| Tepeyac only had two employees, according to former director Peralta: office manager Teresa Cordero and Mr. Flores, who was in charge of debt collection.“(Cordero) did a lot of work for the credit union,” Peralta says. “Mr. Flores, whenever he was around the neighborhood … you would not see anybody else because his job was to collect delinquent accounts. I can’t remember too many people defaulting on their loans.” Indeed, a 1971 El Paso Times article records that only 18 of 1,448 loans had gone uncollected.

“I remember even borrowing money for my second car,” Peralta says. “If I remember correctly, at one point, we had over a million dollars. It helped a lot of people to generate their credit. Once they establish credit with us, we will trust them with a little more money. It really helped a lot of people.”

Making the News

A March 1961 newspaper article from the El Paso Herald-Post showed the Tepeyac Credit Union had potentially 30,000 members, between congregants in the parish at the Sacred Heart Catholic Church and employees and staff of Our Lady’s Youth Center.

“Much time, effort, and sacrifice went into the organization of this unique credit union,” the article reads. “Realizing the problems involved in setting up a credit union which serves a large low-income group, volunteer workers, El Paso Chapter of Credit Unions personnel and many others devoting themselves to the task of solving those problems.”

”Father Rahm and a man named Ed Morrisey raised interest amongst the potential members,” the El Paso Herald-Post article reads, “while others held workshops to explain the idea and principles of operation of a credit union.”

“Tepeyac Federal is considered a pioneer type credit union,” the news clipping says. “Prior to organization, its potential members had no access to credit union benefits and services. Experienced credit union workers now believe Tepeyac Federal Credit Union will not only succeed but will serve as a model … for the organization of similar credit unions elsewhere.”

The efforts of these activists helped create El Paso’s Chicano Movement for Mexican American civil rights, Romo explains: “They were serving the needs directly of the community that this local city government or state or federal governments were not meeting.”

“In 1972, when the La Raza Unida Party was organized, (Delgado) stood up and read his poetry to begin the whole conference.”

Building on a Legacy

In El Paso, the credit union built upon the legacy of Mexican American sociedades mutualistas. These mutual aid societies focused on economic cooperation and community service, flourishing from the 1890s onward.

“It worked a little bit like credit unions,” Romo says. “Whenever people had an emergency sickness in the family, definitely for funerals. They were almost like community insurance groups. There’s a long tradition that goes back to the late 19th century, here on the border of Mexican American communities looking out for each other.”

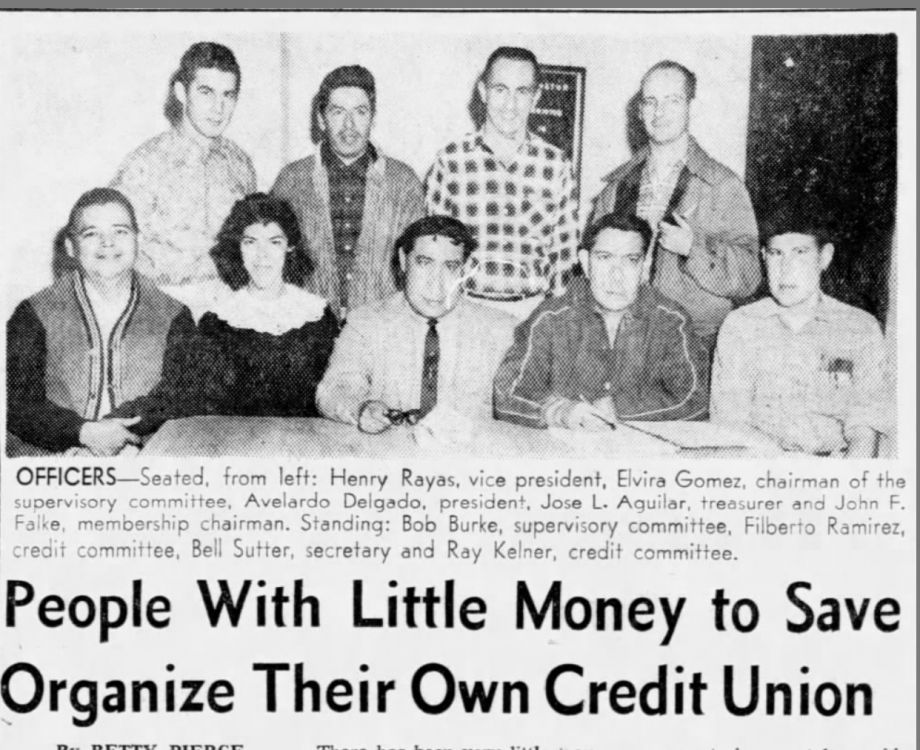

Information on key figures within the credit union is difficult to come by, but a few names stand out . . .Former director Peralta remembers John Falke – the credit union president in a 1967 . . . as a vital part of Tepeyac.“He was a veteran or involved in the military and did a lot of the groundwork. He would go out of his way to set up the whole thing.”

Another leader of Tepeyac was Henry Rayas, who served as president and is showcased in newspaper clippings from the early ‘60s . . .“He and his wife had 18 children,” Peralta recalls. “Once the children grew up and were a little bit more responsible, they would come and volunteer there.”

No Longer Operating

Today, the credit union is no longer operating. Tepeyac’s last statement of financial condition filed with the National Credit Union Administration was dated Dec. 31, 2003, showing $194,730 in total assets, 220 members and one part-time employee.

In December 2003, the Texas Credit Union Department received an application for Tepeyac to be absorbed into El Paso’s West Texas Credit Union, which had been chartered in 1964 to serve state employees in the area.

The state-chartered credit union “made a special effort to reach out to minority populations by offering a range of products that meet their particular needs,” according to a May 2002 hearing before the U.S. Senate Committee on Banking, Housing, and Urban Affairs. . .”These products including low-cost remittances back to Mexico, an affordable housing program and Individual Development Accounts, a form of savings account aimed at helping low-income individuals save toward assets and build long-term financial stability through matching funds.”

The CEO said that “credit unions like West Texas recognize that consumers and their members must give viable options to avoid the traps of predatory lenders. Credit unions have stepped up their efforts to combat predatory lenders in neighborhoods by offering affordable alternatives for both payday loans and mortgage loans.”

West Texas CU Liquidated

But after the credit union was “hammered by bad indirect loans,” per a Credit Union Times report, the National Credit Union Administration announced in 2009 that West Texas Credit Union had been liquidated “after determining the credit union was insolvent and [had] no prospects for restoring viable operations.”

San Antonio’s Security Service Federal Credit Union purchased the assets that year and assumed the member shares of West Texas, which had had $78 million in assets and was serving 25,000 members at that point.

“We Should Have Continued”

Peralta himself continues to be active in the community. . . “Everything that I have been fortunate to do, it has been because of El Segundo Barrio.”

After moving on from the credit union, he was involved with the Chicano movement. “My degree was in education. My goal was to teach at the public schools in South El Paso. But when I did my student teaching, I realized I was in over my head. Those kids were doing so badly that I knew that I couldn’t help them. So I went to try to help them with other stuff like housing.”

He looks back at Tepeyac’s board meetings, which also served as the credit union’s committee to approve loans, with nostalgia. “It was a really effective operation. It was one of the best things that we had going.”

“Now that I look back, it’s something that I feel we should have continued with.” |