Last Friday I received the following email from a credit union’s CFO:

“My CEO and I were discussing the new offering from the Feds, the Bank Term Funding Program (BFTP). We have outstanding borrowings due over the next few months. Liquidity is still tight. I am considering utilizing this program as the current rate offered is almost 65BPs less than the FHLB 1-year term.

“I sat in on an “Ask the Feds” session on Wednesday to learn more about the program. I’m curious as to your thoughts on utilizing this source of funding for Credit Unions. Do you know of any CUs that have received any funding?

“Also, I’d love to hear what you think as far as there not being any negative stigma attached to institutions that do receive funding from this source. Borrowing from the FRB is usually viewed negatively as it is seen as the “lender of last resort.” During the webinar, the speakers assured everyone this would not be the case with this program.”

The follow query was posted by a credit union member on LinkedIn early last week:

I am thinking of transferring all my money. To my 2 credit unions !!! Why is it more secure??

Latest Actions Taken

The following are reports by the Fed and the FHLB system to respond to the financial firms’ liquidity needs. From a Reuters report on the FHLB system on March 13, 2023:

U.S. Federal Home Loan Banks beefed up their lending war chests on Monday to provide more liquidity to banks amid continued higher-than-usual demand for funds as the fallout from the collapses of Silicon Valley Bank and Signature Bank reverberates through medium- and smaller-size financial institutions.

The FHL Bank system raised $88.73 billion by selling short-term notes with maturities from three months to one year on Monday afternoon, according to Informa Global Markets, a provider of syndicated bond data. The offering was raised from an initial $64 billion due to high demand.

Bloomberg on the Fed’s lending ;program as of March 16, 2023:

Banks borrowed heavily over the last week from two Fed backstop facilities. Data published by the central bank showed $152.85 billion in borrowing from the discount window—the traditional liquidity backstop for banks—in the week ended March 15. It was a record high and a staggering increase from the $4.58 billion borrowed the previous week. The prior all-time high? It was $111 billion during the 2008 financial crisis.

“Talking Points”

From press releases by CUNA’s CEO Jim Nussle: “Credit union deposits are safe, secure and insured.” A March 17, CUNA headline: “Credit unions are a safe harbor.”

Chairman Harper ‘s words at NCUA’s Thursday. March 16, monthly board meeting:

“Consumers can remain confident that their hard-earned deposits at federally insured credit unions are safe, just as they always have been, and that the NCUA will continue to act expeditiously, when needed, to preserve the stability of the credit union system.”

Vice Chair Hauptman offered no liquidity initiatives. Rather he lists actions NCUA has taken he believes relevant to the current situation. (emphasis added)

“Even though there’s no analogy to the Silicon Valley Bank and credit union system, previous boards and this board have been urging credit unions to ensure they have appropriate sources of emergency liquidity.

