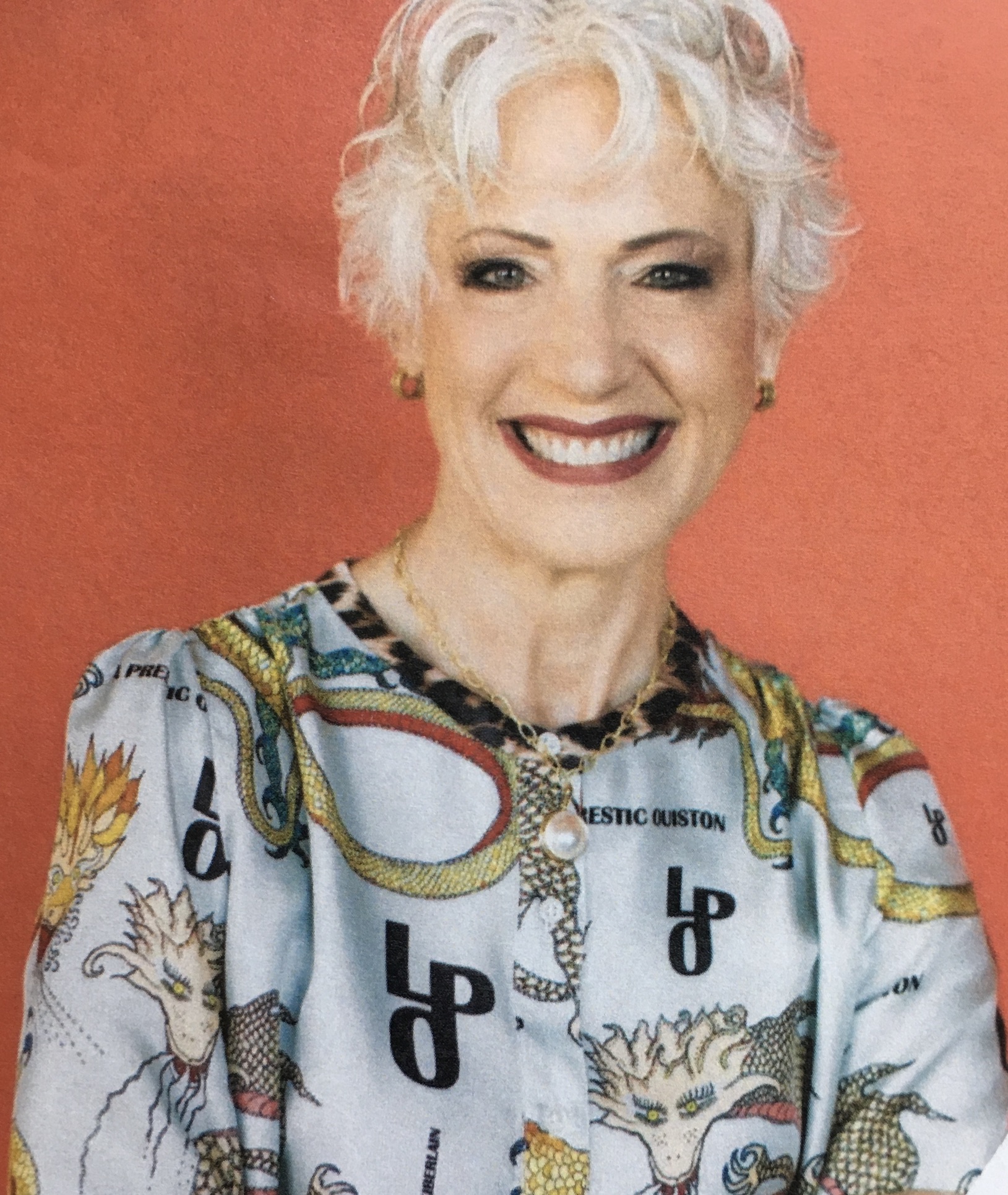

Two continuing board members have worked at the Firestone plant for 22 and 23 years. Both are members of USW Local 301L. The board chair Cindi Summers is the Chief HR Officer at Baker Group. She earned a Master’s Degree in Business Leadership, as well as a B.A. in Management and A.S. for Paralegal Studies.

Christian Quijano, Vice Chair, works in Environmental Risk Management and was board President for the Environmental Professionals of Iowa from 2012-2018.

Their leadership terms begin with an oath administered to all directors at the annual meeting. Standing and facing the members, they commit to “faithfully, honestly and impartially perform the duties imposed upon me. . .”

The board’s most critical role is selecting the CEO. Jim Dean came to the credit union after a long career in multiple leadership responsibilities in Illinois. He has implemented the credit union’s vision of “building better lives” by demonstrating that small can have a big impact: “small but mighty.” He initiated a suit against Apple Pay’s restrictions and joined in a program to lend $10 billion to facilitate home ownership for minorities in Iowa.

He asked that I come to the meeting to learn about the credit union. I saw a genuine dedication to resolving members’ financial challenges from those still in high school to retirees. Over 50% of the 13,786 members live in low income areas. The credit union teaches the basics of savings and borrowing so members have skills to manage in any economy.

Jim’s view of success is more than increasing the volume of financial transactions. He united the credit union’s financial capabilities with partners to support the community’s overall health and well being. The Iowa Food Bank is just one example of this outreach.

With the board he has instilled a timeless evolution of values and principles. This special coop spirit can extend success forever, beyond generations lived and to be lived. He honors the traditions that created the credit union. He gave renewed meaning to the founders’ goal of an organization that “feeds families, futures and trust.”

Jim believes that the strongest credit union advantage is member loyalty. This is not contingent on size, but service. The only size criteria is to be big enough to care about members.

When a decision was made to end Saturday branch hours because of low transaction volume, Jim called each of the members who used this service the most, to let them know of the change and other transaction options.

My Message

When speaking to the annual meeting, I said the most precious gift each has is our time. This evening members gave several hours to learn about the credit union and participate in another anniversary.

My hope was that every member-attendee would expand their involvement to become owner-volunteers, sharing in the promotion, service and financial support of their credit union’s mission.

Affinity’s stability is rooted in and led by community leaders. These volunteers and professional staff demonstrate the potential from democratic member ownership. The Coop spirit enables members to serve the financial needs of others, not just one’s own.

The Importance of Leadership

Affinity is an example of what numerous other credit union leaders do to help members become who they aspire to be. Their coops invest time, energy, and resources supporting members’ ambitions and enabling personal opportunities.

Leaders take risks with decisions when they make members’ needs and dreams their own. The impact of their support and dedication is immeasurable. For it is the members’ who are the foundation of every credit union’s resilience.

Affinity’s leaders love what they do, who they do it with and who they do it for. Is there any higher standard for a life or a profession?