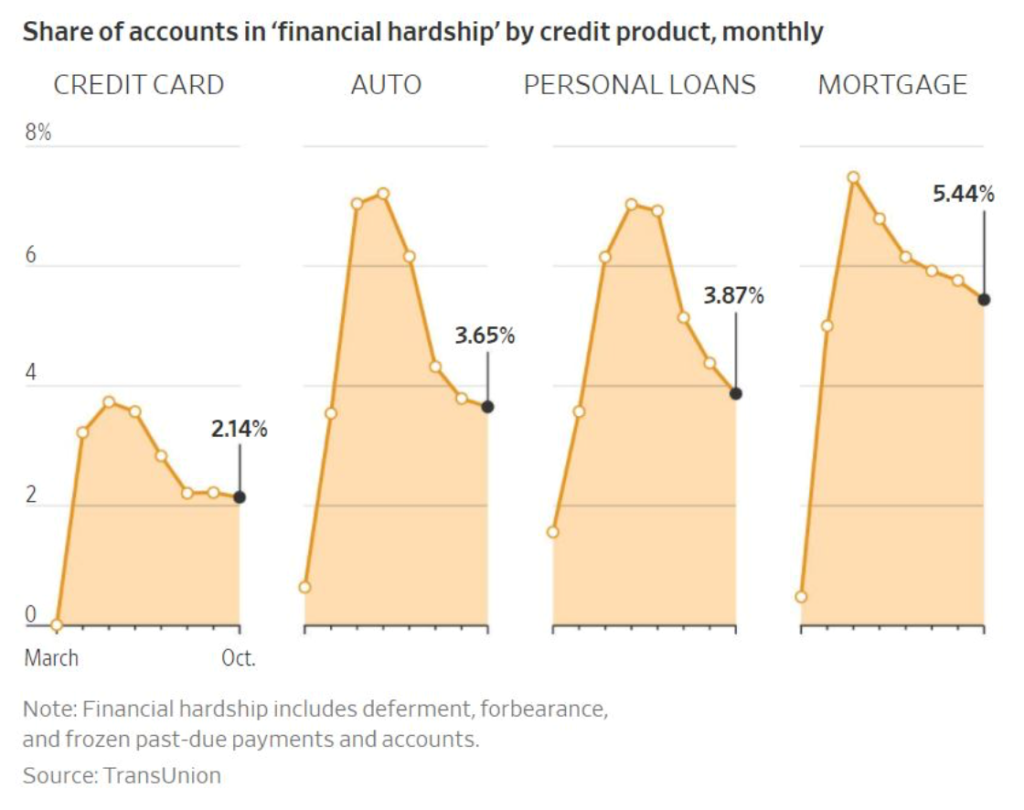

The chart from TransUnion below shows how quickly consumer credit defaults rose and then suddenly declined from March through October 2020.

The September credit union data shows the industry has not seen dramatic upticks in total delinquency and charge offs. However some of these deferrals and forbearance accounts may not have been included as past due.

Key questions include why the sudden turn around? Was it stimulus relief programs? Economic recovery?

Depending on how one interprets these rises and falls will provide some guidance about future trends. For example if Congress fails to pass additional relief, will the down turns reverse? Or is the employment recovery the key to lower rates of credit hardship?