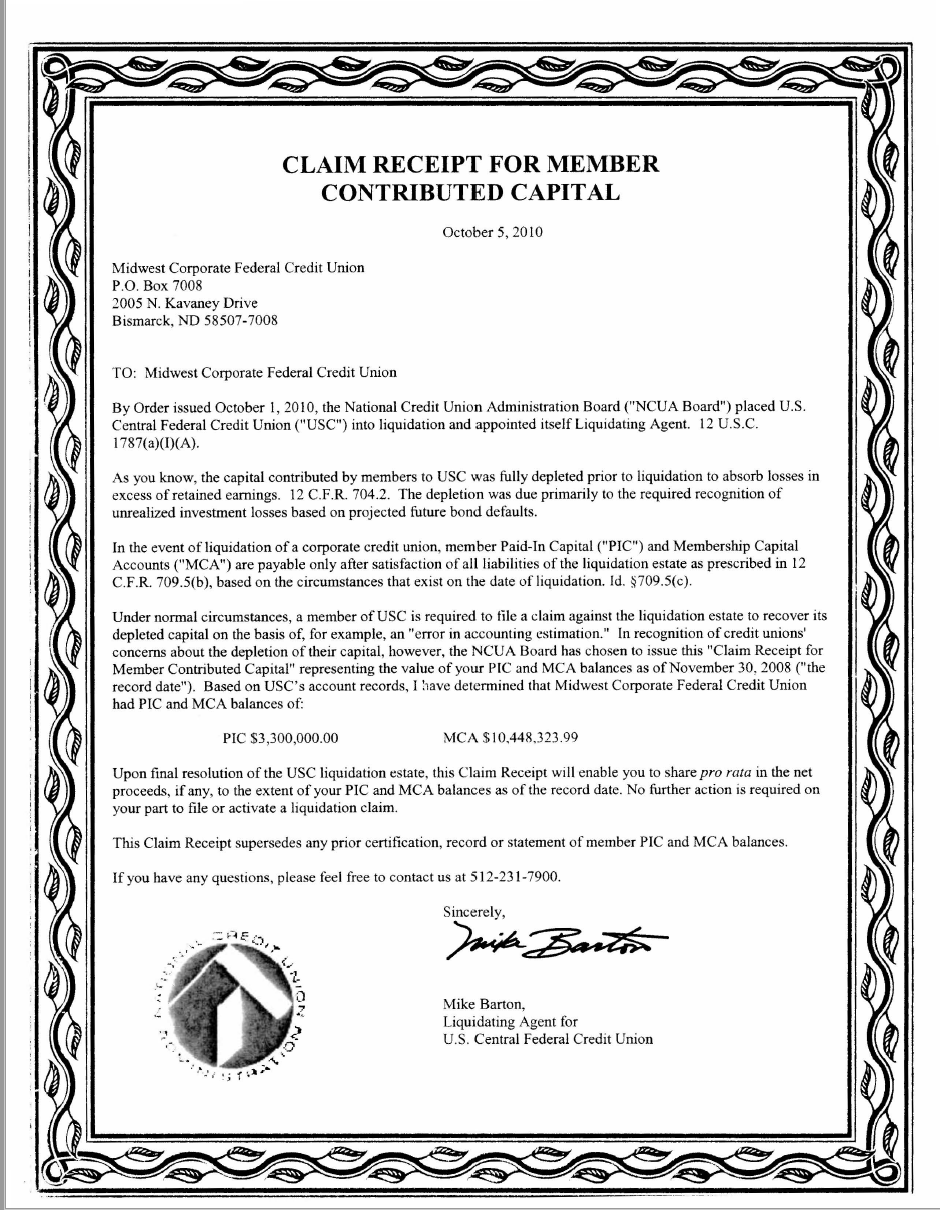

“At the same time, we have urged Congress to strengthen the Central Liquidity Facility, the CLF, by allowing corporates to act as agents for subsets of members. When interest rates started rising, we published guidance on NCUA’s NEV, Net Economic Value methodology – that guidance clarified that credit union management must have an appropriate plan for managing interest rate risk.

“I’ll also note, a little while back, we encouraged the use of interest rate derivatives for exactly situations like this. The events of this past week underscore exactly why we were so concerned about interest rate risk. And this board is very aware that it is fairly unprecedented the rate-hiking cycle we’ve been in. We know it’s not easy to manage, but that is what credit union management is paid to do.”

“I’m grateful for the hard work by credit unions and NCUA to ensure confidence and a safe and sound system. I know springtime is often annual membership meeting season for a lot of credit unions. No doubt, some members will have questions. I hope you credit unions out there will use this opportunity to educate members not only on your credit union, but the credit union difference.” (end excerpt)

His message is clearly a preemptive defense of the regulator’s accountability. “NCUA did all we could. If there is a problem in a credit union, it is not on us.”

Credit unions might wish the NCUA board in is quarterly updates had been more diligent in monitoring the NCUSIF’s interest rate risk. Or that the CLF had been made “shovel ready” versus asking for more resources and authority when existing ones had not been used since 2009. For that’s what the NCUA Board is paid to do.

When Action Counts

The two federal “agencies” that credit unions are using (after the corporates) are the FHLB and the Federal Reserve.

The CLF is missing in action , and silent, even though it has the same “protracted lending authority” as does the Federal Reserve.

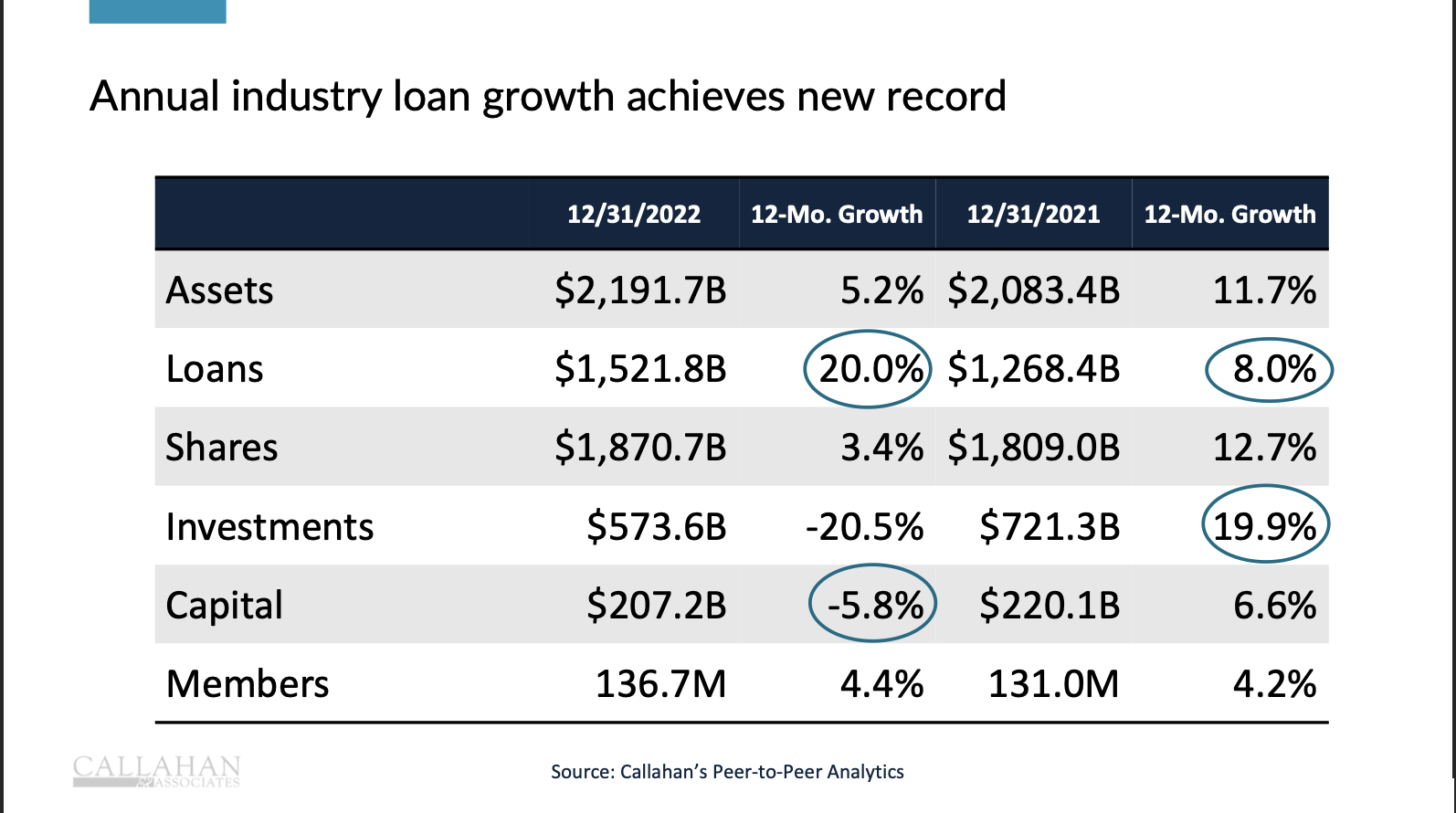

This is not a credit issue. In each bank failure to date no one has pointed to an absence of capital compliance. There have been other regulatory shortcomings mentioned, but not capital. As one observer noted: The main takeaway is capital is not king; it’s a court jester. Confidence is king. Runs start from lack of confidence, and no amount of capital is enough.

The foundation for system stability is action not words. Confidence comes from seeing those with responsibility being proactive versus reactive; public versus silent; and fact-based versus rhetorical reaffirmations.

CLF Missing In Action

Credit unions and their members are addressing similar concerns about their ability to access funds.

What’s going on at the CLF? Where is the initiative shown by both the FHLB system and Fed with actions now to meet liquidity needs? Is the CLF capable of providing same, or even next day, liquidity?

This is the moment to show that the CLF can be relevant, responsive and a vital factor in coop resilience. If the NCUA and credit unions fail to join together in this moment, this week, then why have a CLF at all?

PS: If a credit union can share their experience borrowing from the FED and provide answers to the CFO’s questions above, please post in the comment section. Thank you.